2025 Outlook: Currencies

We expect the US dollar rally will ultimately cool, with early strength giving way to modest weakening. Meanwhile, gold returns are likely to moderate in 2025 after a surge in 2024. Emerging markets’ use of stablecoins should support positive crypto returns, driving blockchain innovations and investment opportunities.

The US Dollar Rally Should Cool in 2025

Aaron Costello, Head of Asia, and Vivian Gan, Associate Investment Director, Capital Markets Research

We expect the US dollar to continue to strengthen in early 2025 but weaken modestly in late 2025 due to moderating US economic growth, Fed rate cuts, and lingering overvaluations. However, the dollar may be volatile, given uncertainty over US fiscal, trade, and monetary policies, as well as the dollar’s tendency to rally amid periods of market stress.

Indeed, the US dollar has rallied 4.9% over October and November, with the market viewing Trump’s trade and fiscal policies as potentially boosting US growth and inflation. As a result, markets have pared back Fed rate cut expectations, which have boosted US bonds yields and supported the dollar’s recent rally. At the same time, markets are also expecting that the Trump administration will increase tariffs on US imports, which would put downward pressure on other currencies and support the dollar.

Despite the above, the US dollar could still weaken in 2025 if US growth slows while growth in DM ex US accelerates as implied by consensus forecasts. 1 While tariffs may place downward pressure on growth outside the US, a slowing US economy would still see Fed rate cuts, therefore reducing support for the dollar. Furthermore, should China’s stimulus gain traction and China reflation take hold, EM growth should pick up, and the US dollar may weaken against EM currencies.

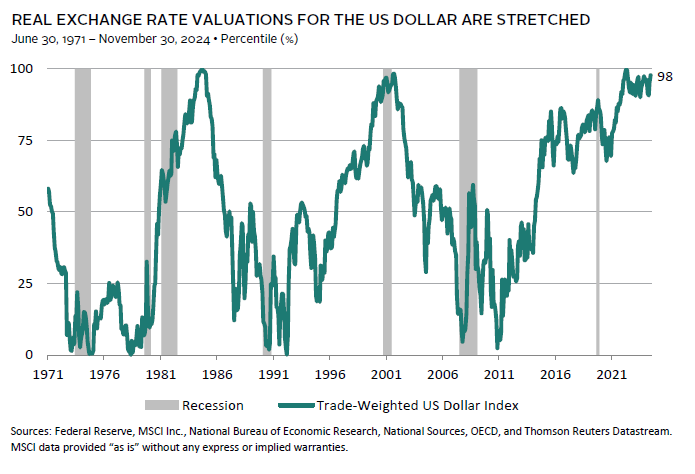

Overall, valuations for the US dollar remain very elevated, which imply the currency should face downward pressure in the medium term. To the extent that markets have priced in a reflationary backdrop, continued dollar strength will require further upside growth surprises in the US, which may not occur. Therefore, while the US dollar may continue to appreciate in the near term, we still expect the currency to lose steam in 2025 as US growth trends lower and as the Fed continues to ease policy.

Gold Returns Should Moderate in 2025

Sehr Dsani, Senior Investment Director, Capital Markets Research

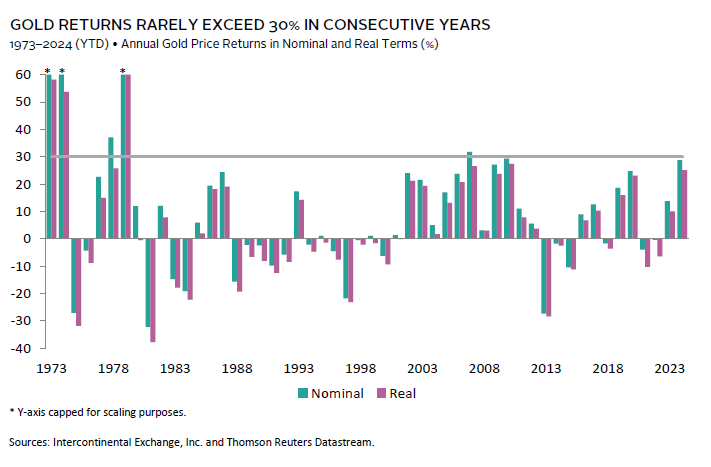

Gold prices are at their highest levels in more than 50 years. In 2024, prices surged nearly 30%, ranking as one of the top returns in history. Several factors supported the rally, including its function as a store of value and its appeal as a safe-haven asset during geopolitical unrest and market uncertainty. We think some of these drivers will likely remain in 2025. However, we doubt returns in 2025 will be as lofty as in 2024.

Investors often turn to gold as a store of value to protect against declining yields. However, with monetary easing widely telegraphed, many investors have already positioned for lower yields, making it unlikely to be a significant source of new gold demand in 2025. Similarly, our expectation that key inflation rates will continue to moderate back to central bank targets, albeit in bumpy fashions, may also reduce investor demand. This is also true for central banks, many of whom increased their gold reserves materially in recent years.

Investors also flock to gold in uncertain times. This has occurred around recessions; for instance, gold prices rose as the GFC began, up 45% year-over-year by early 2008. Geopolitical unrest can also drive gold higher, as occurred on 9/11, when prices were up 6%. However, it is rare for prices to remain elevated. Still, geopolitical risk may remain high, given the many existing conflicts, weak relations between the West and China, and the potential for protectionist US policies. But, to some extent, these factors are embedded in prices. With gold prices at all-time highs, we think gold is likely to lag its impressive 2024 return.

Emerging Markets Crypto Use Should Support Positive Crypto Returns in 2025

Joseph Marenda, Head of Hedge Fund Research and Digital Assets Investing

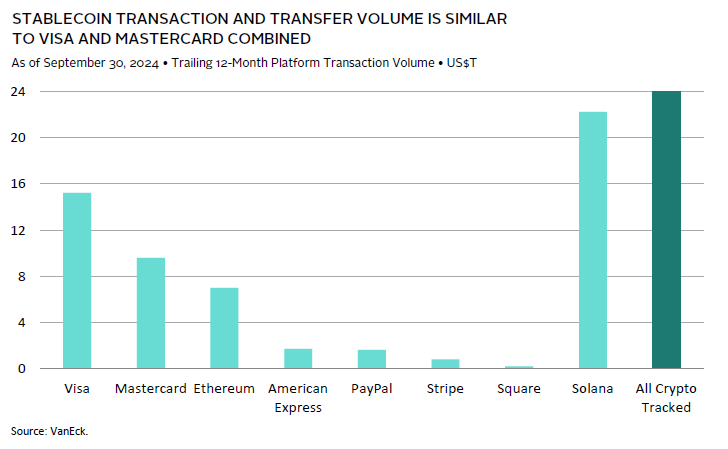

Crypto and blockchain usage hit an all-time high in 2024, driven by 617 million crypto owners globally and 220 million active crypto addresses. The five-year compound annual growth rate for crypto ownership is 99%. What is driving adoption and usage? Many factors, but in 2024 stablecoins found product market fit, particularly in EM countries. Stablecoin use in the crypto economy and real world will be a major driver of the crypto market in 2025.

Invented about ten years ago, stablecoins are digital equivalents of US dollars (or any currency, but 99% of stablecoins are USD backed) that exist on a blockchain. When a user buys a $1 stablecoin, the issuer typically buys $1 of US government debt. In 2018, the market capitalization of stablecoins ranged from $1 billion to $3 billion. Today, stablecoin issuers cumulatively are the 19th largest holder of US debt at $120 billion, more than Germany’s holdings. The growth occurred as stablecoins were increasingly adopted by non-crypto users in EM countries.

Stablecoins have many uses outside of crypto transactions, including as a means of savings, cross-border payments, remittances, and corporate cash management, regardless of country. Emerging markets, in particular, use stablecoins for these activities. With a growing userbase across emerging markets, blockchain protocols and crypto companies are developing USD-based investment products and financial services that will be available globally. This growing pool of USD stablecoins will help drive investment opportunities for crypto VCs, traditional investment managers, and traded blockchain tokens in 2025—making “digital dollars” the dominant use case for blockchain in 2025 and laying the groundwork for global financial systems innovations in 2025 and beyond.

Figure Notes

Real Exchange Rate Valuations for the US Dollar Are Stretched

Trade weights for the US dollar are based on the following: Euro (41.4%), Canadian dollar (27.5%), Japanese yen (11.0%), British pound (10.0%), Swiss franc (6.1%), the Australian dollar (2.7%), and Swedish krona (1.2%). Totals may not sum due to rounding. 2024 inflation data for Australia are through September 30, Eurozone are through November 30, and all others are through October 31.

Gold Returns Rarely Exceeded 30% in Consecutive Years

Real prices are inflation-adjusted. Inflation data are through October 31, 2024. Returns for 2024 are through November 30.

Stablecoin Transaction and Transfer Volume Is Similar to Visa and Mastercard Combined

Data are aggregated.

Footnotes

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.