Optimizing Wealth Transfer for Families: A Focus on Next Gen Investors

Most families of significant wealth inevitably grapple with intergenerational wealth transitions. Shifting the responsibility for a family’s long-term financial health can be a challenging endeavor that has the potential to strain family dynamics. Families without a clear succession plan put their wealth preservation at significant risk, as a lack of planning can lead to uncertainty regarding investment strategy and increase the potential for poor performance. However, generational transfers also present an opportunity for families, by enabling them to take a fresh look at their financial goals and consider new approaches to managing their investments.

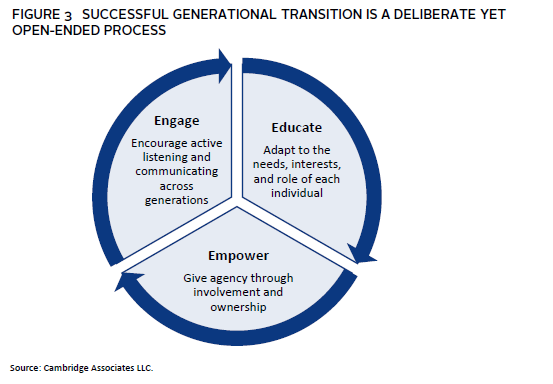

With this in mind, we advocate a three-part framework for families seeking to integrate members of the next generation (“next gen”) into the wealth management process, which focuses on engagement, education, and empowerment. Introducing new stakeholders to the process of stewarding family wealth isn’t always easy, but committing to the “three Es” can help families achieve successful outcomes. Family transitions that are grounded in these concepts should occur more smoothly because the next generation of decision-makers are better prepared, more aligned with the family’s greater goals, and more invested in their responsibility to help achieve them. Ultimately, a thoughtfully planned and executed changeover should help a family foster enduring financial stability.

Part 1: Engagement

Active engagement of the next generation is the first and most important step in succession planning. An individual or group that is disconnected from the realities and responsibilities of wealth ownership is less likely to have interest in—or feel a sense of agency about—the family’s financial future.

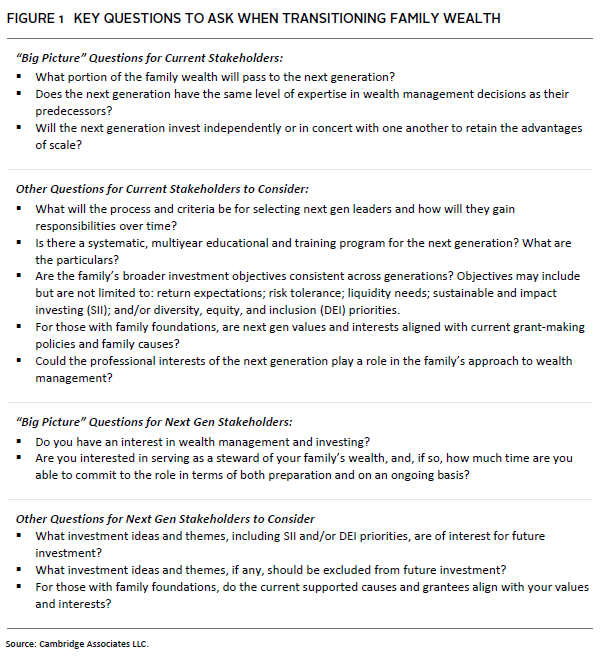

Conversations between principals and next gen wealth owners regarding the scope, aims, and potential obligations of family wealth are critical. It is important to understand not only if and how next gen members want to be involved in oversight, but what their vision is for the management of the family wealth. Given the varied age level, experience, and interests of next gen family members, the ability to consider and collectively discuss key questions about wealth is instrumental in clarifying individual perspectives and arriving at common principles (Figure 1). During this process, some families elect to enroll the aid of a family counselor, who can help to ensure all perspectives are accounted for in the drive toward consensus. Introducing the next generation to the family’s investment team—including investment advisors or managers held in the portfolio—can also help to foster dialogue and shared understanding around wealth ownership responsibilities, concerns, and possibilities.

The opportunity for incoming family members to observe the wealth management process promotes transparent communication and also affords them practical real-world experience. Families can facilitate observation in a variety of ways, but many choose to offer the opportunity to attend investment committee, investment advisor, or family foundation meetings. A more formal approach can include facilitating internship opportunities at the family office, the family’s operating company, or the family’s ecosystem of third-party providers.

Observing the wealth management process affords a third, helpful element of engagement: developing relationships. Making space for the next generation of family members to get to know the people who help manage the family’s wealth—and build their own relationships within that group—can be invaluable. Additionally, conversations with next gen members from other families of wealth are often useful and thought provoking. Next gen conferences and other events can facilitate this type of peer idea exchange and engagement and offer participants an opportunity to meet with members of other families to share experiences, learn from one another, and make personal connections. Finally, conferences and events focusing on wealth management, along with more structured networking organizations, afford valuable exposure and the ability to engage with others in their position.

Part 2: Education

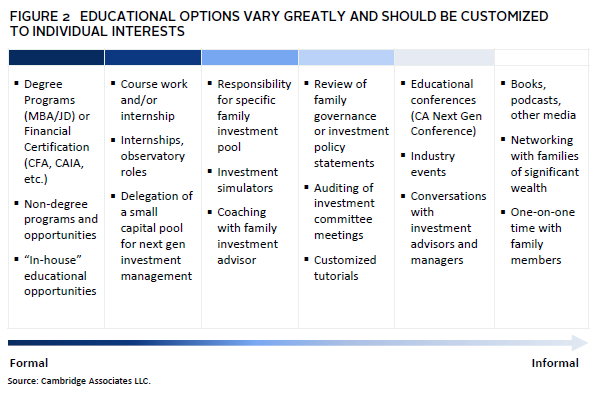

Once engaged, next gen wealth owners must be prepared to serve as effective, prudent stewards of their family’s wealth. Having the appropriate degree of knowledge and context is essential to being a successful agent in family wealth management. While educational opportunities range from formal to informal and vary by structure or intensity, learning should be tailored to meet the needs—by age, experience, and interests—of next gen family members (Figure 2). While basic financial literacy and an understanding of certain key investment principles is a highly useful foundation for next gen family members, education should not be forced. As with engagement, it is important for the next generation to be heard and understood—proactive discussion should inform the level and nature of learning each person wants and feels they need.

Certain family members with a keen interest in investment-focused learning may seek to build foundational knowledge through the pursuit of relevant degrees (undergraduate or graduate level), as well as through the receipt of formal credentials, such as the Chartered Financial Analyst® (CFA®) and the Chartered Alternative Investment Analyst (CAIA) designations. (CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.) Others may find that non-degree programs and opportunities focused on family wealth management are a suitable option. Additionally, next gen wealth owners can enhance learning by reviewing key governance documents, such as investment policy statements and the standard reporting materials prepared for the family assets.

For families with next gen members less exposed to, or interested in, traditional investment-focused learning, partnership with the family’s investment advisors and portfolio managers can be a very effective means of cultivating understanding and sparking curiosity. Some investment advisors provide customized, family-specific guidance to next gen family members about key investment principles and best practices for successful portfolio management. In addition to customized tutorials, many professional advisory firms host educational programs that can facilitate greater understanding of investment concepts and family wealth management. Cambridge Associates has long believed in education as a foundational aspect of serving our clients, and we have designed customized content and programming to inspire and help prepare next gen family members for the stewardship of their family’s wealth. This can include spending one-on-one time with family members who are focused on specific areas of education. Finally, some families feel that the best way to learn about investing is through practical experience. In some cases, family members are able to manage a small portion of the family’s capital to help improve their skill and know-how. In others, they use investment simulators that allow them to get a sense for how manager research, capital allocations, and market dynamics can play out.

Part 3: Empowerment

The final step in advancing the involvement of the next generation is to empower them with clear, meaningful decision-making authority over aspects of the family wealth management ecosystem. Even the most engaged and knowledgeable family members will remain unprepared to take on important wealth ownership challenges if they are not properly empowered to do so. Most family wealth transitions do not happen overnight, and a next generation that is enabled to participate in family decision making early on will feel a stronger sense of alignment with its future. Over time, they will have greater confidence in their ability to drive the family’s continued success.

There are a variety of ways to give the rising generation a sense of agency. Many begin by taking a position as a voting member of their family’s investment committee or through direct involvement in family philanthropic endeavors. Families involved in philanthropy often ask next gen members to set up and manage a small, independent portfolio aligned with a larger family foundation mission. Or many enlist family members as resources for a specific investment or project area, such as impact investing, venture capital, or Web 3.0 strategy allocations. In some cases, oversight of a pool of capital is delegated with specific goals in mind. Serving as the leader of a subcommittee—especially one whose work is focused on an area of primary interest—can afford vital experience in driving an agenda and helping to steer day-to-day wealth administration. Some families ask family members to “get their start” by overseeing a donor-advised fund—a gifted pool of assets intended for a specific charity. Giving rising family members the opportunity to oversee a discrete amount of capital can offer a practical and risk-controlled way to gain direct exposure to key principles of portfolio management decision making, while also imparting a deeper understanding of the roles various assets may play in the family’s wealth ecosystem.

Implementing Wealth Transitions

While the “three E’s” framework addresses how to effectively advance generational wealth transitions (Figure 3), the next obvious question is when to activate the framework. There is no one answer to this question, as each family situation is unique. That said, there are times that present natural opportunities to start.

These include the sale of a family business or the purchase of a new, concentrated family asset (e.g., a large property or a new, closely held business), or when funds become available to beneficiaries per the terms of a trust. Clearly, any number of life events—retirement, divorce, or the death of a matriarch or patriarch, to name a few—can trigger families to reassess their near- and long-term intentions. Identifying key participants in advance of challenging family events such as these can help families to better prepare for the unexpected. Similarly, setting a timetable for when it may be appropriate to begin discussing wealth transfer questions can be advantageous. In many cases, successful transitions are facilitated by principals who proactively assess the interests, aims, and skills of their next generation and work to incorporate these, where possible, into a broader changeover plan.

Family wealth transitions often present challenges. Prioritizing clear communication and planning can help families prepare. The right framework can help families avoid the risk that investment decisions are made without prioritizing established goals. While each family should devise a transition plan that is unique to their needs, those who seek to engage, educate, and empower the next generation of wealth owners are likely to see these efforts result in a strong foundation for continued success.