Trade Finance: An Expanding Opportunity for Institutional Investors

While trade finance is among the oldest forms of institutionalized credit, it has only recently become an accessible market for most institutional investors. Providing high liquidity, good return premiums over cash, and a predictable risk profile, it can play a valuable role in portfolio strategy. However, as a fairly new option for most investors, its characteristics are not well-known. In this piece, we explain the nuances of trade finance, including its evolution, basic mechanics, typical features, available strategies, and portfolio allocation implications.

The Essentials of Trade Finance

Trade finance has a rich history of supporting commerce from as early the 1800s B.C., in what is now Turkey, through the Renaissance, when Italian money lenders financed expeditions to the Levant in search of spices and other goods. It has evolved into a systematized allocation of risks and capital that supports the international transport of virtually every commodity and finished good. While trade finance funds are considerably newer, they are entirely recognizable to those familiar with this type of finance.

As its name suggests, trade finance underpins international trade in manufactured goods and commodities (services are not suited for trade finance). Total global trade was approximately US$16 trillion in 2016 and is forecast to grow to US$19 trillion by 2020, according to the International Chamber of Commerce (ICC). About 10% of these trade flows are enabled by traditional trade finance. 1 Large banks, financial institutions, and international trading houses have historically provided an estimated 20%–40% of the traditional trade financing, 2 with annual global trade finance revenues totaling approximately US$36 billion in 2016. 3 However, a market has developed for institutional investors to step in and address unmet demand for trade finance.

In a 2016 ICC survey of trade finance institutions, 37% of respondents reported having successfully transacted with institutional investors, marking an increase of 30% over the previous year. This has been driven in part by rising regulation, particularly of banks that have traditionally provided the bulk of third-party capital to facilitate trade. The ICC’s survey noted that 90% of respondents identified anti-money laundering and know-your-client regulations as either “significant” or “very significant” impediments to trade finance. It also highlighted that 77% of survey respondents noted that Basel III’s regulatory requirements were significant impediments to trade finance, up from 57% the previous year.

Rising regulatory requirements have caused banks to respond in at least two ways. First, they have moved to an “originate and distribute” model under which large banks structure trade finance instruments and sell off participations to reduce their overall exposure (an approach similar to the traditional syndication of loans and bonds). Second, banks have focused on those clients offering the lowest compliance risk. This focus has deemphasized small- and medium-sized enterprises (SMEs), particularly those in the emerging markets (EM). With compliance costs fixed, these clients have been less profitable for banks, particularly in the current low-rate and low-commodity price environment.

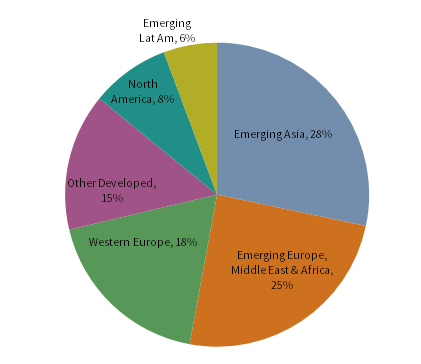

The Asian Development Bank estimates that the unmet trade finance need in Asia alone was US$1.6 trillion in 2015. As a result, institutional investors have gravitated to SMEs in the developing world. The Middle East, Africa, Asia, and Latin America account for 40% to 50% of total global trade in manufactured goods and the World Trade Organization further estimated that trade in goods among EM countries amounted to US$5 trillion. Correspondingly, as Figure 1 shows, a majority of trade finance transactions originate in emerging markets.

Source: International Chamber of Commerce, “Rethinking Trade and Finance,” 2017.

This orientation offers investors exposure to managers specializing in EM risk beyond the typical fixed income offerings of sovereign debt, near-sovereign rated corporates, distressed debt, and non-performing loans that dominate the EM opportunity set. In addition, trade finance managers specializing in SMEs may offer investors a means of achieving potential mission-related or environmental, social, and governance investment goals within the developing world. For example, improved access to trade finance may be crucial to increasing employment and income security for small farmer cooperatives who might otherwise struggle to invest in better seeds and equipment while waiting for payment from buyers.

Trade Finance: Mechanics

The most basic form of trade finance transfers risk from a corporate entity to a lender. For example, an exporter agrees to sell a certain quantity of winter wheat to an importer. Because the importer is located in another country, the exporter agrees to purchase the wheat in its domestic market, load it onto trucks, and transport it to a dock at a specified date. The importer takes possession of the wheat at the dock and loads it onto its own ship. As no money changes hands at the dock, the exporter is wary of non-payment. After all, the importer is in a different country, and collecting a delinquent payment in an unfamiliar legal regime could be complicated.

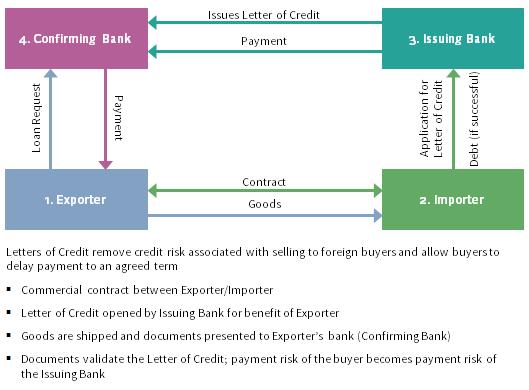

Trade finance traditionally solves this problem through the intermediation of banks. As illustrated in Figure 2, the importer asks its bank (“the issuing bank”) to issue a Letter of Credit (LoC) on its behalf for the benefit of an exporter of wheat. In so doing, the risk of payment then transfers from the importer to the bank. The exporter, in turn, asks its bank (“the confirming bank”) if it will accept the credit risk of the issuing bank. If it finds the risk acceptable, the exporter’s bank confirms the letter of credit. Now the stage is set for financing of the trade of wheat.

When the wheat arrives at the dock, agents of all parties review the documents and confirm that the specifics have been met: the grade is correct, the quantity is as requested, the location and date correspond with the contract, etc. Once this has been approved by all parties, the exporter may take comfort that if, for any reason, the importer fails to pay, the issuing bank will make the payment on the importer’s behalf. At this point, a trade finance lender would describe the collateral as having converted from the underlying commodity, or goods, into a receivable.

This arrangement transfers the credit risk from the importer to its bank and shifts the credit function from the exporter to its bank. The exporter specializes in trade, not in credit. Its business is the purchase and transfer of commodities, not the credit analysis of an importer located in another country. Its bank however, does specialize in credit risk management and can very quickly determine the acceptability of the credit risk of a foreign bank. Naturally, both banks charge a fee to their respective clients.

The importer assumes performance risk, or the risk that the exporter will perform according to the terms of its contract, and the confirming bank assumes the credit risk of the issuing bank. The issuing bank ultimately assumes the credit risk of the importer, but can mitigate that risk through various means, including cash collateral. Trade finance’s benefit to global commerce is that it shifts credit risk to institutions such as banks and trade finance funds that have the ability to manage or diversify that risk, thus permitting exporters to focus on their own performance risk.

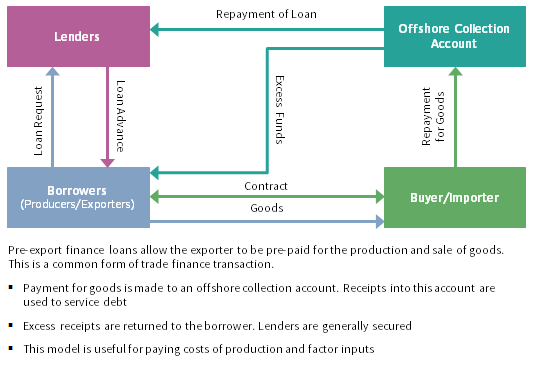

This example describes the most basic transaction encountered in the world of trade finance. The tenor of the instruments is usually very short (e.g., LoC can be opened for a finite period such as a month or a quarter), and the performance is limited to the terms of the contract (e.g., delivery of a specified quantity and quality of a commodity). But trade finance can also refer to the extension of credit for over a year, with elaborate collateral monitoring and multiple performance hurdles and benchmarks. For example, a bank can finance the purchase of seeds to be planted, harvested, and shipped to a buyer next year; this is known as pre-export finance (Figure 3).

Practices and conventions have evolved to support trade finance and eliminate certain risks involved in harvesting, warehousing, and shipping goods from fields to ports. For example, trade financiers take a pledge over the assets described in the contract and hire local agents to inspect and review the commodity as it is harvested and stored. Lender and borrower each agree on choice of law in a developed jurisdiction, thus avoiding the risk of local court corruption. Reputable, international specialist firms own and operate highly secure warehouses, the sole purpose of which is to hold goods in commodity exporting countries for the benefit of trade financiers and other lenders. These warehouses have bays, silos, baskets, and other containers, each of which can hold contents that are clearly designated as the legal collateral of the lenders. Insurers have also emerged to de-risk certain parts of the delivery chain, addressing factors such as weather, terrorism, and fraud. Parties turn to derivative markets to hedge commodity price and other risks.

Common Themes and Features

Regardless of tenor, commodity, flow, or means of transport, the vast majority of trade finance transactions share certain common themes:

- Serves as a form of credit with clearly defined terms, conditions, and covenants. In addition to tracking the financial performance of the borrower, trade finance ties events of default and other conditions to certain performance benchmarks, akin to a project financing or construction loan; most trade finance is denominated in hard currency like USD.

- Tends to be transaction oriented. It provides capital for a clearly identified transaction of finite life that is evidenced by a contract that specifies goods, timing, payment, price, and other requirements. Trade finance does not provide long-term capital for general corporate purposes.

- Usually involves shorter-term assets. Even the longest exposures will typically not exceed two years. As result, asset velocity is high, permitting finance lenders to adjust lending rates in response to the market, thus greatly mitigating duration risk.

- Requires some form of recourse for the financier. Lenders must at least have a first priority lien on the goods for which they are financing production, manufacture, and shipment. Providers of trade finance can also obtain a corporate guarantee for credit enhancement.

- Involves international trade, meaning the import and export of goods carried over long distances and involving different modes of transportation (usually trucks, rail, and ships).

- Tends to be heavily exposed to the emerging markets because those countries typically benefit from a surfeit of commodities while lacking sufficient financial capital. Ultimate payment, however, frequently comes from purchasers in the developed markets, who pay in hard currency, thus reducing currency risk.

- Generally finances trading firms as well as manufacturers (i.e., growers and shippers).

- Can also mean supply chain financing, forfaiting, 4 and factoring, activities that are not necessarily linked to international trade.

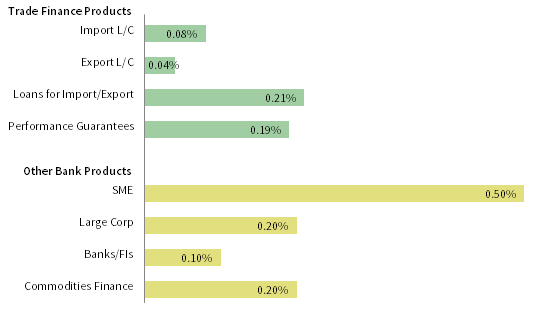

Unfortunately, high-quality data on the performance of trade finance products is lacking. However, the ICC has led recent efforts to collect data, primarily to help banks lobby international financial regulators for more lenient treatment of trade finance in capital regulations. As Figure 4 shows, default and loss rates in trade finance have been significantly lower than for other credit products. This data should, however, be taken with a pinch of salt as it is self-reported and may suffer from omissions that flatter the statistics. Moreover, these rates vary by geography. For example, default rates in trade finance are close to 5% in Africa versus the 0.04%–0.21% overall indicated by ICC data in Figure 4. Although the 5% default rate is relatively high, it is lower than the 9% default rate for all bank assets in that region. As with any credit strategy, it is important to evaluate the specific credit underwriting track record of the manager being considered and the profile of borrowers to which it lends.

Source: International Chamber of Commerce, “ICC Trade Register Report: Global Risks in Trade Finance,” 2016.

Strategy Types

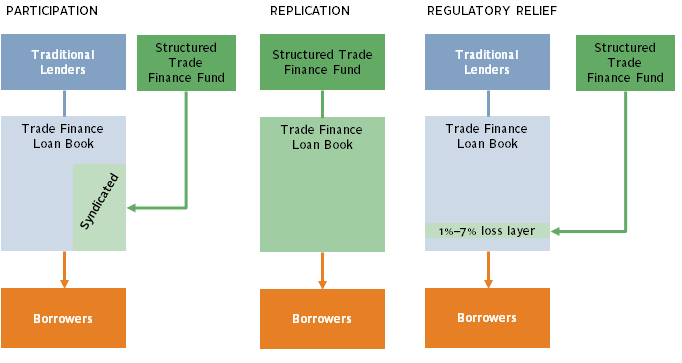

Trade finance funds have emerged to assume risks that banks either want to share or avoid altogether. They belong to the range of private credit solutions that have emerged to fill the gap left by banks retreating from various lending businesses as regulatory capital requirements have increased. One trade finance fund manager estimated that, under Basel III, some banks’ capital requirements for trade finance may have increased by as much as 70% versus those requirements under Basel II. Based on our observations, trade finance funds assume these risks in three ways: Participation, Replication, and Regulatory Relief (Figure 5).

Participation refers to strategies that share in the risks assumed by trade finance banks by purchasing an obligation from a bank that has originated and arranged a loan (banks pursing the “originate and distribute” model mentioned above). An arranging bank syndicates, or sells a participation in a trade finance loan to the trade finance fund, which passively holds the exposure to maturity. The purchase of participations is quite common in the broadly syndicated trade finance market. It requires limited overhead and staffing, as the participating trade finance fund relies on the origination and arranging capabilities of the arranging bank. Nevertheless, the trade finance fund still performs its own due diligence and must have a view of commodities, countries, exporters, and importers. The fund will seek to be a “lender of record” with a direct relationship with the borrower rather than simply entering a “sub-participation” arrangement.

Funds pursuing the Participation model tend to generate modest returns in the mid-single digits in an environment of low interest rates. The return and liquidity profile reflect the short-term nature of the underlying assets. These funds mitigate risk by diversifying their portfolios (typically hundreds of separate transactions) with exposures of varying tenors and by relying on the recovery efforts of arrangers.

Managers following the Participation model can provide a lower risk profile and high liquidity (typically quarterly). We expect this model to be the most prevalent due to its lower barriers to entry, as managers can piggy-back on the origination capabilities of banks. The strongest managers will have the ability to avoid adverse selection (i.e., the ability to avoid exposure to lower quality deals that banks are more likely to syndicate) through their own credit selection and their depth and breadth of relationships with originating banks globally.

The Replication model seeks to mirror the origination and arrangement activities of larger banks, but with smaller borrowers. Trade finance funds pursuing this strategy frequently extend credit to smaller domestic manufacturers or trading houses, which for some reason do not have access to bank funding for part or all of their needs. Larger trading houses might turn to trade finance funds for riskier financings, for bespoke structuring or when speed of execution is essential.

Trade finance funds that originate, underwrite, and manage their own trade finance loans must be able to evaluate borrowers and commodities as well as have the infrastructure to collect and review documents, track shipments, monitor collateral, and secure payment. Funds pursuing this model typically aim to earn mid- to high single-digit returns, with some aiming at low double-digit returns by pursuing riskier borrowers or longer tenor, pre-export projects. Moreover, similar to other credit managers that originate and manage their assets, these managers will deploy capital out of lock-up vehicles.

The Replication model is typically riskier than the Participation model for several reasons. First, the borrowers tend to be smaller (too small for the large international banks that generate assets purchased by Participation model managers) and projects can be “further from the port” or longer pre-export projects (e.g., equipment purchases). 5 Second, Replication model portfolios are likely to be less diversified as their operational infrastructure is unlikely to be able to effectively handle very high deal volumes. Moreover, they tend to operate in regional markets (e.g., Latin America or West Africa) or sector niches (e.g., agricultural commodities only), reducing the diversification achievable by managers pursuing the Participation model. Finally, these strategies are unlikely to be suitable for quarterly liquidity given the mix of exposures. We believe that investors should demand high single-digit to low double-digit returns as compensation for the riskiness of these strategies.

The Regulatory Relief model applies first-loss, risk-sharing principals common in the banking and structured finance worlds to trade finance. Under a first-loss 6 arrangement, a trade finance fund would agree to share in losses of a bank’s trade finance portfolio on individual loans up to a certain amount. For example, a fund may agree to fully bear or share in losses after the first 1% and up to the first 7%, at which point the bank would agree to begin assuming losses completely. This strategy effectively insures the arranging bank up to a certain level of loss, thus enabling the bank to allocate less regulatory capital to the individual loan.

The Regulatory Relief model is quite uncommon but nevertheless an interesting prospect for sophisticated institutional investors that are comfortable allocating to complex, structured credit–based strategies. These strategies have higher barriers to entry for managers, requiring a minimum of a few hundred million dollars raised in a closed-end fund format. Well-known transactions have provided a template for investors to use in evaluating such funds. This is a nascent market worth watching given the low double-digit returns on offer.

Portfolio Allocation Implications

Trade finance strategies have attractive characteristics for a broad range of investors, with many providing quarterly liquidity and targeting a gross return premium of 300 bps – 500 bps over cash. We expect these funds to have a positive (but low) correlation to pro-cyclical assets such as equities, and a low risk profile underpinned by the short-dated nature of the underlying deals and the strong collateralization. At the same time, investors should be mindful that the value of the collateral itself is pro-cyclical since it is frequently composed of commodities. In a strong growth environment that is accompanied by rising rates, we expect returns to be robust, as funds can charge higher financing rates while strong demand keeps a lid on defaults. In a weak growth or recessionary environment, with falling rates and asset prices, trade finance strategies should be resilient up to a point. In extreme downside scenarios, default rates will rise and concentrated portfolios with weaker borrower profiles will experience losses. In general, any losses in a downside scenario should resemble those on senior secured debt, with the caveat that these investments may be further hindered by idiosyncratic risk. Apart from the impact of economic cycles, investors should be aware that less diversified portfolios such as those in Replication strategies can be more exposed to operational risk including fraud.

Investors should also pay keen attention to the investor base and liquidity profile of the fund as a fund could suffer a run if too many investors seek to redeem at once. This is more likely to be a problem with Replication-type managers who have more concentrated portfolios and investor bases but can also affect Participation strategies that are not structured appropriately.

Investors should note that trade finance is evolving and emerging trends such as digitization and blockchain are expected to help reduce the cost of traditional paper-based trade financing by up to 35% (according to the ICC 2017 report). This could further improve the opportunity for trade finance funds as the marginal provider of capital in a growing market. Trade finance funds have so far attracted a range of institutional investors including insurance companies, pension funds, sovereign wealth funds, and private wealth capital. For insurance companies, the combination of low duration and high credit spreads is likely favourable from a solvency capital perspective. For other institutional investors, trade finance offers another avenue to earn a return premium while retaining moderate liquidity and adding greater diversification to the portfolio.

Conclusion

Trade finance offers a differentiated combination of credit risk, duration risk and liquidity profile that can complement other portfolio allocations in fixed income and increase diversification. It is not without risks, but these risks can be analyzed within the existing frameworks of credit investors. Our discussions with participants in the broader ecosystem of trade finance have consistently pointed towards a greater role for institutional investors in providing trade credit through specialized funds. We expect that the landscape of such funds will expand greatly in the coming years. Benefiting from tailwinds like constrained supply of traditional bank-led financing and underlying growth of demand for credit in the real economy, it may finally be time for one of the oldest forms of credit to merit a place of its own in investors’ portfolios.

Himanshu Chaturvedi, Managing Director

Tod Trabocco, Managing Director

Footnotes

- The majority of trade is conducted on “open account terms,” which means that goods are shipped before payment is due and the exporter bears the risk.

- The majority of trade is conducted on “open account terms,” which means that goods are shipped before payment is due and the exporter bears the risk.

- Source: Boston Consulting Group Trade Finance Model as cited by the ICC.

- Forfaiting is a transaction whereby by a forfaiter purchases the claim on receivables from an exporter, without recourse. Unlike factoring, it deals with negotiable instruments like bills of lading and promissory notes, which facilitates a secondary market in forfaiting, making it more liquid. The exporter can get up to 100% financing with forfaiting whereas factoring usually address up to 80% of the value of receivables. There are several other differences that are widely documented in trade finance literature.

- “Further from the port” means the purchase of the commodity at a remote location from where it must be transported over greater distance.

- In practice, the very first loss piece may be retained by the bank to mitigate concerns about adverse selection from providers of external capital and therefore reduce the cost of this capital.