Optimizing Wealth Infrastructure for Families

Many families who have succeeded in building wealth or experienced a major liquidity event find themselves in uncharted territory. This includes families who are thinking through how to separate the management of their finances and investments from those of their company, as well as those who have recently sold a business. In some cases, a family may be reassessing their investment services, feeling their needs have progressed beyond what their current providers are delivering. In others, they may be reconsidering their risk appetite as their focus shifts to building a diversified portfolio and investing with a multi-generational mindset. Each of these scenarios presents a shared challenge—how to position the family for success by designing and building the right infrastructure to propel an investment program forward.

Building an optimized investment infrastructure begins with clearly defined goals and identifying who, both inside and outside the family, will play a role in the wealth management process. Some families choose to build a family office to oversee some, or all of the functions related to managing their wealth in-house. However, for many families, the best approach is to build a team of advisors who are experts in their fields and who can work together to meet the family’s investment needs. This paper serves as a guide for families who have decided to outsource the investment function of their portfolio by partnering with an investment advisor. Its aim is to help families understand the different structural components to consider as they work to create an institutional-caliber portfolio (Figure 1). These structural components include investment management, banking, lifestyle services, legal representation, tax accounting/reporting, and philanthropy.

But First, a Word on Governance and Controls

For a family who has experienced a liquidity event, governance may not be top of mind. However, reflecting on how investment decisions will be made can often provide valuable direction on what type of partners they need. An honest assessment of a family’s desire to be involved in day-to-day investment decisions, oversight, and implementation—and their experience in making such decisions—will guide families to solutions that make the most sense for them. In some families, a primary wealth owner may prefer to make and approve all investment decisions, while in others a delegate or investment committee may be preferable. Considering these complex foundational questions up front can help determine optimal partners.

Investment Management

Working with an Advisor

Investment advisors provide a range of services to help manage a family’s wealth. First, they help the family create an investment strategy that aligns with their financial goals and risk tolerance. This includes due diligence, strategic asset allocation, risk management, investment selection, and regular monitoring of investments. Investment advisors can also provide investment education and retirement planning, estate planning, and tax planning. The role that an investment advisor takes on within an investment infrastructure differs from family to family. For this reason, they often operate in close coordination with lawyers, accountants, and tax specialists to ensure a comprehensive approach to wealth management.

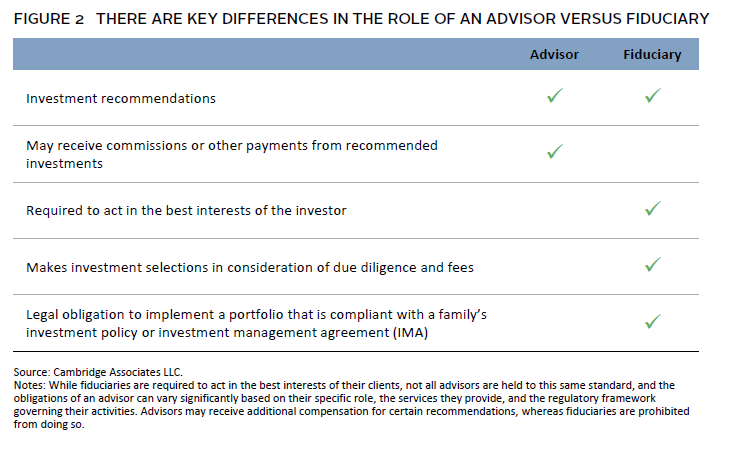

Fiduciary Versus Advisory

When selecting an investment advisor, families should first consider the difference between a fiduciary and advisory relationship (Figure 2). They should consider a fiduciary relationship if they seek a partner who is legally bound to act in their best interests, especially if they prefer not to be deeply involved in day-to-day investment decisions. On the other hand, an advisory relationship might be suitable for families who desire more control over their investment choices and are comfortable with a more collaborative approach.

Portfolio Administration

Handling day-to-day portfolio operations is no small task. Families should note that the amount of time required to source and evaluate investments often goes well beyond what an individual alone can handle, even if they have a strong investment background. Meeting a portfolio’s oversight requirements also involves significant work. An outside investment manager can help family investors sort through the universe of available funds and strategies to identify which investments may best suit their goals. Whether a family creates a single, “one-stop shop” office to support its needs or elects to build a broader team of experts, a strong team is needed to oversee the execution of the playbook. From there, the focus should be on working with reputable and experienced service providers with strong references and a track record of success.

The work of portfolio administration also includes placing and signing off on trades, completing subscription documents, paying capital calls, cash monitoring, approving consent documents, and tracking performance. Cash management—for example, uncovering opportunities to achieve better cash yields than a custodian bank might be offering—is another key administrative task. Considerable work with selected banks is required to set up accounts and services, which we discuss in more detail below.

Many wealth owners try in earnest to take on all this work themselves, but find it becomes too challenging to manage in conjunction with other day-to-day obligations. In most cases, families should have someone readily available to undertake these responsibilities. Some investment advisors, including Cambridge Associates, can manage operational activities for clients—in either a fiduciary or advisory capacity. Alternatively, families who have opted to build a family office often handle portfolio operations with an in-house team.

Banking

Another key infrastructure choice that families need to make involves selecting a bank and the type of investment account they will use to operate and oversee their portfolio. There are two main options to choose from: a brokerage or custodian account (Figure 3).

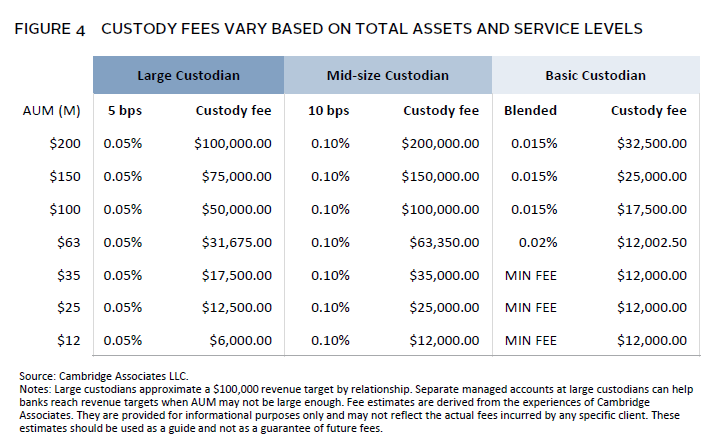

A brokerage account is typically lower cost, as assets are held in a large general account on behalf of families. Because securities in a brokerage account are tied to a broader pool of assets, they may become encumbered or put in jeopardy in the event of a bank failure. By contrast, a custodian account is considered a more secure method of holding assets, with all securities held in the name of the account holder. Custodian accounts allow for assets to remain freely transferable providing an additional layer of capital protection in the event a bank or broker comes under financial pressure. For these reasons, custodial accounts are often referred to as “safekeeping” accounts. The landscape of brokerage account providers is fairly broad. However, when it comes to custodians, choices are more limited. When deciding between brokerage and custodial platforms, families should also consider the related costs. As service utility varies by preference and goals, families should know what they are signing up for (Figure 4).

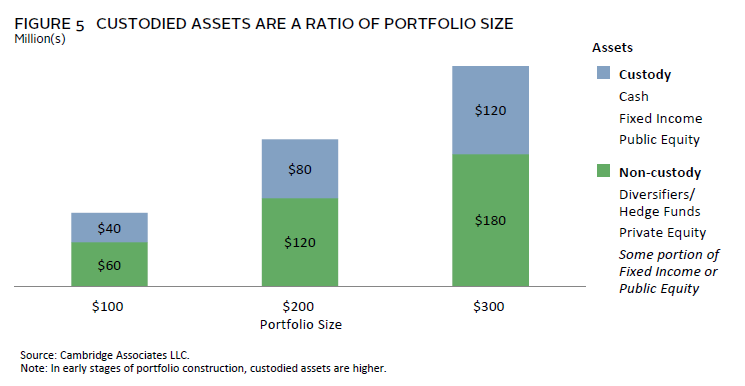

Large custodians target families with assets of $200 million or more. These banks generally have better online portals, more service options, investment capabilities, and superior customer service teams. However, they also have revenue targets to consider when taking on new business, so they prefer larger clients and typically charge around 5 basis points (bps) on market value. Mid-size custodians generally charge a higher fee of around 10 bps, but don’t have defined revenue targets by relationship. In some cases, these banks may want to maintain an existing relationship with the family if a third-party manager is brought in. Alternatively, families with smaller mandates can seek out smaller custodial account providers, which offer no-frills services with fees starting at around $12,000. Figure 5 approximates what percent of assets are custodied once a portfolio is built out and fully allocated to its asset class targets.

After electing whether to use a brokerage or custodian account, account-specific add-on services can be determined. If a custodian relationship is selected, families can opt to add accounting services, including alternative asset pricing, so they have an official book of record. This service is useful for tax purposes, as transaction records and tax document collection can be shared with the tax provider.

Performance reporting is another add-on service that many families use to compare data against that of investment service providers. However, if a family’s investment consultant provides performance reporting, they will want to confirm whether two sources of performance data are useful to them or if this is an unnecessary cost. Some custodians offer nominee services to investors, whereby assets are purchased in the name of the bank. This is done for specific reasons, such as maintaining privacy of holdings and managing administrative complexities between clients and their banks. As families determine what kind of accounts they need, they should consult their existing tax service providers to be sure they are meeting all the bank’s documentation and regulatory requirements. An investment manager can next review the final account structure and domicile information and help recommended which investment vehicles may be best suited.

Beyond selecting where assets will be housed, families often need to negotiate terms related to borrowing and lending. For example, they may have an interest in taking a line of credit against their assets or becoming involved in private lending. In such cases, it’s important to consider both the existing banking relationship and the service offerings of other banks to determine an optimal approach.

Lifestyle Services

Services such as property management, bill pay, and support personnel can serve as additional components of an investment infrastructure that are not related to the portfolio. In many cases, support personnel include individuals who are responsible for cash and balance sheet management and tax coordination. The time and convenience provided by such services can allow family members to focus on other priorities such as business ventures and philanthropic work. Other benefits of lifestyle services include additional risk management and enhanced privacy. Finding the right service level starts by defining the scope and objective of the work, be it office staffing, property management, or household and travel administration. It is important to partner with service providers that align with the family’s specific preferences.

Legal Representation and Structuring

In addition to choosing an investment account type or entity, families need to consider their legal representation and structuring needs. Investors need legal support to determine optimal investment structuring strategies and to review investment agreements as new ideas are evaluated. Asset protection is another key component of legal representation—including the use of trusts and limited liability entities. Families should work with legal professionals who have expertise in wealth management and understand their unique needs.

Likewise, determining a clear legal structure is essential for ensuring a smooth transfer of wealth to future generations. A comprehensive succession plan that addresses issues, such as leadership transition, governance structures, and other family dynamics, will help ensure continuity of the investment strategy and an enduring focus on the family’s key values. For these reasons, a family’s legal representation should also be well-versed in wills, trusts, power of attorney, and healthcare directives.

Tax Accounting and Reporting

Tax accounting and reporting is a crucial component of a family’s investment operations. Beyond ensuring compliance with tax laws and regulations—including income reporting, deductions, and capital gains rules—effective tax accounting can also help maximize an investor’s tax efficiency and preserve wealth. Tax laws and regulations are complex and change frequently. Tax advisors who specialize in working with family investors can help with meeting requirements and identify tax planning opportunities. They can also assist investment transaction record keeping, make it easier to prepare tax returns, and respond to any tax inquiries. In some cases, investment managers can work with custodian banks to help streamline the flow of tax documents to maximize efficiency.

Philanthropy

Many families choose to set up a family foundation as part of their wealth planning. This type of capital pool requires a distinct kind of portfolio management, one that adheres to a unique set of spending requirements and liability needs. It can be beneficial to work with a partner that has experience in managing the fund disbursement process and tracking ongoing commitments. Families can also work with a philanthropy advisor to help them define and implement their giving strategy. Philanthropy advisors specialize in helping families clarify their values, mission, and priorities. Having a well-defined philanthropic plan in place can give families greater confidence in their giving strategy.

Complexity Considerations

For families of significant wealth, complexity is a natural byproduct of a well-managed portfolio. Generally speaking, the infrastructure needed to properly support the daily, weekly, monthly, and annual operations of an institutional-caliber portfolio will parallel the portfolio’s size and scale. A relatively straightforward investment structure with few family partnerships can allow for easier implementation and support. By contrast, more complex investment structures—such as unique pooling vehicles to support the needs of many beneficiaries—require additional flexibility. These structures also usually require enhanced tax management and accounting services. Families should conduct a thorough assessment of their internal resources, including time, expertise, and willingness to engage in investment management. If the complexity outweighs the family’s capacity for effective management, simplifying the investment structure or seeking external expertise may be prudent. On balance, an investment framework’s multidimensionality should help—not hinder—the work of serving the family’s long-term financial goals.

Building Toward Success

If or when a family’s wealth picture changes, it may be time to take a step back and determine the right partners and processes for moving ahead. Building the right investment infrastructure will play a crucial role in helping to preserve and maintain wealth over the long term. Families should take care not to underestimate the amount of work that effective investment management and wealth governance involves. Identifying their unique areas of expertise will help to clarify the areas where collaboration and partnership can be best used. In all instances, costs should be commensurate to the value delivered.

As families navigate the complexities of wealth management, it is crucial to remain proactive in building and adjusting their investment infrastructure. We encourage families to regularly review their investment goals, governance structures, and service provider relationships to ensure they align with their evolving needs. Ultimately, family investors should feel safe in the knowledge that they are operating an institutional-caliber portfolio—confident that their capital is not only protected from undue risk but being put to work in the service of their unique ambitions and values.

Sean Sullivan, Senior Investment Director, Private Client Practice

Heather Jablow, Head of the Private Client Practice, North America

Kara Paluch and Garrett Walsh also contributed to this publication.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.