Foundation Spending Strategies Vary for 2020

Private non-operating foundations are required to spend a minimum of 5% of their assets each year, but they do have some flexibility to meet those requirements over a multi-year horizon. Foundations may also choose to spend more than 5% in a given year. So, while the requirement is a fairly straightforward calculation, strategy may come into play as foundations grapple with fluctuating investment portfolio values and the impacts of COVID-19.

In April 2020, Cambridge Associates conducted a survey of our foundation clients to gauge sentiment about spending for the current year and to understand potential sources of flexibility and liquidity. The following highlights are excerpted from a more detailed study conducted for participating foundations.

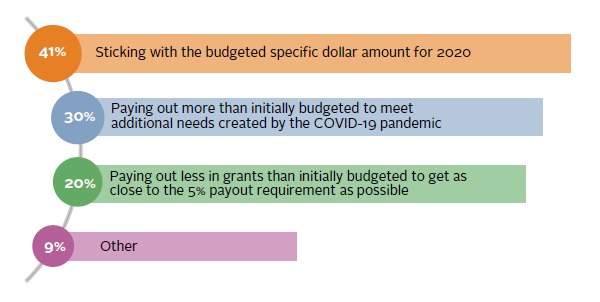

Annual decisions about foundation spending balance immediate needs of grantees and the long-term philanthropic capacity of the foundation. Of survey respondents, 41% indicated that they are sticking with the spending amount that they initially budgeted for this year. These organizations expressed the importance of following through on their funding commitments. Thirty percent of foundations responded that they are paying out more than the 5% requirement this year. They tended to be smaller foundations and foundations with a healthcare focus. Twenty percent may be spending less this year in reaction to declining portfolio market values, and to preserve purchasing power for future years.

FOUNDATION SPENDING SENTIMENT

61 Participating Foundations

Source: Cambridge Associates LLC.

When foundations exceed their minimum spending requirement in a given year they build a balance or carryover of excess qualifying distributions. The balance of these funds can be used to meet spending requirements in future years. Strikingly, 63% of responding foundations have a carryover of excess qualifying distributions; however, most of these foundations felt it was unlikely that they would apply these distributions to meet their 2020 spending requirement.

Although many of our endowment clients are turning to a line of credit for liquidity during this challenging time, a line of credit is unusual for foundations. Only 25% of participating foundations have established a line of credit, and about half of them plan to or have already drawn on it this year. For those who do not have a line of credit, 67% do not plan on establishing one this year, while 9% are looking to establish a line, and 24% are considering a line of credit to provide liquidity for philanthropic priorities.

While we are not even halfway through 2020, the year has already brought tremendous disruption and uncertainty. Foundations are approaching these challenges with responsive philanthropy and a long-term view, so they can support important causes in 2020 and many years beyond.

Tracy Abedon Filosa, Head of CA Institute

Grant Steele, Senior Director – CA Institute

Shreya Vajram also contributed to this publication.

Distribution Calculation Note

The required distribution is calculated as 5% of the average monthly value of assets over the course of the tax year, less some minor miscellaneous deductions. Only spending that meets the criteria for qualifying distributions may be used to satisfy the required amount.