2023 Outlook: Equities

We expect global earnings growth will be below average next year, as prior interest rate hikes increasingly bite. With this backdrop, we expect value equities will outperform, Chinese equity underperformance will correct, and Healthcare may present an overweight opportunity.

Global Earnings Growth Will Be Below Average in 2023

Kevin Rosenbaum, Global Head of Capital Markets Research

Corporate earnings proved resilient in 2022, with nominal earnings expected to grow 10% and inflation to rise 8% globally. This resiliency came even as several central banks raised their policy rates by large margins to address broadening inflationary pressures. We believe this tightening will further weaken the global economy, which is already struggling with the consequences of the war in Ukraine and China’s slowdown. As a result, we expect below-average earnings growth among companies in 2023.

Earnings growth has averaged 10.4% across the last 20-year period. Sales growth contributed roughly half of that growth and is strongly linked to the direction of the economy. As it stands, global real GDP is expected to grow by 2% in 2023. We suspect the risks to that view are skewed to the downside, given the difficulty in knowing the impact of higher interest rates on economic activity in real time and our expectation that the Federal Reserve will not quickly pivot to cutting interest rates. More cyclical areas of the economy, which tend to be leading indicators of the broader economy’s direction, highlight our concern. For instance, Australian, Canadian, and US home prices have all started to contract, and key export bellwethers—Germany and Korea—have seen new order activity fall.

Profit margin expansion has contributed the balance of earnings growth. Across the past two decades, margins increased from 4.6% to most recently 10.8%, which was a calendar-year high. Despite the large change in interest rates and current inflationary pressures, which impacts everything from wages to input prices, analysts expect margins to stay near record levels at 10.7% across full-year 2023. We suspect that expectation is optimistic. Margins typically come under pressure as economic growth weakens, and while we do think inflation will trend down next year with the United States leading Europe, we believe it will remain uncomfortably above central bank targets and a challenge for companies to confront.

While we believe corporate earnings growth will be below average, equity price levels have tended to bottom before earnings in past downturns. Ultimately, we think most investors will be best served by sticking close to their policy equity allocation weight, as we detail elsewhere in this outlook.

Developed Markets Value Stocks Should Outperform Broader Equities in 2023

Sean Duffin, Investment Director, Capital Markets Research

Value investors have not had much to cheer about since the end of the Global Financial Crisis. In fact, developed markets value stocks’ annual return was nearly 3 percentage points (ppts) lower than that of broader equities from 2010 through 2021. But value held up better in 2022, besting the broader market by more than 10 ppts, even as volatility permeated financial markets.

Surging real interest rates have taken a toll on growth-oriented equities, which tend to have longer equity duration. As liquidity continues to get drained from the market, more speculative equities are likely to continue to feel pressure. High-flying technology companies have been hit particularly hard; the Goldman Sachs Non-Profitable Tech Index lost nearly 60% so far in 2022. Even after that decline, the index price still trades near pre-COVID levels, when financial conditions were much looser.

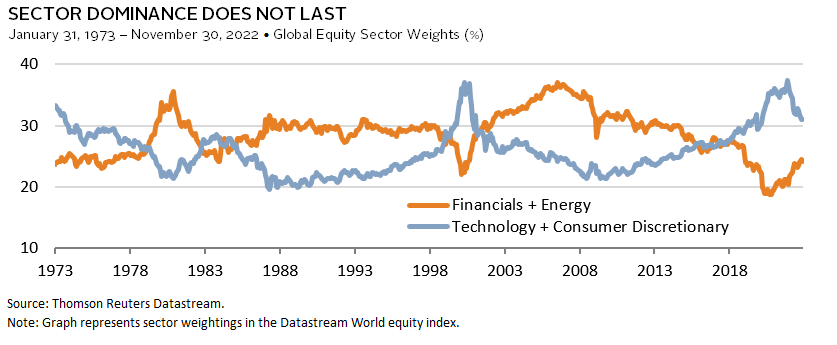

While the end of the rate hike cycle may be in sight, we believe value’s outperformance will persist. Financials and energy—two sectors that are more heavily weighted in developed markets value indexes—have historically benefited from elevated real interest rates and inflation. History also suggests that the recent leadership of growth-oriented sectors will not last, given value-oriented sectors have reclaimed market share from growth counterparts multiple times in the past 50 years as macro conditions changed. Even after richly valued technology stocks lost some of their froth in 2022, many still command high valuations and could decline further.

Much depends on the future path of inflation as central banks are attempting to thread a needle to reduce price pressures while also avoiding a severe recession. An economic hard landing could create a challenging environment for value, which is heavily weighted in some more cyclically sensitive sectors. But favorable starting valuations could help mitigate expected downside for value. Developed markets value trades at a normalized price-earnings multiple that is 0.68 that of broader equities, which ranks in just the 8th percentile of its history dating back to 1984.

Thus, as we enter 2023, we favor equities that look better positioned to hold their value in an environment of elevated real interest rates and have attractive valuations to boot.

The Euro Area Risks Stagflation in 2023

Celia Dallas, Chief Investment Strategist

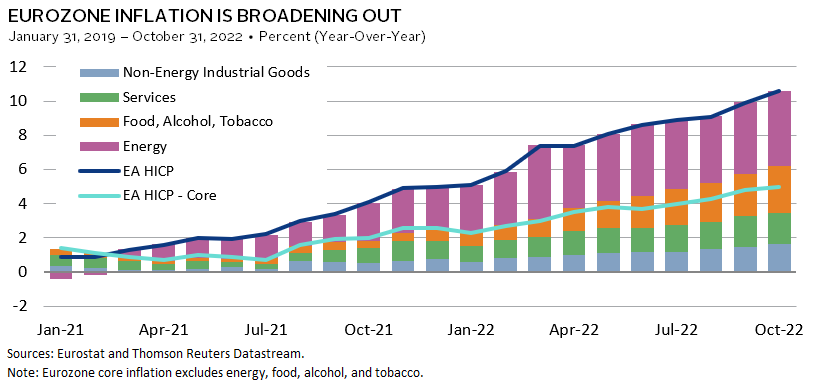

We expect euro area inflation to remain high in an environment of constrained energy supply. At the same time, high energy prices, reduced industrial production, and potential energy rationing will hit economic growth, raising the risk of stagflation. Despite this outlook, relatively cheap euro area equity valuations reflect the outsized risk European equities are facing, and we remain neutral on the equity market.

Nearly half of the EU’s gas and a quarter of its oil were sourced from Russia. In an effort to offset the elimination of Russian gas—along with the loss of hydro power and nuclear production—European countries are importing gas from other sources to the degree that their infrastructure allows, building more liquified natural gas terminals to increase import capacity, accelerating renewables investments, and seeking to reduce consumption. These efforts have resulted in a high energy price tag that is pressuring inflation beyond just energy and food prices. Looking beyond this winter, Europe will need to source gas and refill storage, likely without any Russian gas, putting continued pressure on gas prices and economic growth.

Some corporations have cut back on production, and involuntary rationing may be necessary to get through the winter with limited energy supplies. Since March 2022, the consensus 2023 real GDP growth forecast for the Eurozone has fallen 260 basis points to 0.1%. At the same time, Europe’s central banks are likely to maintain a tightening bias. Meanwhile, governments are engaged in large-scale fiscal interventions aimed at easing the pain of rising energy prices.

These challenging conditions are priced into the market to some degree. On a normalized basis, the price-to–cash earnings ratio of Europe ex UK equities is close to its median historical level, compared to US and other developed equities that continue to trade at a considerable premium. Further, the euro has been the primary relief valve for stress in the euro area, falling 14% versus the US dollar over the first three quarters.

Chinese Equities Should Outperform Global Equities in 2023

Aaron Costello, Regional Head for Asia

The Chinese economy and equity markets have been pummeled over the past two years due to self-inflicted policy actions, starting with the regulatory crackdown on the technology sector, a tightening of credit to the real estate sector, and the ongoing zero-COVID policy. From its peak in February 2021, the MSCI China All Shares Index declined more than 40% through the end of November, underperforming global equities by a wide margin.

With Xi Jinping further consolidating power and giving no clear signal of a change in policies, investors have capitulated on any near-term recovery in the Chinese economy and dumped Chinese equities following the Party Congress in October. Yet, amid the investor gloom, China will likely surprise to the upside in 2023, both by unveiling new pro-growth policies and by moving away from the zero-COVID policy sooner than expected.

The Politburo meetings and Central Economic Work Conference held in December will give more clarity on economic policy and spending plans, while rumors of a change in the zero-COVID policy propelled Chinese equities higher in early November. Although the official stance remains that zero-COVID is the appropriate policy for China, a subtle shift in government rhetoric seems to be underway, particularly regarding the virus’s lethality and local governments’ lockdown procedures. Our view is that small policy tweaks will set the stage for a larger shift, given the negative economic impact of current policies. However, meaningful policy change may not occur until after first quarter 2023, given the required tilt in government rhetoric, and because major policies are formally approved and adopted at the National People’s Congress in March. There may also be a desire to wait until any winter surge in global COVID-19 cases passes.

Thus, while we shouldn’t expect China to abandon its zero-COVID policy in the near-term, investors should watch what the government does, rather than what it says. Given depressed valuations and high skepticism, Chinese equities face a low bar heading into 2023.

EM ex China Equity Performance Will Be Unremarkable in 2023

Stuart Brown, Investment Director, Capital Markets Research

Emerging markets (EM) excluding China equities are on track to underperform developed markets (DM) in 2022 in USD terms. While elevated external pressures and a late business cycle environment temper our enthusiasm for EM ex China in 2023, this backdrop has largely been priced in by markets. The balanced outlook suggests performance could be unremarkable, and we think investors should hold EM ex China allocations in line with their policy.

A continuation of dollar strength and restrictive Federal Reserve policy will weigh on EM ex China equities. In 2022, our EM external vulnerability gauge fell to its weakest level in 20 years, and capital outflows intensified. EM countries drew down foreign exchange reserves to shore up depreciating currencies and cover rising import bills, which adversely impacted current account balances. Although we expect the Fed will eventually pause its rate hiking cycle next year, EM stocks have typically underperformed DM peers in the six and 12 months following the Fed’s final rate hike.

Slowing economic activity poses another headwind. EM tends to lag DM during the latter stages of the business cycle. Weak economic activity will stifle export activity, with the World Trade Organization now expecting trade volume growth of just 1% in 2023. Resource-exporting EMs may be insulated if commodity prices remain elevated, but tech-heavy Asia faces the risk of waning semiconductor demand and heightened geopolitical tensions surrounding the sector.

Still, these dynamics are already baked into markets. Analysts expect EM earnings growth will lag DM in 2023, even after EM earnings growth was downgraded by a larger degree than DM so far in 2022. And EM valuations are low by virtually any measure. The market’s low expectations for EM limit the potential for excessive performance downside.

EM ex China will likely rally when China ultimately relaxes its zero-COVID policy. Although a major policy shift by China may support EM equity performance, we suspect it may also benefit DM shares. In other words, we doubt EM ex China performance will meaningfully diverge from DM equities when China abandons its zero-COVID policy.

An Attractive Healthcare Equity Entry Point Lurks in 2023

Stuart Brown, Investment Director, Capital Markets Research

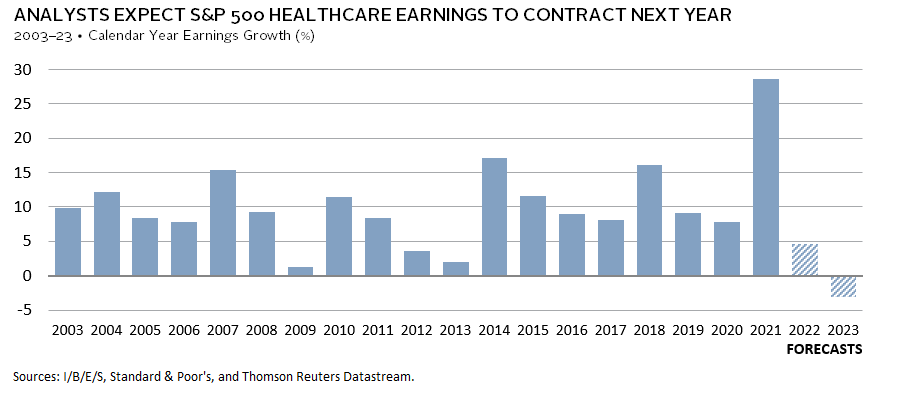

US healthcare stocks were a mixed bag in 2022. Large and mid caps declined but proved defensive amid the broader equity market drawdown. Small caps fared decidedly worse, especially in the biotech and life sciences industries. Performance may again be difficult next year, as the earnings outlook appears weak and economic challenges seem poised to persist. We expect this may present an attractive opportunity to overweight the sector, given its appealing long-term prospects.

Earnings are expected to decline next year, which would be the only earnings contraction on record based on available data beginning in 1993. There are two primary reasons for the diminished outlook. First, the one-time impact from COVID-19 is set to fade after the sector reported record profit growth in 2021. Second, inflation will bite in 2023. Since healthcare inflation tends to lag overall economy-wide inflation, it only started catching up to broader inflation in the second half of 2022 and looks set to continue accelerating. This may impact spending by way of reduced insurance benefits and higher out-of-pocket costs for consumers. At the same time, the industry faces headwinds from labor shortages and rising input costs.

The macro environment will likely also weigh on the sector, particularly smaller companies. These entities tend to have little to no current earnings, with the lion’s share of their value based on future growth. This makes them highly sensitive to elevated inflation and interest rate changes. Merger & acquisition activity—a key driver of performance—is also likely to remain weak, given the higher cost of capital environment.

There may be an opportunity to overweight the sector next year. An attractive entry point might emerge if performance meaningfully lags broader equities, valuations derate, and the earnings outlook rebounds. We also like the sector’s longer-term prospects, given its compelling secular trends. These include the large demographic shifts in many developed countries, convergence of healthcare and technology, and innovation in drug development, among others, all of which have the potential to drive earnings and outperformance. Given the highly specialized nature of the industry, we suggest implementing allocations through active management.