From Policy to Implementation: A Net Zero Playbook for Investors

The scientific community tells us that “climate change is a threat to human well-being” and that the window of opportunity to “secure a livable and sustainable future for all” is rapidly closing. 1 If we fail to act, there will be catastrophic impact on the global economy, asset values, and portfolio returns. This urgency is stimulating action from government and the private sector: over 70 countries and more than 3,000 businesses have made commitments to reach net zero emissions.

Meeting the goals of the 2015 Paris Agreement requires a complete transformation of the economy by 2050 into one with minimal greenhouse gas emissions. This is a gigantic, expensive task, putting climate at the center of economic, and hence investment, outcomes in the coming decades. We believe investors would benefit tremendously by staying ahead of the curve to build climate considerations into their risk management, as well as their search for opportunities. While climate awareness is essential for all investors, others seek to be more ambitious by adopting a net zero goal for their portfolios. This paper explains the rationale for doing so and outlines an approach for target setting and implementation. A net zero policy focuses on decarbonizing the real economy. Investors have two powerful levers to do this: (1) stewardship and engagement; and (2) climate solution investments.

From Climate Aware Investing to Net Zero

Climate awareness involves protecting the portfolio from the risks presented by climate change while investing in opportunities presented by a transition to a low-carbon economy. This approach is primarily focused on managing the impact of the world on the portfolio. Net zero investing, by contrast, reverses the causality and uses the portfolio to drive broad decarbonization in the real world. Importantly, both approaches seek to enhance returns by considering risk and reward in a transitioning world.

What Does “Paris-Aligned” Mean for Investors?

The 2015 Paris Agreement is a legally binding international treaty signed by 196 countries that sets goals to limit the global average temperature increase to 1.5°C by 2050. Achieving this target requires global emissions reductions of around 50% by 2030 and net zero by 2050. A Paris-aligned net zero investment strategy is both consistent with the expectation of net zero by 2050 and makes a proportionate contribution to making it happen by, for example, investing in renewables or influencing behavior changes among portfolio companies in high-emitting sectors.

Some investors’ rationale for taking a net zero approach is to use the portfolio to support their values and accelerate their mission. But long-term investors can share another motivation to follow this path: they cannot diversify away a systematic risk such as climate change, so it is in the best interest of the portfolio to mitigate it. Investors are part of a larger mosaic of stakeholder groups that need to play a part if this goal is to be achieved. Other important stakeholders include policymakers, regulators, and consumers as well as businesses.

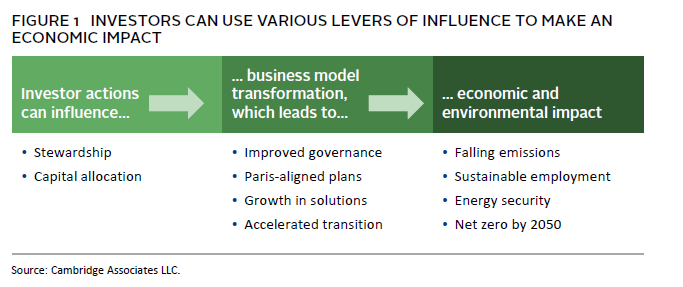

Essential Tools for Net Zero Investors: Stewardship and Capital Allocation

Stewardship in a net zero context includes proxy voting and engaging with management to align business plans and capital expenditure with Paris Agreement objectives. Capital allocation involves the more familiar tools of asset allocation and manager selection. Research shows that with large, established, and self-funding companies, engagement is a stronger lever for change than capital allocation. 2 The reverse is true where capital is constrained, as is the case with companies that are small, young, or in immature markets. 3 Investors can use each tool where it will make the biggest difference to one or more net zero policy objectives (Figure 1).

Setting Net Zero Policy

To ensure a portfolio is supporting a net zero objective requires a formal policy, which should build on the investor’s existing approach to measuring and managing climate risk. Setting a net zero policy is an essential governance step to align stakeholders and enable action. To guide policy and implementation decisions, we suggest the following principles.

- Leverage existing frameworks. The Paris Aligned Investment Initiative (PAII), Net Zero Asset Owner Alliance (NZAOA), and other organizations have thoughtful best practices to harness.

- Focus where it matters. Given an asset owner’s resources and constraints, focus on actions that will be most practical and effective. Concentrate on portfolio components with highest emissions reduction potential.

- Prioritize real-world emissions reductions. Don’t narrowly focus on minimizing portfolio emissions.

- Target portfolio transparency. Work with investment managers to understand the emissions of their investments and the managers’ approaches to reducing them, including voting and engagement.

- Drive long-term returns. Keep the focus on growing the investment portfolio.

- Embrace flexibility. There is no single “correct” approach that satisfies net zero in every area of the portfolio. Different asset classes benefit from different approaches, as methodologies and net zero guidance are evolving.

- Engage with the hard questions. Supporting decarbonization will mean staying involved in some of the highest-emitting sectors as an active shareholder, supporting change and solutions.

Best Practice Policy Objectives

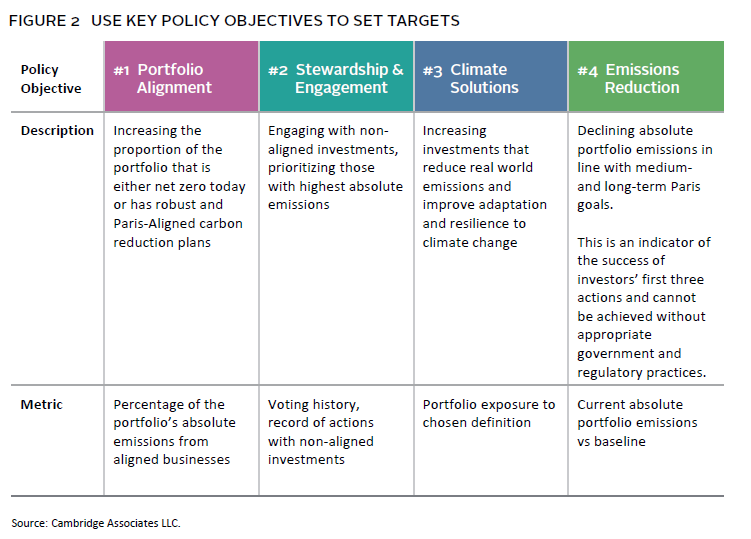

Much work has been done by investor collaborations around the world 4 to develop high-level policy objectives and reporting. This can be boiled down to four key objectives against which targets 5 can be set (Figure 2).

Climate aware investors may already employ certain tactics like investing in climate solutions and engaging with managers regarding climate risk, but not in a holistic framework aimed at Paris alignment. Figure 3 shows how the four key objectives of a net zero policy integrate with existing climate aware investing approaches.

Implementation

Implementation translates the objectives and tools of net zero policy into decisions within the familiar components of investment management. A net zero policy will impact all levels of the portfolio, from the first governance decision to adopt a net zero policy to potentially creating a new asset allocation target, such as renewable infrastructure. A net zero policy will also affect strategy selection, such as investing in climate tech venture capital or thematic public equity in companies with the most ambitious transition plans. The real work begins, however, at the manager selection stage.

Manager Selection for Net Zero

Many asset owners implement their portfolios through third-party managers; careful selection of those managers is the primary way to express a net zero policy. We believe all investors benefit from integrating climate awareness into investing in a way that is both appropriate to their mandate and has a well-explained impact on investment decisions. For a net zero allocator this could mean, for instance, switching a passive equity manager to one with superior voting and engagement resources on climate, or upgrading an active equity manager to one with better climate competence that engages robustly with portfolio companies. We present several additional selection criteria for net zero investors that emphasize transparency and evidence of progress; not all will be as relevant to every manager or strategy.

- Net zero targets or participation in investor climate initiatives, such as the Net Zero Asset Managers Initiative.

- Comprehensive and clearly reported stewardship activities, such as engagement and voting, that promote Paris alignment through science-based targets, ideally with evidence of effectiveness.

- Clearly reported and intentional capital allocation to climate solutions, with evidence that the solutions are displacing emissions from legacy technologies and providing additional progress to real-world decarbonization.

- Clearly reported understanding of the extent to which portfolio companies have science-based targets or are in the process of aligning toward Paris goals.

- Clear reporting of scope 1, scope 2, and (where possible) scope 3 portfolio emissions with evidence of how this influences investment choice and the extent to which the emissions trajectory is Paris aligned. 6

Capital Allocation to Climate Solutions

Investing in climate solutions involves allocating capital to activities that reduce emissions and improve adaptation and resilience to climate change. 7 This broad definition encompasses many themes (e.g., water, land use, transportation, energy systems) and many types of capital (e.g., equity, project finance, grants, debt). Climate solutions span lower risk (e.g., infrastructure) to higher risk (e.g., climate tech venture) opportunities. Climate tech venture and growth equity are areas with the most obvious potential to enhance long-term returns, and manager selection in these sectors is critical.

A key characteristic of climate solutions investment in a net zero framework should be “additionality.” They should ideally provide new primary capital to fund innovation or expand businesses and infrastructure that will avoid current or future emissions. Private investments are often additional if they are financing growth rather than refinancing existing investors; public investments can also be additional if deployed in situations, like in emerging markets economies or smaller, immature businesses with less liquid securities. On the other hand, investing in large, liquid, and self-financing companies is unlikely to have much impact on their activity, and therefore additionality, even if they are in target sectors.

A comprehensive net zero framework requires investors to understand their exposure to climate solutions and set a goal to increase them over time. The most impactful and profitable approach is likely to be opportunistic rather than bucket-filling. We advise allocators to be flexible about annual exposure while working toward a target. 8 Keep in mind that contributing “a proportionate” amount to climate solutions likely means rapidly increasing exposure to climate solutions between now and 2030.

High-Emission Sectors and Strategies

Mature companies in high-emitting sectors need shareholder pressure and support to adopt aggressive climate transition plans, including setting science-based targets with third-party ratification (e.g., via the SBTi). We believe selling out of such companies to reduce financed emissions has little to no impact on real-world emissions and in fact misses the opportunity to support change. Managers and strategies with exposure to high-emitting sectors can still form part of a net zero strategy if they include a credible engagement program targeting Paris alignment. The proviso is that the manager does undertake substantive engagement, including in extremis voting against directors and filing climate-friendly resolutions.

Engaging With Managers & Policymakers

Manager-to-company is not the only important channel of net zero engagement. Since allocators rely on investment managers for much of the net zero implementation, the allocator voice is critical in ensuring asset managers deliver on the net zero objective. Moreover, engaging with managers on net zero can stimulate the creation of new products and strategies. One investor seeding a climate solution strategy can multiply its impact if others follow. Likewise, investors are just one player in the net zero transition. The Paris goals cannot be achieved without supportive policy and regulation. Investor engagement with industry collaborations and regulators is also an important part of a comprehensive net zero policy.

Measuring Portfolio Emissions and Alignment

Tracking carbon emissions is a check on the portfolio against real-world progress toward net zero by 2050. Third-party data providers offer public equity carbon footprints sourced from public company documents, and we expect it will become standard reporting by managers in the next few years. With few private companies disclosing their carbon footprints, methodologies to estimate private investment emissions are less developed but evolving quickly.

The expectation is for absolute emissions to decline and for exposure to Paris-aligned investments to rise such that any emissions in the portfolio by 2040 are from sources that are Paris aligned, as per the theoretical Figure 4. Investments in solutions—especially industrials or infrastructure—may cause a portfolio’s near-term footprint to rise, but that is not a concern provided these investments are Paris aligned.

Portfolio Paris alignment, a rather immature but fast-evolving metric, can best be assessed through the proportion of holdings with targets verified by the SBTi or Transition Pathway Initiative (TPI) databases.

Collaborative Approaches

Investors can amplify their voice by actively participating in industry collaborations such as the Institutional Investors Group for Climate Change (IIGCC) and Ceres. These groups are critical for linking investment activity with other private sector and public policy initiatives, helping to ensure global alignment for net zero.

Timing & Scope

Don’t bite off more than you can chew; some asset classes or strategies may simply be out of scope today because there is no data or industry practice for assessing emissions and alignment (e.g., macro hedge funds). There is no shame in explicitly excluding certain parts of the portfolio today, or elements of data in a net zero policy, provided an effort is made to add them in the future as methodologies develop. The important thing is to start making a real-world contribution and then seek to improve. To add structure to the intent to improve, it is good practice to review net zero policies annually, reporting on progress against targets and identifying areas for improvement.

Conclusion

The world cannot meet the goals of the Paris Agreement unless investors play their part in enabling and incentivizing change. Developing and implementing a net zero policy fulfills this role but presents several challenges, which can be overcome by taking a principles-based approach and focusing on what investors can control. Many related concepts—including fossil fuel divestment, performance benchmarking, target setting, and portfolio monitoring—merit more in-depth discussion. To get started, we emphasize that while absolute portfolio emissions are a necessary check on the portfolio over time, this is not the main show. Engaging with managers, portfolio companies, and the broader industry, as well as allocating capital to climate solutions, are the best ways to implement a diversified, equity-oriented portfolio that is resilient in the face of a warming world and contributes to real-world climate solutions.

Notes on the Data

IPCC, 2022: Summary for Policymakers [H.-O. Pörtner, D.C. Roberts, E.S. Poloczanska, K. Mintenbeck, M. Tignor, A. Alegría, M. Craig, S. Langsdorf, S. Löschke, V. Möller, A. Okem (eds.)]. In: Climate Change 2022: Impacts, Adaptation and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [H.-O. Pörtner, D.C. Roberts, M. Tignor, E.S. Poloczanska, K. Mintenbeck, A. Alegría, M. Craig, S. Langsdorf, S. Löschke, V. Möller, A. Okem, B. Rama (eds.)]. Cambridge University Press, Cambridge, UK and New York, NY, USA, pp. 3–33, doi:10.1017/9781009325844.001.

Kölbel, Julian and Heeb, Florian and Paetzold, Falko and Busch, Timo, Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact (July 20, 2019). Kölbel, Julian F., Florian Heeb, Falko Paetzold, and Timo Busch. in press. ‘Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact’. Organization & Environment.

Footnotes

- Intergovernmental Panel on Climate Change Working Group 6 report, 2022. See Notes on the Data for the full citation.

- For a review of the literature see “Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact.” See Notes on the Data for the full citation.

- However big the investor, selling or buying shares in mature and self-funding companies is unlikely to materially change their cost of capital or their business decisions.

- Such as PAII, NZAOA, or Science Based Targets initiative (SBTi).

- For more on target setting and metrics see The Institutional Investors Group on Climate Change, “Paris Aligned Investment Initiative’s (PAII) Net Zero Investment Framework Implementation Guide,” section 5, page 10, March 2021.

- “The Greenhouse Gas Protocol classifies a company’s greenhouse gas emissions in three ‘scopes’: Scope 1 emissions are direct emissions from owned or controlled sources. Scope 2 emissions are indirect emissions from the generation of purchased electricity. Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.”

- The Climate Policy Initiative— a global nonprofit organization dedicated to helping governments, businesses, and financial institutions drive economic growth while addressing climate change—developed the Global Landscape of Climate Finance that tracks investments in climate solutions.

- Public net zero frameworks from PAII or NZAOA require a formal target.