Investing for a Net-Zero World: A Guide for Investors

Investors are increasingly pursuing climate change–related agendas for both better investment outcomes and alignment with their stakeholders’ beliefs. Global efforts to limit global warming are focussed on achieving net-zero emissions of greenhouse gases by around 2050, which studies show broadly aligns with limiting warming to 1.5°C to 2°C above pre-industrial levels. For investors, this implies both material transition risks to carbon-producing assets and opportunities in cleaner technologies. Growing physical risks from extreme weather are equally ubiquitous. As policymakers set ‘net-zero’ targets, investors are likewise doing so for their own portfolios. This paper provides a high-level overview of the net-zero investing topic and considers practical implementation options for investors.

Background

Our 2019 paper summarised climate change for investors and defined the transition and physical risks their portfolios face. We noted how these risks are material, inevitable, outweighed opportunities, are likely underestimated by financial markets, and extend well beyond disruption to the old energy sector.

The last point is one reason why climate-aligned investing has rapidly evolved beyond ‘divestment’, which aimed to avoid investing in the producers of fossil fuels. While a valid ethical decision, it is likely an inadequate policy for mitigating transition risk and future-proofing portfolios. Companies producing fossil fuels now make up only 5% of the global equity index. Investors must also consider fossil fuel users burning carbon in the other 95% or so of a typical portfolio, an activity that policies aim to reduce severely. In other words, investors should target the same broader net-zero alignment in their portfolios as others target in the real world. Indeed, as markets increasingly realize the materiality of this issue, there is a strong case for investors to move faster.

Portfolio Net-Zero Objectives Should Consider Real World Impact

A portfolio’s reported carbon emissions are just one way to evaluate progress toward net zero and should not be the only measure of success. In fact, some recent adopters of net zero have found that focusing a portfolio too rigidly on reported emissions can lead to poor allocation decisions from both a climate and investment perspective. This is because of the way investors account for portfolio emissions.

For example, selling high-carbon assets to other investors results in no immediate change in real-world emissions, despite having a material impact on reported portfolio emissions. Such rebalancing is the easiest way to reduce portfolio emissions and reduce climate risk, which it is still potentially underestimated. It is surprisingly easy to reduce the carbon emissions of a typical diversified portfolio by 75% or so, considering the emissions are usually concentrated in specific managers, sectors, or even individual assets. For example, the utilities, materials, and energy sectors make up just 11% of the MSCI ACWI Index weight yet contribute 83% of emissions. Ten stocks, comprising a mere 0.8% weight, account for 19% of emissions 1 .

Oftentimes a few active managers contribute to the majority of emissions, so it is essential to determine if they are discounting this risk correctly. Re-balancing passive equity to climate-aligned indexes is also a sensible early step. These indexes are increasingly sophisticated; beyond tilting away from carbon, they can tilt toward green revenues and companies with forward momentum on reducing emissions. Recently, some have incorporated physical risk data.

However, rebalancing to remove carbon from a portfolio will have zero impact on carbon in the atmosphere, because these assets were simply sold on to other investors. Longer term, if enough investors abandoned high-carbon businesses, their cost of capital could rise or their social licence to operate could diminish, creating an indirect real-world impact.

Conversely, investing in real-world efforts to reduce carbon emissions can have a slower (or even negative) impact on portfolio emissions so investors should determine long-term goals when balancing emission reductions with exposure to climate solutions. High-emission industries like steel, cement, power, and transportation need investors’ encouragement and capital to reinvent themselves with green technologies. This real-world action by underlying companies will reduce portfolio emissions more slowly than re-balancing, and emissions in these key areas start from a high base.

Environmental solutions often have higher direct emissions than the index because these solutions are often in heavier industries. This figure alone may be a poor measure of net-zero alignment. For example, two factories making steel components may have the same direct, and relatively high, carbon emissions whether their products are then used in wind turbines or coal mining.

Consider one equity fund investing entirely in climate change mitigation and adaptation solutions. Investments include solar and wind power equipment makers, an electric bus maker, and energy efficiency–focussed industrials. Portfolio exposure to environmental solution revenues is 6.5 times greater than its index, but the current carbon emissions are 2.3 times the index 2 , albeit with a rapid downward trend. The current annual direct emissions of making all this stuff is a poor proxy for the whole-life net-zero contribution of carbon-avoiding or carbon-removing goods and services, as well as for assessing whether they are good investments in a decarbonising world. Emissions reductions should be balanced, therefore, with exposure to climate solutions in a pragmatic way.

Another real world feature of climate change is its uneven impact. The first effects will be felt most strongly in developing economies and by the poor or marginalized in all nations, who are also least able to adapt. The majority of new infrastructure needed to achieve net zero will also be in developing economies. When balancing climate solutions and social justice outcomes, there are multiple factors to consider, including who will bear the cost and the political feasibility of the main goal. The term ‘climate justice’ was coined to reflect these realities and should therefore be a key consideration when designing each component of a net-zero strategy.

Fossil Fuel Producers Can Be Treated Separately

Selling fossil fuel–producing assets to someone else may also have no direct impact on carbon in the real world. However, they are a special case because their product is the source of the problem; and, climate goals aim to choke off demand for their product, so divestment can make sense.

We have previously discussed why the very uncertain future of fossil fuel producers may be underestimated by investors. Furthermore, most are still investing predominantly to sustain fossil fuel production rather than pivoting fast into clean energy. The incompatibility of these business plans with global climate goals, and the attendant flaws and loopholes in many ‘net-zero’ pledges from the industry, are attracting more attention. In May 2021, the International Energy Agency laid out a new 2050 net-zero roadmap 3 consistent with 1.5°C targets. It stated that zero new oil & gas exploration, or new coal mines, were needed from 2021 onward. Put simply, this industry and the reality of the required changes in energy use which will make it obsolete, are now on a collision course. Tactical value trades aside, long-term investors should generally move their portfolios away from fossil fuels as part of their net-zero strategy. Investors aligning with net zero should be particularly cautious when locking up such exposure in illiquid private funds. Energy assets are often used in an ‘inflation-sensitive’ allocation, but carbon is unlikely to be a good long-term inflation hedge in a decarbonising world.

Whatever It Takes: A Holistic Approach to Targeting Net-Zero Alignment

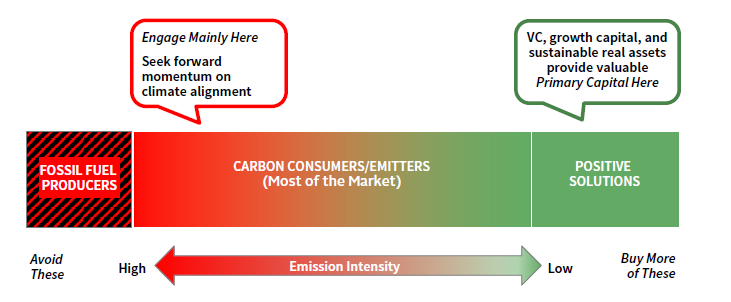

Simply reducing a portfolio’s emissions alone is unlikely to be optimal from an investment or environmental perspective. Instead, a more holistic and ambitious approach that integrates a climate lens across all investments should likely lead to better real world and investment outcomes (Figure 1).

FIGURE 1 PRAGMATIC PROGRESS OVER TIME MUST BE DRIVEN BY ACTIVITY IN THE REAL WORLD AND NOT JUST REBALANCING

Source: Cambridge Associates LLC.

The key point is that the portfolio is both aligned with net zero by avoiding the losers and investing in the winners, and it is contributing to net zero both through engagement and by funding new real-world climate solutions. The starting point should be a detailed audit of managers’ approach and of the underlying holdings in the portfolio. Both interim- and long-term progress targets are then set, based on a range of metrics.

Fossil fuel–producer exposure should decrease over time (or be removed entirely). As discussed, this is straightforward and should be measured separately from emissions.

Portfolio emissions should be reduced over time. In addition to satisfying all the nuances discussed, portfolio emissions should still trend down, but not at the expense of being underweight attractive climate solutions. As a guide, to align with limiting warming to a range of 1.5°C to 2°C, emissions should halve in the next ten years. Emissions expressed per million dollars invested will be more volatile than measures normalised by company revenues (emissions intensity), and bumps in the road should be expected. Investors should also track the real-world decarbonisation momentum being shown by underlying companies.

Positioning highlighted by Climate Scenario Analysis and other climate data should improve over time. Investors should hire managers that proactively consider climate risk and use all the appropriate tools and data sets. This issue should be a standing agenda item and discussed in all manager meetings. Many tools now exist to assess climate risk in the underlying portfolio. We highlight two examples:

- Climate Scenario Analysis. Some of these tools use climate scenarios to stress asset class returns generated from macroeconomic assumptions. Others assess how portfolio holdings are aligned with different climate scenarios on a forward-looking basis. MSCI’s Climate Value at Risk Tool (CVaR) is one example of the latter. It estimates the impact of scenarios – in terms of transition risks net of green opportunities, as well as physical risks from extreme weather – to the present values of a wide universe of equities and bonds. It runs a variety of global climate scenarios ranging from 1.5°C to 3°C. It gives an overall assessment for a portfolio and granular insights into individual sectors and positions. The Paris Agreement Capital Transition Assessment tool, from the 2° Investing Initiative, also looks at the alignment of equity and bond portfolios on a forward-looking basis with various climate scenarios. It has the advantage of being open source.

- Portfolio Warming Potential. Some tools express portfolio positioning in terms of its contribution to global warming, expressed as a temperature. For example, as of first quarter 2021, MSCI estimates the warming potential of the MSCI ACWI at roughly 3.5oC. This analysis uses forward-looking carbon emission data on holdings versus the carbon budgets for different sectors, as well as positive exposure to low-carbon technology.

Exposure to climate solutions should increase over time. There are particularly attractive opportunities in private asset classes, such as clean tech venture capital and sustainable infrastructure spanning areas like clean energy, transportation, and agriculture. Primary capital is also attractive and truly additive in the real world. However, investors should be overweight solutions in liquid assets too, and environmental thematic funds can also be an attractive solution.

Engagement profile should improve over time. Reducing emissions will require businesses to change behaviour. Engaging with companies, including voting on and proposing climate-related shareholder resolutions, can encourage them to be proactive on decarbonisation. While some asset owners implement direct engagement, others work by selecting and encouraging proactive managers that set their own net-zero goals and drive underlying company progress through active engagement. Investors may also join collaborative groups to engage on climate issues in a resource-efficient manner. In all these areas, we must accept that data will not be perfect. Many of the above assessments are harder for alternative investments. Investors should aim for better transparency and reporting on climate over time.

The ‘Zero’ Challenge: Offsetting

Some investors are setting ambitious net-zero emission target dates for portfolios that are much sooner than 2050. We generally advocate moving fast to reduce climate risk. However, while removing 75% of portfolio emissions is easy, the residual is currently a challenge when investing in what remains an overwhelmingly carbon-based economy. While the key focus should be on financed companies reducing their emissions, carbon offsetting within the portfolio to net-off residual emissions may be needed for a shorter-term, net-zero target. This validity of using offsetting investments within a portfolio to meet net-zero targets lacks consensus. There are also questions about the robustness of different offsets 4 .

Carbon removed offsetting represents sequestration of carbon from the atmosphere. Example activities include reforestation, soil carbon enhancement, bioenergy with carbon capture and storage (BECCS), and direct air capture with carbon storage (DACCS). Beyond sustainable forestry, lots of these technologies are nascent and can be hard for investors to access at scale. Carbon avoided represents actions that result in less carbon entering the atmosphere. Example activities include building and operating renewable power to displace fossil fuels, lower carbon transportation, industrial energy efficiency, improved agricultural practices to retain carbon in the soil, and using alternative fuels like hydrogen. Carbon-avoided claims can be particularly controversial for investors making net-zero statements, as former Bank of England Governor Mark Carney recently discovered when making claims of how a large asset manager’s renewable power investment were offsetting its other high-carbon investments 5 .

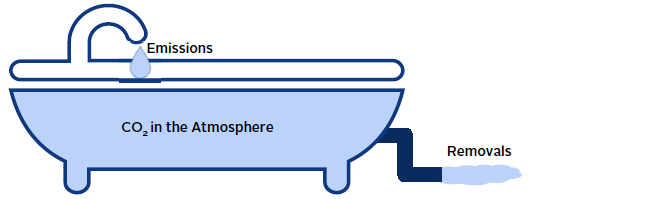

Once again, optimising a carbon number and building the best portfolio aligned with global net-zero goals are not always the same thing, and investors should consider real-world impacts of their investments. The global problem is the rising level of CO2 in the atmosphere. Using the bath analogy in Figure 2, a ton of CO2 emissions avoided (closing the tap) has the same impact as a ton removed (down the drain). Long term, as the tap hopefully closes completely, we need to shift from avoiding emissions to carbon removal from the atmosphere; but, right now, the tap is on full blast, and we must use all the tools at our disposal as investors.

FIGURE 2 A TON OF CO2 EMISSIONS AVOIDED HAS THE SAME IMPACT AS A TON OF EMISSIONS REMOVED

Source: Climate Interactive.

Both of these types of offsets suffer the same potential risks – the accounting may not be robust, they may be non-additive, reverse, have negative unintended consequences, or there may be an unacceptable time gap until the carbon removal actually occurs. Additionally, the investor may not be having any impact in the real world if one is just purchasing the investment in the secondary market, as opposed to funding a new greenfield asset.

Therefore, all offsets have weaknesses. Carbon removal offsets, which are theoretically better, also have drawbacks and the accounting can be dubious – for example, offsetting a flight tomorrow with a sapling planted that may remove that flight’s carbon in 30 years isn’t as straightforward as it seems. What if the tree is cut down or succumbs to climate change before maturing? Finally, does a protected forest area simply drive logging and deforestation elsewhere?

Carbon avoided offsets have a different drawback. They are considered ‘soft’ offsets because they estimate emissions avoided relative to a hypothetical baseline that would have taken place if not for the offsetting activity. Avoided carbon emissions are also ultimately captured in lower gross emission figures. For example, the carbon accounting for a wind turbine can therefore be less favourable than for a tree, but this does not mean investing in the latter is making a better real-world contribution to solving climate change. We need turbines as well as trees. Regardless, investors should exercise common sense. High-quality carbon-avoidance investments can play an important role in decarbonisation (if not net-zero pledges) alongside high-quality removals. Longer term, carbon removals must play a larger part, because, in an ideal world, a decarbonised economy would have few carbon emissions left to avoid. Carbon-removal with long-lived storage is ultimately the best offset. However, there are still few investable options here, as technologies such as direct air capture are nascent. It would be irresponsible, and uneconomic, to ignore other investments materially reducing the build-up of atmospheric carbon that make sense right now. We do not advocate sitting on the side-lines debating measurement definitions ‘while Rome burns’, waiting for technologies that may be investable by 2040.

Conclusion

Net zero is a goal that applies to the entire economy. Either we all succeed, or nobody succeeds. Therefore, investors for whom this goal is important should consider two aspects of it:

- Is the portfolio aligned with net zero, as seen in terms of the path of portfolio emissions?

- Is the portfolio contributing to net zero in the way it encourages and supports companies to change, the way it invests in climate solutions, doing both in a way that favours just outcomes and the interests of the broadest set of stakeholders in society?

We believe both can improve portfolio returns and risk management over the long term, but the second aspect can make a far more significant impact on CO2 emissions in the real world. There is no single ‘right’ lever to pull, but investors should adopt a holistic framework deploying all the tools available in a way and a place where they can make the most difference.

Chris Varco, Managing Director, Sustainable and Impact Investing

Simon Hallett, Managing Director, Endowment & Foundation Practice

Index Disclosure

MSCI ESG Research

MSCI Inc. is the world’s largest provider of Environmental, Social, and Governance (ESG) Indexes with over 1,500 equity and fixed income ESG Indexes designed to help institutional investors more effectively benchmark ESG investment performance and manage, measure and report on ESG mandates. MSCI ESG Indexes are designed to represent the performance of the most common ESG investment approaches by including, re-weighting or excluding companies by leveraging ESG criteria. MSCI Inc. also offers a range of Climate Indexes for investors who seek to incorporate climate risks and opportunities into their investment process.

Footnotes

- All data from MSCI ESG Research LLC. Carbon analysis on indexes as of 31 March 2021.

- All data from MSCI ESG Research LLC. Carbon analysis on indexes as of 31 March 2021.

- ‘Net Zero by 2050: A Roadmap for the Global Energy Sector’, International Energy Agency, May 2021.

- The Oxford Principles of Offsetting gives a great overview for assessing the robustness of offsets.

- Carney’s stumble at Brookfield intensifies focus on ‘net zero’ claims, Financial Times, April 2021. https://www.ft.com/content/2d96502f-c34d-4150-aa36-9dc16ffdcad2