Asia Insights: Managing Risk Through Diversification

Introduction

Aaron Costello, Head of Asia, and Vivian Gan, Investment Director, Capital Markets Research

Asian and global market volatility surged in early 2025 as US tariffs triggered global growth fears. Given the export-oriented nature of most Asian economies and their sensitivity to global growth and demand, the region may bear the brunt of US tariffs. As such, Asia market volatility is likely to persist in the near term, particularly since US trade policy can shift abruptly.

With the United States and China locked in a tariff standoff, at least for now, a key question is to what extent China and other Asian economies will increase fiscal and monetary stimulus to offset the economic impact from US tariffs. Aggressive stimulus, particularly from China, may help to support growth and sentiments in Asia more broadly.

Considering the current environment of higher uncertainty and volatility, as well as global equity market concentration in US large-cap technology stocks, we view portfolio diversification is key in managing downside risks. We favour strategies that are more attractively priced, are less correlated to the broader market, or are able to capitalise on any dislocations that may result from economic stress.

In this edition of Asia Insights, we highlight:

- Within Public Equities: We view Asia ex Japan value-oriented strategies could add a layer of downside protection, given less demanding starting valuations and a differentiated sector exposure that is less concentrated in technology.

- Across Hedge Funds: Asia event-driven strategies warrant a second look today, given an improved manager competitive landscape and a current macro environment that is supportive of alpha generation. Event-driven strategies also tend to be less correlated to broader equity markets, and therefore could serve as a diversifying strategy amid current market volatility.

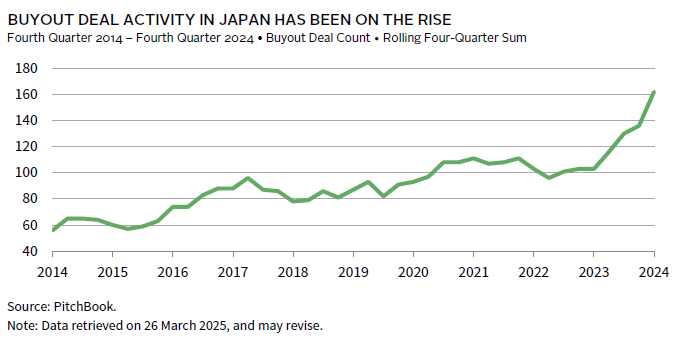

- Within Private Investments: We remain constructive on Japanese buyouts, given strong underlying supply and demand fundamentals. Deal flow is likely to remain robust as Japan’s aging demographics and ongoing corporate governance reforms continue to drive corporate actions. It may be further accelerated by dislocations created by US tariffs. Meanwhile, attractive entry valuations today and the availability of cheaper leverage lend support to continued capital inflows.

- For Real Assets: We see increased opportunities in Asia-Pacific value-add and opportunistic infrastructure today, given the region’s maturing regulatory environment and longer-term demand for infrastructure spending. We are positive today on data centers and renewable energy infrastructure, which are backed by strong fundamental demands while also less sensitive to potential growth and trade shocks.

Public Equities: Seek Diversification Through Asia Value-Oriented Strategies

Wilson Chen, Managing Director, Public Equities, and Vivian Gan, Investment Director, Capital Markets Research

Global equities saw heightened volatility in early 2025 as US tariffs added uncertainty to the global growth and inflation outlook. Markets also saw a tentative rotation in leadership from US large-cap technology stocks towards non-US markets. In the current environment, we view that Asia ex Japan value-oriented strategies could add diversification to investor portfolios, given favourable valuations and underlying exposures.

Value-oriented strategies range from deep value to quality value, with managers seeking to identify undervalued segments of the market. Today, we would focus on value managers that invest with a quality lens, as companies that have stronger balance sheets can better withstand economic shocks. Value strategies that emphasise dividend returns may also be poised to benefit as global rates decline amid continued central bank easing.

While markets are in flux following the tariff announcements, active Asia value-oriented strategies tend to overweight China and Southeast Asia and underweight Taiwan and India as of end March. They also tend to underweight IT and communication services in favour of cyclical sectors (e.g., industrials) or more defensive segments of the market (e.g., consumer staples and utilities). While Asian equities as a whole face macro headwinds, the lower valuations for these markets and sectors may ultimately help to limit the downside. They may also see greater upside should Asian economies strike trade deals with the United States, and benefit from increased monetary and fiscal stimulus, particularly from China.

Overall, the market environment remains uncertain, but we still think Asia value-oriented strategies allow for a differentiated and less tech-concentrated exposure to Asia while offering a valuation cushion that could be more defensive in the current environment.

Hedge Funds: A Second Wind for Asia Event-Driven Strategies

Benjamin Low, Senior Investment Director, Hedge Funds, and Vivian Gan, Investment Director, Capital Markets Research

Asia event-driven strategies are starting to look more interesting today as a diversifying strategy amid current market volatility. Heading into 2025, the region had seen a tentative recovery in capital markets activities, with mergers & acquisitions (M&A) and initial public offerings (IPOs) on the rise. At the same time, the closure of a prominent Asia event-driven hedge fund in early 2024 has created a more level playing field for the remaining players and improved the manager competitive landscape.

Event-driven strategies seek to generate alpha from market inefficiencies around corporate events, such as mergers, spin-offs, stock buybacks, and IPOs. While these strategies are typically equity-oriented, managers may invest across the capital structure to add value. Event-driven strategies tend to be less correlated to broader equity markets, and therefore could play a role in investor portfolios as a diversifying strategy.

The opportunity set for Asia event-driven strategies had been improving amid a rebound in the region’s capital markets activities. Managers invest across both developed Asia (e.g., Japan and Australia) and emerging Asia (e.g., China, India, and Southeast Asia). While US tariffs are adding uncertainty to the near-term outlook, we continue to see the environment as favourable for event-driven strategies. Japan remains a key market of interest as ongoing efforts to improve corporate governance and shareholder returns have led to more robust levels of corporate actions, including M&As, take-privates, and spinouts. Managers also note similar opportunities may increase in South Korea following the introduction of its ‘Corporate Value-Up Program’. China and Hong Kong are also of focus. Weaker economic growth in recent years has led to increased deal opportunities from market consolidation and divestments by multinationals, and these trends may actually accelerate should US tariffs create economic and corporate dislocations in Asia.

Overall, we view Asia event-driven strategies warrant a second look today given the likely increase in corporate actions in the region and the added diversification such strategies can bring to portfolios.

Private Investments: Japan Buyouts Remain Attractive Despite Near-Term Macro Volatility

Sharad Todi, Senior Investment Director, Private Equity

Heading into 2025, buyout activity in Japan was on the rise, with the number of transactions reaching 162 in 2024, the highest level in a decade. Although the penetration level of private equity (PE) in Japan remains lower than in other developed markets, the country is emerging as a natural harbour for leveraged buyouts. We see reasons to remain positive on Japan buyouts now despite near-term macro volatility.

On the supply side, deal flow is likely to remain strong. First, several family-owned small- to medium-sized enterprises struggling to find natural successors are turning to PE firms to ensure business continuity. Second, large conglomerates in Japan are streamlining their operations by divesting non-core assets, creating opportunities for PE investors. Third, the Tokyo Stock Exchange’s demand for listed companies to justify their status by improving book value and capital efficiency ratios is also increasing take-private transactions. All these trends may be magnified by dislocations created by US tariffs.

On the demand side, investors are drawn to Japan for several reasons. Unlike most other Asian markets, control is the norm in Japan, allowing investors to shape the company’s journey more effectively. Valuations also remain attractive. According to Dealogic data, median EV/EBITDA multiples in Japan were 12.0x in 2024, compared to 14.4x for broader Asia, and Japan buyout managers can target even lower entry multiples of 10.0x or below. Plenty of low-cost debt is available, with most managers able to secure financing at 40% to 60% of enterprise value at an all-in cost below 4.0%. The terms of leverage are typically investor friendly, with banks being more relationship-focused and cooperative with borrowers dealing with struggling assets. Japan’s low economic growth rate drives corporates to pursue inorganic growth, making strategic buyers the preferred exit route for PE firms. Furthermore, Japan’s attractiveness as a private investment destination in Asia has increased as China’s appeal has waned, providing large pan-Asian funds a stable market to deploy capital. In addition, investors seeking currency diversification from the US dollar may benefit from a strengthening Japanese yen over the coming years.

All in all, we expect these broad macro trends should persist in the near term and lend support to buyout activity in Japan.

Asia Infrastructure: A Maturing Market with Growing Opportunities

Minesh Mashru, Global Head of Infrastructure Investments, and Derek Yam, Associate Investment Director, Real Assets

Asia-Pacific (APAC) is quietly gaining traction as an investment destination for infrastructure funds, supported by the region’s economic growth and demand for infrastructure spending. Historically, much of the region’s infrastructure capital had originated from global or emerging markets funds, while dedicated APAC infrastructure fundraising has been lumpy year to year. However, we view this should change going forward, given an improving regulatory environment and opportunity set, particularly in emerging Asia with increased deregulation and a relaxation of foreign control ownership rules.

APAC value-add and opportunistic infrastructure have the potential to deliver returns in the mid-teens and above, albeit requiring careful management and local knowledge. These strategies involve greenfield risks tied to development activities and operational complexities, as opposed to core infrastructure, which focuses on brownfield assets. The opportunities are broad based across developed Asia (i.e., Australia and Japan) and emerging Asia (i.e., India and Southeast Asia). However, given that Asian economies are more reliant on trade and, therefore, vulnerable to US tariffs, investors need to be discerning when investing in APAC infrastructure. Economically sensitive and trade-related segments, such as ports and logistics, may be especially impacted.

In the current environment, we favour sectors that are less exposed to trade while backed by strong fundamental demands. Data centers are one, given the region’s increased digitalisation and growing adoption of cloud computing. Current supply of data centers still lags the rapidly expanding demand by local enterprises, as well as hyperscalers seeking to expand their cloud service offerings across both traditional and secondary markets 1 . Renewable energy infrastructure is also attractive, given low current penetration rates and a strong regulatory push towards decarbonisation. Opportunities range from regional solar assets across broader APAC to offshore wind farms in Taiwan, although an understanding of local regulations and onshoring requirements is key. The expansion of cross-border power trading in markets such as Southeast Asia has also bolstered the region’s renewable energy development.

In sum, despite the economic headwinds from US tariffs, we view there remains growing opportunities for APAC infrastructure, given the region’s maturing regulatory environment and structural tailwinds for infrastructure demand.

David Kautter also contributed to this publication.

Index Disclosure

MSCI AC Asia ex Japan Index

The MSCI AC Asia ex Japan Index captures large- and mid-cap representation across developed markets (DM) countries (excluding Japan) and emerging markets (EM) countries in Asia. The index covers approximately 85% of the free float–adjusted market capitalization in each country.

Footnotes

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.