Global Equity Performance Exceeds That of High-Quality Bonds

Global equities have returned more to investors than high-quality global bonds in nearly three quarters of the last 30 years. The margin of outperformance during those years has been considerable, averaging 12.5 percentage points. That high historical success rate, along with our view that healthy economic activity will support both positive earnings growth and risk appetite, leads us to expect that equities will yet again outperform high-quality bonds.

Global economic activity is expected to grow by 4% in 2022. While that real rate is 2 percentage points less than what the world is expected to achieve in 2021, it is higher than the 3% growth rate we’ve averaged over the last few decades. Next year’s growth will be supported by cautious and well-telegraphed central bank actions and rising vaccination levels, with the G20 now aiming to have 70% of the world vaccinated by next September. Strong business demand should also be a key support, as companies look to restock historically depleted inventories.

Healthy economic growth is likely to support earnings growth. At present, analysts forecast global earnings will grow by 7% in 2022. While that forecast, like all forecasts, is unlikely to match what comes to pass precisely, it’s not unreasonable. Consider that over the last few decades, earnings growth has averaged roughly 5%. In the past, when global leading indicators suggested growth would be above trend in the next year—as they are projecting again now—earnings growth averaged 13%.

Healthy economic growth should also support risk appetite. While it’s true that equity valuations are high relative to history—the MSCI World Index currently trades at 29x cyclically adjusted earnings!—it is also true that there are not many obvious pockets of value. And, investing is all about trade-offs. Looking at equity prices a different way, in which earnings yields are compared to bond yields, valuations don’t appear nearly as stretched. In fact, equities offer a reasonable spread over low-yielding bonds. We expect that reality will limit any major rotation out of equities.

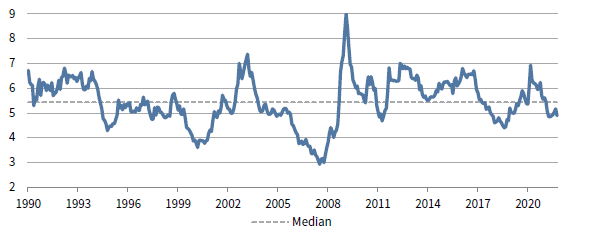

GLOBAL EQUITIES OFFER A REASONABLE SPREAD OVER GLOBAL BONDS

January 31, 1990 – October 31, 2021 • Global Equity Earnings Yield Less Global Bond Yield (%)

Sources: FTSE International Limited, MSCI Inc., OECD, and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: The data reflect the difference between the cyclically adjusted real earnings yield less the global government bond real yield. The MSCI World Index, FTSE World Government Bond 7-10Y Index, and the OECD Total CPI Index were used.

Kevin Rosenbaum, Global Head of Capital Markets Research