2023 Outlook: Currencies

We expect the US dollar to remain firm but with limited appreciation relative to 2022, given our view that it is near the end of its incredible multi-year run. We believe gold’s performance will improve and digital assets, in general, will not surpass prior highs, many of which were set in 2021.

2023 Will Not be a Repeat of the Dollar’s Annus Mirabilis

Thomas O’Mahony, Investment Director, Capital Markets Research

The US dollar experienced a rapid appreciation during 2022. Based on our developed markets (DM) trade-weighted index, which keeps current weights constant, its year-to-date rise of 10.8% is on track to be the sixth largest calendar-year gain for the greenback based on data going back to 1972.

Various factors drove this performance. It began with a widening of interest rate differentials, as the Federal Reserve became more hawkish. This was followed by a widening in expected growth differentials, as the implications of the war in Ukraine for activity in Europe started to become clear. The dollar also benefited all the while from its role as a risk-off currency and broader safe haven, as equity markets declined. The performance challenges facing other traditional safe havens, such as Treasuries and gold, helped its standing in this regard.

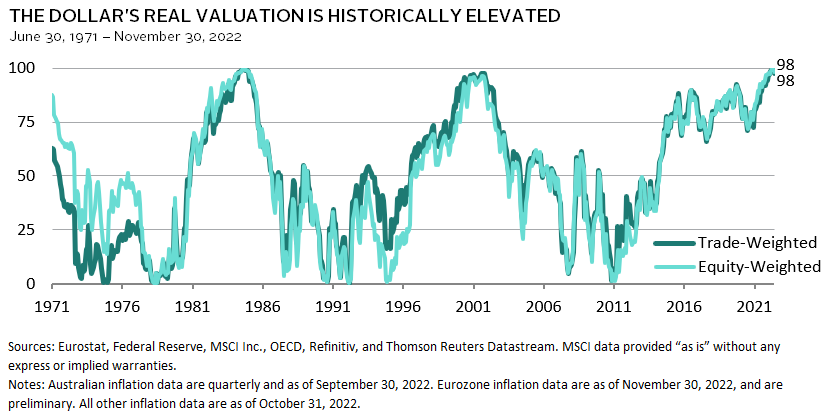

This rally leaves the dollar looking expensive from a long-term perspective. Its real effective exchange rate reached the 100th percentile of our DM basket in October and now sits at the 98th percentile. In addition, the maximum real appreciation this cycle, at 62%, is comparable to the average of 68% seen in the two prior dollar cycles. In recent decades, peaks in the US dollar have typically been associated with troughs in global activity, alongside an easing Fed. Growing recessionary fears and the softer-than-

anticipated US CPI data for October saw the dollar weaken in November, as the odds of these conditions being satisfied in 2023 rose.

While it is possible that we have seen the peak in the dollar for this cycle, we see several factors continuing to act as supports for the greenback in 2023 even if further upside is limited. First, given we believe that inflation risks are skewed to either matching or exceeding current above-target expectations, we doubt the market will price in a deep rate-cutting cycle, keeping interest rate differentials extended. Second, additional rate hikes in Europe, even as a recession there seems likely, is a further headwind to growth beyond that of the direct impact of the energy crisis. Finally, were a meaningful US recession to take hold, further investor de-risking would likely see the dollar benefit from safe-haven seeking flows.

Gold Bullion’s Performance Should Improve in 2023

Sean Duffin, Investment Director, Capital Markets Research

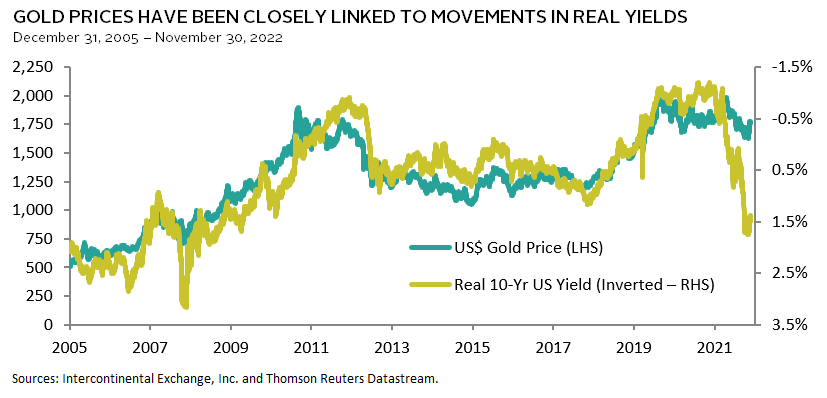

Ever since the gold price soared during the great inflation of the 1970s, many investors believed that gold would rally again whenever high inflation resurfaced. That inflation reckoning finally happened in 2022, and yet, gold declined in USD terms. The sharp rise in real yields and broad-based dollar strength were two key factors that drove this performance, but there are reasons to believe that these factors could lose potency in 2023. We expect gold’s performance will improve after declining 3.9% in 2022, which ranked near the bottom quartile of its annual returns since 1970.

Gold has historically been sensitive to changes in real interest rates. The yield of the ten-year inflation-linked bond rose more than 250 basis points so far in 2022, but gold prices didn’t decline as sharply as might be expected. This suggests that gold’s price was supported by demand linked to heightened geopolitical risks and inflationary concerns. We also shouldn’t expect the same trajectory of steep yield increases in 2023. The forward market implies ten-year real yields will end 2023 at the same level as today.

The dollar’s strength is another key reason the price of gold stumbled in 2022. Non-USD based investors have benefited from the currency gap, as the yellow metal posted positive returns in most major currencies. While the dollar is likely to remain supported in the near term, it is richly valued and has enjoyed a lengthy period of cyclical strength. This suggests the additional pressure the dollar will put on gold next year will likely be smaller than in 2022.

Finally, given the uncertainty surrounding central banks’ efforts to rein in inflation, we expect economic growth will be weak. That could be another support for gold, as it has tended to be historically. Still, gold is speculative, and it is more difficult to own when fixed income securities offer better yields than a year ago.

Digital Assets Will Not Eclipse Prior Highs in 2023

Joseph Marenda, Head of Digital Assets Investing

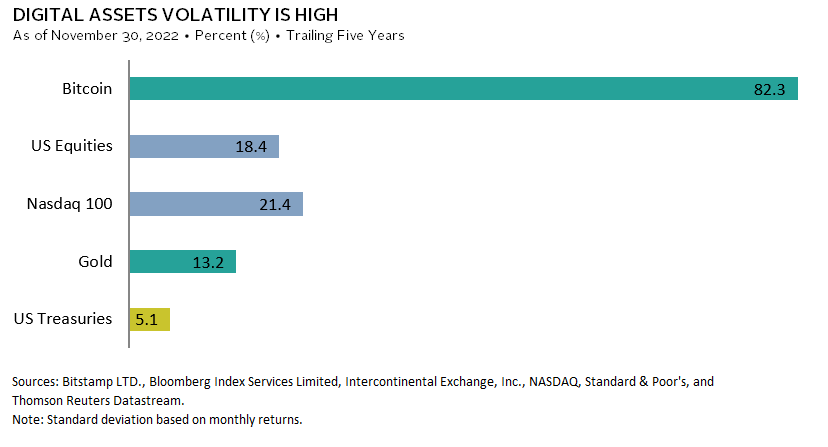

Economic and interest rate headwinds, as well as simple math, will make it difficult for many digital assets to surpass prior highs in 2023. On the latter, digital assets that are down 50% would need to return 100% to reach prior highs, and those down 80% would need to return 500%! While bitcoin, ether, and altcoins have posted gains on this order of magnitude or greater, historically these gains were in the context of strong macro tailwinds. 1

Still, our long-term view of the blockchain as a positive new technology remains unchanged. To be sure, it is still developing use cases and building its user base, which will contribute to the asset class’s volatility. But prior crypto winters have been periods of significant technological progress, and major innovations launched following those winters. Given the pace of venture investment during this winter, technological progress will likely again blossom.

A difficult macro environment may set up an opportunity for some patient investors to enter the digital asset space. Historically, buying risk assets that have sold off heavily has typically been a good strategy. And while valuing digital assets is difficult, venture capital (VC) valuations in late 2022 are down materially, which suggests the ecosystem, broadly speaking, is more attractively priced today than a year ago.

Investors typically enter the space via three main channels: buying digital assets, such as bitcoin, directly; VC funds; and hedge funds. We tend to prefer seed and early-stage venture, given valuations and the strong alignment between investor and founder. But hedge funds are also a possibility, as trading inefficiencies and information asymmetries abound. Allocation size is highly portfolio specific, especially for investors with mature VC allocations, which most likely have exposure already.

In 2023, other downside risks include (1) distress among bitcoin miners, which could force miners to sell their balance sheet bitcoin, driving down other tokens, (2) follow-on failures due to FTX’s collapse, and (3) more FTX-like collapses linked to weak governance and poor business practices.