2025 Outlook: Cross Asset

We expect global equities to outperform bonds, as near trend economic growth should support continued corporate earnings growth and healthy risk appetite. Stock/bond correlations should be lower than the 2023–24 peak levels, even as protectionist US policy may drive global economic uncertainty higher.

Global Equities Should Outperform Bonds in 2025

Kevin Rosenbaum, Head of Global Capital Markets Research

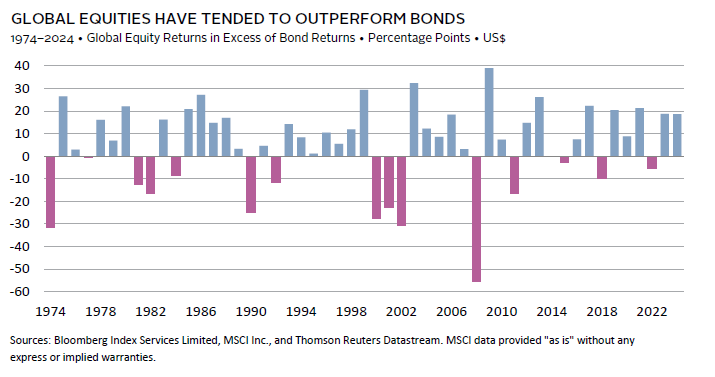

Global equities have outperformed bonds in a little more than two-thirds of the last 50 years. We believe this high probability should translate into outperformance in 2025. This expectation is based on our view that near trend global economic growth will support continued corporate earnings growth and healthy risk appetite.

The evolution of the global economy relative to expectations has important consequences for asset prices. For instance, in 2022, global growth expectations were revised down 1.4 percentage points (ppts) to 3.0% and global inflation expectations were revised up 3.6 ppts to 7.5%. These dramatic changes led to significant interest rate increases and a global equity sell-off. Although the US election may have broadened the range of possible economic outcomes, we believe the most likely scenario is that global economic growth and key inflation rates will not deviate materially from expectations.

Near-trend global economic growth should support continued earnings growth. Currently, analysts project global earnings to grow by 12.3% in 2025, with approximately 40% of that growth coming from increased revenues and 60% from margin improvement. Earnings growth is also anticipated to improve in several markets and reflect broader participation across sectors compared to 2024. While these expectations may moderate, as is common in most years, they align with past earnings expectations, suggesting that analysts are not overly optimistic.

Our global economic expectations should also support risk appetite. Changes in investors’ appetite for risky investments, such as equities, can have large implications for asset prices. Encouragingly, this appetite is also being supported by advancements in artificial intelligence (AI). While we expect AI to have a material impact on productivity growth levels by the end of the decade, its primary equity market impact in 2025 may be to maintain investor optimism, even if protectionist US policies increase global trade barriers. This optimism—alongside expectations of a more benign interest rate environment—should support equity market valuations.

Stock/Bond Correlations Should Fall in 2025

Celia Dallas, Chief Investment Strategist

The economic environment drives stock/bond correlations. Global inflation has decelerated over the last two years, with year-over-year core G7 inflation falling to 2.2% from its June 2022 peak of 7.8%. As key inflation rates continue their bumpy paths toward central bank target levels, and global economic growth remains near trend, correlations between stocks and bonds should decelerate from 2023–24 highs. Lower correlations mean bonds provide more protection against equity risk.

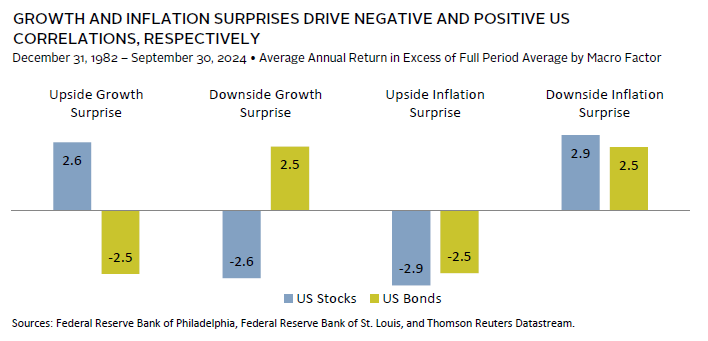

For most of the last 150 years, stock/bond return correlations have rarely been meaningfully negative based on equities and ten-year sovereign bonds. Notable exceptions include the early 1930s, late 1950s, and most of the 21st century. On a rolling 52-week basis, correlations turned significantly positive in 2022 in the United States and United Kingdom, peaking at 50% in July 2024 and 63% in June 2024, respectively. Correlations shift with macroeconomic changes. Equities tend to react positively (negatively) to good (bad) economic news, while bonds move in the opposite direction. In contrast, both stocks and bonds tend to act negatively (positively) to inflation upside (downside) surprises.

The correlation of inflation and growth expectations also influences stock/bond correlations, which tend to be highest when these expectations move in opposite directions. Such periods include when inflation is driven by supply shortages and central banks engage in procyclical monetary policy. This occurred during the 1970s stagflation period and the recent pandemic. During periods when inflation is driven by changes in demand, central banks can engage in countercyclical monetary policy, driving stock/bond correlations negative.

There remains material uncertainty around several aspects of the incoming US government’s agenda, with mooted policies potentially presenting risks to inflation and growth. However, such policies are at least partially priced in, and we nonetheless expect stock/bond correlations to decline from 2023–24 highs as inflation expectations normalize toward central bank targets and growth remains near trend. Sovereign bond yields offer reasonable returns for inflation risk today, and with meaningfully positive yields, they offer upside potential should growth disappoint.

US Policy Should Drive Global Economic Uncertainty Higher in 2025

Sean Duffin, Senior Investment Director, Capital Markets Research

President-elect Trump is expected to employ brinkmanship in various policy areas after returning to office in January, aiming to secure deals that advance his America First agenda. He plans to begin his second term with a focus on increasing tariffs, extending and expanding tax cuts, and enforcing stricter immigration policy. While it is unclear whether these policies will be enacted as proposed, we anticipate strong rhetoric and the potential for retaliatory measures by other countries should increase global economic uncertainty.

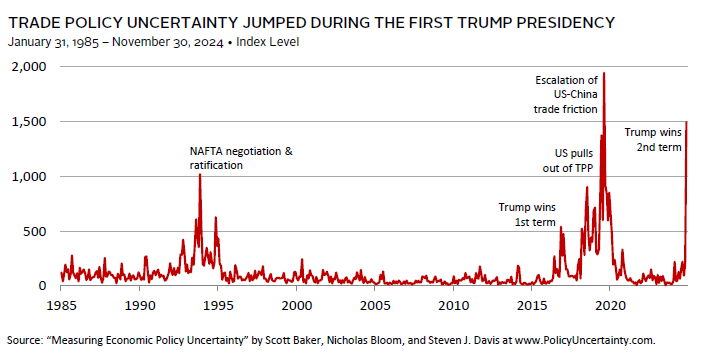

Trade policy was a major focus during Trump’s first term and will likely be one again in 2025. Previously, he initiated a series of escalating tariffs on Chinese imports, threatened tariffs on European autos, and imposed tariffs on steel and aluminum from US allies. While these tactics led to renegotiated deals in certain areas, they also strained longstanding alliances and created instability in global markets. This time around, Trump has suggested up to 20% tariff on all US imports and a 60% tariff on imports from China. If these proposals come to pass, economists estimate that they could temporarily boost inflation and detract from real US output. Moreover, it would increase the risk of retaliatory tariffs that could create more significant supply chain disruptions.

Trump’s proposed immigration policy looks more aggressive than in his prior administration. It focuses on increasing deportations, restricting work visas, and changing asylum processes. These policies could create labor shortages in certain areas that rely heavily on immigrant labor, such as agriculture, construction, and hospitality. This could lead businesses and investors to become more cautious due to fears of talent shortages, potentially adding inflationary pressure.

These policies will neither be implemented overnight nor will they occur in isolation. There will be offsetting developments that may mitigate the economic and market impact of these plans. While we expect near-trend global economic growth and bumpy disinflation to continue across most major economies, the results of the US election broaden the range of possible economic outcomes in 2025.

Figure Notes

Global Equities Have Tended to Outperform Bonds

Data are presented on an annual basis. Global equity returns are represented by the MSCI World Index (Gross) from 1974–87 and the MSCI All Country World Index (Gross) from 1988–2024. Bond returns are represented by the Bloomberg US Treasury Index. Data for 2024 are as of November 30.

Growth and Inflation Surprises Drive Negative and Positive US Correlations, Respectively

US Stocks are represented by the MSCI US Index, net of dividend withholding tax. US Bonds represented by the Datastream 10-yr US Treasury Benchmark Index. Growth Surprise is the average of the Chicago Fed Nation Activity Index and the difference between realized IP growth and Survey of Professional Forecasters forecast from a year prior. Inflation Surprise is the average of the year-over-year inflation rate and difference between realized inflation and Survey of Professional Forecasters forecast a year earlier. “Upside” and “Downside” are classified by comparing the growth and inflation indicator values to its full sample median. Analysis based on quarterly data compared to one year earlier.

Trade Policy Uncertainty Jumped During the First Trump Presidency

The Trade Policy Uncertainty Index reflects the frequency of articles in American newspapers that discuss policy-related economic uncertainty and contain one or more references to trade policy.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.