Asia Insights: Navigating Higher Rates and Volatility

Introduction

Aaron Costello, Regional Head for Asia, and Vivian Gan, Associate Investment Director, Capital Markets Research

The path of global central bank tightening remains a top-of-mind question for investors after the recent stress in the US and European banking sectors. While financial contagion seems contained for now and has yet to spread to Asia, the current environment of higher rates and the risk of slowing global growth pose challenges for Asian markets. Furthermore, China’s reopening has boosted the outlook for the region as a whole, but heightened US-China geopolitical tensions remain a risk. In this edition of Asia Insights, we highlight areas we continue to find opportunities in, despite the current environment of higher rates and market uncertainty.

- Public Equities: After receiving muted interest from international investors over the past decade, Japanese equities deserve more investor attention, given higher relative earnings growth momentum, low starting valuations, and strong corporate balance sheets that are attractive qualities in the current environment. Over the longer horizon, regulatory changes and increased activist engagement will help improve the return profile of Japanese equities.

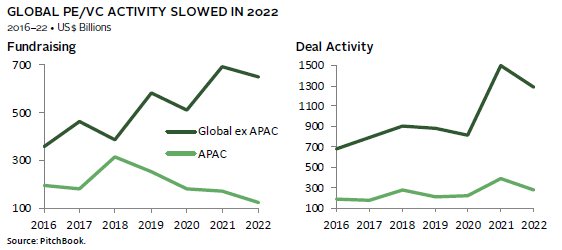

- Private Investments: Global fundraising and deal activity slowed in 2022, and Asia private equity and venture markets were not spared. Capital availability and deal activity in Asia may remain tight in the near term, as international investors seek to reduce geopolitical and emerging markets risk. However, this presents an opportunity for high-quality managers that face lesser capital constraints.

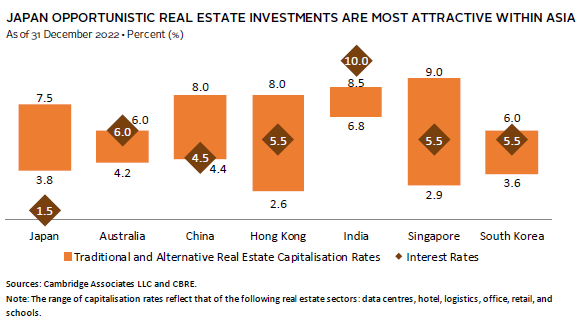

- Real Assets: Rising interest rates across major Asian economies have eroded the attractiveness of Asian real estate and led to a meaningful decline in recent investment activity. Within the current environment, however, Japan opportunistic real estate strategies can still offer investors a higher return profile, given lower borrowing costs arising from the divergence in the Bank of Japan’s monetary policy from other Asian central banks.

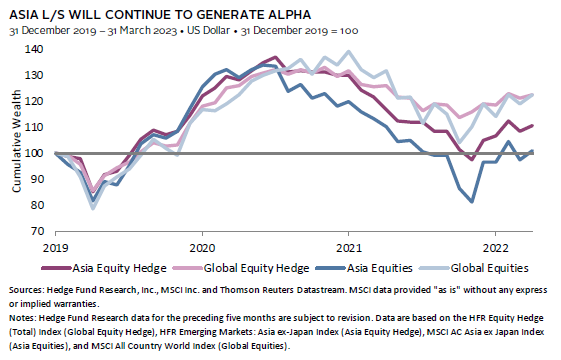

- Hedge Funds: Asia equity long/short strategies have successfully generated alpha in recent years, although they have underperformed their global counterparts given the relative weakness in Asian equity markets. However, we view that the tide is turning for Asia long/short strategies, as the current environment of higher rates and volatility, together with China’s reopening, present a positive backdrop for managers that can generate alpha on both the long and short side of their portfolios.

Public Equities: The Stars Are Aligning for Japanese Equities

Wilson Chen, Managing Director, Public Equities

Investor interest in Japan has been muted, as flat valuation multiples and the yen’s weakness saw Japanese equities underperform their developed markets (DM) counterparts. Over a trailing ten-year period, Japanese equities returned 9.1% 1 and 5.4% in local currency and US dollar terms, respectively, versus 10.5% and 9.8% for DM ex Japan equities. Looking forward, we view that there are short- and long-term tailwinds for Japan that warrant closer investor attention.

In the near horizon, Japan still stands to benefit from the reopening of its domestic economy and China’s alike in the form of renewed tourism spending. Corporate earnings growth in Japan – which has been stronger than its DM peers over the past decade – is likely to sustain its positive momentum because of the divergence in monetary and fiscal policy in Japan versus other developed economies. Furthermore, Japanese companies tend to have strong cash balances and balances sheets, allowing them to remain more resilient amid higher market volatility and slowing global growth.

Current valuations for both Japanese equities and the currency remain undemanding. While Japan trades close to fair value in absolute terms, valuations relative to DM ex Japan are low at the 25th percentile of historical observations. Real exchange rate valuations for the yen versus the US dollar are also near all-time lows, reducing downside risks from further yen weakness, especially if the Federal Reserve pauses its rate hike cycle later in the year.

There are positive signs that inflation in Japan is ticking up. While some of this was due to higher import costs, we are seeing evidence today of wage growth and companies increasing prices after years of holding back. A transition from a deflationary to an inflationary environment would induce a paradigm shift, as attitudes toward domestic consumption and investment change. Over the longer term, policy changes emphasising increased governance and shareholder returns – including the unwinding of cross shareholding and the increasing of share buybacks – coupled with a rise in activist engagement, will further enhance the return profile and attractiveness of Japanese equities.

Private Investments: Capital Availability and Deal Activity Likely to Remain Muted for Now

Vish Ramaswami, Managing Director, Private Equity

2022 saw a dramatic fall in dollars raised and deployed by Asia private equity and venture capital (PE/VC) funds. Asian venture markets were hit by the global crash in technology and biotechnology valuations. Returns of mature funds were impacted, dampening the outlook for new fundraising. Meanwhile, companies faced difficulties raising new equity rounds, given flat valuations, and new company formation slowed. Growth and buyout deals have also seen weaker operating metrics over the past two to three years, which affected portfolio marks and dragged down returns. The denominator effect 2 has forced limited partners (LPs) to cull managers. Availability of capital fell, while cost went up.

This downward trend mirrors that of other regions. However, in an environment of uncertainty, illiquid commitments suffered additionally in less-proven markets fraught with political or currency risks, such as Asia-Pacific. The impact is particularly pronounced in China, which has absorbed and invested the vast majority of VC raised in Asia but is in a unique geopolitical standoff with the United States. The latter is where most LPs are based and is integral to VC activity, from idea generation to public markets for exit. Beyond VC, we also see a general pullback from China by managers with regional or global mandates.

Meanwhile, ex-China country-focused and regional funds have also seen fundraising slow, reflecting the cautious mood toward Asia-Pacific more broadly. This general muted sentiment is likely to persist over 2023, and coupled with tighter capital availability, means that deals are taking longer to close. PE deals are re-pricing, favouring overcautious buyers, and VC may see flat or even down rounds as the prospect of public market exits becomes more distant.

Amid all this, high-quality managers have raised healthy sums and are optimistic that the situation presents a good investing environment for those with capital. LPs with dry powder face an opportune moment where hitherto access-constrained managers are now open to new capital. The additional silver lining is that the collapse of Silicon Valley Bank (SVB) has had little impact on Asia-Pacific, given few portfolio companies in the region banked with SVB and venture debt, in any case, is a very small portion of overall venture activity.

Real Assets: Japan Remains a Bright Spot Within Asian Real Estate

Johnny Adji, Senior Investment Director, Real Assets and Private Credit

Asia commercial real estate activity saw a marked decline in 2022, and the outlook for the market remains muted in the near term. Rising interest rates across major Asian economies have increased the cost of new acquisitions financing. At the same time, elevated inflationary pressures and cooling global growth have placed a drag on the income return to Asian real estate, particularly for non-residential, commercial sectors.

Across developed Asia markets – including Australia, Hong Kong, Singapore, and South Korea – traditional real estate investments appear even less attractive considering the negative carry yields arising from higher borrowing costs in tandem with lower capitalisation rates. With transaction volume and valuations remaining under pressure, we expect capitalisation rates for these segments to edge upward – potentially expanding by 75 basis points (bps) to 100 bps in the next six to 12 months – following a similar recent trend in the United States and Europe. Alternative real estate strategies (e.g., schools and data centres) in these markets are slightly more attractive as they offer higher yields, although elevated interest rates are still weighing on the overall return profiles. While the same picture looks to hold for Asia emerging markets such as China and India, the outlook there is somewhat more positive, as a result of the countries’ higher economic growth and potential real estate rental growth.

Against this backdrop, we view that Japan continues to be a bright spot for real estate strategies. In contrast to its Asian peers, borrowing costs in Japan remain relatively low, driven by the country’s lower levels of inflation and the Bank of Japan’s commitment to its ultra-loose monetary policy to stimulate economic growth. Capitalisation rates in Japan also remain stable, ranging from 3.8% for traditional real estate to up to 7.5% for alternative sectors. Furthermore, low interest rates in Japan imply that USD-based investors can pick up carry yield from hedging back to the US dollar (while also removing currency risks). As a result, managers investing in Japan real estate are more likely able to achieve their target returns without having to either underwrite capitalisation rate compressions or aggressive rental growth rates.

Hedge Funds: The Tide Is Turning for Asia Equity Long/Short

Benjamin Low, Senior Investment Director, Hedge Funds

Investor sentiments toward Asia equity long/short (L/S) strategies have been dampened by the ongoing volatility in China, as well as the broader weakness of Asian equities relative to their global peers. Indeed, since mid-2021, the performance of Asia L/S funds has trailed that of their global counterparts, although they still managed to add value over the broad Asia market.

Going forward, we view that the outlook for Asia L/S strategies is turning more positive, driven by increased alpha opportunities arising from current market conditions. Higher funding costs and market volatility have led to a wider dispersion between fundamentally strong and weak companies, allowing for alpha creation on both long and short portfolio allocations. Short rebate has turned positive with the rise in global interest rates, providing a boost to returns for funds that have a meaningful short allocation. The continued reopening of China’s economy will also lead to a re-rating in China and other Asian markets as investment capital returns to the region. Managers with proprietary fundamental research capabilities will be better poised to benefit from China’s rebound, particularly in emerging themes such as advanced manufacturing and clean energy where there are no clear winners yet.

Fund managers that can generate consistent short alpha in the current environment will gain traction from investors. However, managing fund capacity will be critical, as a rapid growth in assets under management could necessitate investments into less inefficient segments of the market and erode alpha. Furthermore, while current financial conditions bode well for equity L/S managers, elevated inflation and rates are still headwinds for equities in general. Most Asia L/S fund managers are less versed in navigating through a high inflation environment, increasing the odds of more fund closures in the horizon. However, as manager crowding lessens, the competitive landscape and overall performance of Asia L/S is likely to improve as a result over time.

Drew Boyer and Derek Yam also contributed to this publication.

Index Disclosures

HFR Equity Hedge (Total) Index

The HFR Equity Hedge (Total) Index includes equity hedge investment managers that maintain positions both long and short in primarily equity and equity derivative securities. Managers would typically maintain at least 50% exposure to, and may in some cases be entirely invested in, equities, both long and short.

HFR Emerging Markets: Asia ex-Japan Index

HFR Emerging Markets: Asia ex-Japan funds focus greater than 50% of their investments in the Asia ex-Japan region, which includes China, Korea, Australia, India, Hong Kong, and Singapore.

MSCI AC Asia ex Japan Index

The MSCI AC Asia ex Japan Index captures large- and mid-cap representation across two of three developed markets countries (excluding Japan) and eight emerging markets countries in Asia. With 1,201 constituents, the index covers approximately 85% of the free float–adjusted market capitalisation in each country.

MSCI All Country World Index

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets and 24 emerging markets countries. With 2,898 constituents, the index covers approximately 85% of the global investable equity opportunity set.

MSCI Japan Index

The MSCI Japan Index is designed to measure the performance of the large- and mid-cap segments of the Japanese market. With 237 constituents, the index covers approximately 85% of the free float–adjusted market capitalisation in Japan.

MSCI World ex Japan Index

The MSCI Kokusai Index (also known as the MSCI World ex Japan Index) captures large- and mid-cap representation across 22 of 23 developed markets countries (excluding Japan). With 1,272 constituents, the index covers approximately 85% of the free float–adjusted market capitalisation in each country.

Footnotes

- Data reflect annualized returns. Japanese equity performance is based on the MSCI Japan Index and DM ex Japan equity performance is based on the MSCI World ex Japan Index.

- The denominator effect refers to a rise in the proportion of private investments in investor portfolios resulting from public market declines.