The Pension (Re)volution: How the Hybrid Approach is Reshaping Retirement Plans

Independence Day, 1985. You just saw Back to the Future and can’t stop thinking about tomorrow—in particular, your retirement years. You imagine sitting beachside or traveling through Europe, confident that your company’s well-funded defined benefit (DB) plan will provide steady monthly income for life. But things are about to change for the generation behind you. There is a new kid on the pension block: the defined contribution (DC) plan, said to help employees save money on taxes while providing “adequate” retirement savings.

As almost 40 years pass, companies big and small start moving from the DB model toward the DC plan, shifting investment risk from employers to employees. With time, plan design improvements result in lower fees, simplified investment options, and risk management via target date funds. But where did it all lead? Are today’s employees as prepared for retirement as they should be, or is there a better way? A way that enables twenty-first century US companies to provide the benefits of DB plans while decreasing costs and managing risk? Our answer—yes. We believe “pension Shangri-La” is attainable for plans of all shapes and sizes through an approach that delivers high value employee benefits with low or no cost to the employer.

Enter the Hybrid Approach

For many organizations today, the transfer of DB liabilities is finally economically viable, as their plans’ funded status has improved. However, the conditions that are enabling plan termination are also paving the way for a redesign of retirement programs. Driven by the rise of cash balance (CB) plans, a new opportunity is emerging that can not only save costs, but also improve participant outcomes: the hybrid approach. The hybrid approach to retirement savings blends the options and strengths of the DC model with a CB-defined benefits strategy. Furthermore, today’s robust risk management tools, higher interest rates, and improved funded status have created ideal conditions for plan sponsors to explore this new, balanced solution.

Combining the Best of Both Models

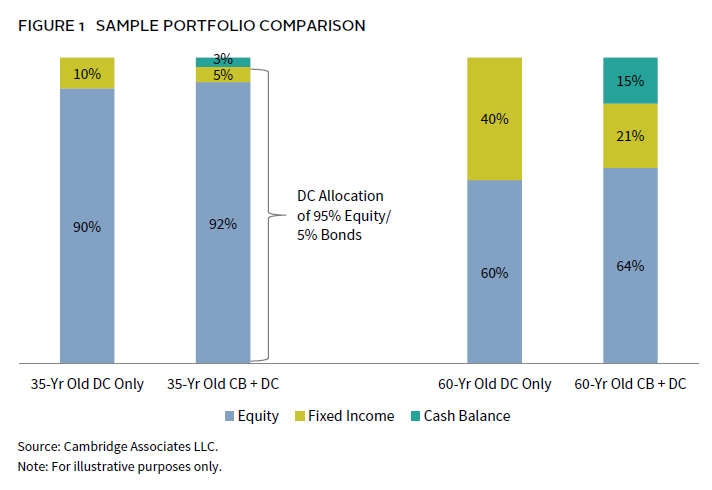

With a hybrid framework to retirement savings, some, or all, of the employer contributions typically associated with a DC model are redirected to a CB structure. The CB account serves as the low-risk component of the employee’s retirement plan, offering a guaranteed cash pool that is protected from losses and grows based on prevailing interest rates. Meanwhile, the employee’s personal retirement savings continue to flow into the DC plan, where he or she can choose how to invest, potentially allowing for higher growth allocations than what might be available in standard target date funds. The combination creates a more comprehensive retirement program, even though the hybrid approach maintains higher equity allocations in the DC account (Figure 1).

The Benefits: Reducing Cost and Risk for Pension Plan Sponsors

Employers typically offer DC benefits via a matching contribution structure, such as 4% of eligible compensation. While this makes costs predictable for the employer, it also makes them more onerous. Shifting these contributions to a CB plan can significantly lower costs through long-term investment returns. The long-term net return of the capital markets can meaningfully decrease employer cost, while the CB nature of the plan is a lower-risk alternative to a traditional pension plan.

Furthermore, if DB plan assets perform well over time, the employer’s cost to provide retirement benefits could be de minimis. This is encapsulated in the concept of a “hurdle rate,” which is the investment return needed to fully cover the DB plan costs.

These costs primarily include:

- Benefit accruals (the amount a participant earns in benefits each year)

- Interest cost on liabilities (e.g., annual interest, such as on a mortgage)

- Associated plan expenses, such as administration, actuarial, audit, and legal

Established, overfunded DB plans have a head start in this scenario, as their assets are already greater than their liability. But a hybrid approach can renew the investment horizon for virtually any plan, allowing employers to tap all areas of opportunity as they seek to reap the gains of the capital markets while using modern risk management controls.

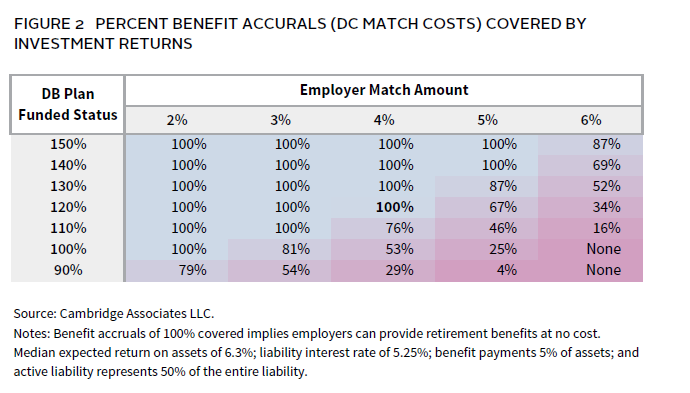

Figure 2 demonstrates how a plan sponsor can harness the power of capital markets to provide a high-value benefit at a low cost. The table illustrates the percentage of retirement benefit (i.e., Employer Match Amount in a DC plan) covered by investment returns for a hypothetical CB pension plan. It is based on funded status and uses an opportunistic allocation of 50% growth-oriented assets (e.g., equities and diversifiers) and 50% liability-hedging assets. For example, at 120% funded status and a benefit equivalent to a 4% match, investment returns could cover 100% of employer cost.

As a plan’s funded status improves, its capacity to cover the cost of future benefits increases and its administrative costs decrease. This is particularly significant for plan sponsors focused on the long-term health and costs of their benefits and investment programs. However, every plan sponsor has different goals and risk tolerance levels, and reaching for higher returns usually increases the chance of a downside event hurting the organization’s balance sheet or cash flow.

One way to evaluate such risk is to determine the likelihood of DB funds falling below 100% over a ten-year period. While a plan sponsor may want this risk to be as low as possible, they must weigh the likelihood of that risk against the hybrid program’s savings. Based on our previous 120% funded/4% match example, the DB plan has approximately a 21% risk of its funding dropping below 100%. (This is the risk of providing ten years of benefit accruals free of charge to the employer while letting the funded status decline below 100%.) By adjusting the asset allocation, contributions, and benefit levels, the appropriate balance can be achieved. For instance, a 130% funded plan with a more conservative asset allocation that is saving 50% on accruals can reduce their risk of dropping below 100% funded to 1%.

The main takeaway? A hybrid approach has the potential to significantly reduce the cost and risks of providing retirement benefits, especially at higher funded status levels. While Figure 2 details a single option, the exact combination of benefit levels and investment strategies should be tailored to each specific plan to achieve its unique objectives.

Helping Employees Retire With More Confidence

At first glance, a hybrid approach may appear to sacrifice employer returns. However, with certain tweaks to the way DC assets are invested, employees can realize similar total retirement savings while reducing risk, maintaining their opportunity to retire comfortably.

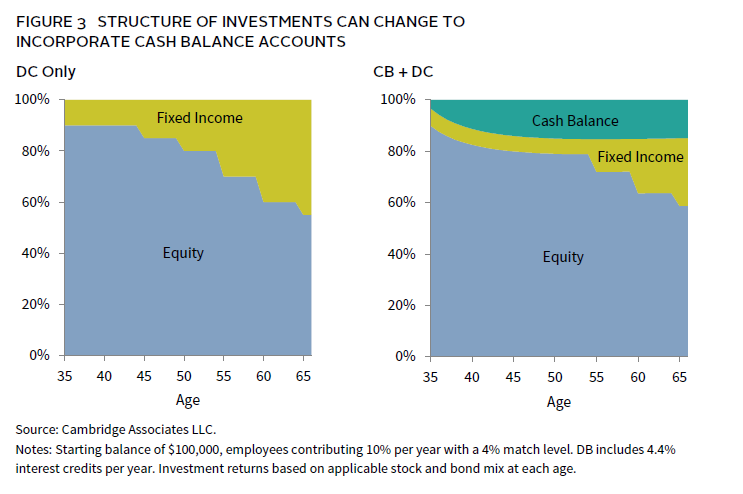

Given that a CB-defined benefit plan is the employee’s lowest risk option, the DC plan doesn’t need as much lower-risk fixed income, such as that found in a target date fund. If a portion of the plan’s fixed income is transitioned to equities, the DC plan can grow more quickly and generate additional returns, while still allowing the combination of CB + DC to be less risky than the stand-alone DC plan. Figure 3 depicts potential investment design under both constructs, showing how the CB component can become an integral part of the employees’ retirement program.

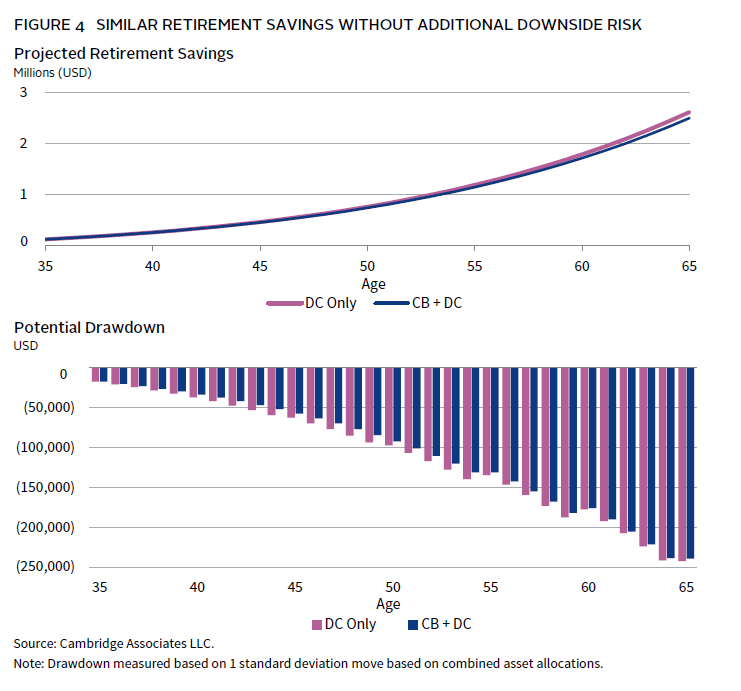

Additionally, the shift to a hybrid structure results in some interesting impacts on account balance and risk, as shown in Figure 4. While the combined account balance upon retirement is slightly less, the employee also assumes slightly less risk along the way. This is particularly important in the event of an unanticipated early retirement or unplanned withdrawals, such as those related to a company transfer.

Even though the account balances are similar, the hybrid approach could underperform the DC-only plan in a bull market. In this case, it is likely the CB plan will be exceptionally overfunded, which would allow the sponsor to increase the cash balance benefit and maintain a low cost to the business. In addition, a retirement program with a CB-defined benefit plan offers the option to take the benefit as an annuity—providing, by default, a solution to the retirement income issue that is such a hot topic today.

The final and potentially largest hybrid benefit to employees is downside protection. Because the CB plan cannot decrease in value, it provides diversification benefits. For example, during the rising rate environment of 2022, both equities and bond values fell, but the CB value would have increased, providing market diversification for participants nearing retirement.

Combining Tradition and Innovation to Benefit All

It is common knowledge that the average American has an underfunded retirement. What’s more, most lack knowledge or experience in the intricacies of capital markets. Many feel a growing anxiety about underfunded retirements, frequently deepened by their lack of investment savvy. In this environment, there may be a growing preference for the stability and predictability once offered by traditional pension plans.

A modernized, hybrid retirement plan preserves the capacity of employees to accumulate savings for retirement while reducing expenses for employers, representing an important shift in how benefit plans are structured. By switching to the hybrid approach we believe employers could save 50% or more, over time, on retirement costs through harnessing the capital markets and the bundling of accounts across all participants.

Although no single strategy can address all challenges related to saving for retirement, adopting a hybrid approach represents a significant initial step toward improving retirement savings outcomes—for employers and employees alike. So, when the future arrives, both parties will be less apt to look back with regret.

Serge Agres, Managing Director, Pension Practice

Jacob Goldberg, Senior Investment Director, Pension Practice

Serge Agres, CFA, FSA, EA - Serge Agres is a Managing Director and Investment Actuary at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.