Private Credit Strategies: An Introduction

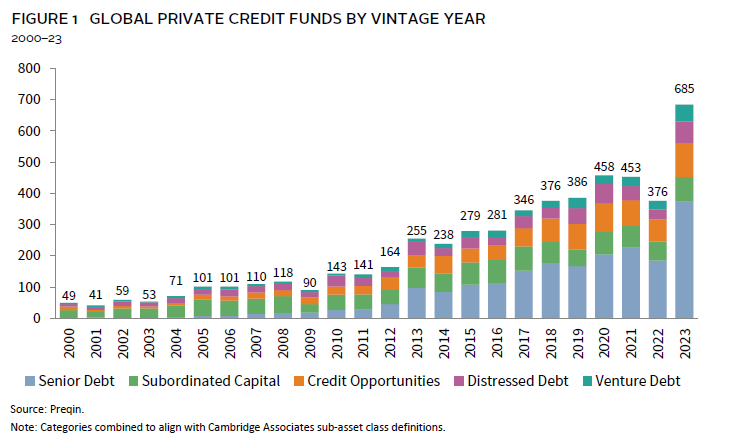

During the last 15 years, the private credit asset class has grown significantly, accounting for $1.6 trillion today across a wide range of risk and return profiles. Prior to 2008, the asset class was composed primarily of mezzanine and distressed funds. Following the Global Financial Crisis (GFC), new banking regulations encouraged banks to de-emphasize traditional corporate lending, which led to significant changes in financing markets. Asset managers recognized the need for capital and the opportunities that it created. The growth of direct lending coincided with the decline in corporate lending at banks. While loans to larger companies drove the growth of the bank loan syndication market and broadly syndicated loans (BSLs), direct lending funds formed to lend to middle-market companies. At the same time, managers continued to develop creative strategies to provide capital to borrowers in need of solutions that fell outside of what could be financed in the traditional lending markets. Figure 1 illustrates the growth of the asset class and the expansion of new strategies. This paper describes why we believe private credit can be attractive in any market, outlines the various sub-asset classes, and discusses the construction of a private credit portfolio and its implementation into a portfolio.

Why Private Credit?

The private credit asset class benefits from several characteristics that we believe are attractive to investors’ portfolios. The asset class has a contractual maturity date, often benefits from collateral, and is senior to the equity in the capital structure. These attributes provide compelling downside protection and a shorter duration relative to private equity (PE) and venture capital (VC).

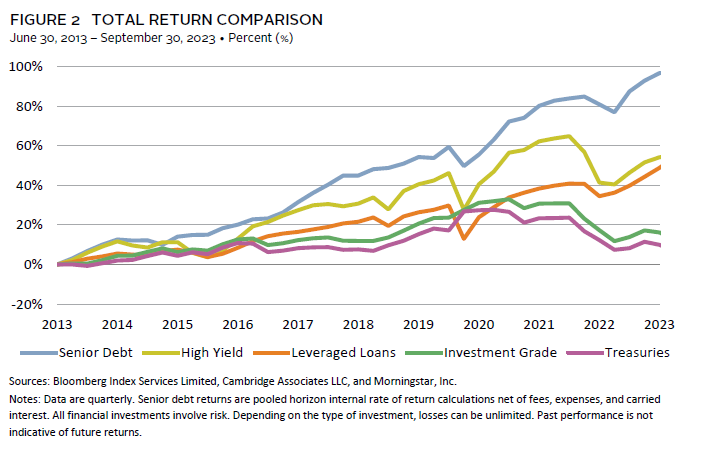

Private credit has historically outperformed public leveraged finance asset classes such as BSL and high-yield bonds. As a private investment, the asset class exhibits less volatility than the publicly traded markets. While public and private credit marks will be driven by credit quality, public markets also include an element of supply/demand (market technical) that can cause mark-to-market price volatility. Depending on credit quality, private credit spreads tend to be 200 basis points (bps) to 600 bps higher than public markets (Figure 2).

Direct lending loans are floating rate, which have limited interest rate risk and help to protect a portfolio from rising rates. Loans will typically be structured with an interest rate floor, which will ensure a minimum level of income. Most strategies will distribute interest income quarterly, and, with an average life of three to four years, principal is returned at a significantly faster rate than private equity strategies. Additionally, with a contractual maturity date, private credit funds have shorter lives than other private investment strategies.

Relative to public markets, private credit strategies offer investors stronger alignment of interest. In the public markets, whether high-yield or BSL, underwriting banks have an originate-and-distribute model. In this model, the underwriting bank will view the borrower as their client, not the investor or holder of the loan. The motivation for the bank as intermediary is to obtain the best deal for the borrower that will clear the market. In private credit markets, the general partner (GP) is often the originator of the loan and the manager of the risk. The GP views the limited partner (LP) as its client, and its objective is to get the best deal possible for the fund.

Private credit strategies, particularly direct lending, benefit from downside protection through a number of contractual provisions. Financial maintenance covenants provide an early warning to deteriorating borrower performance, allowing for lender intervention and the ability to work with the company to influence an improvement plan. Lending on a first-lien senior-secured basis means that the direct lending loan is secured by assets of the company. In the event of a restructuring, private credit’s position in the capital structure means that it will receive a recovery before the equity. If the equity is worth anything greater than zero, then the direct lending loan will receive all its money back plus a return.

Private credit includes a diverse array of strategies allowing investors to build a portfolio of complimentary strategies. The section below reviews the sub-asset classes in more detail, but we believe that the diverse strategies available in private credit allow an investor to construct a portfolio that will be less correlated to equity markets and can produce stable, attractive returns.

Sub-asset Class Review

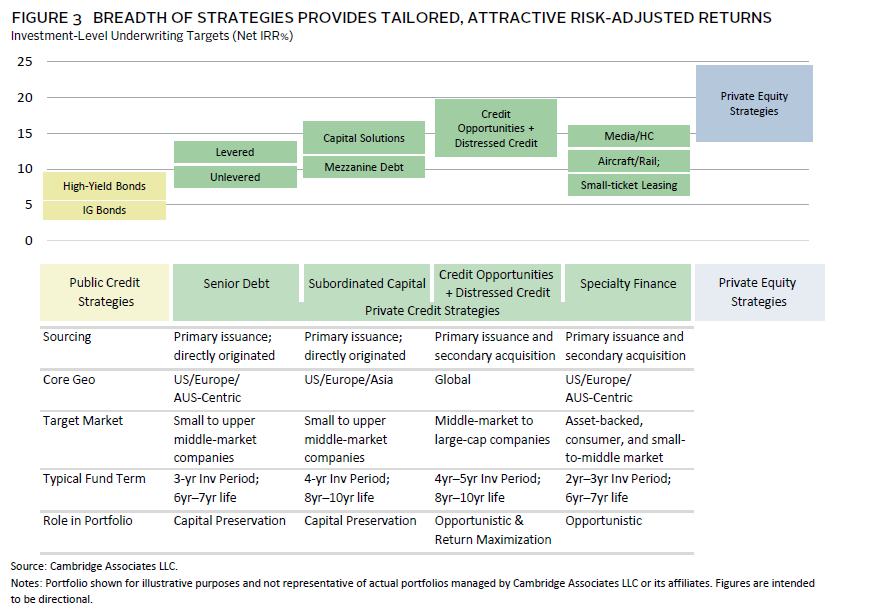

Figure 3 depicts how private credit strategies offer a range of return targets and fund lives.

Senior Debt

Senior debt, or direct lending, refers to funds that lend money to performing companies on a first lien senior secured basis. The loans will be used for a variety of purposes, including financing leveraged buyouts and acquisitions, funding growth, or repaying existing debt. The company may be owned by a private equity firm (sponsor-backed) or a public or privately owned company (non-sponsor-backed). Managers will tend to focus on company size, with lower middle market defined as companies with $10 million to $50 million of EBITDA; core middle market as companies with $35 million to $100 million of EBITDA; and upper middle market as companies with greater than $100 million in EBITDA. Sponsor-backed core middle market is considered the most competitive area of the market. Upper middle market competes with the BSL market, and, as such, tends to feature weaker terms and less favorable pricing.

The loans will generally be floating rate, based on the secured overnight financing rate (SOFR) plus a credit spread, minimizing interest rate risk, and issued below par to create original issue discount (OID). The loans will be secured by the assets of the company. The fact that the loans are generally secured by all the assets of the company is important as it impacts the recovery value. Historically, first-lien debt has an ultimate recovery value of 70%, while unsecured bonds have a recovery rate of 47%, according to Moody’s.

Senior debt funds may use fund level leverage to increase the capital available for investment in order to increase the returns. Leverage will generally be non-recourse to the LPs and will not be mark to market. The leverage provider could be a bank, another fund, or a structured finance vehicle such as a collateralized loan obligation. The debt used for this purpose will be secured by the loans owned by the portfolio and not by the obligation of the LP to fund a capital call. This is different from a subscription line, which is secured by the fund’s right to call capital from the LPs. Subscription lines do not increase the amount of capital available to invest but instead change the timing of the cash flows, which could increase the internal rate of return. Generally, private credit funds use subscription lines only to facilitate capital calls and will pay the lines down to zero periodically.

Subordinated Capital

Subordinated debt is a loan or security that ranks lower than other loans with regard to claims on assets or earnings. Subordinated debt is a riskier form of debt as it is not repaid until after unsubordinated (senior) debt holders have been repaid in full. Often called mezzanine debt because it ranks between the senior debt and the equity of a company, the debt will frequently include some form of equity, either a co-investment in the common equity alongside the private equity owner or warrants.

The subordinated capital category also includes capital appreciation strategies. These funds will invest, typically in performing companies, anywhere in the capital structure from senior debt to preferred equity. The debt investment will often include some form of equity upside, such as warrants, preferred securities, or in the common equity. As the demand for mezzanine debt has waned in recent years, many mezzanine debt managers have migrated to this strategy. In both traditional mezzanine and capital appreciation strategies, the returns are driven by both the debt security and the equity ownership. Typically, a subordinated capital fund will include between 10% to 20% equity exposure.

Credit Opportunities and Distressed

Credit opportunities refers to a broad range of strategies that are typically opportunistic in nature, meaning they are either investing in companies in stressed or distressed situations, or addressing an unmet capital need in a creative way. Credit opportunities funds may have a broad spectrum of credit and debt-related investments across geographies. Investments can be made in performing, stressed, or distressed companies, and can be directly originated and structured in the primary market or reflect purchases of securities in the secondary market. While the return of a credit opportunities fund will be focused on income, there will often be an element of equity return or capital gain, particularly in more distressed situations.

Credit opportunities managers may pivot to a greater focus on distressed when market default rates rise to elevated levels. Some managers are exclusively focused on distressed situations. Distressed investors target companies or assets where the company is at a high risk of entering bankruptcy or restructuring. While it is not the intent of the fund to own the company, the manager is prepared to take equity through a restructuring and own that equity for a period of time. This strategy differs from distressed for control strategies, where the explicit purpose of purchasing the debt security is to take ownership of the company through a restructuring of the debt. We view distressed for control as more of a private equity–type strategy, as the manager seeks to own and manage companies as its primary activity.

Specialty Finance

Specialty finance managers pursue a very broad array of niche strategies, requiring highly specialized expertise. A key feature of specialty finance strategies is that they provide diversification away from single name corporate risk—either by lending or investing in pools of assets—or investing in assets that are not correlated to equity markets. A common strategy is to lend against a pool of financial assets, such as consumer or small business loans. The fund is essentially funding the non-bank originator of the loans who may remain as the servicer of the loans. The loans are placed into a special purpose vehicle, which insulates the investment from distress at the originator as the loans can be moved to another servicer. The loan will be structured by looking at historical default and loss rates and requiring the originator to retain the first loss piece, or cushion, to the pool. This is similar to the process used to create asset-backed securities. Another common strategy is for the fund to own a portfolio of equipment, such as rail cars or aircraft, and lease the equipment to create a cash flow stream.

Other strategies include investing in royalties. In life sciences, managers may invest directly in the royalty, helping the company or other entity that owns the royalty to monetize its asset by allowing the fund to collect the royalty payment for a period of time. Similarly, in music royalties, the artist can monetize its catalogue by selling the royalty payments. Increasingly, life sciences managers have moved to a lending strategy where the patent is taken as collateral. This will shorten the duration of the investment. Additional strategies include life settlements, insurance, trade finance, litigation finance, and non-performing loans.

Specialty finance can have a wide range of return targets and duration depending on the strategy. Consumer lending tends to be very short, while royalties—particularly music royalties—can be very long dated. Returns can range from the high single digits to the high teens.

Implementation

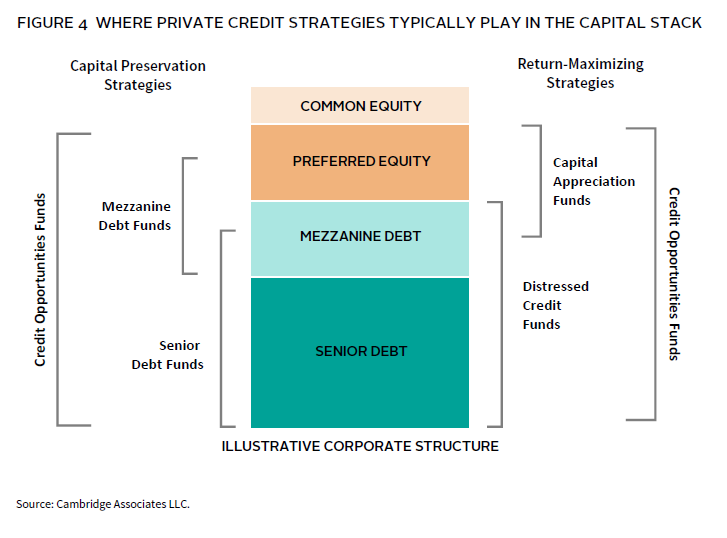

With the variety of private credit strategies available, we believe it is possible to create a well-diversified portfolio that can generate income and provide some upside. We like to construct portfolios with a mix of senior debt, credit opportunities, and specialty finance strategies (Figure 4). Senior debt strategies generate cash flow and provide a ballast to the portfolio, offering downside protection and income. A credit opportunities strategy should generate returns higher than direct lending during benign markets, and, importantly, will benefit from market stress and dislocations. The funds can offset any stress that may be seen in the senior debt strategies during periods of elevated defaults. An allocation to specialty finance will provide diversification away from single name corporate risk.

When constructing a portfolio, an investor’s primary objective will influence allocation to the different sub-strategies. For example, an income-oriented investor may focus on direct lending strategies, picking a diversified group of managers to gain exposure to sponsor and non-sponsor and across the borrower size categories. This portfolio may also consider an allocation to income focused specialty finance strategies to provide some diversification. The portfolio should provide a stable income stream, 100 bps to 200 bps higher than the public leveraged finance markets, with lower volatility and risk profile.

Investors more focused on returns will gravitate to higher returning strategies in credit opportunities and distressed. Strategies may focus across different asset classes, such as corporate, real estate, and structured products. A portfolio constructed this way could be attractive to a tax-paying investor, as it can focus on strategies that offer a greater degree of capital gain relative to income.

Investors seeking a diversified allocation to private credit may invest across the different sub-asset classes, such as senior debt, credit opportunities, and specialty finance. We believe that a portfolio constructed this way can deliver an attractive income stream, coupled with some higher returning credit opportunities strategies that can also benefit from a dislocation. The addition of specialty finance will serve to diversify away from corporate risk. Investors can weight the components depending on their preference for income relative to higher returning strategies.

Investors allocate to private credit from various parts of their portfolios. Some investors will have a specific allocation to private credit as part of their total portfolio. Investors that allocate from their illiquid buckets will often focus on higher returning strategies as they are comparing the funds to their private equity and venture allocations. In a zero-rate environment, many investors looked to direct lending to improve returns in their fixed income allocations. Finally, many investors have looked to their diversifiers bucket to carve out a piece to allocate to private credit, recognizing that the lock-up nature of the funds is illiquid relative to the rest of that allocation, but that the private credit portfolio can generate some income and an attractive return.

Conclusion

The private credit market has developed and evolved significantly since the GFC. The asset class includes a broad array of strategies to satisfy investors’ return objectives. Strategies can be cash flow generating and offer shorter duration than other private investment strategies. Downside protection creates an attractive risk mitigant relative to private equity and venture strategies. Investors can construct portfolios to provide income, benefit from market dislocations, and provide some diversification away from single name corporate risk.

Frank Fama, Co-Head of Global Credit Investment Group

Walker Haymond, Brittney McManus, and Ilona Vdovina also contributed to this publication.

Index Disclosures

Bloomberg Aggregate Bond Index

The Bloomberg Aggregate Bond Index is a broad-based fixed income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

Bloomberg US Corporate High Yield Index

The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high-yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the indexes’ EM country definition, are excluded. The US Corporate High Yield Index is a component of the US Universal and Global High Yield Indexes. The index was created in 1998, with history backfilled to July 1, 1983.

Bloomberg US Treasury Index

The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting. The US Treasury Index is a component of the US Aggregate, US Universal, Global Aggregate, and Global Treasury Indexes. The index includes securities with remaining maturity of at least one year. The US Treasury Index was created in March 1994, and has history back to January 1, 1973.

Morningstar LSTA US Leveraged Loan 100 Index

The Morningstar LSTA US Leveraged Loan 100 Index is designed to measure the performance of the 100 largest facilities in the US leveraged loan market. Index constituents are market-value weighted, subject to a single loan facility weight cap of 2%.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.