Portfolio Protection: Challenges with Equity Put Options

Recently, investors asked: “Equity valuations feel high. How can I use options to protect me?” Others may fret, “I have a pending liability and I want to make sure I have the capital to fund it.” Interest in using derivatives to protect from equity drawdowns has increased, perhaps driven by elevated equity levels or uncertainty stemming from COVID-19. It is also linked to the fact that derivatives are easily accessible. Even individuals can trade equity options from online brokerage accounts.

But we advise extreme caution in using derivatives to protect portfolios from sharp equity drawdowns. Many alternatives are easier to implement, simpler to explain, and better for the bottom line. For far too many investors, the protection that put options provide is less than their cost, delivering a drag on performance. The ongoing outlay for hedges can exhaust stakeholders’ patience. Behavioral biases lower the chances of success, often causing mistiming on the buy or the termination of the hedge. Furthermore, the expertise required to maintain an ongoing hedge is significant. Investors and investment committees may spend more time and resources implementing and monitoring the hedge than the protection desired at the outset. For these reasons, we recommend investors look to asset allocation to defend against equity risk before buying puts. For those investors that must pursue a tail-risk hedge, we provide a list of potential pitfalls and methods to help mitigate them.

Throughout this paper, we adopt the lens of a portfolio with a long-term horizon and significant equity allocations. These parameters encompass nonprofits, family wealth, and pension plans that Cambridge Associates serves. While derivatives can be useful instruments for hedging some types of risk, such as unwanted currency or interest rate exposure, this paper focuses on investigating put options’ use as protection from equity market drawdowns. We explore the challenges in hedging with put options; evaluate alternatives to tail-risk hedging; share insights from our CA Institute survey of institutional clients; and discuss methods of navigating the challenges through a case study.

Why Not Deploy a Tail-Risk Hedge?

Equity options give the holder the right but not obligation to sell (in the case of put options) or buy (in the case of call options) an asset at some point in the future. Each option is a contract with an expiration date. The most liquid equity options market use S&P 500 Index as a reference. For example, the terms of an S&P 500 Index put option could include:

- Index Reference Level: 4,000

- Strike Price: Investors that want protection after a 15% drawdown would seek a strike of 3,400 (or 15% below the current reference level). The contract would pay off only if the reference level falls below the strike price. In the case of the index falling to 3,200, the put option would deliver a gain of 200. Combined with a multiplier of 100, the payoff would be $20,000.

- Cost: If the quote is $4, then the upfront premium paid would be $400, after applying the multiplier.

- Expiry: The contract would expire three months in the future. An investor could sell the put option or rebalance before expiry.

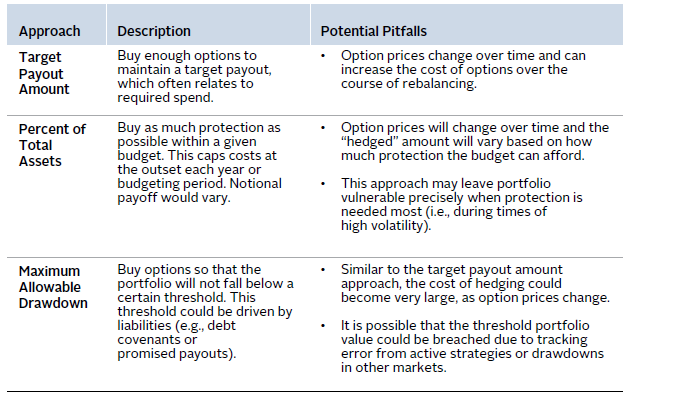

From these basics, we highlight two decisions that investors must make in structuring a hedge. The first is the time horizon: ongoing hedge versus short-term hedge to cover a particular concern. The second decision is to balance the cost versus the protection delivered by the option; Figure 1 summarizes three approaches.

FIGURE 1 BALANCING COST VERSUS PROTECTION IS KEY WHEN SIZING TAIL-RISK HEDGES

Source: Cambridge Associates LLC.

Now that we have covered put option basics, let us shift to what it can and cannot deliver for a portfolio. Across academic studies, buying an ongoing tail hedge using put options is a money-losing proposition. 1 One study suggests that systematically buying put options within a stock portfolio eroded almost two-thirds of the equity returns over nearly thirty years. Buying put options with a stock portfolio effectively delivered 35% of the stock market return in exchange for about 75% of the stock market risk. 2 3 How can this be? In short, it is due to challenging valuations. Said differently, the realized volatility of the market tends to be lower than the volatility priced into the option at the time of purchase.

A skeptic of this research might question our simplification that equates put options with tail-risk hedging. We agree there is more to tail-risk hedging than simply put options. Regardless of the instrument underlying the hedge, investors should evaluate the alternatives through a consistent framework with these questions in mind: What is the cost of hedging and the likelihood of success? What opportunity costs am I willing to sacrifice? When will this strategy perform poorly? Another critique challenges us to consider specific crises instead of results averaged over long time periods. While it is true that put options paid off during market crises such as in 2008–09, an investor would need to forecast a sharp downturn with near perfect timing to profit from it. We encourage weighing the broad body of research versus vivid anecdotal evidence.

Fear of severe market drawdowns drives investors to pay a small premium now to protect against a catastrophic decline later. This is often referred to as “portfolio insurance,” given the similarities to more commonly known insurance policies. We propose a better metaphor: investors are the insurance company and not the policy holder purchasing insurance. A diversified portfolio with a long-term horizon is the insurance company, and the gains of owning stocks require that investors be willing to accept the “left tail” or sharp drawdowns. There is evidence to support this in equity markets outside the United States 4 and in other asset classes, as well. 5 We encourage investors that are considering tail-risk hedging to view it from the perspective of an insurance company that is paid to collect premium for bearing risk and pay out when disaster happens. Attempts to limit this risk hurts the bottom line. Buying put options are akin to re-insurance, which is when an insurance company reduces its exposure, usually to mitigate concentration in one type of disaster (e.g., hurricane risk for a specific time period in a specific geography).

We suggest investors only consider tail hedges when shifting asset allocation is not an option and when there is too much risk that is both significant and specific to the institution. For example, if the institution cannot bear a probable drawdown over a specific time frame (e.g., between now and an upcoming outflow), then a portfolio-level derivatives strategy may be better than significant turnover of the underlying portfolio. This could be especially true if there are significant allocations to illiquid private investments. Nevertheless, investors that have the flexibility to adjust equity risk through rebalancing should do so.

Alternatives to Tail-Risk Hedging

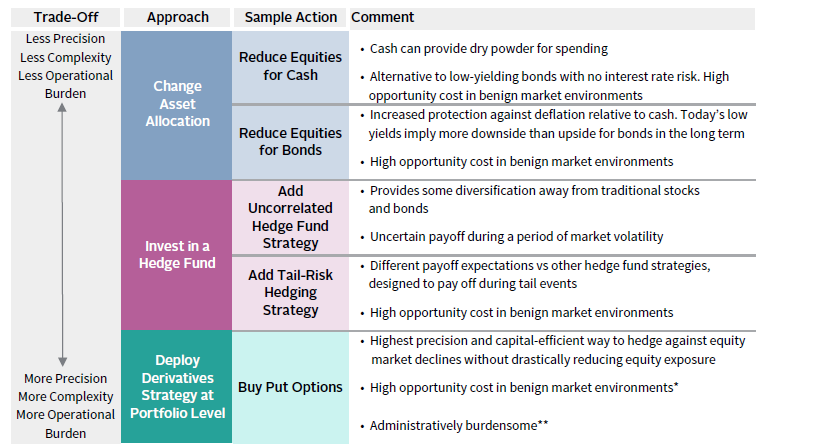

We believe asset allocation should serve as the default and primary method for managing overall risk. Reducing equity exposure and holding proceeds in cash or high-quality fixed income is easier to manage and understand, and is less deleterious to portfolio return than an ongoing tail-risk hedge.

Another approach is to hire “uncorrelated” hedge funds with low equity risk or funds that rely upon tail-risk strategies. Tail-risk hedge funds deploy a wide range of strategies, from traditional equity options to complex hedges. Relative to an in-house CIO managing the hedge, a dedicated manager may have a higher degree of expertise and may deliver superior implementation. However, the payoff in the event of an equity drawdown often is not enough to cover the foregone gains during a calm or strong equity market. Sizing the manager can also be a challenge as an investor balances the need for protection against the opportunity cost of foregone returns. A tail-risk hedge fund could become one of the top active risk positions if an investor needed sizable protection. Furthermore, extended periods of market calm can introduce business risk as investors run out of patience and exit the strategy. In the extreme, redemptions may impair the fund’s ability to deliver protection and cause the fund to close. We summarize the pros and cons of alternatives in Figure 2.

FIGURE 2 PRECISION, COMPLEXITY, AND OPERATIONAL BURDEN IMPACT TAIL-RISK ALTERNATIVES

* Total option premium cost can be reduced by selling call options.

** The administrative burden can be lessened by using an outsourced provider.

Source: Cambridge Associates LLC.

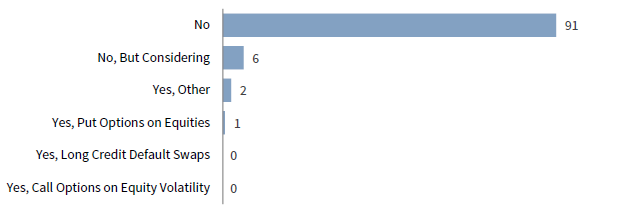

CA Institute Survey Insights

Tail-risk hedging’s lack of popularity is evident among institutional investors, as well. According to the CA Institute’s recent survey of more than 170 institutions, 6 nearly all respondents (91%) indicated that they do not directly own derivatives to hedge equity risk; nevertheless, 6% did indicate they are considering it moving forward and 3% have implemented a derivatives-based hedge in the past (Figure 3). This represents an uptick relative to history and may reflect the lowered opportunity cost of holding derivatives relative to more traditional defensive assets, such as high-quality sovereign bonds.

FIGURE 3 DO YOU DIRECTLY OWN (NOT THROUGH A MANAGER) DERIVATIVES TO

HEDGE EQUITY RISK IN YOUR PORTFOLIO?

n = 176 • Percent of Respondents (%)

Source: Cambridge Associates LLC.

Note: The “Yes, Other” category includes owning call options on volatility and credit default swaps, among other strategies.

Case Study for Implementation Best Practices

If investors decide put options are appropriate for a portfolio, proper implementation can be challenging. For example, suppose a family foundation’s CEO is worried about upcoming potential stock drawdowns and wants to investigate buying put options. The in-house investment team, led by a chief investment officer (CIO), manages a diversified portfolio including public equity, private equity, hedge funds, and fixed income. To complicate the matter, the CIO learns there is a large grant outstanding that may pay out at any time over the next year. The CIO does not want to dramatically shift the total asset allocation and faces liquidity demands.

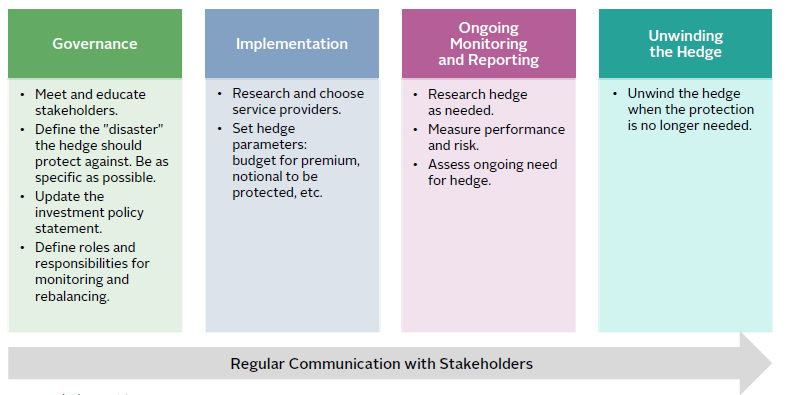

To be successful, our CIO needs to carefully explore each aspect of the hedge and document the decisions with stakeholders. We categorize the stages of a tail-risk hedge into: Governance, Implementation, Ongoing Monitoring and Reporting of the Hedge, and Unwinding the Hedge. We explore the elements summarized in Figure 4 through our family foundation scenario.

FIGURE 4 A SUCCESSFUL TAIL-RISK HEDGING STRATEGY INCLUDES FOUR STAGES

Source: Cambridge Associates LLC.

Governance. Are stakeholders clear about what success looks like? In our case study, success would be ensuring the payment of the upcoming grant, regardless of equity market conditions. Our CIO should consider alternatives to hedging, such as setting aside the monies needed for the grant in cash or fixed income. She would also listen carefully to stakeholders’ concerns, understand what the “disaster” looks likes so she could better deliver on the hedge. In this case, because the challenge is short-term and specific to the institution’s upcoming cashflow, the CIO decides to implement through a direct derivatives strategy using put options. The CIO also confers with the board, and they agree to delegate decision-making around the characteristics of the hedge to the investment committee (IC) chair to establish prudent oversight. These conversations are documented in an investment policy statement to address the scope and purpose of the hedge, the allowable allocation or hedging “budget,” the instruments permitted, the risk management guidelines, and the performance reporting methodology.

Implementation. Our CIO understands that tail-risk hedging with puts comes with complexity and challenges. Because the specific concern involves protecting a sizeable outflow, she chooses the “target payout” approach, whereby she would buy puts whose protection would satisfy the grant payment (Figure 1). The CIO proposes selling call options to offset some of this cost, acknowledging the accompanying cap on potential gains if equity markets rally. Advice from other advisors, such as tax advisors and operations, is also incorporated. The IC chair should also approve outsourcing day-to-day implementation and rebalancing to an external firm. This approach is preferable because the CIO can communicate broad criteria (e.g., desired amount of protection) and leave the implementation up to the external provider.

Ongoing Monitoring and Reporting. Given the unique circumstances, the CIO presents the track record in two ways: one with the hedge and one without. Performance should be evaluated differently because the hedge’s goal is not to achieve a return, but instead to protect the ultimate payout amount. To monitor the risk of the hedge, our CIO provides updates on costs, recent trade activity, and position-sizing risk. For different implementation methods, further considerations could include counterparty risk when using custom options, manager risk when hiring a hedge fund, and currency risk when investing in foreign markets.

Unwinding the Hedge. When is the hedge complete? Since the goal is to protect the upcoming grant, the natural trigger will occur once the grant has been paid out or when the hedge is monetized in a market drawdown. In contrast, ongoing tail hedges can serve other purposes such as generating liquidity to rebalance during times of market stress. Regardless of time horizon, we advise that investors set defined payoff or drawdown thresholds that will serve as a trigger to conclude, trim, or reassess the hedge. Setting triggers mitigates the common behavioral bias that drives investors to hold onto protection during periods of market stress instead of locking gains. Investors often look to purchase more protection in a drawdown, precisely when put options are the most overpriced. We observe a similar pitfall during crises where investors add to bonds just when they are valued richly, instead of rotating into cheaply valued stocks.

Conclusion

The perceived benefits of options as a tool to protect against equity drawdowns are often outweighed by their complexity, implementation, and ongoing costs (both economic and behavioral). There are many risks lurking under the surface. Investors are better served by adjusting a portfolio’s asset allocation. A tail-risk hedge requires many ingredients to work, including a talented investment team, strong governance from stakeholders, and a clear alignment between the two groups.

Jean Lu, Managing Director, Endowment & Foundation Practice

Heamon Williams, Investment Associate, Endowment & Foundation Practice

Footnotes

- Joshua D. Coval and Thomas Shumway, “Expected Option Returns,” University of Michigan Business School Working Paper, 2000; Christopher S. Jones, “A Nonlinear Factor Analysis of S&P 500 Index Option Returns,” The Journal of Finance LXI, no. 5 (2006): 2325–2363; and Joost Driessen and Pascal Maenhout, “An Empirical Portfolio Perspective on Option Pricing Anomalies,” Review of Finance 11, no. 4 (2007): 561–603.

- Roni Israelov, “Pathetic Protection: The Elusive Benefits of Protective Puts,” The Journal of Alternative Investments 21, no. 3 (2019): 6–33.

- Joost Driessen and Pascal Maenhout, “An Empirical Portfolio Perspective on Option Pricing Anomalies,” Review of Finance 11, no. 4 (2007): 561–603.

- Roni Israelov, Lars N. Nielsen, and Daniel Villalon,“Embracing Downside Risk,” The Journal of Alternative Investments 19, no. 3 (2017): 59–67.

- CA Institute, “Risk and Liquidity Mini Survey,” Cambridge Associates LLC, 2021. Full survey results are available to participants only.