Endowment Spending Amid Record Inflation

Inflation is having a moment. After laying low and playing a minor role in institutional 1 financial decisions for decades, inflation has soared, dominating headlines and raising expectations for future costs. In addition to its impact on financial markets and investment portfolios, inflation increases the costs of delivering the nonprofit mission and makes it more challenging to maintain the endowment’s purchasing power. This paper discusses the impact high inflation is having on institutional operating budgets and the endowment’s ability to keep pace. We also consider how high inflation can materially inflate the annual endowment spending calculation when an inflation index is a component of the spending policy. After many years of behaving like a gentle nudge, inflation has become a big shove, raising costs and spending calculations.

Inflation Is Real

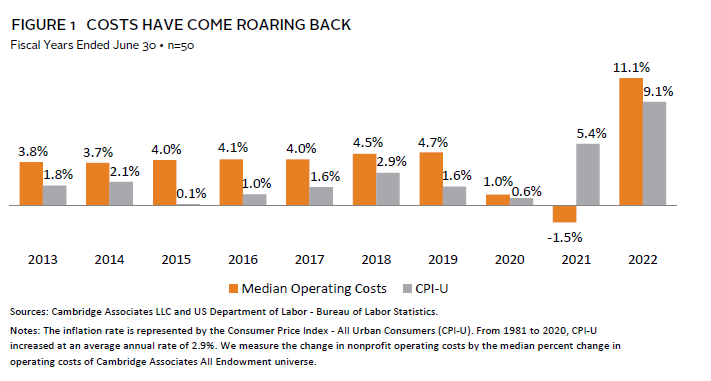

For nearly four decades, inflation has been consistent and low. This pattern continued for the first eight years of the past decade, as the Consumer Price Index – All Urban Consumers (CPI-U) averaged 1.5% and never exceeded 3% (Figure 1).

From 2013 to 2019, operating costs of nonprofit organizations also followed a consistent growth pattern; annual increases ranged from 3.7% to 4.7%. Operating cost growth consistently outpaced consumer inflation until 2021, when they diverged. Inflation jumped to 5.4%, and operating expenses decreased for many nonprofits because of scaled back operations during the COVID-19 pandemic. In 2022, the pattern shifted again when CPI-U marked a torrid growth rate of 9.1%, and expenses came roaring back with an even higher 11.1% growth rate. The higher operating costs were boosted by two coinciding factors: higher, inflation-driven costs of delivering the mission and the higher volume of expenses institutions incurred as they resumed activities post-pandemic.

Is Endowment Spending Keeping Pace with Inflation?

In 2022, endowment support of the budget did not keep pace with the growing costs. The median growth rate of endowment spending was 4.8%, failing to keep up with expense growth of 11.1%. But endowments are composed of long-term capital. Annual statistics are indicators, but not accurate measurements, of long-term results. That is why an endowment policy outlines goals and long-term performance metrics:

- Investment policy is designed to deliver long-term returns that keep pace with, or exceed, the combined rates of spending and inflation over time.

- Endowment spending policy is designed to deliver spending that balances funding needs and the preservation of endowment purchasing power.

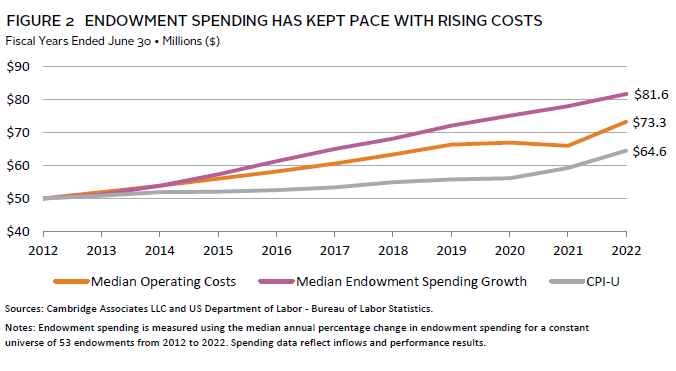

Using a longer-term lens, we see that endowment spending has met this goal, keeping pace with the costs of delivering the mission and inflation over the last decade (Figure 2).

Since 2015, the median increase in endowment spending has outpaced the growth rate of inflation and operating costs. We see that endowment spending maintained a steady trajectory in 2021 when expenses dipped, and continued that trajectory in 2022 when costs increased sharply. This ten-year analysis shows that the median endowment spending growth has achieved the goal of keeping pace with—and, in this case, exceeding—the costs of delivering the programs, people, and place associated with the mission. But the lines are drawing closer, as operating costs grow faster than endowment spending. The slopes of these lines will be important to watch going forward. Persistent inflation creates an even higher hurdle for endowment growth. Strong returns and net flows (the combination of endowment fundraising and spending) will be needed now, more than ever, to contribute to growth to help keep pace with the escalating costs of delivering the mission.

Inflation and Spending Policy

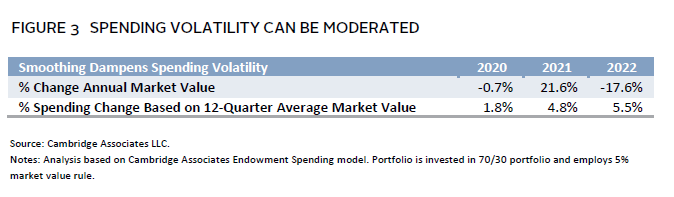

Endowment spending policies are designed to balance the endowment’s near-term funding needs and the long-term purchasing power. The majority (72%) of institutions in the Cambridge Associates 2022 Spending Policies and Practices Study employ a market value–based spending policy to achieve this goal. A market value–based rule calculates annual spending as a percent of a recent market value, or an average of multiple market values, known as a trailing average. Spending generated by a market value rule tends to fluctuate with investment performance. Volatility in spending linked to the market value can be moderated by employing an average of trailing market values. For example, when the market value of a representative portfolio increased 21.6% in 2021, spending based on the same portfolio’s 12-quarter average market value moderately increased 4.8%. The opposite is also true in down markets. In 2022, when endowments weathered negative investment performance, the portfolio market value declined 17.6% after spending, and the spending based on a 12-quarter average value increased 5.5% because the negative return year was moderated by prior years with positive returns (Figure 3).

Approximately 25% of endowed institutions rely on a policy that incorporates inflation factors to keep pace with funding needs. A constant growth spending policy calculates a spending amount by increasing the prior year spending amount by a prespecified percentage or an amount linked to inflation. Constant growth rules are employed by 17 institutions (7%) in our annual study. More than half of those institutions rely on a prespecified percentage growth factor for the constant growth component of the calculation, and approximately 40% link growth to CPI. As such, high inflation can supercharge the spending policy calculation for a spending rule linked to an inflation index and erode the purchasing power of the endowment if inflation is not short lived.

Hybrid rules blend elements of both market value and constant growth policies, usually with a higher weighting to constant growth. In 2022, 17% of endowments (42 institutions) employed a hybrid policy. Nearly 90% of those institutions build up annual spending growth by an inflation index and 60% (21 institutions) link the spending growth to CPI. Hybrid rules incorporating high inflation and the market values that resulted from the record-high 2021 investment returns may be supercharged by both components. This confluence of high returns and high inflation have not been a consideration for hybrid rules in recent decades (Figure 4).

High Inflation Can Supercharge Inflation-Linked Spending Calculations

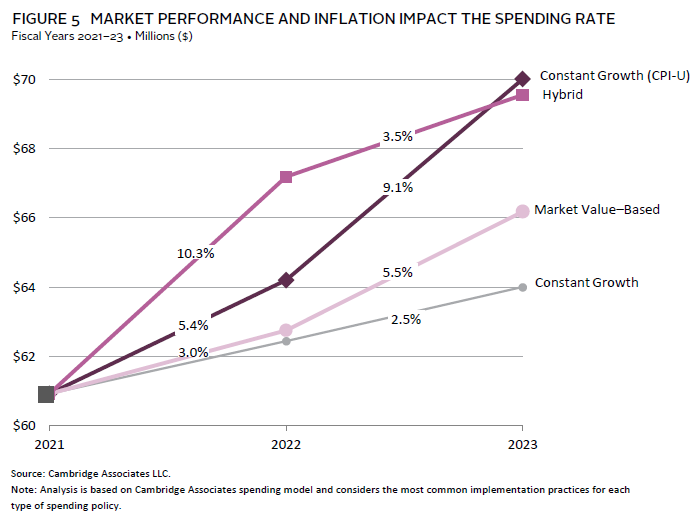

Fiscal year 2022 was the first year where spending policies incorporated the extraordinary performance of 2021, and thus higher market values. It also captured the initial spike in inflation from 2021. That confluence led to a 10.3% increase in the annual spending calculated by a typical hybrid spending policy in 2022, when the market value component of the hybrid rule applies the spending rate to the prior year ending market value (Figure 5). The constant growth spending policy linked to CPI-U grew at 5.4% (the rate of CPI-U from the prior year) in 2022. In 2023, we expect an inflation-linked hybrid rule and constant growth rule will both spend similar amounts. The constant growth rule growing at the inflation rate will catch up to the hybrid rule, which will have more subdued growth in 2022 due to dampened investment performance. In this recent environment, we see that a market value rule that smooths values over 12 quarters will deliver much lower spending than rules linked to inflation.

There are many details of rule mechanics to keep in mind when thinking about the spending calculation. Some rules lag in market value or inflation measurement dates, which can impact the amount and timing of spending calculations. Smoothing periods can also have a significant impact. In our modeling, the single measurement date in the hybrid rule drives higher spending, but the smoothing component of the market value rule calculates more modest increases in endowment spending. Other relevant details may include the weighting of hybrid components, “collars” (caps and floors on spending) linked to market value, and which inflationary indexes are employed.

Which Rule Works Best in a High Inflation Period?

- If preservation of endowment purchasing power is a higher priority, then a rule linked to market value will provide lower spending and preserve more capital for future spending needs.

- If an institution wants (or needs) its endowment spending to keep pace with rising costs, then a rule linked to inflation will work best, because it will spend more as inflation spikes.

An institution that has had an inflation-linked rule in place will have been spending less in low-inflationary years and will have more purchasing power to work with in a high inflationary period. This is the power of implementing a spending policy over the long term, rather than shifting policy to time a market cycle. The inflation-linked rule will be ready for high inflation if it has been in place during the prior low-inflationary period. The market value rule will deliver more spending in higher performance cycles and less in a low-return period.

When thinking through spending policy and perhaps changes or overrides to policy, it is important for all institutions to keep long-term goals in mind. Similar to investment policy, spending policy should not change with market conditions, but rather, be consistently applied to shifting market conditions as they occur. It can be helpful to build in belts and suspenders, such as market value “collars” on constant growth rules. More general flexibility can also be helpful, to allow decision makers to prudently override a spending calculation if more (or less) spending is needed, in times of market value and inflation volatility.

Working with Inflation

We expect that inflation will come down from its recent peak, but we doubt it will quickly settle at the low levels we have enjoyed in recent history. This means that in the near term, institutions can expect persistent inflation will elevate operating costs. Spending policies linked to inflation indexes will, by design, calculate higher spending to keep up with those costs. While this may erode purchasing power in the short term, the inflation link has tempered endowment spending in low-inflation periods from the previous era, so the endowment may be poised to spend more to meet this inflationary moment. It will be important to keep a close watch on effective spending and performance. Spending more now will result in less available in the future, but this may be the moment inflation-linked rules have been preparing for—spending more prudently during low-inflation periods to be ready when inflation ultimately returned.

Tracy Abedon Filosa, Head of CA Institute

Other contributors to this publication include Cameryn Dera and Billy Prout.