2023 Outlook: Portfolio Wide

We expect most investors should maintain equity allocations in line with policy targets. Consistent with this idea, we believe investors with portfolios that are more diversified across risk exposures will tend to fare better than investors holding more correlated investments.

Investors Following Rebalancing Plans Will Be Rewarded in 2023

Kevin Rosenbaum, Global Head of Capital Markets Research

We expect economic growth will be below trend, and while inflation rates will trend lower across major developed markets, with the United States leading Europe, we think inflation rates will remain uncomfortably high relative to central bank targets in 2023. This backdrop has typically been associated with elevated market volatilities and weak investment performances. Despite this reality, we don’t think most investors will be well served by underweighting equity risk relative to policy portfolios. Attempting to time markets can easily lead to long-term underperformance.

A key reason why we suggest sticking close to equity policy weights, rather than trying to time when you rebalance with when markets bottom, is the difficult nature of identifying equity market bottoms in real time. Consider March 2009, when equity markets bottomed during the Global Financial Crisis—US real GDP was contracting 5% annualized, US monthly retail sales were contracting 13% versus the prior year, and newspapers were highlighting financial system risks. Neither that backdrop nor the backdrops of any other major equity market bottom offered compelling evidence that equity markets were set to rally, meaning investors under-allocated to equities would not fully participate.

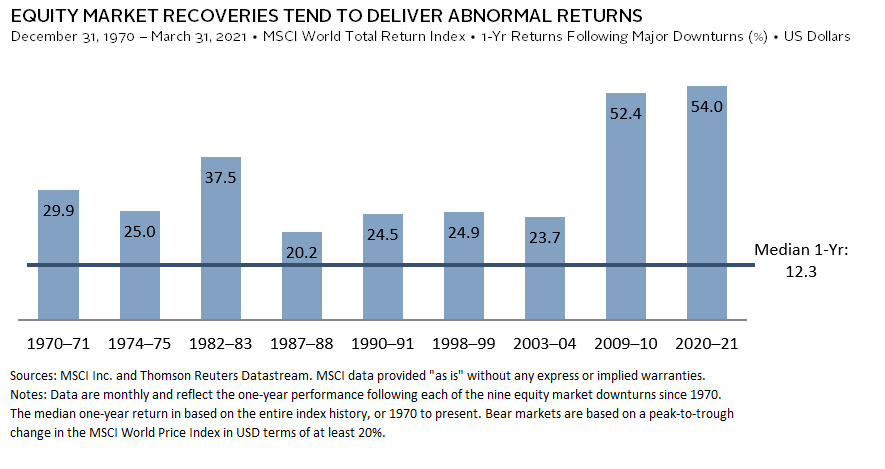

Relatedly, when markets move violently in one direction, they tend to correct violently in the other direction. Looking back at the nine major global equity market downturns that have occurred since 1970, equity returns in the 12 months after the downturn ranged from 20% to 54%. These returns stand in stark contrast to the median one-year return across the ~50-year period of 12%. Theory also supports this pattern. Collectively, investors suffer from behavioral biases, such as loss aversion, which tend to generate additional selling in down markets. This results in a disconnect between equity price levels and rational expectations, which eventually unwinds. So, investors that wrongly time rebalancing decisions during downturns may not fully participate in the rare chunky returns that tend to follow.

But stepping back, stressful situations also tend to impact decision-making processes negatively. The best way to mitigate this challenge is to stick with decision-making frameworks and plans.

Portfolios Will Benefit from Diversification in 2023

Thomas O’Mahony, Investment Director, Capital Markets Research

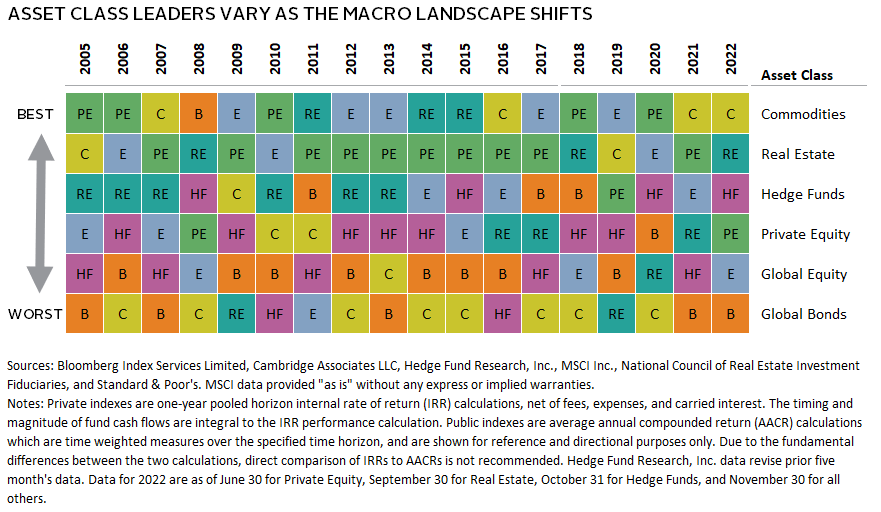

Subdued inflation, sustained growth, and relative peace provided a goldilocks environment for the balanced portfolio in recent decades. With concerns surrounding all three factors to various extents, tail risks for portfolios have not been as simultaneously elevated for some time. Therefore, thoughtful portfolio construction with regard to macro drivers and risk exposures should be a key concern in 2023.

Inflation is slowing from its recent peak, but we doubt it will quickly settle at the low levels that we have become accustomed. Though equities do a good job of outperforming inflation over long horizons, their performance can be challenged over shorter horizons when inflation exceeds expectations. Allocations to inflation-linked bonds or gold can play a partial role in mitigating such inflation exposure, albeit with interest rate risk. Other complementary methods include real assets investments, which range from direct commodity exposure in the form of commodity futures, to investments in real estate, natural resources equities, and infrastructure.

At the same time, the lagged impact of the highest inflation rate in over 40 years—combined with concerted global monetary tightening—has the potential to drive a material slowing of growth and, subsequently, dampen inflation. Despite their recent subpar performance, US Treasuries remain best placed to thrive in the event of such an outcome, with the ten-year yield at 3.68%.

Alternative fund structures, such as hedge funds, present further diversification possibilities. For example, macro regime shifts have proven to be fruitful periods for global macro funds. Trend following strategies can also help to cushion portfolio returns during prolonged bear markets, while allowing for participation in extended rallies. More esoteric strategies, inside and outside of the hedge fund umbrella, can also provide less correlated returns, such as the insurance-linked strategies discussed elsewhere.

Over long horizons, more diversified portfolios have delivered higher returns with lower volatility than the classic balanced portfolio. The combination of diversifiers that is most suitable for a portfolio depends on an investor’s specific goals and circumstances. But as we move forward into 2023, likely a period of continued macro uncertainty, we believe it is prudent to build resiliency into portfolios by using the diversity of investment opportunities available.

Kevin Rosenbaum, CFA, CAIA - Kevin Rosenbaum is Head of Global Capital Markets Research at Cambridge Associates.

Thomas O’Mahony, CFA - Tom O’Mahony is a Senior Investment Director at Cambridge Associates. Tom is part of the Capital Markets Research Group that is charged with developing the firm’s strategic and tactical asset allocation guidance. He conducts research into broad macroeconomic themes in addition to asset class topics. Tom has authored numerous publications and contributes to the firm’s […]