2025 Outlook: Interest Rates

We expect most major central banks to continue cutting policy rates, which should allow bonds to outperform cash. With breakeven inflation rates likely to be range bound, returns of inflation-linked and nominal bonds should be similar.

Most Major Central Banks Should Continue Easing in 2025

Celia Dallas, Chief Investment Strategist

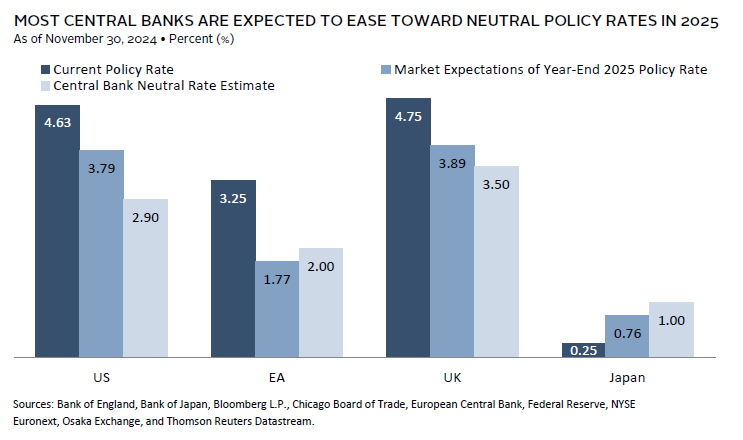

Moderating inflation and near-trend economic growth will allow most major central banks to bring policy rates toward neutral in 2025. Market expectations have fluctuated throughout the year and are now more aligned with central banks. Consequently, we expect the upside for sovereign bond performance is likely limited.

The US Federal Reserve initiated its easing cycle with a 50-basis point (bp) cut in September, responding to a labor market slowdown and reduced inflationary pressures. Similarly, the European Central Bank (ECB) and Bank of England (BOE) have cut rates, driven by weak domestic growth and decelerating, yet still elevated, inflation. Japan is an exception, facing continued inflationary pressure exacerbated by a weak currency and slow economic growth. The Bank of Japan (BOJ) has signaled its commitment to gradually increasing policy rates.

Moderating inflation in 2025, even if it remains above target rates, gives central banks the leeway to cut policy rates, increasing the likelihood of a soft landing. While central banks are not fully transparent about their policy plans, their estimates of the neutral rate, or R*, provide insight on their intentions. Indeed, the Fed’s median Federal Open Market Committee (FOMC) members’ long-run policy rate expectation is 2.9%, equivalent to their current R* estimate. The Fed anticipates a gradual approach to reach R*, aiming for 2026, based on their latest released estimates. The ECB and BOE have less distance to ease to reach neutral, while the BOJ needs to move in the opposite direction. Still, markets are pricing in easing of roughly 85 bps in the United States and the United Kingdom and 148 bps in the euro area.

Market expectations have converged toward those of central banks over the last year and now look reasonable based on current growth and inflation conditions. We reckon expectations will remain volatile as policy uncertainty stemming from the US presidential election results have broadened the range of potential economic outcomes.

Bonds Should Outperform Cash in 2025

TJ Scavone, Senior Investment Director, Capital Markets Research

In 2025, bonds will likely outperform cash, driven by supportive economic conditions and attractive valuations. However, the outcome of the US presidential election could counter these tailwinds if Trump fully implements his policy proposals. Consequently, we maintain a neutral stance on high-quality bonds and duration exposure.

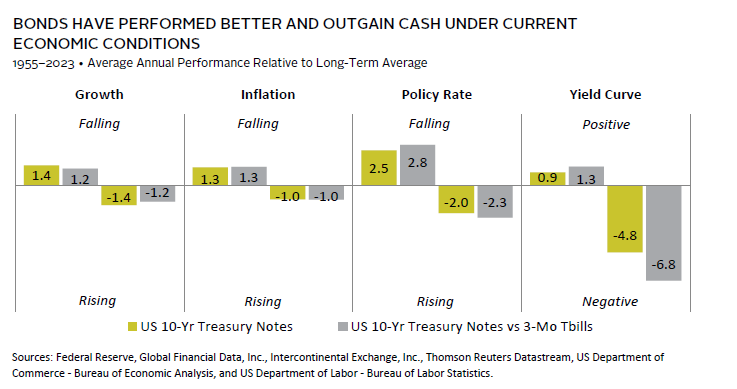

Cyclical conditions support high-quality bonds. Inflation has declined and the imbalances in the labor market have closed, while we expect economic growth to remain close to trend across developed markets. This scenario increases the likelihood of continued disinflation. As a result, we anticipate lower policy rates next year as central banks focus more on labor market weaknesses than inflation. As this happens, cash yields will likely fall below bond yields, making cash less attractive. High-quality bonds typically deliver higher returns, both in absolute terms and relative to cash, when inflation and growth slow, central banks ease monetary policy, or the yield curve slopes upward. Most of these conditions are moving into place heading into next year.

However, the US presidential election outcome could somewhat offset these factors. Trump’s proposed policies on taxes, tariffs, and immigration likely pose an upside risk to bond yields if fully implemented, all else being equal. This concern contributed to ten-year US Treasury yields rising roughly 40 bps in recent months. As a result, some of this risk is now reflected in the price and yields are beginning to look somewhat elevated compared to economic fundamentals. US ten-year Treasury securities currently yield 4.2%, which is above our estimated fair value yield of 4.1%. Furthermore, while these policies could temporarily inflate consumer prices, their impact on growth is more uncertain and could detract from GDP growth next year.

Given this uncertainty, we recommend a neutral allocation to high-quality bonds. While we do not see enough evidence to support a tactical overweight at this time, we advise against reducing exposure in favor of shorter-duration assets or cash, given cyclical tailwinds and attractive valuations.

Inflation-Linked Bonds and Nominal Bonds Should Deliver Similar Returns in 2025

TJ Scavone, Senior Investment Director, Capital Markets Research

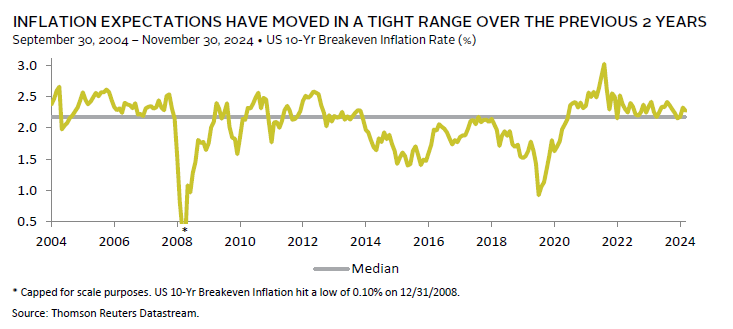

Inflation-linked bonds (linkers) are set to generate solid returns in 2025 due to higher real yields and favorable global economic conditions. While we expect disinflation to continue, we also anticipate breakeven inflation rates will remain rangebound. 1 Therefore, we believe linker and nominal bond returns will be similar next year.

The real yield on the Bloomberg World Government Inflation-Linked Bond Index reached 1.5% as of November 30, which is back within its pre-Global Financial Crisis (GFC) range. With real yields well above zero, linkers once again provide a positive real return and serve as a viable inflation hedge. In fact, linkers are among the few major asset classes we expect to deliver positive real returns in another inflation shock, according to our scenario-based return projections.

In 2025, linkers should benefit from similar cyclical tailwinds as nominals. However, linkers tend to outperform nominals when inflation expectations rise. The next year looks mixed in this regard. Inflation has fallen substantially from its post-pandemic peak, and we expect it to continue moving toward central banks’ targets. This will likely cap market-based inflation expectations. Currently, ten-year breakeven inflation rates in the United States are 2.3%, which is firmly within their post-pandemic range. On the flipside, we see limited room for breakeven inflation rates to fall below their post-pandemic lows absent a recession. As such, we expect breakeven inflation rates to remain rangebound in 2025.

A supply shock would likely benefit linkers, but these are hard to predict. For example, the escalation of the conflict in the Middle East has not challenged supply chains or the production of key resources like oil as some expected. Tariffs are another unknown. While they increase consumer prices, their effects are temporary and are unlikely to sustainably lift inflation expectations.

In summary, we believe linkers will generate solid returns in 2025, but we do not see a compelling case to overweight or underweight them versus nominal bonds.

Figure Notes

Most Central Banks Are Expected to Ease Toward Neutral Policy Rates in 2025

The “Market Expectations of Year-End 2025 Policy Rate” reflect the market-implied policy rates based on futures pricing. Feds funds target range is 4.50%–4.75% and the mid-point of 4.63% is used for the current policy rate.

Bonds Have Performed Better and Outgain Cash Under Current Economic Conditions

Data are annual. Economic conditions are positive for bonds when growth, inflation, and the policy rate are falling, and the yield curve is positive. Economic conditions are negative for bonds when growth, inflation, and the policy rate are rising, and the yield curve is negative. Growth and inflation conditions are defined by the change in the annual rate of growth, policy rate conditions are defined by the year-over-year difference in the policy rate at year-end, and yield curve conditions are defined by the spread between US ten-year and three-month yields and whether they are positive or negative.

Footnotes

TJ Scavone - T.J. is a Senior Investment Director in the Capital Markets Research Group at Cambridge Associates.

Celia Dallas - Celia Dallas is the Chief Investment Strategist and a Partner at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients achieve their investment goals and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.