Venture Capital Will Continue to Crush It

Globally, the venture capital (VC) industry will continue to evolve as capital floods in seeking compelling returns that can be had for those willing to wait. As of June 30, 2021, the USVC index generated a ten-year net IRR of 18.7%, and for the more impatient, it registered a one-year net return of 88.1%. Strong performance explains why there are now more non-VC funds investing in VC deals than VC funds themselves, who have plenty of their own capital to invest with a projected $106 billion in commitments for 2021, breaking industry records.

As fund sizes and available capital swell and companies choose to stay private for longer, later-stage venture investing has grown, particularly with the emergence of crossover investing, whereby managers invest in a private company prior to and through a public offering. While this strategy has been around for some time, it was more episodic and smaller in scale in the past. Most companies that are crossover candidates are venture-backed technology businesses, exhibiting strong growth that has accelerated in a COVID-19–constrained world. Managers with skills on both sides of the private/public line, including some hedge funds and long-only funds, continue to attract meaningful capital for this strategy and account for quite a bit of the non-VC investment in venture capital.

VC managers have been mobilizing their fight response to this permanent development, with many creating “full stack” capabilities, typically forming separate vehicles to allow them to invest in and maintain pro-rata ownership in portfolio companies. VC managers are also adding public market capabilities to be more formidable as their companies crossover into the public arena. With VC-backed IPOs accounting for an average of 84% of IPO value over the last three years, these are necessary skills to woo entrepreneurs and to build additional value for investors post IPO. As a result, we expect public companies to continue to be a significant presence—currently 17%—in the USVC index, if not even more so as VC firms expand their full stack capabilities.

All of this will create challenges for investors expecting only certain skills from certain investment managers. Regardless, we expect venture capital will continue to crush it next year.

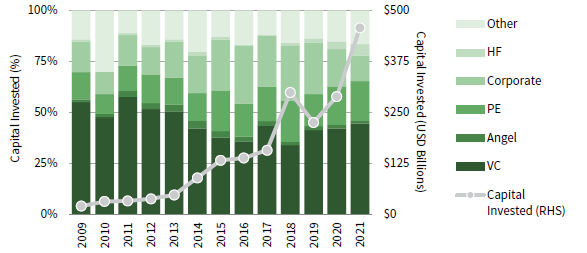

SHADOW CAPITAL: NON-VC FIRMS HAVE INCREASINGLY PARTICIPATED IN VC DEALS IN RECENT YEARS

2006–21 (September 30, 2021)

Source: PitchBook.

Notes: Dataset includes all Global Venture Capital Deals, as defined by PitchBook. Deal categorizations are based on the sole/primary investor(s). When there are multiple primary investors involved in a deal, the full deal amount is attributed to each investor; therefore, deals may be included more than once in different investor categories. Deals with no sole/primary investor listed are not included in the dataset.

Andrea Auerbach, Global Head of Private Investments