2025 Outlook: Public Equities

We expect developed markets (DM) value and small-cap equities to outperform, given our economic views and their steep valuation discounts. Regionally, we believe US equity performance will not match the level set in 2024, allowing European, Japanese, and emerging markets (EM) equities to perform more in line with broader developed markets. Within emerging markets, strong Indian equity gains should moderate, while we doubt Chinese equities will collapse. At the same time, we expect long/short equity strategies will perform better than typical.

Developed Markets Value Equities Should Outperform in 2025

Sean Duffin, Senior Investment Director, Capital Markets Research

There are several key reasons that value looks set to outperform growth in 2025. First, the euphoria surrounding the AI boom has moderated, alleviating a key tailwind that benefited growth stocks in recent years. Second, value stocks trade at attractive discounts relative to their growth counterparts. Third, central banks have recently begun cutting rates, and value stocks have often benefitted from these rate cycles.

Large-cap growth stocks have surged due to rising AI stock prices in the last few years, but much of that enthusiasm appears priced in. The “Magnificent 7” stocks, central to the AI theme, now make up more than 40% of the MSCI World Growth Index. Heading into 2025, we believe that investors may recalibrate expectations for growth stocks, given concerns about sustainability and uncertain timeline for realizing returns on AI investments.

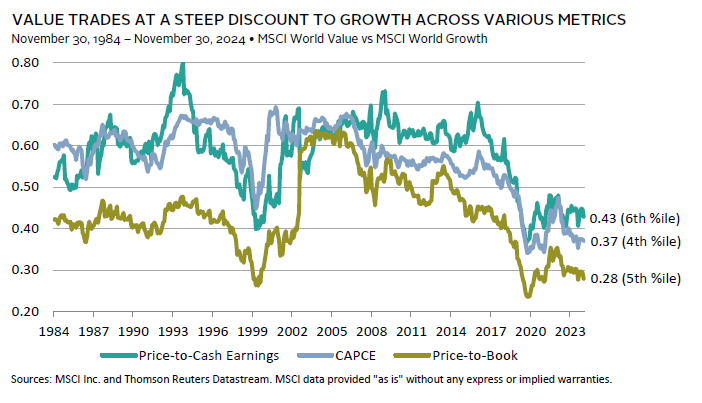

By almost any valuation metric, value stock indexes are trading at historic discounts to their growth counterparts. For example, value stocks currently trade at a 63% discount to growth stocks on a normalized price-earnings ratio basis, well above the typical 43% discount that they have averaged in the last 40 years. From these levels, value offers a margin of safety in an environment where the range of economic outcomes is wide. If the relative earnings growth advantage of growth stocks shrinks, value stocks could see considerable relative upside from valuation re-rating.

Central banks have started cutting interest rates, as inflation has moderated and economic data has softened. With policy rates starting from their highest levels in several decades, central banks have more leeway to reduce borrowing costs and keep economic growth stable. This should be supportive to cyclical sectors where value stocks are concentrated. Indeed, value stocks have historically edged growth stocks in the 12 months after the initial Fed rate cut when a recession is avoided. On the flipside, any upside risk to inflation and yields as a result of Trump’s new policy proposals could also be a boon to value stocks, which outperformed growth under such circumstances in 2022 when unexpected inflation surged and the Fed was forced to hike rates.

US Equity Returns Should Be Lower in 2025

Sehr Dsani, Senior Investment Director, Capital Markets Research

The US market’s return in 2024 reflects its profitability growth. That growth was mostly driven by its roughly 30% exposure to the information technology (IT)sector, which made great strides in AI-related innovation. However, valuations and growth forecasts imply that the market is pricing in high expectations. We think this, combined with the fact that returns have rarely exceeded their solid performance in 2024, suggests US equity returns in 2025 should be more typical.

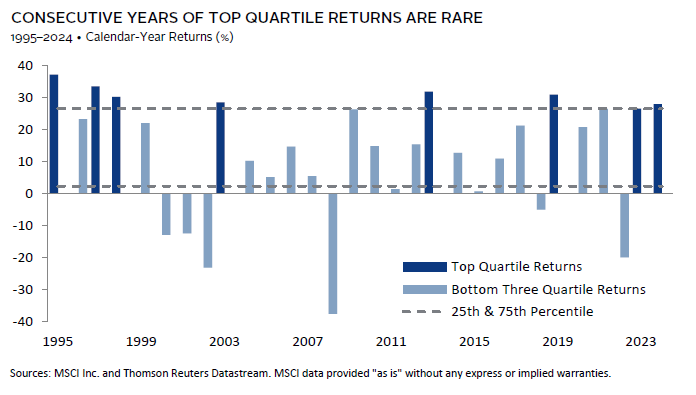

Returns for US equities in 2023 (26%) and so far in 2024 (28%) were great, ranking in the top quartile of returns since 1995. While it is rare for returns to be that high for two consecutive years, it is even more rare for it to occur three years in a row. More often, years of strong performance have been followed by middling returns.

Nonetheless, solid economic and earnings fundamentals make it reasonable to expect returns to be typical next year. Although US GDP growth (2.1%) is forecast to slow, it is still relatively attractive versus other developed markets. Additionally, expected 2025 earnings growth of 14% exceeds the rest of the world by 7 ppts. Relative profitability has notably improved since the pandemic, in part because of the US overweight to IT. This sector’s high barriers to entry and highly specialized products means it benefits from higher margins than other more competitive industries.

However, valuations adequately reflect this leadership. The normalized price-to–cash earnings multiple in the United States is close to peak levels, and while neither DM ex US (76th percentile) nor emerging markets (58th percentile) are trading at inexpensive levels, they are cheaper than the United States. It is hard to argue that multiples will expand further when considering that projected earnings growth rates for the largest US sector (IT) are within the top quartile of its historical range, after an already robust 2024. Overall, it would take dramatically higher earnings and valuations in 2025 to achieve higher returns than 2024. We think that is unlikely because the market is already pricing in elevated levels.

Relative Performance of European Equities Should Improve in 2025

Thomas O’Mahony, Senior Investment Director, Capital Markets Research

European equities have underperformed global equities by more than 16 ppts so far in 2024. This is perhaps unsurprising in light of the strong performance of tech stocks and Europe’s underweight to those sectors. However, underperformance has extended beyond mere differences in exposures, as Europe underperformed across all 11 GICS sectors. Macroeconomic divergence has also been a factor behind this performance gap. On a trailing one-year basis, GDP in the euro area and United Kingdom has grown by 0.9% and 1.0%, respectively, in comparison to 2.7% in the United States.

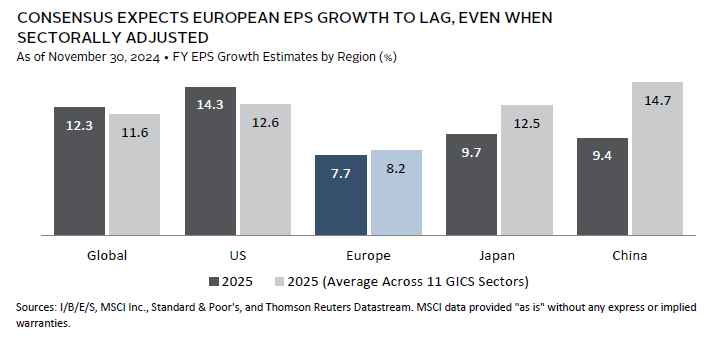

Going into 2025, expectations for European equities are relatively depressed from a bottom-up perspective, leaving some scope for upside surprises. Analysts expect European earnings growth to lag that of global equities by 4.6 ppts in 2025, according to the consensus estimate. This is lower than 86% of relative year-ahead earnings per share (EPS) growth forecasts going back to 1987 and 3.7 ppts below the average forecast over that history. What’s more, it is slightly worse than the amount by which earnings growth in Europe has trailed that of global equities so far this year. This is despite the fact that consensus expects GDP growth differentials to narrow in 2025. Currently, GDP is expected to grow by 1.2% and 1.4% in the euro area and United Kingdom, respectively, and 2.1% in the United States.

Valuations also paint a picture of negative sentiment toward European equities. Once adjusted for sectoral differences, the forward price-earnings (P/E) ratio for both Europe ex UK and the United Kingdom relative to global equities is close to 0.8. Nonetheless, despite some valuation cushion and relatively depressed EPS expectations, we refrain from taking an active overweight to the region. A primary concern is the continuing challenges faced by Germany, the largest economy in the region. Activity and sentiment indicators are deteriorating and indicating contraction, loan growth has flatlined, and fiscal policy will likely be a detractor. Adding to these cyclical headwinds is the more secular issue of increasing competition from China. Similarly, the threat of tariffs on exports to the US remains a source of uncertainty and a potential headwind, even if partially priced in. In addition, while we do not foresee a global recession in 2025, risks are more tilted toward the downside, whereupon the cyclicality of European equities may be a headwind.

Japanese Equity Performance Should Be Similar to that of Developed Markets in 2025

Thomas O’Mahony, Senior Investment Director, Capital Markets Research

Japanese equities should benefit from some supportive factors as we head into 2025. These include a corporate reform agenda, continued inflows from individuals and less stretched valuations. However, we also expect the yen to strengthen, which would be an earnings headwind. What’s more, we remain sensitive to the risks of a broader economic slowdown, during which Japanese equities tend to underperform. All told, we ultimately expect their performance to be broadly in line with that of developed markets.

Central bank divergence should drive a recovery for the yen in the coming quarters. The BOJ has started to raise rates, and with inflation consistently above target and positive real wage growth we expect further hikes. Meanwhile, the Fed will likely cut rates further, even if the impact of the incoming administration means cuts will be more gradual. The yen’s real effective exchange rate is more than 30% below its median, suggesting potential for further strengthening. This could negatively impact Japanese equities in the short term due to the earnings headwind a stronger yen represents.

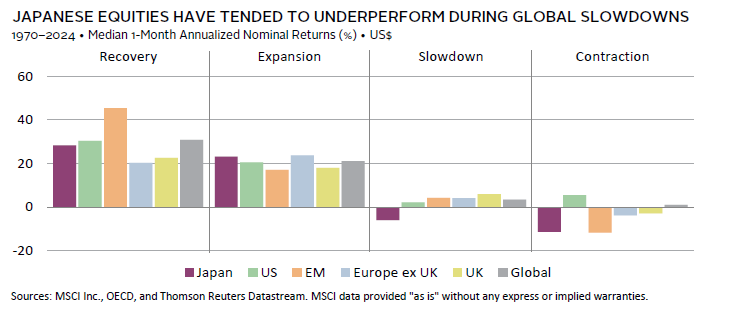

Japanese equities are vulnerable to global economic slowdowns due to their cyclical exposure, particularly in industrials and consumer discretionary. We expect global growth to be close to trend but remain sensitive to downside risks, given weak activity data in China and Germany, signs of a cooling US labor market and the potential impact of tariffs. Japanese valuations, while somewhat attractive, do not sufficiently compensate for these risks. Our cyclically adjusted price-to–cash earnings (CAPCE) valuation measure shows Japanese equities trading at the 76th percentile of their own history and the 14th percentile versus global peers.

A potential ongoing tailwind for Japanese equities comes from the continued adoption of the Tokyo Stock Exchange (TSE) corporate reform agenda. This is aimed at increasing shareholder value by encouraging improvements in corporate governance and transparency, and promoting financial efficiency. An expanded tax-free Nippon Investments Savings Account scheme for Japanese individuals should also be a source of continuing inflows into domestic equities. However, these factors are not enough to warrant an overweight position. Small-cap Japanese equities may exhibit greater resilience due to lower foreign revenue exposure and potentially greater benefits from TSE reforms.

Developed Markets Small-Cap Equities Should Outperform in 2025

Stuart Brown, Investment Director, Capital Markets Research

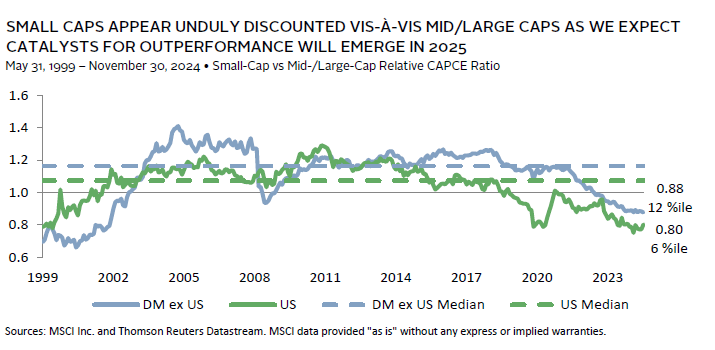

DM small-cap equities have struggled to keep pace with their larger-cap brethren. 2024 was no exception, with small caps on track to underperform for a fifth time in the past six years. This has left them trading at historically discounted levels vis-à-vis mid/large caps. However, we think 2025 may mark a turning point, and recommend that investors modestly overweight broader DM small caps.

Markets are likely to favor cyclical equity market sectors as central banks continue easing policy. Small caps are among the key beneficiaries of rate cuts, being relatively overweight the industrials, real estate, materials, and consumer discretionary sectors. Indeed, some of these were the top-performing segments in the second half of 2024. This dynamic looks set to continue, particularly as we expect near trend economic growth with limited risk of recession. Such an environment should support risk appetite, boosting small caps.

Recent underperformance has created a valuation opportunity. Both US and DM ex US small caps trade at historically wide discounts to their mid-/large-cap peers. Highly valued US tech stocks are partly to blame, as high expectations from the impact of AI have left global equity indexes increasingly concentrated. Further, small-cap earnings growth is expected to exceed that of mid-/large-caps. Taken together, we think investors are well compensated for leaning into small caps at these valuation levels.

The US and DM ex US segments enjoy distinct tailwinds. In the United States, small caps stand to benefit from a potential policy shift, given Trump’s preference for tax cuts and a lighter regulatory touch. Ongoing investment in manufacturing capacity favors industrials, while potential for a steeper yield curve supports financials via several channels, namely net interest margins. US small caps are overweight these two sectors. DM ex US small caps are relatively overweight Japan, where improving economic fundamentals should allow for further monetary policy normalization and support the yen. In addition, DM ex US economic growth is expected to pick up modestly after slowing in 2024.

Emerging Markets Equity Performance Should Be Similar to Developed Markets Equity in 2025

Stuart Brown, Investment Director, Capital Markets Research

EM equities are on track to trail DM peers for a fourth straight year in 2024. However, the underperformance margin is among the narrowest over that span. We see this as a fair analog for 2025, where we expect EM equity performance to broadly match that of developed markets. Indeed, many of the factors benefiting EM performance in 2025 should help DM performance as well.

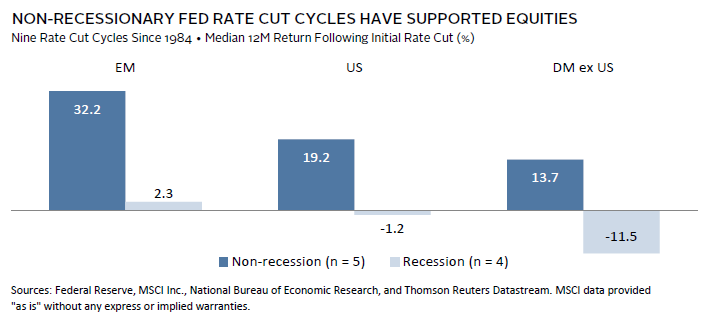

The economic outlook should support EM equities. We expect the Fed to continue cutting interest rates as the US economy expands in-line with recent trends. This setup bodes well for EM equities, which have historically delivered strong results during non-recessionary Fed rate-cutting cycles. Further, economists expect GDP growth differentials versus the United States to shift in favor of non-US countries and regions. The US election result may contribute to near-term US dollar strength, but we ultimately think the economic backdrop will induce modest weakening in 2025, providing a tailwind for EM stocks.

Broader policy easing has bolstered the earnings outlook. With the hurdle of Fed rate cuts cleared, we think EM central banks will continue their own rate-cutting cycles. Monetary easing in China and across broader emerging markets has often been a tailwind for EM corporate profits, where consensus expectations for EPS growth of around 15% appear well supported. Chinese stimulus has also lifted prospects for EM trade. Earnings among smaller Asian economies and Latin America, where China represents a significant proportion of export demand, stand to benefit the most.

Valuations may ultimately limit EM performance. Although emerging markets trades at a nearly 40% discount to developed markets, absolute valuations have climbed to among their highest levels in the past decade. These elevated levels are largely concentrated in India and Taiwan, which have been the primary drivers of EM performance in recent years. Given these two countries account for nearly 40% of EM market capitalization, the risks of underwhelming expectations are elevated. Against this backdrop, we are wary of leaning into EM equities, and suggest investors hold this allocation in line with the weight in their policy portfolio.

Chinese Equity Prices Should Not Collapse in 2025

Aaron Costello, Head of Asia, and Vivian Gan, Associate Investment Director, Capital Markets Research

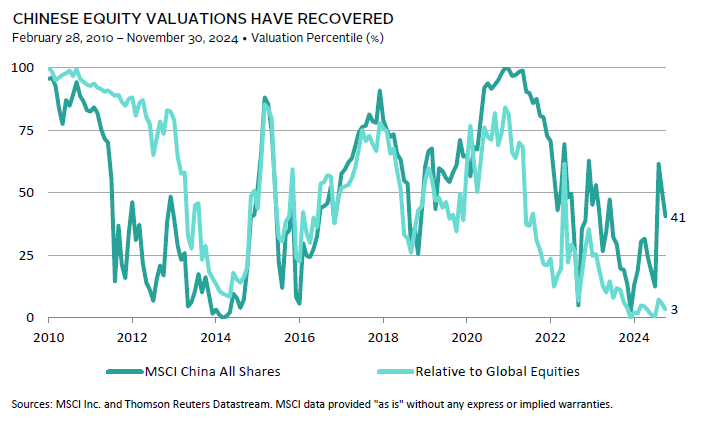

We expect the Chinese equity rally to stall but not necessarily collapse in 2025, given markets have already front run the benefits of increased fiscal and monetary stimulus. With Chinese equity valuations back to fair value, a further re-rating of the market will require China’s economic data and corporate fundamentals to improve, which will take time absent further policy support.

Chinese equities rallied 35% from their September lows to their October peak 1 as investors frontloaded expectations of more aggressive fiscal stimulus from China. However, the rally subsequently stalled as the fiscal measures announced disappointed and the re-election of Trump raised concerns about more hawkish US policies on China.

With the recent rally, Chinese equity valuations have risen, with our preferred valuation metric for China at the 41st percentile relative to its own history. For the Chinese equity rally to resume, this will require a meaningful acceleration in China’s economic growth, easing deflationary pressures, and a rebound in corporate earnings growth. Although certain Chinese economic data are starting to improve, key indicators such as housing market data and inflation data remain weak and will take time to recover. Nevertheless, downside risks to China seem contained as monetary easing and actions taken to control local government debt risks should help to prevent further stress.

Overall, given investors have priced in current policy stimulus, and Chinese equity valuations are fair, a further re-rating of the market may require China to ramp up stimulus in 2025. This may occur either in response to weaker-than-expected economic growth or further US policy actions (e.g., increased tariffs) on China. While additional stimulus is needed for a renewed rally, a market collapse is unlikely given current policies should help to stabilize the economy. Thus, we believe investors should hold China allocations in line with the weight in their policy portfolio.

Indian Equity Performance Should Moderate in 2025

Stuart Brown, Investment Director, Capital Markets Research

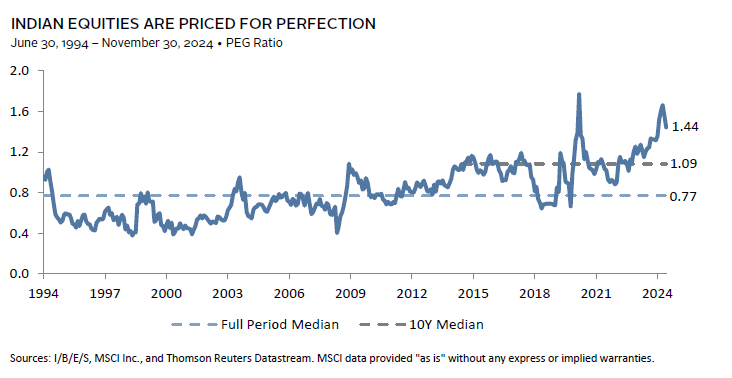

Indian equities have been on a tear. The market gained a staggering 13.5% annualized over the past five years, topping nearly all other countries. Still, amid a backdrop of high valuations and expectations, we expect Indian performance will moderate in 2025. Investors should hold the country in line with its weight in global equity benchmarks.

Indian equities are richly priced, reflecting high growth expectations. A composite of Indian equity valuations trade nearly 40% above their 20-year median, the highest level among large EM countries. India’s forward P/E ratio of 22.8 sits near an all-time high, with small caps even more expensive. Although the 2025 earnings outlook (18%) was upgraded during 2024 and profitability recently hit a ten-year high, the 20-year average EPS growth rate was just 10%. Further, India’s PEG ratio—which relates valuations to growth expectations—of 1.44 is near a ten-year high. Taken together, Indian stocks are priced for perfection and face elevated risks from even a modest earnings disappointment.

The economic outlook, which has contributed to equity market exuberance, appears stable. Growth is expected to slow modestly to 6.8%, supported by lower inflation, investment in infrastructure and industrial capacity, and a broadening of consumer strength to rural populations. A favorable monsoon season in 2024 should support 2025 consumption, while also limiting upward pressure on food prices. This should enable the Reserve Bank of India to lower rates, as food makes up a meaningful share of India’s inflation basket.

India should remain resilient to external shocks. Despite potential for Chinese equities to garner increased foreign investment flows, we do not think this will come at India’s expense. Domestic investors have superseded the impact of foreign flows, and Indian households in aggregate remain underinvested. Downside risks to global growth would likely be mitigated as India’s economy is domestically oriented, with exports making up a relatively small share of the economy. Further, India has shored up its foreign exchange reserves, providing yet another buffer to adverse shocks, such as higher oil prices.

Long/Short Equity Should Deliver Above-Average Results in 2025

Stephen Mancini, Senior Investment Director, Hedge Funds

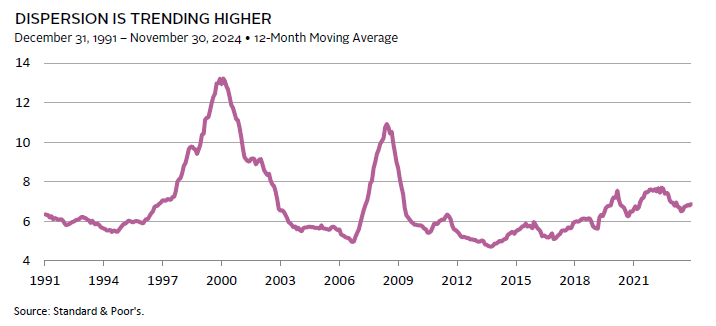

We expect most long/short equity strategies will perform better than typical, driven by a favorable macroeconomic backdrop and the potential for strong alpha generation on both the long and short sides of the portfolio.

Contributing to the attractiveness of long/short equity are the ongoing challenges faced by companies reliant on capital markets for funding. Despite central banks’ recent easing decisions, rates remain elevated relative to the past 15 years. This environment has created a relative scarcity of capital, making it marginally more difficult for financially challenged companies to secure the funding they need to sustain operations and growth. As a result, these companies face headwinds, providing fertile ground for attractive short opportunities. The continued tailwind from the positive short rebate many long/short funds are receiving further enhances the potential for alpha generation on the short side, as managers can capitalize on the struggles of overleveraged and underperforming firms while earning a positive carry on their collateral.

On the long side, the market presents numerous opportunities for managers to add value by identifying companies with real earnings and strong free cash flow growth that are trading at relatively attractive valuations. While certain segments of the market may exhibit frothiness, many fundamentally sound companies remain undervalued, offering significant upside potential. Furthermore, global ex US valuations remain favorable; coupled with idiosyncratic fundamental catalysts, the global opportunity set on the long side remains robust. The ability to discern between overhyped stocks and those with genuine growth prospects is a key advantage for skilled long/short equity managers.

The combination of strong alpha potential on both the long and short sides should enable long/short funds to generate attractive long/short spreads. By maintaining a balanced and diversified portfolio, managers can mitigate market risk while capitalizing on individual security selection. This approach not only enhances the potential for outperformance but also provides a robust framework for navigating various market conditions.

Figure Notes

Value Trades at a Steep Discount to Growth Across Various Metrics

The cyclically adjusted price-to–cash earnings (CAPCE) ratio is calculated by dividing the inflation-adjusted index price by trailing ten-year average inflation-adjusted cash earnings. Cash earnings are defined as net income from continuing operations plus depreciation and amortization expense. MSCI does not publish cash earnings for banks and insurance companies and therefore excludes these two industry groups from index-level cash earnings.

Consecutive Years of Top Quartile Returns Are Rare

Returns are based on the MSCI US Index, net of dividend withholding tax. Return data for 2024 are through November 30.

Consensus Expects European EPS Growth to Lag, Even When Sectorally Adjusted

Japan FY EPS data represents earnings growth from March through the next 12-month period. Regions are represented by the following indexes: MSCI ACWI (Global), S&P 500 (US), MSCI Europe (Europe), MSCI Japan (Japan), and MSCI China (China).

Japanese Equities Have Tended to Underperform During Global Slowdowns

Japanese equities are represented by the MSCI Japan Index, US Equities are represented by the MSCI US Index, EM equities are represented by the MSCI Emerging Markets Index (data begin in 1988), Europe ex UK equities are represented by the MSCI Europe ex UK Index, UK equities are represented by the MSCI UK Index, and Global equities are represented by the MSCI World Index prior to 1988 and the MSCI ACWI Index thereafter. Data for 2024 are through October.

Small Caps Appear Unduly Discounted Vis-à-vis Mid/Large Caps as we Expect Catalysts for Outperformance Will Emerge in 2025

CAPCE ratio based on trailing five-year average real cash EPS.

Non-Recessionary Fed Rate Cut Cycles Have Supported Equities

EM returns are represented by the MSCI Emerging Markets Index, US returns are represented by the MSCI US Index, and DM ex US returns are represented by the MSCI World ex US Index. Recessions are defined by NBER cycle peak-to-trough dates. EM data begin December 1987 and exclude the first non-recessionary rate cut cycle in 1984. For the non-recessionary rate cut cycle in 1987, the EM return calculated is for nine months due to limited data availability. Total return data are gross of dividend withholding taxes.

Chinese Equity Valuations Have Recovered

Valuation percentile reflects the average of three valuation metrics: ROE-adjusted P/E, five-year CAPCE, and P/FE. Global Equities are represented by the MSCI All Country World Index (ACWI).

Indian Equities Are Priced for Perfection

PEG ratio calculated as the forward 12-month P/E ratio divided by the consensus long-term (five-year) average earnings growth expectation.

Dispersion Is Trending Higher

Dispersion is calculated as the weighted cross-sectional standard deviation of the performance of stocks within the index during one month.

Footnotes

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.