VantagePoint: China – Reassessing Risks and Opportunities

As the second largest economy in the world, China remains an important destination for global investor capital. The country is home to dynamic and innovative companies, offers an inefficient onshore equity market that provides managers with a rich potential source of alpha, and contains assets that can provide diversification to portfolios. Yet, the pace and scope of China’s regulatory crackdown are causing concern. Investors have doubts about the ability to earn attractive returns in tech and tech-enabled businesses; the persistence of the Chinese entrepreneurial spirit; and the capacity of foreigners to access investments in China. Concerns are also mounting that policies may result in a severe economic slowdown, as real estate developer Evergrande’s debt debacle and power shortages take a toll on economic growth.

In this edition of VantagePoint, we review the nature of regulatory developments and their impact on the investment opportunity set. As a preview, we believe that dedicated, strategic allocations to Chinese assets are still warranted. Investors should carefully consider their sector exposure and evaluate managers’ capabilities in the current regulatory and geopolitical environment. Sectors that conflict with national security and social stability objectives will be particularly challenged, while other favored sectors and smaller companies should benefit from policy support. Managers’ ability to pivot to address policy priorities will be central to their prospects. At the same time, valuations for many securities and sectors have improved, but equity markets are not unambiguously cheap. We remain constructive on public equities (particularly A-shares) and Chinese government bonds, as well as private equity and venture capital (PE/VC) investments in China. However, the latter faces more uncertainty and may require more re-underwriting of manager strategies and capabilities.

What Is Happening?

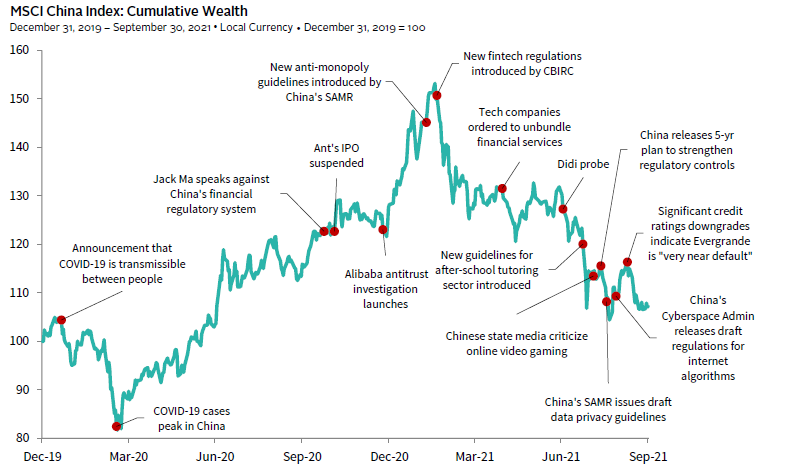

China’s policymakers have released a slew of regulations over the last year, starting with the November 2020 suspension of Ant Financial’s IPO, to more recent developments, including new data privacy rules and guidelines seeking to ban “unfair competition.” At a recent meeting, Chinese President Xi Jinping called for “common prosperity for all” and the need to “regulate excessively high incomes and encourage high-income groups and enterprises to return more to society.” These changes have come at a rapid clip and have largely affected consumer tech names, which had historically been left largely unregulated. These regulatory efforts can be linked to two overarching pillars: national security and social stability.

These pillars have long been important in China. However, they have gained urgency in a world where China faces increasing geopolitical pressure, especially from the United States, which has pivoted to treat China as a strategic competitor and has been implementing regulations related to China regarding trade, technology, national security, and human rights concerns. Beijing has accelerated its focus on both improving stability and self-sufficiency at home and opening its economy more to the outside world, including attracting foreign investment. China’s efforts to address these concerns may slow economic growth, but policymakers have repeatedly shown a propensity to accept some short-term pain to meet long-term objectives. In comparison to other major economies, China’s economic growth is likely to remain competitive, even if it decelerates in the near term.

REGULATORY CRACKDOWN HAS INTENSIFIED

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Geopolitics Intensify National Security Focus

Tensions between the United States and China have intensified over the last decade. Under the Trump Administration, the United States moved to cut off ZTE, Huawei, and other Chinese national champions from US semiconductors. The Trump Administration also oversaw an increase in the scrutiny of US-listed Chinese companies, requiring more stringent information demands, blacklisting and beginning the process of delisting some Chinese companies, and pressuring certain US investors to divest from China. The December 2020 passage of the US Holding Foreign Companies Accountable Act (HFCAA) appears to have been the tipping point for Chinese authorities. HFCAA allows the United States to de-list foreign companies that do not submit their audit papers to the Public Companies Accounting Oversight Board (PCAOB) for three consecutive years, something current Chinese law does not allow their companies to do. Furthermore, any hope that the Biden Administration might be softer on China dissolved after the acrimonious Anchorage, Alaska meeting between the two countries’ high-level officials (the first of the Biden Administration) in March.

These geopolitical tensions made it clear that China needs to shore up its vulnerabilities at home. China’s key vulnerabilities relate to its tech capabilities, especially regarding semiconductors; its reliance on US dollar funding, which the United States has used as leverage over its adversaries (e.g., Iran); and its data security. It will take considerable time for China to address these weaknesses, but they have evolved as a clear focus for Beijing.

The US/China tech war has accelerated the Chinese government’s investment in hard tech sectors such as semiconductors, clean energy, advanced manufacturing, and artificial intelligence to achieve self-sufficiency, if not global leadership. China’s regulatory crackdown is, in part, intended to drive a shift in private capital from soft-tech investments in the consumer internet space—now viewed as wasteful and not in the national interest—toward hard tech. The country’s efforts to reduce reliance on the US dollar have focused on strengthening the renminbi (RMB) to improve its credibility as a trade and reserve currency.

Concerns about data security have played out in the ability of Chinese companies to list on US exchanges. For years, the US IPO market has been the exit market of choice for many Chinese venture capital portfolio companies. Historically, US exchanges have provided avenues for Chinese companies to IPO at earlier stages of their life cycle, often before turning profitable, with an easier and quicker listing process, access to deeper and more liquid markets, and often more relevant price comparables for similar US businesses. However, national security concerns at a time of heightened US-China tensions have led Chinese regulators to effectively put a halt to such listings.

China may have lost confidence that US financial markets can remain independent of US politics. As such, China may no longer be comfortable having its companies exposed to US oversight and potentially pressured to hand over sensitive data. Many US-listed entities are in the technology, new media, or other “sensitive” sectors. Limitations on US listing may slow IPOs for Chinese companies, but it will not halt them. China wants these companies to list in the mainland and/or Hong Kong, which is increasingly integrated to the mainland via the Stock Connect and Greater Bay Wealth Connect programs. As a result, we should see further IPO reforms in these markets to make up for the inability to list in the United States.

The current crop of US-listed Chinese companies are likely to return to either Hong Kong or the mainland by secondary listings or “take-private” strategies backed by Chinese private equity funds, rather than wait for the HFCAA to force US delisting. Many of the big-name Chinese tech stocks already have HK-secondary listings, while others are expected to follow suit. Private equity (PE) firms may find companies that don’t qualify for a HK-listing to be attractive take-private targets given current valuation discounts. Ultimately, the wave of Chinese companies returning home should continue to drive inflows into China and support onshore markets and the RMB, as we have seen in recent months.

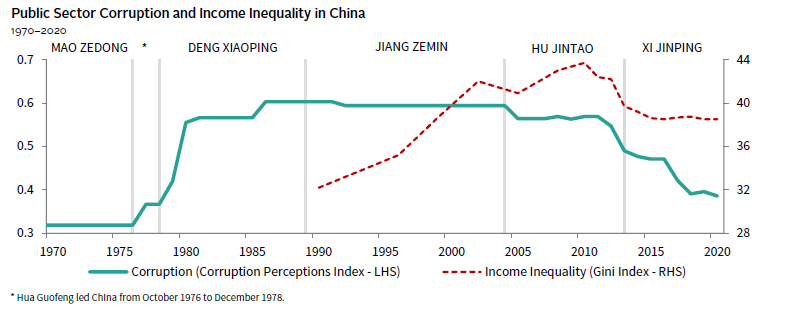

Prioritizing Social Stability

Since Deng Xiaoping assumed leadership of China in 1978, following the end of Mao Zedong’s Cultural Revolution in 1976, the Chinese Communist Party has embraced entrepreneurship through its unique blend of “socialism with Chinese characteristics” to achieve economic development. China’s economic success has been undeniable. However, over time, corruption and income disparity have increased. Former Chinese President Hu Jintao began addressing these issues, which, along with reducing China’s debt pile, has remained a priority under Xi Jinping’s leadership.

CHINA IS TAKING ON RISING CORRUPTION AND INCOME INEQUALITY

Sources: China National Bureau of Statistics, United Nations University World Institute for Development, V-Dem Institute, and World Bank.

Notes: Gini Index measures the extent to which the distribution of income among individuals or households within an economy deviates from a perfectly equal distribution. A Gini Index of 0 represents perfect equality, while an index of 100 implies perfect inequality. Gini Index values prior to 2017 are sourced from the World Bank, index values thereafter are extrapolated using the UN’s dataset. Gini data are through 2019. Public sector corruption captures to what extent public sector employees grant favors in exchange for bribes, kickbacks, or other material inducements, and how often they steal, embezzle, or misappropriate public funds or other state resources for personal or family use.

The term “common prosperity” is also not new. It was first used by Deng Xiaoping, who made it acceptable in China for people to become rich. Deng promoted the idea that some people needed to “become prosperous first” to help grow the economy, allowing more citizens to prosper over time. Today, this slogan ties to the idea of narrowing wealth inequality with a focus on fighting corruption, compelling the ultra-wealthy to increase charitable donations, cracking down on tax evasion, boosting small- and mid-sized enterprises, increasing services to low-income groups, providing more affordable housing, and limiting for-profit provision of services that are also offered by the government (e.g., after-school tutoring). Education, healthcare, financial, and property sectors have all seen tightening regulations in the name of social stability.

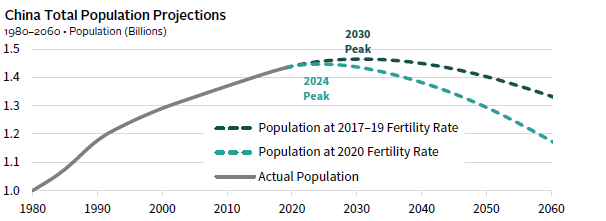

Social equity and affordability of basic needs have become more urgent concerns as China seeks to offset its deteriorating demographics. Census data released by the National Bureau of Statistics in May showed record low births last year. If 2020’s fertility rate persists, China’s population would be expected to peak in 2024, six years earlier than the United Nation’s forecast based on the average fertility rate from 2017–19.

CHINA’S POPULATION PEAK IS NOW EXPECTED IN 2024

Sources: Institute for Health Metrics and Evaluation, University of Washington and United Nations, Department of Economic and Social Affairs, Population Division (2019).

Notes: The population at 2017-19 fertility rate scenario is based on the UN “Medium Variant” population forecast, which assumes a fertility rate of approximately 1.7. The population at 2020 fertility rate scenario is based on the UN “Low Variant” population forecast, which assumes a fertility rate of approximately 1.3. Inputs for population projections include fertility rates, migration rates, and mortality rates.

Regulations seeking to improve social stability have been ongoing. For example, government policies have sought to curb runaway housing prices that hurt affordability for years. China began cracking down on overleveraged property developers in 2018, but the 2020 introduction of “three red lines” 1 to rein property developer debt and improve home affordability led directly to Evergrande and a few other property developers’ distress as they have been cut off from new credit. Xi Jinping has also focused on air quality in response to demands from China’s growing middle class. China began rationing electricity in May, and shortages have spread as China seeks to reduce energy consumption per unit of GDP by 3% to meet objectives of reaching peak carbon emissions by 2030. Policies to rein in energy use are also likely a response to rising geopolitical strains. China imports large quantities of oil and other commodities by sea, which is vulnerable to foreign navies.

Education is a newcomer on the regulation front. However, officials have expressed concerns about the sector since at least 2016 due to the exorbitant cost of supplemental education, the significant amounts of time and money spent by families on after-school tutoring, and aggressive advertising. These conditions have perpetuated an unbalanced playing field that puts wealthy families at an advantage and has likely contributed to deteriorating demographics by limiting the affordability of raising children.

China is not alone in expressing concerns about growing income inequality. Income redistribution through more progressive tax measures and other policies should be expected in many economies, especially with the growth of populist and nationalist sentiments. However, unlike many other countries, the Chinese state has considerable leeway to adjust given relatively low tax rates and the strong ability to influence the private sector. Investors should expect ongoing regulatory scrutiny of companies that run afoul of key common prosperity themes.

Impact and Implications

Despite the ongoing regulatory crackdown, China has not sought to limit foreign investment in onshore Chinese assets or in Hong Kong. Recent regulatory announcements have mostly impacted offshore-listed Chinese equities (MSCI China Index), which are now fairly valued and historically cheap relative to developed markets equities. Private equity and venture capital face challenges as regulatory pressures have already hit some sectors that have traditionally been the focus of private capital. At the same time, private equity and venture capital remain an attractive way to invest in China’s most innovative and dynamic companies, but uncertainty around the ability of companies to IPO on US exchanges and of foreign investors to access investments in sensitive sectors (e.g., semiconductors, artificial intelligence) has increased. Distress in China’s large property developers like Evergrande may create opportunities for investors in high-yield markets or specialized credit opportunities. Should Chinese economic growth slow more than is priced into capital markets, Chinese government bonds should offer attractive diversification at a reasonable price.

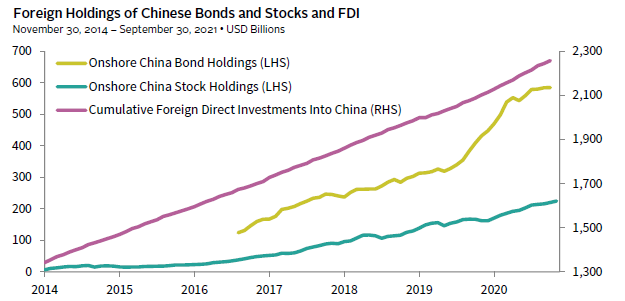

Funds Keep Flowing Into China

Despite limitations on Chinese company US listings, China has shown no signs of seeking to limit foreign investment in Chinese equities listed in Hong Kong and the mainland. While investors have been dumping offshore stocks, they seem to be buying A-shares with Stock Connect inflows still rising. To be fair, this likely reflects mainland investors bringing money back onshore after selling HK-listed stocks, but for now we have not seen a flood of money pouring out of A-shares. Foreign holdings of China bonds also continue to rise, albeit at a slower pace. Foreign direct investment (FDI) and PE/VC investment into China this year has been quite robust. However, these data lag and reflect decisions made earlier in the year.

CHINA’S MARKETS CONTINUE TO ATTRACT CAPITAL

Sources: Bloomberg L.P., CCDC, Shanghai Clearing House, and Bond Connect.

Notes: Data for foreign holdings of onshore bonds begin June 30, 2017, and represent the total foreign holdings in the depository of the CCDC and the Shanghai Clearing House. Data for both foreign holdings of onshore bonds and cumulative foreign direct investments into China are as of August 31, 2021. Data for foreign holdings of onshore stocks are represented by the Stock Connect Northbound cumulative inflows.

Regulating China “Super-Platforms”

Globally, internet companies face growing anti-competitive and data protection concerns in the United States, Europe, and China. While it may take considerable time for democracies to effectively rein in tech giants’ powers, China’s political system enables swift action. China is likely not an outlier, but rather is leading western economies in setting stricter regulatory standards.

Chinese policymakers see a need to tighten regulations on “super-platform” internet companies such as Tencent and Alibaba for several reasons. They believe such companies are engaged in anti-competitive practices, are providing “essential infrastructure,” and are attracting capital away from more productive uses—especially those required to achieve technology self-sufficiency, such as semiconductors, clean energy, advanced manufacturing, and artificial intelligence.

Overall, internet platform companies’ business models will need to change. This is because acquisitive and anti-competitive growth strategies are no longer permissible and protective moats from scale may erode as companies are required to allow portability of personal data under the Personal Information Protection Law passed in August. Compliance and operating costs should be expected to increase to meet data security, personal information protection, and initiatives to improve standards for gig labor. In short, internet platform companies’ profits are under pressure.

However, the Chinese government is not trying to put these big tech companies out of business; these are large employers that play a significant role in China’s economy. Instead, the government is compelling these companies to adhere to new regulations that align with national security and social stability initiatives. To the degree that such companies can support government priorities, they can improve their growth prospects.

Public Equity Valuations Sending Mixed Signals

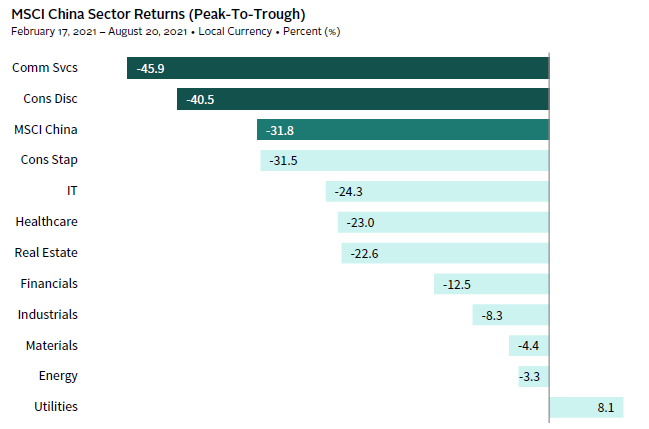

Public equity markets have fallen sharply, with the predominantly offshore MSCI China Index tumbling more than 30% peak-to-trough and underperforming the onshore A-share market, which has only fallen about 15% over the same period. While some stocks and sectors are selling at cheap valuations, the aggregate market is not convincingly cheap, and the onshore A-share market offers more appeal.

MSCI China’s underperformance has been driven by its exposure to big tech companies that have listed offshore, while the onshore A-share market is underweight tech. Furthermore, the A-share market—a relative safe haven with respect to Chinese equities in the current environment—continues to see steady inflows as investors rotate out of offshore tech companies. Even among MSCI China constituents, some sectors have held much better, with the big tech stocks in the communication services (e.g., Tencent) and consumer discretionary (e.g., Alibaba, JD.com, Meituan, etc.) sectors feeling the most pain. As a result of this dispersion, some China managers have been able to outperform and even generate positive returns year-to-date.

CHINESE EQUITIES HAVE LOST A LOT OF GROUND, PARTICULARLY CONSUMER DISCRETIONARY AND COMMUNICATIONS SERVICES

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Note: Returns are total returns gross of dividend taxes.

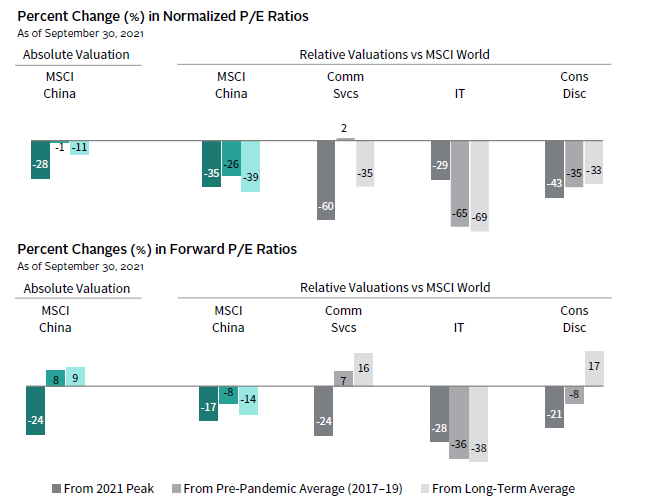

Despite the sharp sell-off, the valuation picture is mixed. The MSCI China Index looks roughly fairly valued at 11% below its long-term average and 1% below its pre-pandemic average on a normalized price-earnings (P/E) basis, even as valuations are down 28% from 2021 peaks. Forward P/E ratios paint a similar picture of middling valuations.

CHINA CHEAPER, BUT NOT UNAMBIGUOUSLY CHEAP

Sources: MSCI Inc. and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Normalized P/E is represented by price to return on equity–adjusted earnings (ROE-Adjusted P/E). ROE-Adjusted P/E is calculated as trailing 12-month P/E multiplied by the ratio of the current level of profitability (ROE) to the historical average ROE. Absolute Valuations show MSCI China P/E ratios, and percent changes indicate whether P/E ratios have become cheaper/more expensive for Chinese equities in isolation. Relative Valuations show P/E ratios for each respective Chinese equities index divided by MSCI World, and percent changes indicate whether P/E ratios have become cheaper/more expensive for Chinese equities relative to MSCI World.

However, relative to developed markets equities and US equities in particular, the market looks historically cheap. The ratio of China’s normalized P/E relative to that of developed equity markets trades 39% below its long-term average and is the lowest relative valuation on record. Relative forward P/Es are closer to their historical average, but also trade at a discount. Similarly, communication services and consumer discretionary appear cheaper based on longer-term relative normalized earnings than based on relative forward P/Es. There is a clear “China discount” relative to global equities, but this is driven more by stretched US valuations than bombed out China valuations.

The Evolution of PE/VC Implementation

China is a large, growing economy that offers access to some of the world’s most innovative and dynamic companies. Private equity, and especially venture capital, fund businesses in the “new economy” that are disruptive, accumulate sensitive data, and can create billionaires, exacerbating income inequality. As such, the Chinese private investment ecosystem is also at the center of many regulatory pressures.

In the near term, sectors like education will be among the hardest hit as portfolios get marked down to reflect the new regulatory requirements. However, education is a relatively small share of the market, so the impact should be small for most investors. Over time companies in areas like education will need to refine their business models and valuations will adjust accordingly.

Exit uncertainty will also need to be resolved, as discussed above. Companies planning to list in the United States in the next year or so will face delays and higher costs that will pressure performances. Companies considering US listings may need to restructure for mainland China or Hong Kong exits. Further, companies may face bottlenecks as more companies seek to exit in Hong Kong and mainland China since current underwriting capacity may not be adequate to handle the volume. Over time, these pressures should subside as Hong Kong and mainland China IPO markets evolve.

Longer term, we believe investments in Chinese private equity and venture capital will continue to be additive to portfolios; however, the opportunity set is evolving. Even before the recent regulatory deluge, opportunities in China’s PE/VC sphere were shifting with demographic and consumption patterns. Sectors like consumer tech, which historically offered strong returns, have matured and are no longer priorities for China. More appealing consumer themes focus on new products, local brands, and aspirational goods. Healthcare remains attractive given an aging population that increasingly demands best-in-class healthcare products and services. Demand for productivity tools has increased to address challenges associated with China’s shrinking population and to successfully compete against cheaper manufacturing locations offshore. Venture capital is also funding sectors like semiconductors, databases, clean or green tech, artificial intelligence, and other “deep tech” sectors that are increasingly priorities to China as the country seeks to develop technology self-sufficiency.

Most of these investments require patient long-term capital to support innovation. Local capital has tended to be short-term oriented, so we anticipate authorities will continue to welcome foreign capital provided investors play by China’s rules. However, the ability of foreign investors to access the more sensitive sectors—hard tech and semiconductors—is uncertain. Foreigners may be constrained to access such opportunities through minority investments in onshore public companies.

The changes in the opportunity set for this asset class suggest that the top managers of the future may well not be those that have historically achieved the strongest results. Consequently, to identify the best positioned managers, we have been prioritizing factors such as organization stability, alignment of capabilities with evolving investment themes, the ability to guide portfolio companies through internal or external stresses, capital market skills, and regulatory/government insights. Further, regulatory risks highlight the need for diversification through careful portfolio construction at the manager and portfolio level.

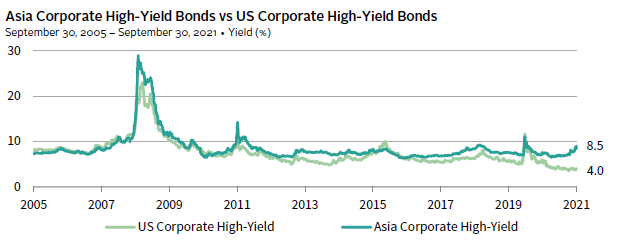

Bonds Are Getting Appetizing

The debacle surrounding China’s largest property developer, Evergrande, has pushed up Asian offshore high-yield bond yields and spreads to materially higher levels than US comparables. The market, as represented by the J.P. Morgan JACI High Yield Index, is concentrated in China (48%) and Chinese property developers (35%). As such, the outlook for Asian high-yield bonds depends on whether the sell-off can remain contained within China’s real estate sector, the ability of the impacted property developers to restructure their debts, and how offshore investors are treated.

HIGH-YIELD BONDS GETTING INTERESTING, BUT NOT YET AT PRIOR PEAKS

Sources: Bloomberg Index Services Limited, J.P. Morgan Securities, Inc., and Thomson Reuters Datastream.

Notes: Asia Corporate High-Yield is represented by the J.P. Morgan JACI High Yield Index. US Corporate High-Yield is represented by the Bloomberg US Corporate High Yield Index.

Evergrande is now headed for restructuring, and a smaller property developer, Fantasia, has also defaulted on its external debt. However, we believe the impact of this stress is likely to be controlled similar to other heavily indebted entities the government has recently forced to restructure. Still, market pricing may not be adequate to offer appeal as high-yield spreads in Asia and China have risen above levels seen in 2020, but remain below those seen in 2011 and 2008. Unsecured offshore US dollar bonds are at the bottom of the capital structure, senior only to offshore common equity. As such, pricing must reflect residual asset values after other senior onshore liabilities are paid. There are likely opportunities given large divergences in pricing of onshore and offshore liabilities even adjusting for expected lower recoveries of the latter. Given the specialized skills required to analyze and execute in this market, we expect investments in Asia credit hedge funds and private credit specialists will offer the most appealing opportunities, particularly should restructuring start to occur.

In contrast, Chinese government bonds remain well supported by strong investment demand. Yielding 3%, they offer reasonable returns on an unhedged basis for the diversification they provide to portfolios. Should economic stress increase, as is likely from the Evergrande situation, such bonds should benefit. At the same time, the RMB has been supported by continued strong capital inflows into equities, bonds, and FDI, an improved current account surplus, and still-high interest rate differentials relative to major developed markets bonds.

Conclusion

China remains an important destination for global investor capital. As the second largest economy in the world, China is too large to ignore. However, companies and investors need to adjust their strategies to reflect China’s evolving focus on social stability and national security; the winners of the past decade will not be the winners of the next. More importantly, China will be more regulated than in the past as it seeks to address the social and environmental consequences of its prior lack of corporate regulation. As the economy slows and geopolitical competition with the United States intensifies, Chinese companies and global investors need to remain acutely aware of Chinese domestic policies and priorities. Even as China’s economic growth slows, Beijing maintains the flexibility to support economic growth given it has been relatively restrained in using monetary and fiscal stimulus over the last 18 months, in contrast to major developed markets.

Chinese regulations are far reaching, creating winners and losers across the economy. Internet platform companies, previously left to thrive under light regulations, are now in the cross hairs of much of the regulatory activity. Sectors providing public services, such as education, healthcare, media, and entertainment are also at risk of continued regulation. Limitations on for-profit activities, price controls, and other actions may be expanded to promote social equity.

Winners will include the companies that are best able to adjust to new political priorities, including internet companies and those providing social services. Hard technology sectors, particularly those related to high-tech manufacturing, are also likely winners. Foreigners’ ability to invest in such companies may be constrained. We anticipate that minority ownership of public companies listed on Chinese onshore and Hong Kong exchanges will still be welcome. Private investments in these strategically important sensitive sectors are more complicated.

Celia Dallas, Chief Investment Strategist

Aaron Costello, Regional Head for Asia

Vish Ramaswami, Head of Asian Private Investments

Joe Comras and Vivian Gan also contributed to this publication.

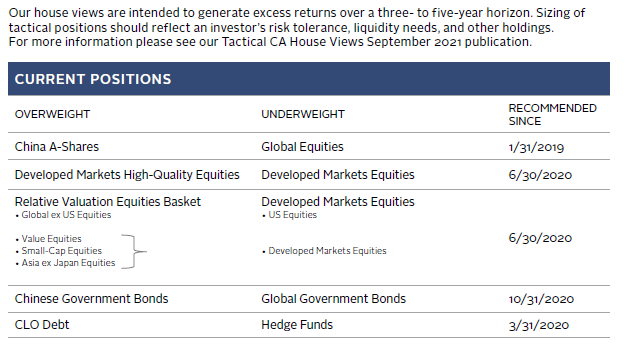

OVERVIEW OF TACTICAL CA HOUSE VIEWS

Index Disclosures

Bloomberg US Corporate High Yield Index

The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Bloomberg EM country definition, are excluded.

Corruption Perceptions Index

The Corruption Perceptions Index ranks countries by their perceived levels of public sector corruption, as determined by expert assessments and opinion surveys. The index generally defines corruption as an “abuse of entrusted power for private gain. The index is published annually by the non-governmental organisation Transparency International since 1995.

Gini Index

The Gini Index or Gini coefficient, is a measure of the distribution of income across a population. It is often used as a gauge of economic inequality, measuring income distribution or, less commonly, wealth distribution among a population. The coefficient ranges from 0 (or 0%) to 1 (or 100%), with 0 representing perfect equality and 1 representing perfect inequality. Values over 1 are theoretically possible due to negative income or wealth.

J.P. Morgan Asia Credit Index (JACI) Non-Investment Grade Corporate Index

The J.P. Morgan Asia Credit Index (JACI) Non-Investment Grade Corporate Index consists of liquid US dollar–denominated debt instruments issued out of Asia ex Japan. The JACI Core is based on the composition and established methodology of the J.P. Morgan Asia Credit Index (JACI), which is market capitalization weighted. JACI Core includes the most liquid bonds from the JACI by requiring a minimum $350 million in notional outstanding and a minimum remaining maturity of two years. JACI Core also implements a country diversification methodology. Historical returns and statistics for the JACI Core are available from December 30, 2005. The non-investment-grade version of the index is limited to issuers classified as non-investment-grade based on the middle rating between Moody’s, Fitch, and S&P.

MSCI China Index

The MSCI China Index captures large- and mid-cap representation across China A-shares, H-shares, B-shares, Red chips, P chips, and foreign listings (e.g., ADRs). With 740 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float–adjusted market capitalization.

MSCI World Index

The MSCI World Index represents a free float–adjusted, market capitalization–weighted index that is designed to measure the equity market performance of developed markets. As of December 2017, it includes 23 developed markets country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. With 1,561 constituents, the index covers approximately 85% of the free float–adjusted market capitalization in each country.