ESG Challenges and Opportunities in Chinese Equities

Investor interest in China has grown over the years as China’s economy expanded and the market opened up to foreign capital. However, environmental, social and governance (ESG) issues remain a key concern for many investors.

This paper provides an overview of how Chinese public companies rate in ESG metrics and discusses how investors can incorporate ESG factors when investing in Chinese public equities. While Chinese companies currently have among the lowest ESG ratings globally, the ratings have been improving over time. Furthermore, evidence suggests that higher ESG-rated companies perform better than low-rated companies in China, supporting the findings in our 2016 paper that ESG-based stock selection can add value in emerging markets equities. However, adopting a pure ratings-based investment approach in China is problematic given lower levels of ESG disclosure and a lack of standardization of the reported metrics. In integrating ESG considerations in China, it is perhaps more important for investors to understand the material risks involved and how fund managers address these considerations in their portfolio construction.

China Has Low But Improving Rates of Voluntary Disclosure

In 2019, Bloomberg published a compilation of ESG disclosure data for more than 11,500 public companies trading on major exchanges across 25 countries. Using data points collected from published disclosures, news items, and third-party research, Bloomberg found that China ranked among the lowest in terms of ESG disclosure.

A low rate of information disclosure creates difficulties for investors and asset managers to integrate ESG considerations into their investment process for Chinese firms. Nondisclosure and a lack of standardization on the metrics reported by Chinese companies could lead to an inaccurate assessment of how a firm compares against its domestic and global peers on key ESG issues.

However, ESG disclosure in China has increased over the past decade. A study by UNEP FI/PRI (United Nations Environment Programme Finance Initiative) found the percentage of companies in the Shanghai-Shenzhen CSI 300 Index that provided some form of voluntary ESG data disclosure through annual sustainability reports, nearly doubled between 2009 and 2018, from 43% to 82%. This is in part due to the opening of China’s markets, which has helped Chinese companies to recognize the benefits of information disclosure in attracting foreign capital. It also follows government policy pushes toward greater transparency in disclosing ESG risks. For instance, in May 2021, the China Securities Regulatory Commission (CSRC) published a consultation on revised disclosure requirements in annual and semi-annual reports for listed companies in China. Items proposed by the CSRC include a new Environmental and Social Responsibility chapter that will require the mandatory disclosure of any environmental-related penalties, as well as enhancements to the current corporate governance chapter to standardize disclosure and improve transparency.

ESG Scores in China Are Low Relative to Global Peers

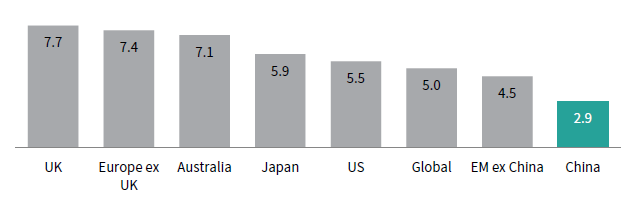

Investor concerns regarding ESG practices in China are not unfounded. MSCI ESG Research data show that China ranks 47 out of the 50 countries in the MSCI All Country World Index (ACWI), with a median Industry-Adjusted Score of 2.9, out of a scale of 0 to 10 (Figure 1). 1 Only Peru, Qatar, and Egypt score lower than China on this metric.

FIGURE 1 MEDIAN ESG SCORE IN CHINA IS LOW

As of June 30, 2021

Sources: Factset Research System and MSCI ESG Research. MSCI data provided “as is” without any express or implied warranties.

©2021 MSCI ESG Research LLC. Reproduced by permission.

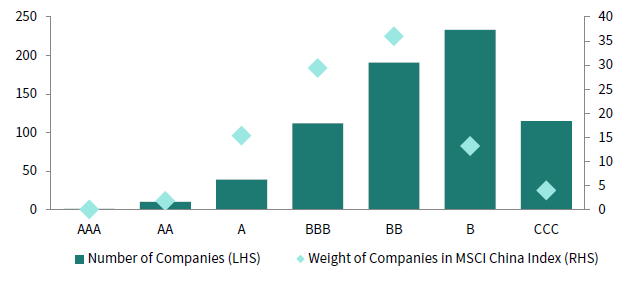

China’s low median score arises from the fact that a significant portion of the companies in the MSCI China Index are considered “ESG laggards” relative to their global peers, with a MSCI ESG rating of B or CCC. As seen in Figure 2, the distribution of ESG ratings in the MSCI China Index 2 is negatively skewed. As of June 2021, just ten companies representing 1.9% of the rated companies in the MSCI China Index are considered “ESG leaders,” with a rating of AAA or AA. In contrast, close to half of the companies are rated B or CCC. However, these lower-rated companies are also the smaller companies in the index, making up just 17% of the index’s weight. The majority of China’s larger companies, such as Alibaba, Tencent, and Meituan, are currently rated as “ESG average” by MSCI.

FIGURE 2 MANY COMPANIES IN CHINA HAVE BELOW AVERAGE ESG RATINGS

As of June 30, 2021

Sources: Factset Research System and MSCI ESG Research. MSCI data provided “as is” without any express or implied warranties.

©2021 MSCI ESG Research LLC. Reproduced by permission.

Notes: Data are shown for the 701 rated companies in the MSCI China Index. Index weights are normalized based on the rated universe of companies in the MSCI China Index.

For Chinese companies with a B or CCC rating, an overview of the common issues challenged by the environmental, social, and governance pillars is as follows:

Environmental Pillar: Chinese companies rank lower than their global peers across a broad range of issues, such as carbon emissions and toxic emissions & waste. However, stricter environmental policies have seen incremental positive developments in terms of climate change, as reflected in China’s carbon intensity both at the national level (CO2 emissions/GDP) and at the corporate level (CO2 emissions/sales), which have been trending down over the past decade.

Social Pillar: Chinese companies have some of the lowest social-pillar ratings relative to global peers. One area in which Chinese companies received a heavier penalty is privacy & data, indicating lower privacy and internal data security management systems and higher occurrence of data breaches and/or privacy-related controversies. In addition, lower health & safety scores reflect a higher risk of health and safety accidents that can lead to production disruptions, litigation, and liabilities.

Governance Pillar: In terms of corporate governance, Chinese companies generally scored lower when it comes to board and pay. One of the concerns relating to board performance is independence, as many companies lack an independent majority of board members (55% for MSCI China Index versus 33% for the MSCI ACWI constituents). This issue is compounded if the company has a controlling shareholder, which is the case for many of the state-owned companies and founder-led firms in China, as it reduces the influence of minority shareholders. A main issue regarding pay was the lack of executive pay disclosure, with 59% of the companies in the MSCI China Index flagged versus 37% in the MSCI ACWI.

In addition to corporate governance concerns, Chinese companies also score lower on the corporate behavior front, indicating higher risks surrounding items such as fraud, executive misconduct, antitrust violations, or tax-related controversies.

However, the lower ESG ratings in China could also reflect the fact that China has lower levels of disclosure as compared to other countries. A key component of MSCI’s ESG rating is the assessment of risk management surrounding 35 key issues, which requires ESG-specific company disclosure. When no disclosure is available, MSCI does not assume that the company’s performance is the “worst,” but the methodology does impute a performance level that is below average in the industry context. For instance, under the health and safety issue, the model uses a score of “3” for companies that fail to disclosure injury or fatality rates, so a company that has a low rate of workplace incidents but does not disclose its data will be penalized, while a company with a very poor safety management record could score higher than it should. The impact of variances in disclosure standards on ratings is one of the reasons why a pure ratings approach is less useful for ESG investing in China.

ESG Ratings Differ Within China

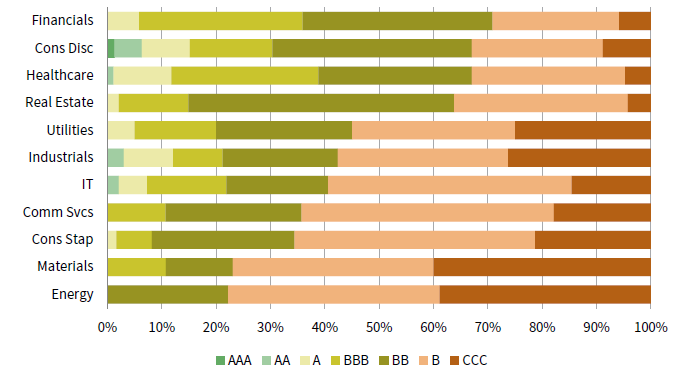

Although China’s ESG scores are low in aggregate, ESG ratings within China vary across sectors (Figure 3). In particular, Chinese companies in the materials and energy sectors have among the lowest ESG scores relative to their global peers, with around 80% of the companies in these two sectors having B and CCC ratings. Many of the materials companies are involved in the mining industry and have issues relating to pollution, water stress, and toxic emissions & waste, while energy companies in China (which are predominantly coal or oil & gas–related companies) are flagged for similar issues. Corporate governance is also a concern for many of the energy companies due to board and executive pay issues.

FIGURE 3 DISTRIBUTION OF ESG RATINGS DIFFER ACROSS SECTORS IN CHINA

As of June 30, 2021

Sources: Factset Research Systems and MSCI ESG Research. MSCI data provided “as is” without any express or implied warranties.

©2021 MSCI ESG Research LLC. Reproduced by permission.

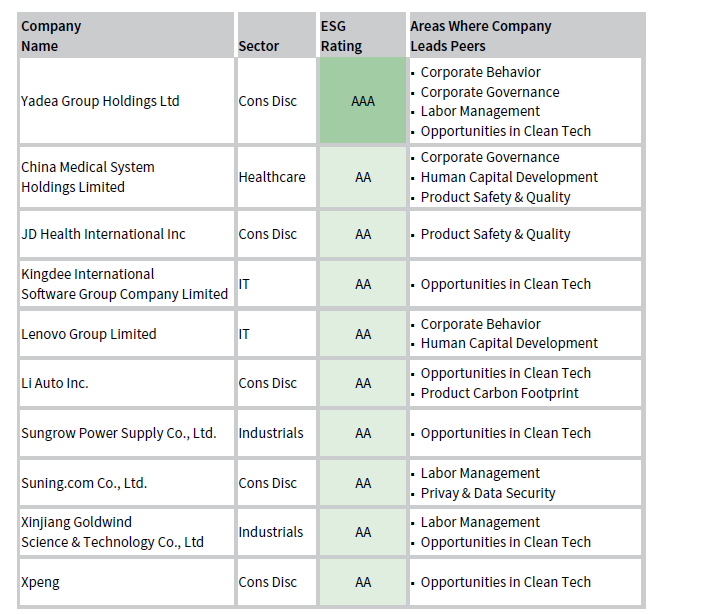

On the other hand, consumer discretionary and healthcare are two sectors that see a more positive distribution of ESG ratings and a lower proportion of B- and CCC-rated companies. These two sectors, along with information technology and industrials, are also where the handful of China’s AAA- and AA-rated companies can be found (Figure 4). These companies are predominantly Chinese technology companies focused on online platforms or clean technology, and many of them also have strong corporate governance practices and oversight of issues within the social pillar. Yadea Group Holdings Ltd, an automobile company, stands out as being the only AAA-rated Chinese company by MSCI in this list. Yadea Group manufactures and sells two-wheel electric vehicles, and demonstrates positive practices in terms of product carbon footprint and clean technology efforts. The company is also assessed to lead domestic peers in governance issues.

FIGURE 4 CHINA’S ESG LEADERS ARE FOUND IN A FEW SECTORS

As of June 30, 2021

Source: MSCI ESG Research. MSCI data provided “as is” without any express or implied warranties.

©2021 MSCI ESG Research LLC. Reproduced by permission.

Finally, the distribution of ESG ratings is changing within China across time, with incremental improvement appearing across the market. The proportion of Chinese companies with a CCC rating has declined from 22% in 2018 to 16% as of June 2021, whereas those with a B rating has declined from 37% to 33% over the same period. The corresponding increase has been mainly in the BB category (6% over the period), although we note that there are improvements across the board for the higher ratings, as well.

Do Higher-Rated ESG Companies in China Outperform?

Aside from helping investors to align their investment objectives and concerns, one argument for integrating ESG considerations is that it may provide investors with higher risk-adjusted returns. Companies with positive ESG practices that actively seek to reduce their risks of incurring financial penalties (e.g., pollution fines, accident compensations) or participating in fraudulent behavior are arguably in a better position to deliver sustainable returns over the long run.

To analyze if higher ESG-rated companies in China have outperformed, we divided the constituents of the MSCI China Index into three categories—leaders (AAA–AA), average (A–BB), and laggards (B–CCC)—and used the median price return in each category as a proxy. The results are shown in Figure 5. Over the past 12 months ending June 2021, the median leader Chinese company demonstrated a meaningfully higher return of 83%, whereas the average and the laggards achieved lower and similar returns of 18%. The trend is similar for the trailing three-year period, with the leaders outperforming the lower ESG-rated companies. Over the trailing five-year period, however, the data are more mixed, showing similar returns across all categories and the laggards modestly outperforming the leaders by 40 basis points.

FIGURE 5 CHINA’S ESG LEADERS HAVE OUTPERFORMED THE LAGGARDS

As of June 30, 2021 • Price Return (%)

Sources: Factset Research System and MSCI ESG Research. MSCI data provided “as is” without any express or implied warranties.

©2021 MSCI ESG Research LLC. Reproduced by permission.

Note: Data reflect the median trailing year return of companies within each assigned rating. Ratings are as of June 30, 2021, and are assumed to be held constant over the trailing year periods. The number of companies (including multiple share classes) with each assigned rating as of June 30, 2021, are as follows: AAA = 1, AA = 10, A = 39, BBB = 112, BB = 191, B = 233, and CCC = 115. Returns are annualized for periods of more than one year.

A key simplifying assumption made in this analysis is that the constituents of the MSCI China Index and their ESG ratings (which are as of June 2021) are held constant across the trailing periods. Thus, the analysis does not account for any changes in ESG rating upgrades or downgrades. Additionally, the dataset for higher-rated companies is small, particularly in the trailing three- and five-year periods, which limits the robustness of the analysis. Lastly, we recognize that sectoral and style factors may also be at play, given that the ESG leaders in China tend to fall within the technology sector, which has generally outperformed materials and energy over the periods of analysis, although these stocks have been recently hit by the regulatory reforms in China. However, as discussed in our 2016 paper “The Value of ESG Data: Early Evidence for Emerging Markets Equities,” stock selection based on ESG quality can be a meaningful factor in driving excess returns in emerging marekts equities even after accounting for sectoral and style biases. A key driver is the governance quality, which is a material ESG risk factor in China and plays an important role in determining the long-term operational sustainability of these companies.

In addition to ratings-level performance, we also looked at the index-level performance of the MSCI China ESG Leaders Index, 3 which is a capitalization-weighted index that provides exposure to companies with higher ESG ratings. Companies must have and maintain a MSCI ESG rating above B to be eligible for inclusion in the index. Index constituents are also subjected to controversy screens and business involvement screens. 4 The latter implies that companies involved in severe and ongoing issues such as human rights concerns and bribery and fraud are screened out from the index.

Figure 6 shows that the MSCI China ESG Leaders Index has meaningfully outperformed broader Chinese equities. From the index’s launch date of July 2013 to June 2021, the MSCI China ESG Leaders Index had an annualized return of 16.0% versus 11.0% for the MSCI China Index, with essentially the same volatility. A main driver of the outperformance was exposure to Chinese internet companies and especially Tencent Holdings, which had an average weight of 31% in the MSCI China ESG Leaders Index and contributed 50% of the index’s performance over the period. Nonetheless, even excluding Tencent from the two indexes, the MSCI China ESG Leaders Index would have still outperformed the MSCI China Index over the period (10.4% versus 8.6%), and similarly if we excluded both Tencent and Alibaba (12.1% versus 8.0%).

FIGURE 6 MSCI CHINA ESG LEADERS INDEX HAS OUTPERFORMED

As of June 30, 2021

Sources: Factset Research System, MSCI Inc., and Thomson Reuters Datastream. MSCI data provided “as is” without any express or implied warranties.

Notes: Total return and volatility data are net of dividend taxes. Annualized figures are based on monthly data from July 31, 2013 to June 30, 2021.

Yet, both Tencent and Alibaba are rated “average” relative to global industry peers on ESG standards. Thus, this index reflects the challenges in using a ratings- and rules-based ESG strategy in China. As the ESG Leaders Index’s country-level construction methodology is based on the stock’s free float–adjusted market capitalization rather than its ESG score, the result is that the index’s performance is not necessarily driven by the “best-in-class” companies. In the MSCI China ESG Leaders Index, the top ten constituents accounted for 72% of the index’s weight as of June 2021, but all of them have an average ESG rating of between BB and A; so while not “laggards,” they are not necessarily “leaders.”

As a result, the sector composition of the MSCI China ESG Leaders Index is different. For China, a large portion of the market’s energy and materials sectors (which are mostly companies with B and CCC ratings) is screened out. Indeed, we see that as of June 2021, the MSCI China ESG Leaders Index is overweight for consumer discretionary, communication services and healthcare, with minimal exposure to companies in the energy and materials sectors (Figure 7).

FIGURE 7 SECTOR COMPOSITION OF THE MSCI CHINA ESG LEADERS INDEX IS DIFFERENT

As of June 30, 2021 • Percent (%)

Sources: Factset Research Systems and MSCI Inc. MSCI data provided “as is” without any express or implied warranties.

Overall, the findings in this section are mixed. The ratings-level analysis showed that higher ESG-rated companies outperformed over trailing one- and three-year periods but not across the trailing five-year period. The index-level analysis, which uses a different time period, showed meaningful outperformance of the MSCI China ESG Leaders Index since the inception of the index. The variance in results is in part due to the beginning- and end-point sensitivity of all return-based analyses. Given the short dataset, it may be too soon to definitively conclude that ESG leaders (i.e., AAA- and AA-rated companies) in China outperform. However, evidence suggests that excluding the lowest ESG-rated and controversial companies, and reweighting across the higher ESG-rated companies, can lead to higher risk-adjusted returns.

Factoring in Controversies

Investors allocating capital to China may also be concerned with headline risks related to the actions of specific companies, or have broader concerns relating to controversial Chinese government policies that factor into their capital allocation decisions. In this aspect, integrating ESG considerations into the investment process, or investing with managers that do so, may help to provide some level of comfort. For instance, in the MSCI China ESG Leaders Index, companies that have been flagged for alleged involvement in surveillance issues in the Xinjiang Uyghur Autonomous Region are excluded. One example is iFlytek Co., Ltd, which has an ESG rating of BB as of June 2021 but fails the controversies assessment. Hangzhou Hikvision is another company that has been flagged for activities in Xinjiang, and has been removed from many ESG-focused products and indexes.

However, investors should be aware that these measures cannot definitively prevent headline risks, as ESG ratings and controversies scores are lagging indicators dependent on the availability of news and research reports. Therefore, a company’s rating or controversy flag may only be affected after the release of any controversial news. If index-driven approaches are backward looking, then active approaches tend to be more forward looking or able to react quicker to new developments.

Integrating ESG Considerations in Chinese Equities: Implementation Challenges

In this section, we consider implementation options for investors thinking about investing in Chinese equities through an ESG approach and discuss the potential challenges associated with each approach. We consider three possible options:

- A screening-based approach,

- A passive approach via the tracking of an ESG equity index, and

- An actively managed integrated approach, where ESG factors are deemed to play a material role in determining the long-term risk and return of securities.

Screening-based approaches are designed to exclude investor exposure to certain controversial business activities. Depending on the investors’ needs, these can be based on a single factor (e.g., ex fossil fuels) or based on a set of values (e.g., socially responsible screens, which encompasses factors such as child labor, gambling, tobacco). These screens are useful for investors with certain investment mandates, but the strategies do not necessarily result in portfolios that tilt toward “best-in-class” companies or avoid poor ESG companies outside of the screened factor.

The second option involves an ESG ratings rules-based index approach that aims to track higher ESG-rated companies. Our earlier analysis showed that such an approach in China provides a different sectoral exposure and has historically had a positive impact on performance. In terms of implementation, however, we identify several challenges with passive strategies that rely on a pure ratings approach:

- Low levels of ESG disclosure in China and a lack of standardized reporting metrics impact the rating assessment. A company with positive ESG practices may be unrated or inaccurately rated due to poor disclosure.

- A single company’s ESG rating may vary across different rating providers due to different environmental, social, and governance issues and the weights assigned to these issues. A study by the MIT Sloan School of Management found that across a dataset of five ESG raters, the average correlations between the scores of more than 800 companies was 0.61. (In contrast, correlations on credit ratings from Moody’s Investors Service and S&P Global Ratings are at 0.99.) Investors need to be cautious about the underlying key issues and weights when relying on a single rating provider’s score.

- Using MSCI’s rating methodology as an example, Chinese companies are assessed in relation to global peers. However, less distinction is made for how a company performs relative to its domestic peers. Holdings diversification may also be an issue given the limited number of high-rated ESG stocks in China in the global context.

For the third option on active strategies, the issues raised above hold, as well. Given the lack of standardized data, a ratings approach calibrated toward global standards may not work as well in China. We see this among ESG-focused managers with a broad Asia or emerging markets mandate that often have a significant underweight to China. Part of the reason may be due to the managers’ overall investment approach and country-allocation decisions, but another reason is due to lower levels of ESG disclosure in China, which limits the data collection and assessment process. Consequentially, these managers tend to be overweight other countries, such as India, whereby companies have longer operating histories and better disclosure standards. Additionally, since a large proportion of Chinese companies are deemed to be of poorer ESG quality compared to their global peers, there tends to be a higher overlap in commonly held highly rated ESG names amongst these Asia and emerging markets mandates.

For dedicated China managers, ESG strategies remain in the nascent stage of development. According to a 2019 Asset Management Association of China survey, only 16% out of the 324 surveyed asset managers have a formalized ESG investment policy or process in place. Nonetheless, for dedicated China managers that have ESG integration policies in place, a key advantage is their on-the-ground knowledge and analysis of variances in ESG practices within Chinese companies, which is important given that material ESG risks in China can be different from those in developed markets due to different regulatory standards and social development needs. Consequently, their portfolio holdings can differ significantly from the ESG indexes (i.e., they can hold stocks that are not rated by external rating agencies or stocks that are lower-rated due to differences in views on ESG practices), offering investors diversification potential and the ability to invest in companies that are domestic leaders or improving their ESG practices before they are on the radar of global investors.

Furthermore, a common theme among these managers is emphasis on governance, with management teams’ reputation and practices viewed as a material factor in the early identification of corporate misconduct and controversial activities. This provides an advantage over third-party data providers, for which controversies are a lagging indicator. While this is not a guarantee that investors can avoid headline risks, it can provide investors with higher comfort knowing that preemptive measures are being taken to filter out controversial companies.

Conclusion

While China’s ESG disclosure and scores remain low, we expect these to improve over time as disclosure requirements become stricter and Chinese companies become more aware of the importance of positive ESG practices in attracting foreign capital. The quality of China’s ESG data (e.g., data accuracy and completeness) is also expected to improve due to regulations requiring standardized disclosure of ESG risks.

Based on historical returns, reducing exposure to lower-rated companies and overweighting higher-rated companies in China has resulted in a higher risk-adjusted return. Part of this may be driven by sectoral and style biases given the overweight to the technology sector, and relative performance may change as the market cycle evolves. However, over the long run, an ESG approach in China may still provide opportunities for outperformance, as companies that actively seek to reduce their exposure to ESG risk factors remain in a better position to deliver sustainable returns for investors.

Perhaps more importantly, the integration of ESG in China may allow for investors to better understand material risks, thus giving investors more comfort in investing in China. Using a pure ratings-based approach can be challenging given the variances that arise from nuances in ratings methodologies. While some of these may improve over time as disclosure standards in China improve, it may still be some time before Chinese companies catch up to global peers on data disclosure and transparency.

Thus, active strategies that invest in China via an ESG approach may need to customize their assessment rather than rely on a global framework. In this respect, we see that managers that have the ability to dedicate resources to focus exclusively on China and apply a local lens to identify material ESG issues may be in a better position to navigate risks.

Vivian Gan, Investment Associate

Aaron Costello, Managing Director

Appendix

MSCI ESG KEY ISSUE HIERARCHY

As of November 2020

Source: MSCI ESG Research. MSCI data provided “as is” without any express or implied warranties.

©2021 MSCI ESG Research LLC. Reproduced by permission.

MSCI CONTROVERSIES COVERAGE STAKEHOLDER PILLARS AND INDICATORS

As of June 2021

Source: MSCI ESG Research. MSCI data provided “as is” without any express or implied warranties.

©2021 MSCI ESG Research LLC. Reproduced by permission.

MSCI CONTROVERSIAL BUSINESS SCREENING CRITERIA

As of June 2021

Source: MSCI ESG Research. MSCI data provided “as is” without any express or implied warranties.

©2021 MSCI ESG Research LLC. Reproduced by permission.

Index Disclosures

MSCI All Country World Index

The MSCI ACWI is a free float–adjusted, market capitalization–weighted index designed to measure the equity market performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 27 emerging markets. It covers more than 3,000 constituents across 11 sectors and approximately 85% of the free float–adjusted market capitalization in each market. The developed markets country indexes included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The emerging markets country indexes included are: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

MSCI China Index

The MSCI China Index is the China exposure currently included in the ACWI. It comprises Chinese companies listed in Hong Kong (70%), the United States (18%), and mainland China (13%) (Numbers do not sum to 100 due to rounding). Thus, the analysis in the paper does not focus solely on mainland listed or “A-share” companies.

MSCI ESG Rating

The MSCI ESG Rating is designed to measure a company’s resilience to long-term, industry material environmental, social and governance (ESG) risks. We use a rules-based methodology to identify industry leaders and laggards according to their exposure to ESG risks and how well they manage those risks relative to peers. MSCI ESG Ratings range from leader (AAA, AA), average (A, BBB, BB) to laggard (B, CCC). Equity and fixed income securities, loans, mutual funds, ETFs, and countries are also rated.

MSCI Global Sustainability Indexes

MSCI’s Global Sustainability Indexes, of which the MSCI China ESG Leaders Index is a part, are constructed by including companies with the highest broad ESG ratings representing a target of 50% of the market capitalization in each sector of the parent standard index. Detailed methodology is laid out in MSCI’s November 2016 “Global Sustainability Indexes Methodology” report.

Shanghai-Shenzhen CSI 300 Index

The CSI 300 Index is a free-float weighted index that consists of 300 A-share stocks listed on the Shanghai or Shenzhen Stock Exchanges. The index has a base level of 1,000 on December 31, 2004. This ticker holds prices fed from the Shenzhen Stock Exchange.

Footnotes

- The Industry Adjusted Score is a company’s weighted average ESG score calculated from 35 underlying key issues (see the Appendix) identified by MSCI and normalized by industry. These, in turn, correspond to a MSCI ESG rating that ranges from AAA—AA (ESG Leaders) to B—CCC (ESG Laggards). Detailed methodology is laid out in MSCI’s November 2020 “ESG Ratings Methodology” report.

- The MSCI China Index is the China exposure currently included in the ACWI. It comprises Chinese companies listed in Hong Kong (70%), the United States (18%), and mainland China (13%) (numbers do not sum to 100 due to rounding). Thus, the analysis in the paper does not focus solely on mainland-listed or “A-share” companies.

- MSCI’s Global Sustainability Indexes, of which the MSCI China ESG Leaders is a part, are constructed by including companies with the highest broad ESG ratings representing a target of 50% of the market capitalization in each sector of the parent standard index. Detailed methodology is laid out in MSCI, “Global Sustainability Indexes Methodology,” 2016.

- More details on the controversy screens and business involvement screens are provided in the Appendix.