Simplifying Net Zero Implementation: Possible Pathways to a Portfolio That Can Be Good for the Climate

In our 2023 ‘From Policy to Implementation: A Net Zero Playbook for Investors’, we laid out why and how an investor might incorporate climate goals into their portfolio without compromising its financial goals. Subsequent experience has shown us new ways to streamline the process, as investors often get bogged down in reporting and activities that don’t impact the real world.

It doesn’t need to be this hard. Investors can simplify net zero implementation by prioritizing practical and pragmatic steps towards real world emissions reduction. We provide both a feasible pathway to climate impact for investors with a mature portfolio and a template for building a net zero portfolio from scratch.

Our focus is mainly on the impact the portfolio can have on the climate since we have covered elsewhere how to manage the risks and opportunities climate change presents for the portfolio. As our 2023 paper explained, we see a ‘net zero portfolio’ as one that consciously contributes to decarbonisation of the real economy through the way it is invested. It might equally be described as a ‘climate impact portfolio’. Those GHG 1 emissions attributable to the portfolio itself are relevant but don’t necessarily indicate progress in the main goal. What matters is not so much the investors’ own footprint but how they use their influence in the real world.

Ambitious goals are not enough; credible investors need clarity on the actions necessary to meet them. This paper focuses on the decisions and actions investors can take today and how to prioritize limited time and attention where it really matters. Existing investor climate frameworks 2 have focused on holdings level data and decisions but our primary audience is investors with $100m+ in a diversified portfolio of third-party managers. These investors delegate to their managers the tasks of investment selection and they exercise ownership rights (engagement, voting, etc.) so we emphasize instead measurement and targets for what those investors directly control, such as manager selection itself.

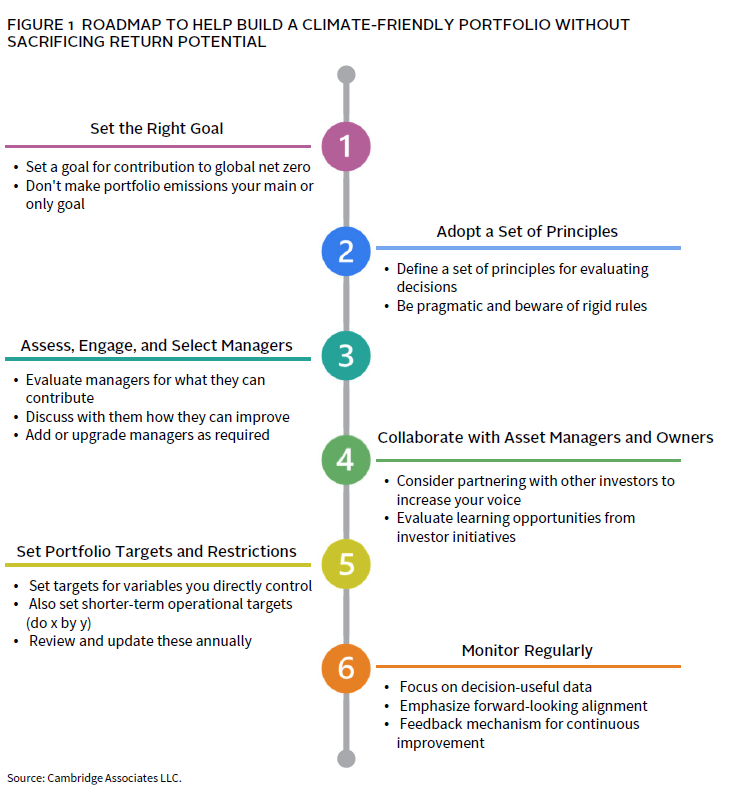

To unlock the potential for a pragmatic and efficient net zero approach it is also necessary to get the policy goal and principles right, set achievable targets, and monitor the right variables. Figure 1 summarizes our roadmap for building a portfolio that seeks to be good for the climate without sacrificing return potential.

Set the Right Goal

Recommended net zero strategies often emphasize portfolio emissions targets, probably because they represent the most commonly reported metrics. While net zero emissions by 2050 is the right collective global goal, it may not be the most appropriate target at the portfolio level. As our earlier paper explains, the only emission reductions that matter are those made today and in the future by the companies responsible. Portfolio emissions data are backward looking and can be manipulated by cutting exposure to managers exposed to high emissions sectors even if this has next to no impact on company behavior and disrupts the investment strategy to no purpose. This is why we recommend framing a high-level portfolio climate goal as:

“Contribute to the collective global goal of net zero emissions by 2050.”

This emphasizes an investor’s future impact rather than historic footprint and it requires each investor consider their own most effective points of leverage. But such a goal also needs ambition to be credible: A simple approach is to maximize contribution, subject to financial performance goals and a practical timeline, while tailored wording allows a flexible approach as there are various paths suitable for different investors, asset classes, and managers. Flexible language shouldn’t hide token efforts that lack proportionality or accountability; however, it needs to be paired with robust operational targets as discussed later.

Adopt a Set of Principles

Our goal in policy advice is to enable more investors to start the net zero journey and contribute as much as they believe practical and consistent with their other obligations. Over-emphasis on numerical rules and targets, especially for portfolio emissions, can get in the way when investors’ influence is indirect through external managers. To advance our goal of action over perfection, we propose a set of principles – not rules – slightly updated from our 2023 paper:

- Focus where it matters: On assets, managers, and decisions where the potential impact on emissions is greatest.

- Concentrate on contributing to real world emissions reduction rather than reported portfolio emissions.

- Emphasize pragmatism; don’t make perfect the enemy of the good but plan for evolution and improvement.

- Be open to using a variety of tools; different managers or assets can play different roles.

- Consider the time value of carbon; mitigation today is worth more than mitigation in 20 years.

- Focus metrics on ‘decision-useful’ information rather than data for data’s sake.

- Require market competitive returns since the only scalable solutions are those with a path to profitability.

- Create feedback loops; communicate to investment managers the importance of climate in investor’s decision making and listen to their perspective. Two-way constructive dialogue is important.

Applying these principles means each portfolio component, each manager, should be considered on its own terms: Can it make a contribution to net zero? In what way? Could it do more and if so, how? We expand on how to apply this below.

Assess, Engage, and Select Managers

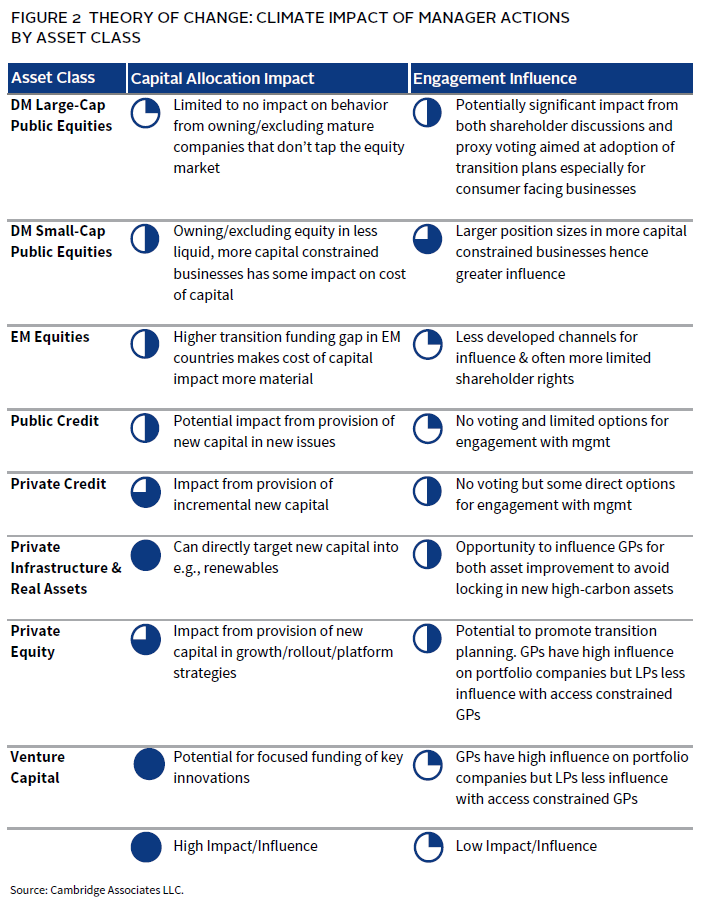

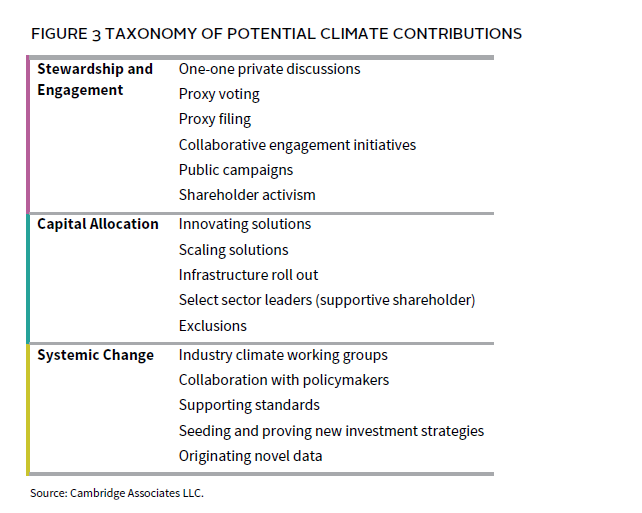

Net zero’s end goal is for businesses to reduce the emissions associated with their activities as close as possible to zero. But the most effective way an investment manager can contribute to this single goal will depend on their strategy and asset class. A worthwhile contribution needs to be a robust ‘theory of change,’ supporting real world impact in the asset class concerned. Figure 2 shows our perspective on the nature and potential significance of climate action for a range of major asset classes while presenting a fuller taxonomy of potential contributions (Figure 3).

The investor must determine the most appropriate and reasonable contribution a manager can make, and whether the manager is living up to those expectations.

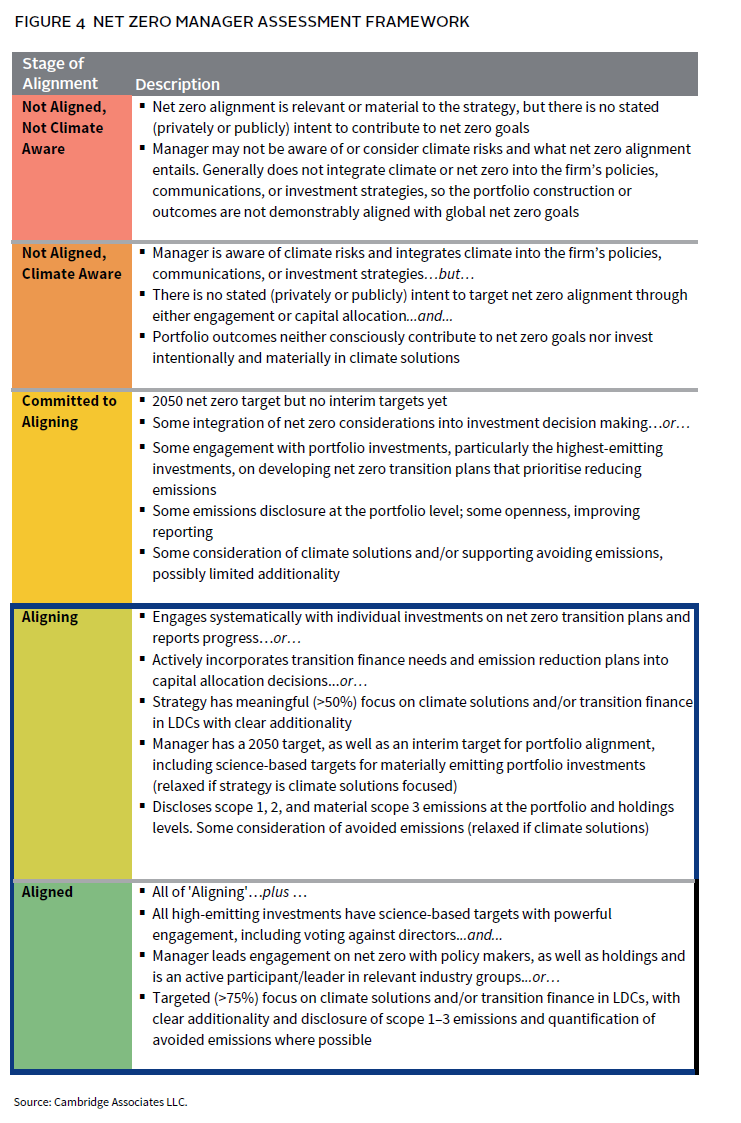

Assessing Managers for Net Zero Contribution

The first lever of impact investors have is selecting managers that will make the best contribution to net zero. To support this, we have developed an assessment framework (Figure 4) to classify any manager on a spectrum of contribution from ‘Not aligned, not climate aware’ to ‘Aligned’. There are different potential paths to alignment; while some elements are quantifiable, there is an unavoidable component of contextual judgement and investors should expect approaches to evolve and improve over time. They may choose to adopt their own assessment framework; the important thing is to apply it consistently. The outcome of assessment should be a ‘thesis’ regarding the manager’s specific assessed contribution to net zero goals, as well as any gap between current behaviour and reasonable potential. This can be used as part of ongoing monitoring and engagement.

If starting with an existing mature portfolio, all managers can be designated one of: Aligned or aligning, Not aligned 3 , or Neutral. The non-aligned managers should be the focus of engagement towards aligning; if that is unsuccessful, the manager may be inappropriate for the portfolio. Pragmatism accepts that there may be non-aligned strategies that offer a unique and hard to replace source of alpha or diversification, in which case the rationale can be documented as an exception.

Prioritisation and Relevance (Importance of Theory of Change)

Manager evaluation and engagement may require a substantive two-way dialogue, so it is important to be consistent with Principle 1 (Focus where it matters): Some asset classes or strategies are just not that relevant for net zero. These we can label ‘Neutral’, which doesn’t mean there is no link to climate at all, but that there is no current robust theory of change to support a specific climate contribution. We believe an investor’s limited time and attention is better spent elsewhere.

Managers can be classed ‘Neutral’ either because their asset class offers no impact opportunity (government bonds and cash today) or because the strategy employed precludes it. The latter is illustrated by high (>100%) turnover strategies where the holding period is so short as to limit either engagement or a durable capital allocation effect. There are no hard and fast rules, however, and investors need to make their own pragmatic decision where to apply this classification. Further examples include bio-tech venture funds or macro strategies that invest mainly through index derivatives; in neither case is there a meaningful climate impact to be made because of either the sector or investment instrument chosen.

Labeling a manager ‘Neutral’ does not mean they are uninvestable, but simply that no time need be spent on further assessment or engagement. Neutral assets can be used where necessary to achieve diversification and risk tolerance or to access unique and exceptional alpha, but investors seeking to maximise net zero contributions should realise these assets represent an opportunity cost in terms of impact. For this reason, they should periodically review whether neutral is still appropriate or whether the same portfolio role could be played by a more impactful manager.

Engagement in Manager Assessment and Selection

The second lever net zero investors have is manager engagement, with the aim of encouraging and educating managers to make a bigger contribution to net zero goals consistent with both the reasonable impact their strategy might have, as well as their performance objectives. Engagement is also a tool to improve disclosure and general climate competence. Engagement can, and should, be an ongoing effort, but its importance is amplified when used as part of initial assessment and selection and when tied to a hire or retain decision.

Engagement as a Constructive Dialogue

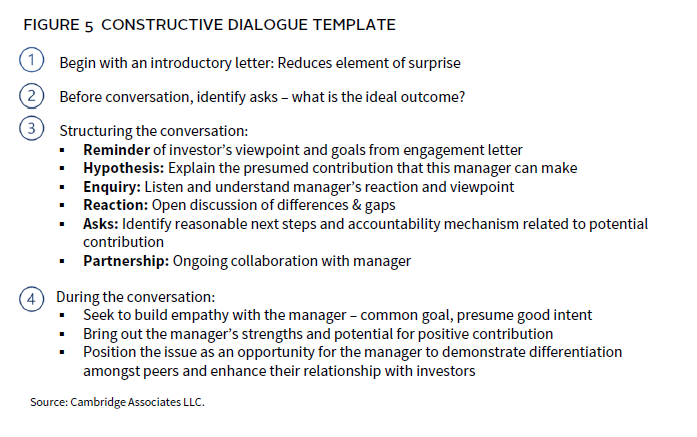

Since there are many potential ways to advance net zero goals and a one-way conversation is unlikely to be persuasive, we emphasize the importance of a constructive dialogue that acknowledges the manager may have their own ideas of their best contribution. Investors can engage directly or through their advisor. To help set up this conversation for success we propose the following template (Figure 5).

Engagement can seem time consuming but prioritising it can offer an opportunity for deeper understanding and relationship building with managers. Integrating engagement with the selection and review process substantially limits the time requirement and may be more effective by tying it to an investment decision point.

Combining Engagement with Manager Selection in Practice

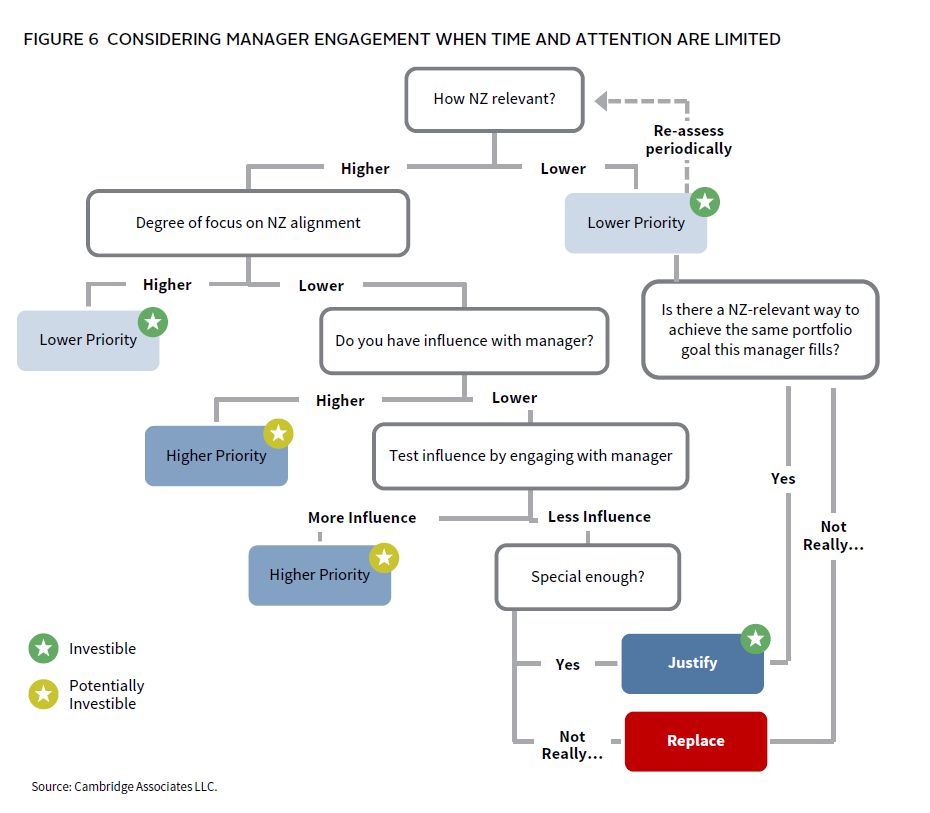

Figure 6 illustrates how an investor might triage limited availability and attention on manager engagement, ultimately deciding whether to pass or terminate if engagement is unsuccessful. ‘Priority’ refers to how much effort to give engagement; clearly managers that are not net zero relevant or are already a high contributor need less attention. The first decision branches according to the managers’ relevance to net zero with subsequent branches considering the degree of net zero contribution and the extent of the investor’s potential influence. The final stage considers a manager that is not making a reasonable net zero contribution and shows no desire to make one or consider the investor’s perspective. An investor with a net zero objective should set a high bar for the degree of unique diversification or alpha expected to justify such a manager in the portfolio.

Climate Solutions

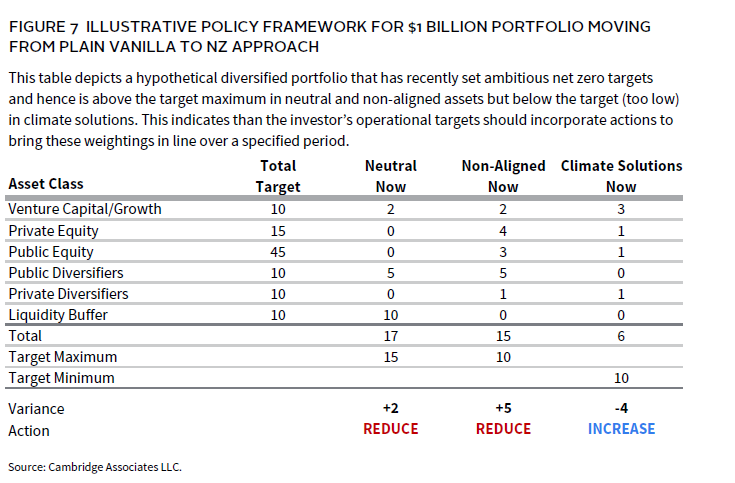

Climate solutions are defined as investments that advance the development and deployment of technologies or practices that contribute to global emissions avoidance, reduction, or removal. This third lever of net zero impact has a particularly direct and powerful theory of change since investing capital in the innovation, scale up, and roll out of climate solutions is foundational to reducing emissions and decarbonising the economy. Solutions occupy a spectrum from infrastructure all the way to early-stage venture. They can be found in public and private markets, though there is reason to believe private vehicles that provide net new capital to climate solutions have more impact than buying shares of established businesses in the public market from a theory of change perspective. We propose that net zero investors set a target for exposure to managers that are predominantly (>50%) and intentionally targeting that area, though there is no perfect classification, and investors may choose a definition that better suits their beliefs and strategy. Climate solutions may fit within one of several asset classes, as illustrated in Figure 7.

Collaborate With Asset Managers and Owners

Why Collaborate?

Collaboration amongst asset managers and asset owners is the final lever of impact. It is an efficient and necessary approach to coordinate a shared and targeted net zero agenda, consolidate expertise across a larger share of voices, and reduce duplicative efforts leading to higher-quality conversations with engagement targets.

Joining coalitions provides a forum to engage with a variety of stakeholders from companies to policymakers to regulators to the broader financial services ecosystem, depending on the coalition objective.

What Does Collaboration Look Like?

Collaboration can be undertaken through formal coalitions (e.g., CA100+, PRI, Spring, ShareAction, UKSIF, IIGCC) or informal partnerships. Lower-touch actions within coalitions can include signing joint letters and using insight gained from collaborative groups to have richer discussions with managers. Higher-touch actions can include (co-)leading deeper discussions to participating in working groups on a topic the investor may be especially knowledgeable in.

We propose that asset owners reflect on their capacity and comparative strengths beyond simply assets under management that can magnify the reach of their collaboration. A foundation can leverage its reputation and moral standing. A pension with a large membership can leverage its reach with its constituents. Families with a recognisable name can draw attention to an issue, and those with an operating business can add strategic value through their industry networks and insights.

Set Portfolio Targets and Restrictions

Policy Targets

We propose investors emphasize targets that are directly in their control and are primarily manager based, thus forward looking. (By contrast, rearranging the portfolio to make reported emissions look lower is like driving through the rear-view mirror). Important targets can be for exposure to ‘aligned and aligning’ managers and to climate solutions managers. Restrictions can also be placed on the maximum number of non-aligned or neutral managers. The way target expectations are paced should reflect whether the goal is for a mature portfolio, which will take time to thoughtfully transition, or to define a new portfolio from scratch. Example policy metrics in terms of targets for neutral, non-aligned, or solulations investments are shown in Figure 7 as part of a simple portfolio monitoring dashboard. These targets should be calibrated against the baseline and achievability for the investor.

Operational Targets

As well as longer-term policy targets, a practical net zero strategy benefits from shorter-term operational goals revised on an annual basis that reflect specific steps on the journey. For example:

- Complete alignment assessment of all managers by 12.202x (for an existing portfolio taking on a NZ goal).

- Review at least three potential climate solutions managers by 12.202x.

- Complete engagement process and retention decision for managers X and Y by 12.202x.

Fossil Fuels

Climate-focused investors should adopt a careful and pragmatic approach to fossil fuel exposure. Even under net zero scenarios, fossil fuels will continue to be used until 2050 and beyond, but their use needs to decline steadily to a small fraction of current levels. State-owned national oil companies may be the last to exit the sector, putting an earlier squeeze on private businesses. Investors would be prudent to ensure their managers assess the risks of holding long-duration fossil fuel assets and incorporate the need for a “managed phase-out” into their valuation and engagement strategies. We do not consider fossil fuel divestment necessary for a credible net zero strategy and to avoid tokenism, it is important to be clear on the theory of change supporting any divestment decisions.

Investors that have made a policy decision to completely exclude fossil fuel exposure need to identify existing exposure and set a pragmatic hierarchy of actions for liquid managers (switching share classes, engaging with managers, or terminating and switching, if necessary), allowing time for implementation. We strongly encourage a de-minimis exception and it is reasonable to rule some funds and managers as ‘out of scope’ for exclusion owing to limited impact (e.g., high turnover quantitative strategies which may own incidental fossil fuel exposure for short periods). Private fund due diligence should incorporate an assessment of fossil fuel exposure risk.

Legacy Assets

An existing portfolio adopting a net zero target should assess and categorise all managers. For liquid managers, decisions to retain or exit are straightforward. However, for private fund holdings that are non-aligned or otherwise exceed restrictions (e.g., through fossil fuel exposure), these should be allowed to run off over the funds natural life and can be ‘neutralized’ in terms of policy targets and restrictions.

Monitor Regularly

Progress against climate goals should be reviewed on an annual basis and judged against the adopted principles. This timing can confirm the strategy is meeting the desired level of ambition and to set tactical goals for the following year. As part of this review, holdings data can be gathered from managers to inform discussion of alignment and manager engagement, and to hold managers accountable.

Holdings Level Climate Data Reporting

Portfolio-financed emissions are not a variable under the investor’s direct control and are backward looking. Moreover, reducing portfolio emissions doesn’t necessarily represent a contribution to real-world emission reduction. Nevertheless, they can be a helpful diagnostic to understand managers’ strategies, risks, and net zero progress. More forward looking is the extent to which portfolio companies have adopted science-based decarbonisation targets (SBTs), preferably with external validation 4 .

Accordingly, where holdings level data are available (public equity and credit), it is helpful to gather the following information on an annual basis: Scope 1 & 2 5 (and where possible Scope 3) greenhouse gas emissions data along with the number of portfolio holdings who have SBTs 6 . This can be aggregated at the manager, asset class, and portfolio level (only scopes 1 & 2 aggregated) as follows:

- Total emissions per $ invested.

- Proportion of holdings (by value) with SBTs.

- Proportion of total emissions attributable to companies with SBTs.

The emissions of concern are those from companies without credible targets to reduce them. Understanding this exposure in a manager’s portfolio can inform a useful conversation on their attitude to emissions and how their voting and engagement supports portfolio companies to adopt SBTs.

Holdings level emission and SBT data is not yet available for most private investments so emissions can be proxied using sector exposure for asset class and portfolio level aggregation. Alternatively, the investor can make a qualitative view on a fund’s alignment based on its strategy and approach.

The above data can be compared with the following reference scenario that approximates market wide progress in line with Paris goals:

By 2025, 70% of portfolio emissions from in-scope assets are from holdings aligned/aligning with net zero or held by managers whose voting and engagement policies support alignment, and rising to 90% in 2030.

While quantitative look through data helps hold managers accountable, we consider the most important monitoring effort to be an annual review of the ambition of the strategy, achievement of tactical goals and managers’ delivery against the expectations defined for them. This then informs the setting of new tactical goals, and prioritises manager selection and engagement efforts.

Summary & Conclusion

A successful net zero investor will not just be ambitious in the targets they set but also be clear on the actions that are necessary to meet them. Our approach to net zero investing is grounded in pragmatism and flexibility, with a focus on real-world outcomes in an intrinsically messy world. Good practice will continue to evolve, but by focusing on high-impact areas, engaging with managers, allocating capital to climate solutions, and participating in collective initiatives, investors can start making a meaningful contribution to the global goal of net zero emissions by 2050. This framework helps to provide a structured yet adaptable path for investors to navigate the complexities of net zero investing while seeking to maintain competitive returns. Through continuous monitoring and engagement, we believe investors can ensure their portfolios are aligned with their climate objectives, driving real-world emissions reduction and fostering a sustainable future.

Simon Hallett, Head of Climate Strategy

Footnotes

- Greenhouse gas emissions, principally CO2 and Methane.

- Such as the Institutional Investor Group on Climate Change’s Net Zero Investment Framework (NZIF).

- For simplicity, the first three stages of alignment from Not aligned/not aware to Committed to aligning can be grouped together as ‘not aligned’, though they may offer different potential for engagement.

- The Science Based Targets Initiative (SBTi) is the principle standard setter and validator of corporate climate targets and the source of most data thereon.

- For an accessible definition of scope 1, 2 & 3 emissions, see https://climate.mit.edu/explainers/scope-1-2-and-3-emissions

- For more background see https://www.myclimate.org/en/information/faq/faq-detail/what-are-science-based-targets-sbt/

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.