Healthcare Systems: Recalibrating for 2021 and Beyond

Healthcare systems appear to have navigated the most severe financial impact of the pandemic. We believe the present time provides an opportunity to reset investment strategy and recalibrate portfolios as necessary. While the operational dynamics of providing care to communities will vary greatly depending on the balance sheet, regional footprint, and margin stability unique to each healthcare institution, the pandemic will likely continue to pressure cash flows of many systems for some time. The recovery of investments has been a welcome development, but future return expectations must be re-rated downward, given elevated equity valuations and extremely low bond yields. A robust operational and investment review can serve as a key pillar in communicating financial implications across all constituents of the healthcare system and ensure optimal management and deployment of capital.

What Has Happened and Where We Are

The COVID-19 crisis impacted investment portfolios and the operations of healthcare systems dramatically, but thankfully both are recovering. After the most rapid bear market in history and a 34% drop in global equities in a little over a month, stocks have more than recovered their losses to record levels, according to the MSCI ACWI in USD terms. Healthcare systems will look back at their first quarter 2020 balance sheet values as an adverse and (hopefully) brief low water mark.

The recovery in operational trends has been more complex. The pandemic’s evolution may be better categorized as a shift from sudden shock to more pervasive uncertainty. Elective procedures have recovered to varying degrees, but some healthcare systems are still confronting lower and less optimal operational run rates that may not recover to pre-COVID-19 levels in the near term. Healthcare systems have already made difficult employment decisions, including compensation cuts, furloughs, and layoffs. As the crisis has settled into this next phase of less acute but still challenging financial conditions, healthcare systems are balancing future operating expenses and capital initiatives against a backdrop of economic uncertainty and the reality that COVID-19 may persist for some time, even as vaccines are deployed.

An Opportunity to Recalibrate

As we stated in the initial days of April 2020, during what turned out to be the apex of the investment market crisis, it was imperative for healthcare systems to ensure immediate cash flow needs could be addressed and that long-term investment strategy be preserved as much as possible. We advocated determining liquidity needs, using as many levers as possible to raise needed liquidity (including drawing credit lines) before penetrating long-term funds. Once that exercise was completed, we emphasized the importance of rebalancing all portfolios back to target by adding risk assets, sticking to one’s long-term strategy to be positioned for recovery. The subsequent investment recovery has been rapid, but those that were agile and stuck to strategy with diligent rebalancing have been rewarded.

With investment losses largely recovered and volatility subsided, we believe this is a good time to refresh enterprise and investment models and reassess whether current portfolio structures are appropriate relative to the current outlook. We know that most healthcare systems conduct the exercise of an enterprise and strategic asset allocation review once a year, but we would advocate for conducting this review as soon as possible, even if “off-cycle.”

Scoping Out the Operational Outlook

An important initial step in conducting a thorough investment recalibration is weaving the new realities of COVID-19 into updated operational budgets and long-range plans for the healthcare system as an enterprise. While not as acute as the operating disruption witnessed during the early days of COVID-19, healthcare systems should refresh enterprise assumptions for the next several years and take the following steps to ensure a smooth transition out of the crisis.

- Model Multiple Stress Scenarios. Uncertainty will continue to be high with COVID-19, suggesting that systems should not anchor on one scenario when updating budgets. Fortunately, there have been many months of post-COVID operational trends that can be used to inform financial models around expected revenues and margins in a set of COVID-19 scenarios (“base,” “negative,” “severe”).

- Prepare for Economic Impact on Operations. Prior recessionary market experiences (2001–03; 2008–10) can be relied upon to inform how revenue may be pressured in the event of a prolonged recession driven by high unemployment. Healthcare systems can model adverse revenue mix shift, reimbursement pressures, potential bad debts risk on receivables, and other headwinds that have been experienced in prior recessions.

- Assess the Impact of Compressed Operating Margins. Most healthcare systems are operating at compressed (if not negative) operating margins, even if operating cash flow margins are maintained at a solid level. While throttling back capital spending and other cuts may help offset the adversity of these trends, it is important to adjust cash flow projections.

- Adjust for Strategic Initiatives and Capex. Healthcare systems must determine how much longer capital spending can be curtailed, as long-term cuts in capital cannot be sustained forever.

- If in a Position of Strength, Play Offense on M&A. Several larger and structurally well-positioned systems are fortunate to have maintained financial strength in this difficult environment. Those institutions have and will likely continue to play offense by opportunistically acquiring weaker hospitals/networks. If such a bolt-on strategy is in play, the investment portfolio must allow for incremental liquidity to help support such transactions.

- Determine Debt Capacity. While it is tempting to tap debt markets at record low financing yields, healthcare systems should balance the benefit from any new debt with how it could impact the system’s credit profile.

Resetting Investment Expectations

The investment return outlook for diversified portfolios appears challenging. Equity assets have fully recovered and hit record highs on depressed earnings and cash flow levels, further stretching the rubber band of valuation. Equity returns may be muted absent a recovery and acceleration in corporate profits. Sovereign bond yields are extremely low, resulting in less protection against downside shocks to risk assets. Additionally, credit spreads are relatively tight and provide little enhanced return if investors elect to take credit risk. Both equities and bonds offer these prospects in an uncertain economic environment, with COVID-19 looming as an existential risk. Reaching for yield in short and intermediate healthcare accounts has far less income potential than in prior history, yet the specter of equity price declines and/or seizing up of market functioning and liquidity cannot be ignored—a market crisis on par with March 2020 could always be imminent.

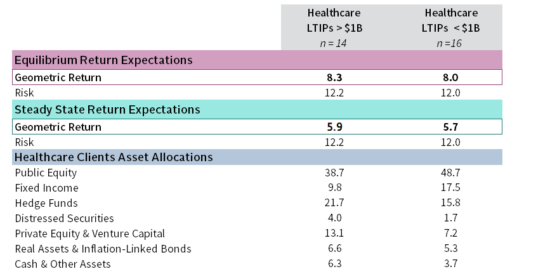

We believe it is imperative to update investment assumptions reflective of these valuation realities. As Figure 1 demonstrates, downward pressure on return expectations is a reality that must be acknowledged. Whether it be a more liquid orientation as expressed by our smaller clients ($1 billion and below), or a more alternatives heavy allocation that is typical of our larger clients ($1 billion and larger), return degradation relative to prior expectations is a significant risk. The expected return of portfolios using our “steady state” returns, which use asset returns reflective of current low bond yields, are over 2% lower when compared to expected portfolio returns using our long-term equilibrium expectations.

FIGURE 1 DOWNWARD PRESSURE ON RETURN EXPECTATIONS IS A REALITY

As of November 30, 2020 • Percent (%)

Source: Cambridge Associates LLC.

Notes: LTIP stands for Long-Term Investment Portfolio. Returns are nominal; equilibrium return and steady state return expectations assume 2.5% inflation. Risk refers to standard deviation. Return and risk metrics are annualized and generated using Cambridge Associates proprietary portfolio models incorporating assumed asset class returns, standard deviations, and correlation between asset classes. Allocation data are as of June 30, 2020 and may not sum to 100% due to rounding.

An update of the enterprise and investment model, using techniques described, will unfortunately lead to a downward re-rating of expectations on how robust investment gains will be for healthcare systems. The re-rating is a difficult message to internalize during such difficult times for healthcare providers, but it must be understood as future budgets and plans are created. Given this reality, systems should conduct the following steps to facilitate the most useful communication with the system’s executive leadership and governance.

- Assess Expected Nominal Returns. Extremely low bond yields mean that the primary lever to maintain nominal returns is to increase risk and equity orientation. But investors should be cautious about adding equity risk at the most expensive equity valuations in nearly two decades.

- Do Not Ignore Downside Risk. Lower-return expectations do not equate to lower risk; in some cases, asset classes have been cast as “return-free risk” given volatility can persist, yet terminal returns can be quite low. Using the updated operational scenarios from the enterprise review, many healthcare systems regrettably may have even less tolerance for downside risk than they did prior to COVID-19, as future operational cash flows have been impacted.

- Recalibrate the Investment Policy as Necessary. Uncertainty abounds about future outcomes of the economy and capital markets, but because there is higher clarity, this is a far better time to make shifts in investment strategy than in times of market duress.

- Keep an Eye on Covenants. Debt ratings have been resilient for most systems despite the operational and investment volatility resulting from COVID-19. Any meaningful shift in equity orientation or liquidity profile must maintain conformity with key financial metric thresholds to sustain debt ratings. Fortunately, the low cost of financing that most systems can use in raising new debt is a favorable development that helps offset some of the pain resulting from lowering expected returns on assets.

- Adjust the Healthcare Systems Budget for Investment Returns. After assumptions have been modified, models have been updated, and asset allocations have been reviewed, it is paramount to adjust expected return assumptions that impact other parts of the healthcare system budget. While many of these adjustments may result in lower expected income and gains from investments, it is better to set realistic expectations than to be disadvantaged by shortfall for the next several years.

It will be disappointing to many constituents within the healthcare system community to lower investment return expectations due to rich equity valuations and depressed bond yields. That said, this exercise is valuable in refining expectations and budgeting earnings that can be reasonably expected from a healthcare system’s investment assets. Furthermore, if lowered expectations result in a gap that is too large to bear, it may be worth considering making changes to the fundamental risk profile of the healthcare system—including potentially increasing portfolio equity orientation—to raise the range of expected outcomes. Healthcare systems will be most successful by balancing their operational acumen with strong execution on capital initiatives, tactical M&A, and optimized investment portfolios.

Jeff Blazek, CFA, Head of Healthcare Practice

Hamilton Lee, Managing Director

Bridget Sproles, Managing Director

Kristin Roesch and Clare Skillman also contributed to this publication.