The Dollar Finds Temporary Support

The US dollar tends to appreciate during two broad economic regimes. One is when the US economy is materially outperforming its global counterparts, attracting capital looking to benefit from the superior US prospects. The other is when growth slows sharply, attracting safe-haven-seeking capital. This is the “dollar smile” model of the currency, and looking at 2022 through this lens suggests some dollar strength may be in store.

The appreciation of the dollar in recent months can be attributed to both sides of the smile to some extent. The outperformance of the US economy has reduced the output gap in the United States more quickly than has occurred in any other major economy. Even if the upward pressure on inflation rates caused by supply-chain disturbances proves short-lived, this removal of slack raises the prospect of inflation stabilizing at a more elevated level than was evident pre-pandemic. This prompted the Fed to become more hawkish as the year advanced, supporting the US dollar. On the other side of the smile, virus-induced slowdown fears and some idiosyncratic concerns about China have also boosted the dollar via risk aversion.

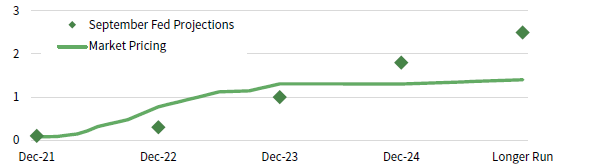

THE MARKET EXPECTS MORE HIKES IN THE SHORT RUN THAN PROJECTED BY THE FED, THOUGH LESS IN THE LONG RUN

December 2021 – December 2025 • Percent (%)

Sources: Bloomberg L.P. and Federal Reserve.

Notes: Market pricing data is taken as the one-month OIS (Overnight Indexed Swap) rate at various forward starting points. The ‘Longer Run’ data point is five years forward starting. Market data as of December 1, 2021.

Despite the market pricing in a more hawkish Fed, it remains short of pricing in the rates profile implied by the Fed’s September projections. As we head into 2022, the path of least resistance would appear to be for US short rates to continue to move higher, particularly versus peers such as Japan, the Euro Area, and Switzerland, which have more subdued core price pressures. This should ultimately offer some support to the dollar for a time. A material deterioration in growth expectations may be required for the Fed to meaningfully back away from these projections, which could similarly boost the dollar via a de-risking of positioning. Regardless, the dollar is richly valued versus its history and faces the headwind of a large current account deficit. Therefore, the dollar’s potential upside likely remains limited in magnitude when compared to past hiking cycles, as well as limited in duration. As always, the confidence intervals around currency forecasts are wide.

A strengthening dollar can be a challenge for non-US risk assets, particularly emerging markets where it raises the cost of capital and can spur capital outflows. Other things being equal, a rising dollar is also a headwind for commodities, given they are priced in the currency. However, current patterns of fluctuation in supply and demand dynamics look set to continue to dominate this impact in the near term.

Thomas O’Mahony, Investment Director, Capital Markets Research

Thomas O’Mahony, CFA - Tom O’Mahony is a Senior Investment Director at Cambridge Associates. Tom is part of the Capital Markets Research Group that is charged with developing the firm’s strategic and tactical asset allocation guidance. He conducts research into broad macroeconomic themes in addition to asset class topics. Tom has authored numerous publications and contributes to the firm’s […]