2023 Outlook: Credits

We expect most liquid credits will generate higher returns in 2023 relative to 2022, given the better yields on offer. We also see private credit as offering opportunities, particularly in secondary trading.

Liquid Credit Markets Should Generate Higher Returns in 2023

Wade O’Brien, Managing Director, Capital Markets Research

Many high-yield (HY) borrowers are prepared for a downturn, as gross leverage is nearly the lowest in a decade and refinancing needs over the next 12 months are limited. More importantly, prices offer investors cushion for future stress. B-rated HY bonds trade around $0.88, and CCC-rated bonds trade around $0.76—pricing last seen during the COVID-related depths of March 2020 and before that, early 2016. So, while HY defaults will almost certainly rise from current depressed levels (1.5% on a trailing 12-month basis), even if they soar past current rating agency forecasts (around 3% to 4% over the next 12 months) and recoveries are in line with historical averages, investors buying bonds at these prices could still see reasonable returns over a three-year period.

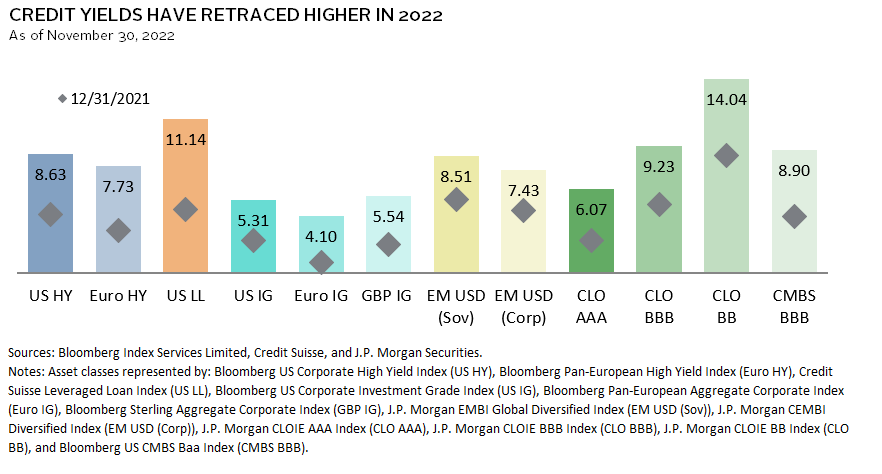

Higher-quality credit investors should not ignore their own expanding opportunity set. Rising interest rates and credit spreads mean yields of assets such as AAA-related CLO debt (now over 6%) and US investment-grade corporate bonds (now over 5%) have more than doubled over the course of 2022. Given extremely limited historical default rates, the main risk to investors is marking-to-market from higher base rates. European investment-grade buyers also should relish the opportunity. Investment-grade sterling corporate bonds now yield 5.5% thanks to the recent LDI-driven volatility in the gilt market. This is more than sterling HY bonds were yielding as recently as February!

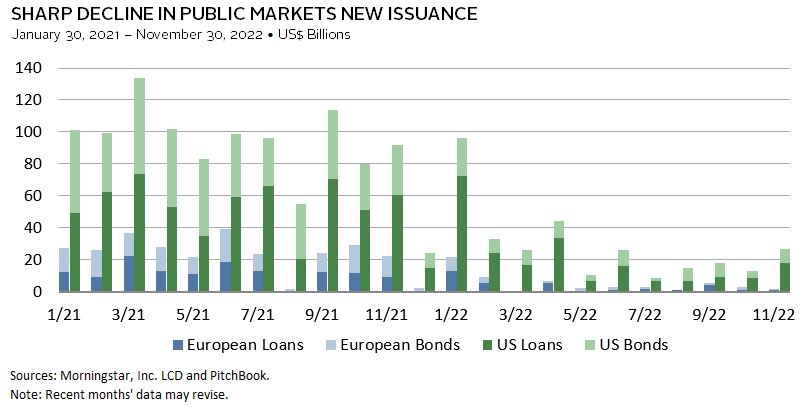

Although we expect liquid credit performance will improve in 2023, investors should understand the markets are likely to be volatile and may get worse early in the year before improving. The near closure of new issue markets in recent weeks is an ominous sign. Still, those willing to weather volatility are likely to see attractive returns, given today’s depressed valuations.

Returns of Insurance-Linked Securities Will Improve, Benefiting From Better Pricing in 2023

Christine Farquhar, Global Co-Head of Credit Investment Group, and Joseph Tolen, Investment Director, Credit Investments

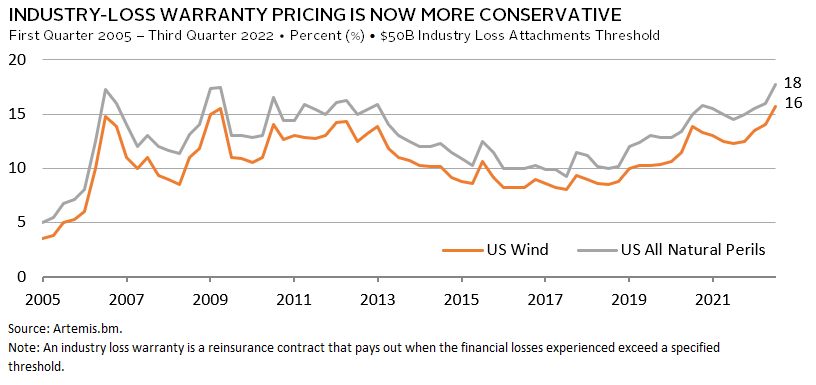

Insurance-linked securities (ILS) provide a capital markets alternative to traditional reinsurance. Investors receive interest (insurance premiums) and repayment of principal, net of any claims. Over the last 15 years, these assets have been weakly correlated with equities and bonds. Yields rose through 2022, in response to regulatory pressures and a lack of underwriting discipline in Florida. We expect this back-up in yields will translate into great performance next year. Pricing on industry-loss warranties, 1 which allow investors to trade insurance risk on the basis of parametric industry loss triggers, has been offering yields not seen in more than a decade.

ILS strategies can be complex, as portfolios need to be carefully constructed to limit the tail risk from major events. A combination of liquid catastrophe bonds (CAT bonds) and collateralized reinsurance contracts is best placed to deliver optimal reward for well-managed risk. Experienced managers with transparent track records and limited conflicts with parent company balance sheets are best positioned. The standard benchmark is the Swiss Re Cat Bond Index, reflecting the more liquid end of the $97 billion ILS market (as of June 2022), but it is not directly investable.

We believe the yields on offer provide a good return opportunity relative to risk next year, but investors clearly need to review the asset class on a regular basis, as it backstops property against the risks of climate change and global warming. More frequent weather events and more severe loss outcomes have already put upward pressure on yields to compensate investors. Managers are factoring these developments (along with increased general claims inflation) into security selection. They are more careful selecting insurance counterparties in Florida and limiting exposure to aggregate contracts, which are more exposed to higher frequency events such as wildfires, hailstorms, and tornadoes. Explicit meteorological modelling and disciplined underwriting of insured risk increase our confidence in manager selection.

Man-made risks, such as cyber, shipping, and aviation losses, are generally not as well rewarded for less transparent risk. In short, 2023 represents a market dislocation and opportunity to invest in a diversifying asset on attractive historic yields.

Credit Opportunity Strategies Should Deliver Above-Average Returns in 2023

Vijay Padmanabhan, Managing Director, Credit Investments, and Frank Fama, Global Co-Head of Credit Investment Group

We believe that the macro environment will continue to cause stress in the economy and create an attractive investment environment across a number of strategies. Primary market yields are attractive due to increased rates and credit spreads. Secondary trading opportunities are attractive, as supply chain issues and inflation are pressuring margins, creating the opportunity to buy the securities of good companies at discounted prices. While the opportunity is global, Europe is particularly attractive due to the geopolitical headwinds. As a result, we expect returns of private credit opportunity strategies to be above their long-term average of 10% in 2023.

Shortly after the war in Ukraine began, European banks pulled away from lending and the public broadly syndicated loan and high-yield markets largely shut down. As a result, private credit managers have become the main liquidity providers, which has allowed them to demand good terms and pricing. Banks are saddled with underwritten deals they cannot syndicate, and they are desperate to get them off their balance sheets. Loans and bonds have traded lower, making the secondary market attractive. Inflation is driving down margins of otherwise good companies and creating opportunities to buy securities in the 70s that are likely to recover to par.

We expect to see continued pressure on companies and anticipate default rates to rise from low levels. Historically, it takes a recession to bring inflation off its peak, and the central banks have made clear that they are willing to take that risk. While spreads have widened and defaults have increased, they are not near the levels of past economic downturns. Managers are patiently waiting for what is likely to be a prolonged distressed cycle across a range of industries.

Credit opportunities managers normally have flexible mandates that allow them to generate double-digit returns deploying capital in performing credit and early-stage stress situations. In contrast, specialized managers—including distressed managers—may not always find the environment conducive for investing. Performance of managers will vary, and managers with strong portfolio monitoring teams and experienced workout teams are likely to fair better.