Treasury Bond Yields Plunge to Historic Lows

Yields on ten-year Treasuries dropped below 50 basis points (bps) today for the first time in history as COVID-19 fears spread. While we cannot rule out a recession, given the uncertainties associated with the virus and its impact on economic activity, we believe today’s low yields are less about long-term growth forecasts and more about expectations of further Federal Reserve easing, risk aversion, and liquidity preferences. The equity and commodity markets are in panic mode as well; the S&P 500 Index fell more than 7% this morning—its second sharpest intraday decline since 2008—temporarily triggering an automatic trading halt. While the situation may worsen in the near term, we don’t believe long-term investors with sufficient liquidity should cut risk in a market panic.

Though today’s yields are mainly the result of safe-haven buying as we noted, some of the fall in yields reflects a downward recalibration of near-term growth. Last week, the Organisation for Economic Co-operation and Development (OECD) downgraded its 2020 global growth forecast to 2.4%, the lowest since the Global Financial Crisis (GFC).

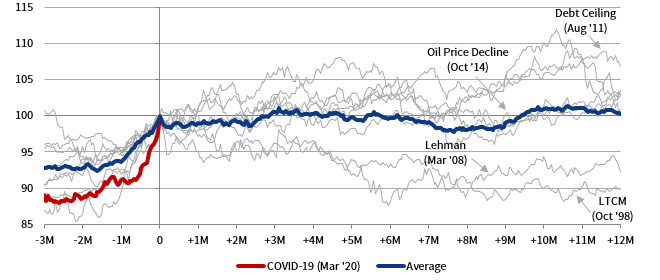

Unfortunately, past sharp movements in Treasury yields don’t provide much guidance for today. Several, like the ones connected to the Long-Term Capital Management collapse in 1998, the debt-ceiling scare of 2011, and the oil downturn in 2014–16 (which is also repeating this year), happened when the economy was on reasonably solid ground and didn’t lead to a near-term recession. Others, like the one linked to the Lehman Brothers bankruptcy in 2008, occurred when the economy and credit markets were contracting. The economy and markets recovered in the years following these incidents, but the path and pace of recovery varied.

CUMULATIVE RETURNS OF 10-YR TREASURIES DURING SELECT BOND RALLIES

1998–Present

Sources: BlackRock, Inc., Bloomberg Index Services Limited, FactSet Research Systems, and Thomson Reuters Datastream.

Notes: Data are based on daily returns. The 9:30 AM opening price return (+2.4%) for the iShares 7-10 Year Treasury Bond ETF (IEF) is used to estimate the daily return for March 9, 2020; all other data are based on the daily total returns for the Bloomberg Barclays US 10-Year Treasuries Bellwethers Index. Cumulative returns are rebased to 100 at the daily date of the peak rolling one-month returns during each respective period. “Average” includes a total of eight independent bond rallies, including the four labeled on the chart, as well as rallies that peaked in December 2000, August 2002, October 2003, and May 2010. Chart assumes that the peak of the current COVID-19 bond rally peaks at 9:30 AM on March 9, 2020, which may not be the case.

The Fed delivered an emergency 50 bp interest rate cut last week, and Fed funds futures now price in a further 100 bps of cuts this month, which would take the target rate to zero. However, even Fed Chair Jerome Powell seems skeptical that cheap borrowing will inoculate the United States or global economy, noting that “…a rate cut will not reduce the rate of infection. It won’t fix a broken supply chain… [but] it will support accommodative financial conditions and avoid a tightening…” Given the fall in share prices immediately after the Fed announcement, many investors evidently share Powell’s concerns.

Ultimately, we believe investors should be hesitant to center their portfolio positioning around a particular economic expectation. We believe most are well-served by following their rebalancing policy, even though doing so can be profoundly uncomfortable during anxious periods. In last Fall’s series, Managing Portfolios Through Equity Market Downturns, we noted that after the GFC institutional equity allocations fell more than 10 percentage points (ppts) as of the market trough and remained at least 5 ppts below pre-GFC levels for the ensuing five years. Many of the investors selling risky assets today likely have little choice in the matter; however, a long-term orientation and thoughtful liquidity planning give investors structural advantages, including the option of strapping themselves to the mast to ride out storms like this.

Sean McLaughlin, Head of Cambridge Associates’ Capital Markets Research

TJ Scavone, Investment Director on the Capital Markets Research team, also contributed to this piece.