China A-Shares Outperform Global Equities

China’s equity markets have lagged global equities sharply thus far in 2021 in the face of a regulatory crackdown. We expect Chinese equities, particularly China onshore A-shares, to outperform global equities in 2022. Such shares are inexpensive relative to global equities and are relatively insulated from the regulatory stresses that have disproportionately hit the offshore market. We expect targeted monetary and fiscal support should benefit A-shares relative to global equities, where policymakers are looking to reduce emergency fiscal and monetary supports.

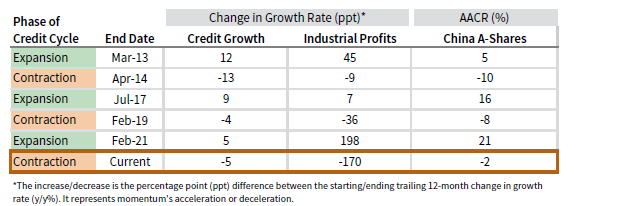

China A-shares also offer reasonable value relative to global equities, with the ratio of their normalized P/E ratios trading at the 16th percentile of historical relative valuations. In absolute terms, relative to its own history, the MSCI China A-share market trades above its median, but not excessively so (65th percentile). At the same time, earnings momentum for China A-shares has remained robust. Year-to-date, only real estate, communication services, and consumer discretionary sectors have seen forward 12-month earnings estimates decline meaningfully in the MSCI China Index. Not only are these sectors underweight in the A-share market relative to the MSCI China Index, but the earnings deceleration in these sectors has been lesser in the onshore market. If the People’s Bank of China eases monetary policy later this year or early next, as seems likely, onshore earnings momentum may increase, as that market tends to benefit disproportionately from credit expansion. And, if this easing occurs as the rest of the world begins tightening, China A-shares should outperform.Big tech companies that have listed offshore have been in the crosshairs of Beijing’s regulatory moves and have dragged down equity performance. In contrast, the onshore A-share market is underweight tech, particularly the consumer discretionary and communication services sectors that include stocks like Alibaba, JD.com, Meituan, and Tencent. The China A-share market has been a relative haven with respect to Chinese equities and continues to see steady inflows as investors rotate out of offshore tech companies. Further, as real estate prices soften, onshore equities are likely to attract more domestic capital that would otherwise be invested in apartments.

ACCELERATING PRIVATE SECTOR CREDIT PROVIDES A BOOST TO ONSHORE CHINA A-SHARES

December 31, 2012 – November 30, 2021

Sources: MSCI Inc., National Bureau of Statistics of China, People’s Bank of China, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: China A-Shares are represented by MSCI China A Onshore Index price returns, in local currency terms. Private-sector credit is represented by aggregate financing to the real economy less government bonds and equity financing on the domestic stock market by non-financial enterprises. Industrial profits data are decumulated (i.e., are based on monthly values, rather than accumulated YTD values) and gaps in data are linearly interpolated. Industrial profits data are also smoothed using a two-month rolling average. Industrial profits and private credit data for the first expansion cycle begin March 31, 2013. Industrial profits and private credit data are through October 31, 2021.

Celia Dallas, Chief Investment Strategist