US Election Anxiety: Keeping Calm Amid Political Uncertainty

Markets have been jittery as the US presidential election approaches. The macro backdrop is shifting, with slowing economic growth and ebbing inflation meaning a cycle of monetary easing beckons. At the same time, elevated valuations for a variety of assets are causing investors to reconsider narratives around themes, such as AI investment, and consider asset allocation tweaks. Investors should resist positioning portfolios for any one political outcome and remember that increased market volatility around elections is common.

2024 seems to be following the same pattern, with additional curveballs such as August’s yen “carry trade unwinds” adding to investor unease. Still, there are numerous reasons to believe that the differing policy platforms of Democratic presidential nominee Kamala Harris and Republican presidential nominee Donald Trump will have limited long-term impact on markets. Even in the event of a sweep by one party, both candidates have policy goals that may be constrained by wider market conditions and that contain inherent contradictions. For example, boosting US energy supply may depend on global oil supply/demand dynamics, most of which are outside a president’s control. Increasing the supply of goods while limiting their prices may also prove self-defeating. Despite the potential for deficits to increase under either candidate, interest rates may still decline as growth slows and inflation continues to ebb. Finally, there also may be more shared political ground than is realized regarding the fate of legislation such as the 2017 Tax Cuts and Jobs Act.

The following sections discuss our views on five common election-related narratives in the marketplace today. Specifically, we discuss how:

- Stock market volatility may rise as the election approaches and policy uncertainty grows but historically settles down post event.

- Discounted relative valuations and a rebound in earnings growth for some companies are more likely to spark a rotation in equity style factors than politics.

- Regardless of the election result and despite elevated deficits, we expect fading inflation and slowing growth will be good for bond investors.

- A “red wave” should temporarily boost the US dollar but eventually stretched valuations and the Fed following its global peers with rate cuts will lead to the currency’s decline.

- On climate, a Harris win will mean more investment, while a Trump win may mean some regulations are rolled back; however, legislation like the Inflation Reduction Act (IRA) will be difficult to roll back, given its established law and broadly distributed benefits.

A common thread of the sections is that we believe that the macro environment and valuations will be larger drivers of investment outcomes than the election. This is not to say that certain election outcomes don’t create some specific winners and losers; for example, smaller companies could benefit more from tax cuts under a red wave. Nor is it to argue that sequencing doesn’t matter—markets may remain volatile after the election if new policies that are negative for markets (e.g., tariffs) are implemented before other positives (e.g., corporate tax cuts). Still, given that market focus eventually returns to fundamentals, and everything that is promised by politicians is not always delivered, we do not recommend making asset allocation changes due to perceived election outcomes.

Market Narrative #1: Volatility Will Be Elevated Around the Election

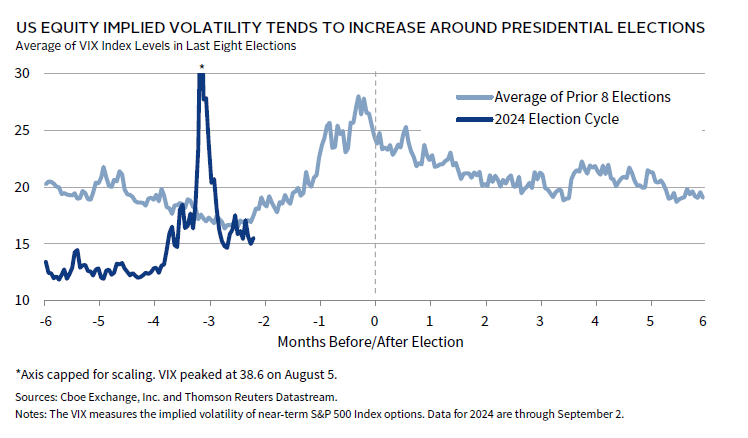

We agree with this marketplace narrative. The CBOE Volatility Index (VIX), which is a measure of expected short-term equity volatility, has tended to increase in the months leading up to US presidential elections, with a notable increase approximately two months before election day. This rise in volatility is due to investor unease about potential policy changes and media amplification of political events. However, this heightened volatility usually subsides immediately after the election, as the resolution of uncertainty allows investors to assess the new administration’s impact on capital markets.

For much of 2024, the VIX traded at very low levels, averaging less than 14 from January through July, well below its long-term average of 19.5. However, October VIX futures indicate that investors have expected higher volatility near the election, as these futures have been priced around 13% higher than September futures since they started trading in January.

Recently, the VIX spiked due to concerns about US economic weakness and unknown risks linked to an unwinding of the yen carry trade. Broader economic issues like these often drive market volatility more than election concerns. For example, the 2008 Global Financial Crisis intensified about a month before the presidential election, overshadowing election jitters.

Investors should expect volatility around the US presidential election to remain high relative to this year’s typical level. While there can be other catalysts that drive stock market turbulence to a greater degree than politics, it is worth remembering that equity markets are often in better shape just one year after the election. In fact, since 1980, there has only been one election year where the S&P 500 was lower 12 months after the election—2000, amid the implosion of the dot-com bubble.

Market Narrative #2: The US Election Result Will Trigger an Equity Style Rotation

We disagree with this marketplace narrative. We don’t think the US election results will be the main driver of a major equity market rotation. Instead, we believe that valuations, fundamentals, and the changing macro environment are more likely to drive relative performance.

Recent months have seen signs of slowing economic growth, ebbing inflation, and a nascent rotation in the US equity market. Previous winners, such as large-cap growth stocks, have underperformed, given concerns over valuations and payoffs for AI-related investment, while simultaneous growing expectations of future Fed easing have boosted demand for previous laggards like small-cap equities and value stocks.

At first blush, certain aspects of the economic platforms of the main candidates could be viewed as accelerating these macro changes and thus quickening this rotation. For example, Democratic pledges to extend most household tax cuts could boost revenues for more cyclical value stocks, while Republican promises to further reduce corporate tax rates could boost margins of small US companies, which have higher effective tax rates. In the same vein, Republican promises of lighter regulatory oversight could boost value sectors such as energy and financials.

But history cautions against simplified narratives and ignoring fundamentals or valuations. Recall, for example, that despite similar pledges around eight years ago, the first Trump presidency saw energy stocks underperform. Conversely, these (oversold) energy companies rebounded, while (expensive) clean energy stocks lagged during the Biden administration despite passage of the IRA. More broadly, given many Russell 2000® companies are unprofitable, it is not clear how much they would benefit from further reduction in corporate tax rates.

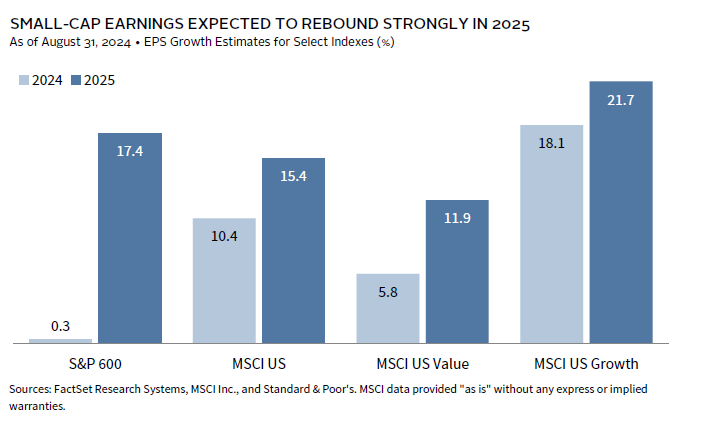

Looking ahead, we think a rotation toward high-quality US small-cap companies and value stocks is more likely to be driven by deeply discounted relative valuations and a rebound in earnings growth as opposed to being weighted on a particular political outcome. Small caps in particular are expected to post weaker earnings growth in 2024, but a lower base means profit growth should recover under most potential economic and political outcomes next year. Expected rate cuts will help by lowering debt servicing costs. While potential election outcomes could influence regulations and legislation that benefit some sectors more than others, absent a crystal ball we continue to rely instead on time-tested valuations and fundamentals.

Market Narrative #3: One Party Sweeping the Election Will Be Bearish for US Treasury Securities

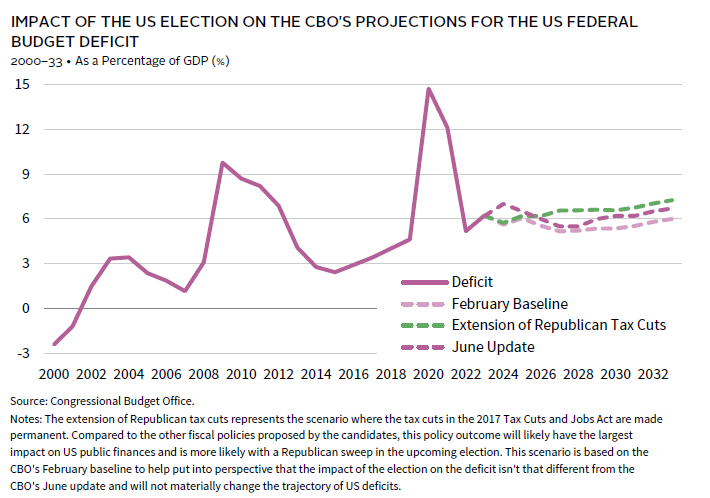

We disagree with this marketplace narrative. While a unified government 1 might lead to slightly larger deficits, it does not change our view that the US economic cycle will likely support US Treasury performance over the next one to two years. Consequently, we do not recommend reducing allocations to high-quality US bonds, and we still see value in maintaining duration at a total portfolio level.

The belief that a unified government will be bearish for US Treasury securities assumes this outcome will lead to greater fiscal expansion, increased Treasury supply, and higher yields. Similar concerns led to ten-year Treasury yields surging nearly 100 basis points after the 2016 election. More recently, concerns about deteriorating public finances in developed markets have added to bond market volatility. However, studies show that the historical relationship between government debt and yields is relatively weak. Yields tend to be more sensitive to economic fundamentals and changes in monetary policy expectations. Additionally, the poor US fiscal outlook is well-known, and the CBO’s latest projections suggest the election outcome will have a limited impact on the current trajectory of US public finances.

Tariffs are another concern, with former President Trump proposing a 10% tariff on all imports into the United States. Estimates suggest this would increase annual core inflation by around 1 percentage point. 2 However, this is a one-time price boost that will drop out of the annual figures after one year. In theory, the Fed should look through the price impact of tariffs, especially if it is weighing them against a continued cooling in the labor market, as we expect.

While the election could contribute to increased bond volatility and higher interest rates in the short term, it is important to remember that the election does not happen in a vacuum. Over the course of a full presidential term, we would expect the underlying economic cycle to be the more important driver of Treasury yields. In that regard, we expect continued moderation in US inflation, cooling in the labor market, and the Fed embarking on an easing cycle to support US Treasury securities.

Market Narrative #4: A Red Wave Will Strengthen the Dollar

We agree that a Republican sweep could initially strengthen the dollar. Implementation of the Trump administration’s proposed policies, including the imposition of tariffs on imports and a sweeping reduction in immigration, would provide support to the dollar. A Republican-controlled Congress delivering looser fiscal policy 3 would also serve as a bolster. However, we believe this boost would likely prove transient, with the broader cyclical backdrop being the more significant driver and auguring for a longer-term decline.

Both economic theory and the precedent of the prior Trump administration suggest that the imposition of trade tariffs would tend to strengthen the dollar. In the first instance, there is a competitiveness adjustment in the currencies of impacted markets, as a new competitive equilibrium is found. This process would tend to support the dollar versus its peers, at least initially, due to the less trade-dependent nature of the US economy. Additionally, while a tariff-driven price rise should be a one-off, market interest rates could still move higher in response, particularly given the context of recent elevated inflation. Limiting immigration could also impact interest rates by capping the supply of labor, which would benefit the dollar. A Republican sweep of Congress—which is not currently expected—could be more growth supportive in the short run than the counterfactual, potentially bolstering the dollar as expectations adjust.

However, we expect the underlying cyclical backdrop to be the more important driver of the currency over the course of a full presidential term. In this regard, and with the dollar still richly valued, more balanced global growth and the Fed following its peers into a rate-cutting cycle should see the dollar decline. Additionally, cutting immigration reduces potential growth, while tariffs essentially function as a tax on the consumer and should eventually weigh on growth and inflation if not offset in some way. Though a unified Republican Congress is likely to deliver some offsets, they are unlikely to have the type of durable impact on growth that may be needed to support the dollar more structurally. Finally, Trump has spoken often about his concerns over the strength of the dollar and his desire to revive domestic manufacturing via a weaker currency. Explicit intervention to weaken the dollar looks unlikely, but jawboning could eventually have some impact when it aligns with the direction justified by fundamentals.

Market Narrative #5: A Harris Presidency Will Permit Greater Climate Investment

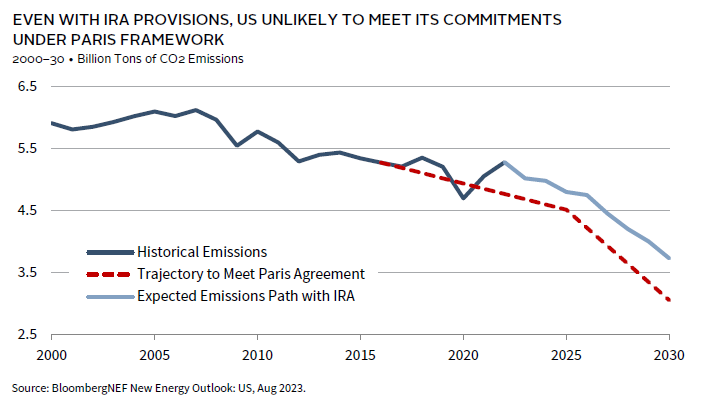

We agree with this marketplace narrative. Kamala Harris is expected to continue implementing the IRA, with a substantial portion of its funding still available for climate investment. She may have the opportunity to expand climate initiatives if Democrats secure majorities in both chambers of Congress.

The Biden administration has championed climate-friendly initiatives, including rejoining the Paris Agreement and passing the IRA, which represents the largest investment in addressing climate change in US history. As vice president, Harris was closely involved in the rollout of the IRA, and her continuation of this policy will likely be a top priority for her administration. The IRA is expected to accelerate decarbonization; models project that it could contribute to an average 37% reduction in US greenhouse gas emissions by 2030 compared to 2005 levels. 4 However, these initiatives may fall short of the US commitment to cut emissions by 50% by 2030 compared to 2005 levels.

Harris may not just continue President Biden’s climate policies but could seek to expand them if the opportunity arises. For example, Democrats have hinted at a desire to expand clean energy tax credits beyond what has already been established in the IRA. Harris’s ability to drive a more ambitious climate policy will depend on the balance of power in Congress, as significant changes to climate legislation would require approval by both the House of Representatives and the Senate.

By comparison, a Trump presidency would focus on scaling back renewable energy policy. With a second term, Trump could be more effective in repealing some climate-related regulations due to more experienced staff and a judiciary that may be more favorable to deregulation efforts. However, Trump’s ability to fully reverse climate investment trends is limited. Significant climate and energy investments, such as those in the IRA and the Infrastructure Investment and Jobs Act, are established by law and would be difficult to repeal. These laws have bipartisan support, especially in areas benefiting from the investments. Furthermore, the broad trend toward clean energy and decarbonization is driven by market forces and technological advancements, which are likely to continue regardless of political changes.

Navigating Narratives, and Staying the Course

Looking ahead, investors should remain focused on long-term drivers of asset prices rather than getting swayed by political noise. While we expect higher volatility near the election, it should subside once the immediate uncertainties are resolved. Certain asset classes may come under more pressure in some election outcomes, given the potential policy implications. For example, higher tariffs are likely a near-term headwind for US Treasury securities and non-US stocks, all else equal. Still, even in these instances, we expect other factors—such as the current macro environment, fundamentals, and valuations—will likely outweigh any policy-related impact on asset prices over the course of a full presidential term.

As such, we do not believe investors should position portfolios in response to any one election outcome. Instead, we believe investors are best served by relying on a well-constructed asset allocation, sticking to any predetermined rebalancing policy, and monitoring liquidity sources and needs to navigate and potentially take advantage of any dislocations in asset prices around the election.

Sean Duffin, Senior Investment Director, Capital Markets Research

Wade O’Brien, Managing Director, Capital Markets Research

Thomas O’Mahony, Senior Investment Director, Capital Markets Research

TJ Scavone, Senior Investment Director, Capital Markets Research

Other contributors to this publication include Drew Boyer and Graham Landrith.

MSCI US Index

The MSCI US Index is designed to measure the performance of the large- and mid-cap segments of the US market. With 625 constituents, the index covers approximately 85% of the free float–adjusted market capitalization in the United States.

MSCI US Growth Index

The MSCI US Growth Index captures large- and mid-cap securities exhibiting overall growth style characteristics in the United States. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate, long-term historical EPS growth trend, and long-term historical sales per share growth trend.

MSCI US Value Index

The MSCI US Value Index captures large- and mid-cap US securities exhibiting overall value style characteristics. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price, and dividend yield.S&P SmallCap 600® Index

The S&P SmallCap 600® Index seeks to measure the small-cap segment of the US equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable.

Footnotes

- A unified government occurs when one party wins the White House and both houses of Congress.

- Please see Jan Hatzius et al., “The Effect of Tariffs on Government Revenue, Growth, and Inflation: Lessons From the Last Trade War,” Goldman Sachs Economic Research, April 6, 2024.

- See, for instance, the Penn Wharton Budget Model which estimates that Trump’s tax and spending proposals would increase the primary deficit by $1,548 billion between 2025 and 2028, in comparison to the estimated $711 billion increase that would result from Harris’ proposals.

- John Bistline et al., “Emissions and Energy Impacts of the Inflation Reduction Act,” Science, Vol 380, Issue 6652 (30 June 2023): 1324–1327.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.