The Financial Performance of Real Assets Impact Investments: Introducing the Timber, Real Estate, and Infrastructure Impact Benchmarks

Executive Summary

This report analyzes the financial performance of 55 real assets impact investing funds of vintage years 1997 through 2014, grouped into three sectors: timber, real estate, and infrastructure. Impact investments are defined by their intent to generate social and/or environmental returns alongside a financial return.

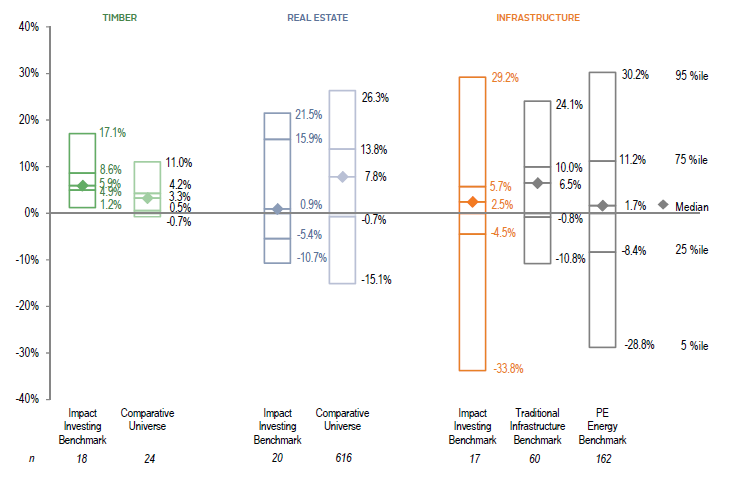

Overall, we note two key findings. The first is that risk-adjusted market rates of return are achievable in impact investing, as evidenced by the fact that the distribution of impact investing fund returns mirrors the distribution of conventional real asset fund returns (Figure 1). The second is that fund selection is key to success, as the distribution of individual fund returns varies widely; this applies equally to impact investing funds and conventional funds.

Figure 1: Distribution of Fund IRRs Net to LPs by Quartile

As of June 30, 2016

Notes: The Timber Impact Investing Benchmark includes funds of vintages 1997–2014 and the comparative timber universe was constructed of traditional funds of the same vintages. The Real Estate Impact Investing Benchmark includes funds of vintages 2004–2014 and the comparative real estate universe was constructed of traditional funds of the same vintages. The Impact Investing Benchmark includes funds of vintages 2005–2014; the focus of funds in this benchmark is sufficiently differentiated that a comparative universe does not exist today. For reference purposes, we have included the returns of our traditional Infrastructure Benchmark and our PE Energy Benchmark, limited to funds raised over the 2005–2014 period.

- Impact funds focused on the timber sector, raised in vintage years 1997–2014, performed well. Since inception to June 30, 2016, they have produced a pooled net internal rate of return (IRR) of 5.9%, comparing favorably with conventional timber funds, which returned 3.3% over the same period using the same set of vintage years. Top quartile funds returned at least 8.6% compared with at least 4.2% for conventional timber funds. The impact objectives of these funds include sustainable timber production, land conservation, and biodiversity conservation.

- Impact funds focused on the real estate sector, raised in vintage years 2004–2014, did not have as much downside as conventional funds raised in the same period, nor as much upside. Real estate impact funds have produced a pooled net IRR of 0.8% versus 4.9% for conventional real estate funds since inception to June 30, 2016. The IRR for the impact universe was pulled down by the poor performance of a handful of larger funds. Notably, the universe of impact real estate funds is skewed younger than that for conventional funds, with half of the impact funds raised in vintage years 2011–2014 compared to just under a third of the conventional universe. The impact objectives of these funds include green real estate, affordable housing, and community services.

- Impact funds focused on the infrastructure sector, raised in vintage years 2005–2014, generated a wide variety of performance. The top fund produced a net IRR over 29% since inception to June 30, 2016, and nearly one in four funds generated a net IRR greater than 10%. However, three funds had returns below -15%, so the overall pooled net IRR was 0.3% and median IRR, 2.5%. The funds included in the impact benchmark invest primarily in renewable energy, a new sector that cannot be easily compared to a conventional benchmark. For reference, a conventional infrastructure benchmark returned a pooled net IRR of 6.6% over the same period using the same set of vintage years, with a median of 6.5%, while a conventional private equity energy benchmark returned a pooled net IRR of 3.8% with a median of 1.7%. In addition to renewable energy, the impact objectives of funds in the impact infrastructure sample include climate change mitigation and water resource management.

The findings reflect performance of real assets impact funds that is comparable with conventional real assets funds, albeit with variation at the individual fund level, reinforcing the importance of manager selection in private investing. At the same time, these impact fund managers are also rigorously pursuing a range of impact objectives—both social and environmental.

This report adds to the growing body of data on the performance of impact investments. Creating and analyzing benchmarks for private investments, especially for a younger, emerging portion of the market such as impact investing, poses a number of challenges. Difficulty acquiring private fund performance data and strict inclusion criteria limited our ability to amass a large dataset, which presented data analysis limitations that are unavoidable at this stage. Cambridge Associates produces an ongoing quarterly impact investing benchmark report to track private equity and venture capital impact investing funds over time, and this report launches real assets impact investing financial performance benchmarks in timber, real estate, and infrastructure. The value of this information to the market will only increase as more funds are added to the benchmarks and existing funds mature.