The Transformative Public University Endowment

In today’s dynamic funding and operating environment, a lot is at stake for public colleges and universities and their endowments. The public university endowment is more than a static funding source; with strong stewardship, a growing endowment can transform a university’s financial equation. The most forward-thinking public universities use their endowments for far more than balancing budgets. The right combination of investment principles, fundraising strategies, and spending policies can drive endowment growth and expand the resources available to advance academic programs, research, and student access.

This paper explores the strategic and expanding role of the endowment in the public university business model. We analyze the components of endowment spending and endowment growth, and how spending can drive growth. We demonstrate how transparency about endowment net flows can deepen understanding of the current and future role of the endowment and strengthen communication with donors about the impact of their gifts.

The Role of the Public University Endowment

Public university endowments support the university through three types of spending:

- Funding the operating budget and directly support student scholarships, faculty positions, research, and service delivery. This level of spending is determined by the endowment spending policy, which is designed to keep pace with inflation and deliver consistent support every year.

- Funding for revenue enhancing activities, such as fundraising infrastructure and investment management. Public universities and foundations often source this additional funding via an administrative fee (also known as an admin fee), which is assessed on the endowment market values.

- If flexible funds are available, an additional draw from the endowment may support sporadic needs, such as capital campaign costs, capital project financing or other strategic priorities.

These three categories of spending add up to the total amount of withdrawals from the endowment. To maintain purchasing power, endowment return must equal the rate of total spending plus inflation over time.

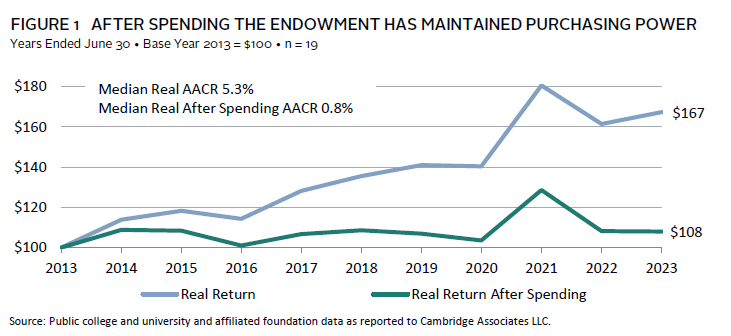

Over the past ten years, the median experience of public university endowments has met that goal (Figure 1). After adjusting for inflation, investment returns, and spending, an endowment starting at $100 in 2013 grew to an adjusted value of $108 in 2023. The median real (adjusted for inflation) average annual compound return (AACR) of 5.3% slightly exceeded spending, and the median growth rate net of spending was 0.8%. This growth indicates that the endowment maintained purchasing power and delivered to donors and stakeholders who have consistently benefited from endowment spending.

To move beyond maintenance of current spending levels and expand the role of endowment assets, a university needs to raise new endowment funds. New inflows increase the purchasing power of the endowment, and the endowment spending that funds the mission. Inflows represent new commitments to funding more of the mission. A growing endowment relieves reliance on student revenues, state appropriations, and annual fundraising dollars. Inflows also provide an investment advantage, as they replenish endowment liquidity needed to fund spending. They offer more flexibility for the investment strategy to incorporate illiquidity that comes with long-term investment commitments in venture capital and private equity.

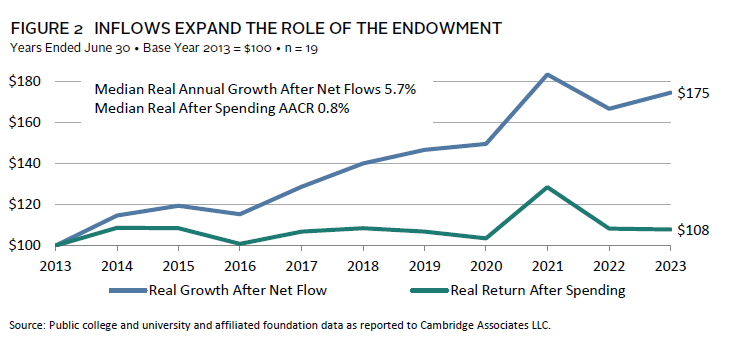

The combination of spending and fundraising is net flow. Inflows from successful fundraising efforts have been a significant driver of public university endowment growth over the past ten years. When we analyze endowment performance and factor in all elements of net flow (shown as the real return after net flow in Figure 2), we see that the median growth rate of public university endowments has grown 5.7% annually since 2013. Inflows augmented strong performance and provided a 67% bump to overall growth after spending over this ten-year period.

Sources of Growth

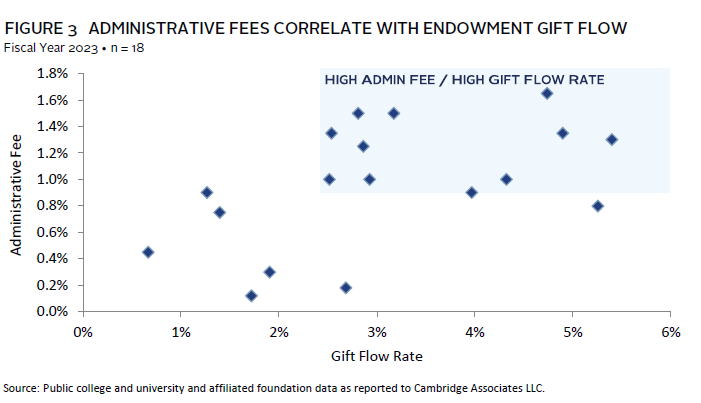

There is a delicate balance between spending, sustainability, and growth, especially when sourcing revenue enhancing funding from an administrative fee assessed on endowment assets. The implementation and disbursement of the administrative fee is a balancing act, with a goal to fund strategic investments and growth without eroding the purchasing power of existing endowment funds. For those that strike the right balance, the admin fee can support sustainability and growth. But if the admin fee is too high, it will erode purchasing power and ultimately divert resources away from the mission. It is the responsibility of the board, with direction from the investment committee and the finance committee, to strike this balance. The calibration of endowment uses and sources will affect investment performance, liquidity, spending, and sustainable growth. When applied strategically, the admin fee can be an investment in endowment growth (Figure 3). In 2023, we saw a correlation between levels of admin fees and endowment fundraising achievement; those with admin fees of 1% or higher experience gift flow rates of 3% and above.

How Attention to Net Flow Can Transform the Role of the Endowment

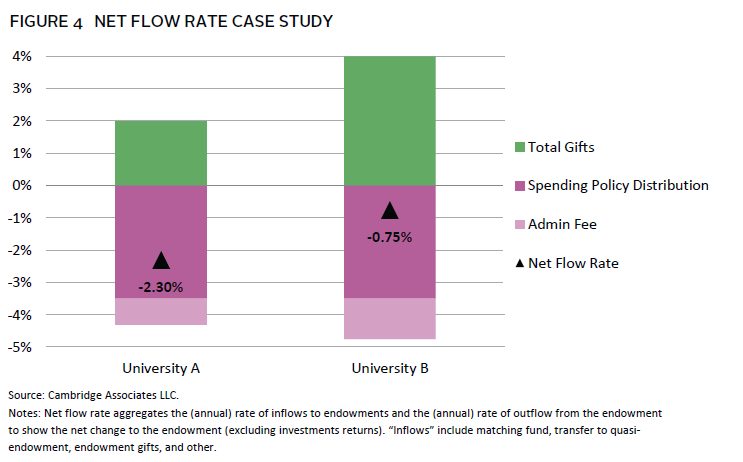

In the following case study, we consider the correlation between net flow and specifically how a higher administrative fee that yields higher gift flow can expand the endowment support delivered to the university. We model two public university endowments over the past ten years that both earn the average investment returns for their peer group (7.9% nominal AACR) and have the same spending policy rate (3.5% effective spending). University A assesses a lower admin fee of 0.8% and has a gift flow of 2.0%, while University B has a higher admin fee of 1.25% and a higher gift flow of 4.0% (Figure 4).

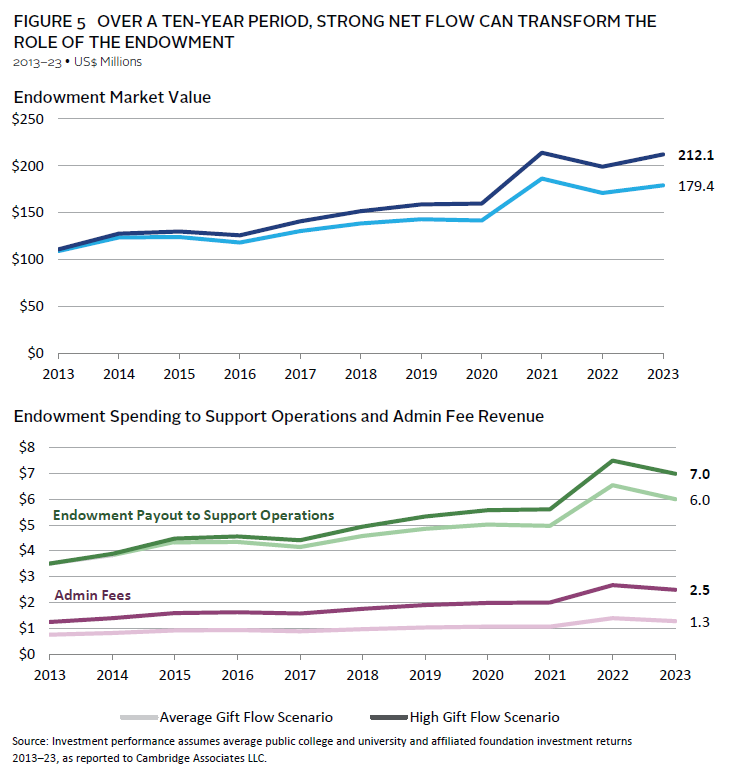

Net flow matters. University B’s net flow of -0.75% versus University A’s -2.3% results in higher market value, endowment spending, and administrative fee revenue (Figure 5). Both endowments grow over the ten-year period from 2013 to 2023, but stronger net flow contributed to an expanded role for the University B endowment. The University B endowment ends with $32.7 million more in endowment value and delivers $1 million more in annual budget funding by Year 10 and $1.2 million more in administrative fee revenue.

Net Flow Strategy

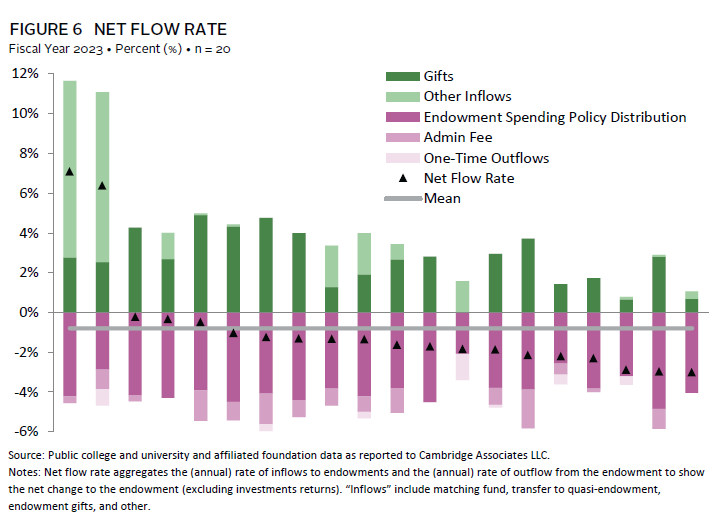

In 2023 we saw a range of net flow results for public colleges, universities, and affiliated foundations (Figure 6). The net flow rate is time-sensitive, and we expect it to fluctuate year to year because the ratio is a function of fiscal year spending and fundraising achievement (dollars in the door) and market values.

Institutions on the left side of Figure 6 had strong net flow that contributed to endowment growth in 2023. Institutions on the right side had limited fundraising and higher spending, which may have eroded purchasing power. The net flow metric measures the combination of inflows and outflows and communicates important information about the role of the endowment and the plan for the future role of the endowment. What-if analysis about net flows and the power of new endowment gifts can help donors understand the direct link to endowment assets and a sustainable financial model for important programs and purposes. Given that net flow tells us a great deal about portfolio liquidity and the current and future role of the endowment in the university financial model, it makes sense for the Board, leadership team, advancement team, investment management team, and the investment committee to communicate about this metric every year.

Conclusion

The public university endowment can be much more than a static funding source. A strong investment program that is augmented by successful fundraising and disciplined spending can propel endowment growth. Moving beyond a balanced budget, forward-thinking public universities are considering how endowment growth can transform the revenue model and expand resources available to students and faculty. Net flow analysis can provide transparency about the current and future role of the endowment and strengthen communication with donors about the long-term impact of their endowment gifts. Endowment strategy that factors in net flow patterns and plans can achieve an investment edge and inspire fundraising.

Tracy Abedon Filosa, Head of CA Institute

Cameryn Dera also contributed to this publication.

Tracy Filosa - Tracy is a Managing Director and Head of CA Institute.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.