Endowment Radar Study 2024: Why Colleges and Universities Have Endowments

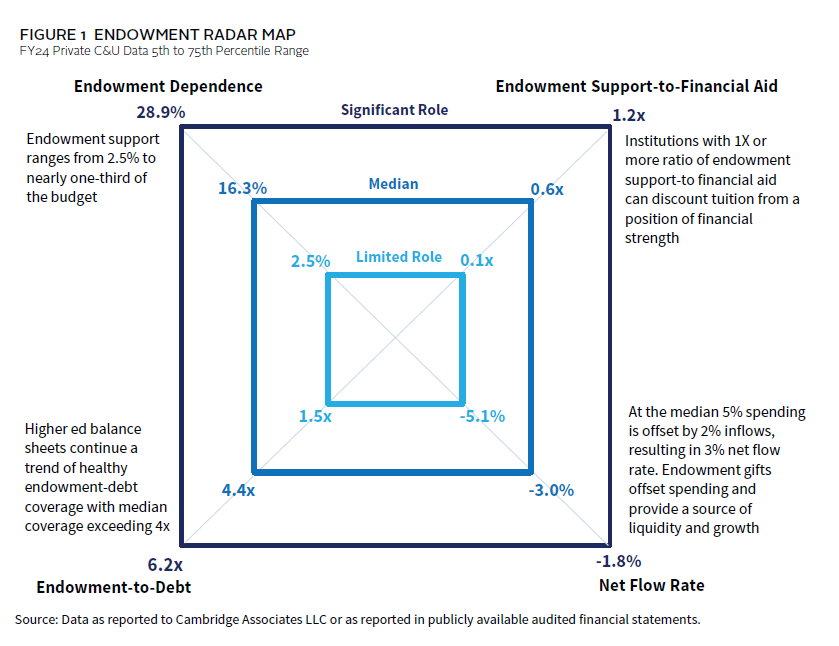

The initial months of 2025 have been extraordinary for higher education. Colleges and universities are facing questions about their missions, policies, curricula, and why they have endowments. While endowment wealth is in the headlines and crosshairs, the purpose of endowments can be lost, under the radar one might say. The 2024 Endowment Radar Study 1 highlights that endowment funds are not in the business of making money—they are in the business of giving money away. Endowment spending is a dependable source of revenue that pays for teaching and research and reduces reliance on student fees and annual fundraising appeals.

This note highlights the key takeaways in the 2024 Endowment Radar Study and concludes with commentary about the role of the endowment going forward in a more challenging environment.

In 2024, endowments continued to deliver essential funding and stability for the nonprofit businesses of colleges and universities. The majority of institutions in our study:

- Relied on endowment funding to balance the budget of a nonprofit business model.

- Increased endowment spending to fund the growing costs of delivering higher education and making education affordable and accessible.

- Increased funding of financial aid and increased the tuition discount rate.

- Maintained a healthy balance sheet and limited growth of debt.

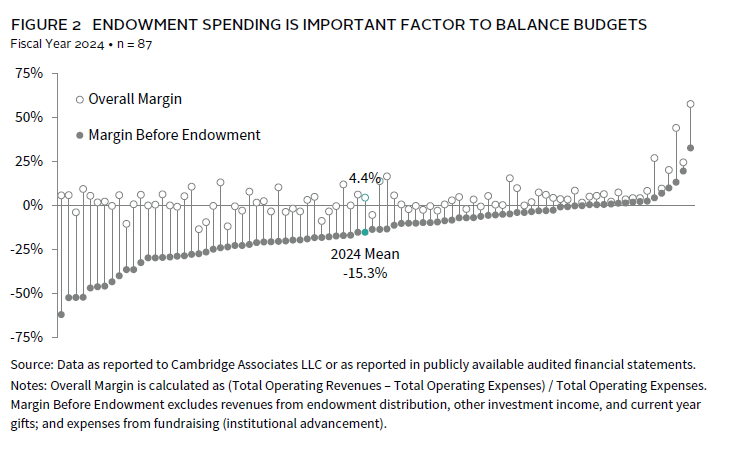

Endowment Spending Is Essential to Funding the Nonprofit Business Model

The colleges and universities in the Endowment Radar Study are nonprofit organizations, meaning they do not have shareholders or distribute profits. If there is an operating surplus or investment gain at the end of a fiscal year, those net assets are retained by the organization to support future fiscal years. The financial model works because subsidies afforded by tax-exempt status—fundraising and endowment distributions—make up the deficit between expenses and earned revenues (money earned from teaching and research). Most of the endowed colleges and universities in our study do not have sufficient revenues to fund their annual expenses without subsidies provided by spending from their endowment funds (Figure 2). The average operating deficit (margin) before endowment spending was -15.3%. An infusion of endowment spending provides a modest cushion and shifts the average margin to 4.4%.

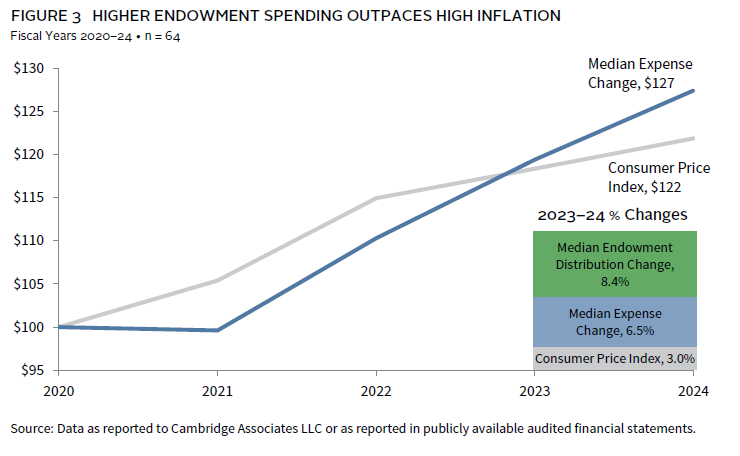

Endowment Spending Has Grown to Outpace Inflation and Deliver Consistently

Colleges and universities are not immune from inflation. Over the past four years, median expenses for the cohort have grown 27% compared to 22% inflation growth for the broader economy, as measured by the Consumer Price Index (CPI). In 2024, the median expense growth rate was 6.5% exceeding 3.0% CPI. Endowment spending increased to contend with higher costs. The median change in endowment dollars distributed to the educational enterprise was 8.4% in 2024, a pace that exceeded inflation and the 6% median endowment growth rate (Figure 3).

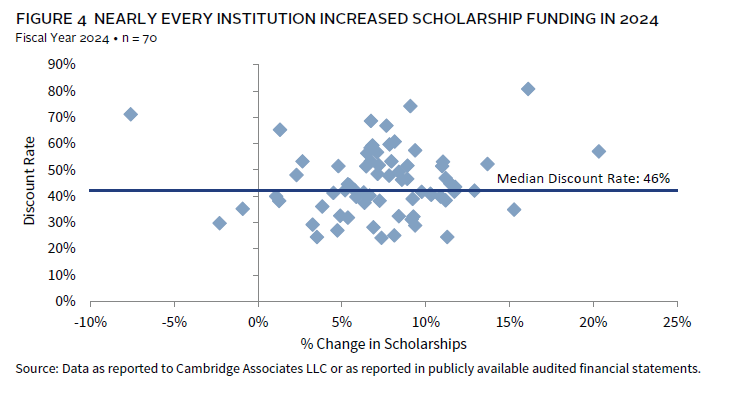

Endowment Spending Reduces the Cost of Attendance

One of the pressure points for the operating margin is the growing “cost” of forgone revenue in the form of discounted tuition provided to students as financial aid and scholarships. Financial aid commitments have increased for the colleges and universities in our study every year. This trend continued in 2024, when the average growth rate in financial aid was 7.4%.

Nearly every institution in our study increased institutionally funded scholarships and financial aid awards in 2024 (Figure 4). The median tuition discount rate was 46%, meaning that only 54% of gross tuition charges were actually collected from students. Sticker prices do not tell the full story of the price of college.

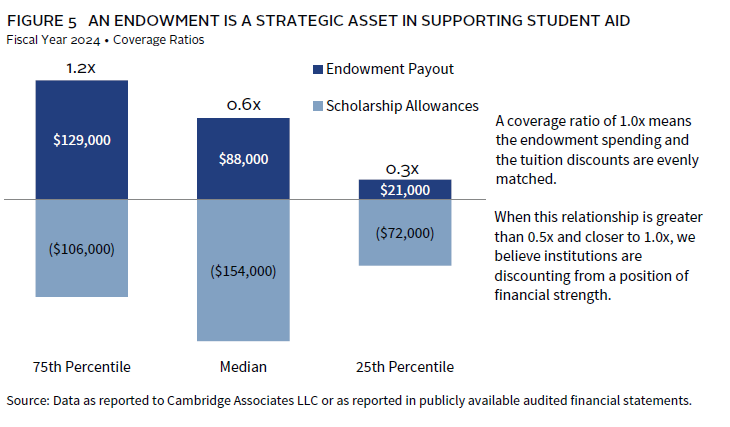

The endowment distribution directly supports financial aid and scholarships via endowments restricted for those purposes and indirectly by subsidizing total costs, which increases the availability of other funds that can be used to support financial aid. Endowment support-to-financial aid is a coverage ratio that considers the direct and indirect roles the endowment plays in pricing strategy. It measures the relationship between endowment spending and financial aid discounts to students.

Figure 5 shows the range of endowment distribution-to-financial aid coverage ratios. At the 75th percentile, institutions have slightly more than a one-to-one coverage ratio; the endowment distribution exceeds the scholarships and aid awards. For the median institution, a ratio of 0.6x means that 60% of aid is offset by endowment subsidy. At the 25th percentile, the 0.3x ratio indicates that one-third of scholarships are offset by endowment spending. Those institutions are discounting at a level that exceeds endowment support.

Endowment Assets Are Key to Balance Sheet Health

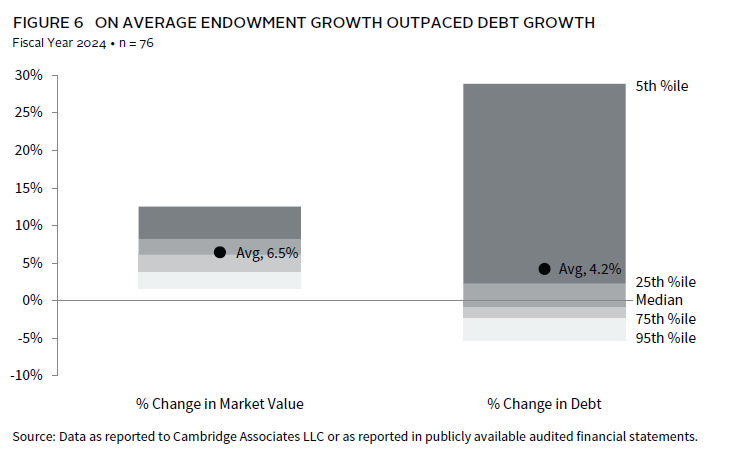

The endowment-to-debt ratio helps us understand balance sheet health and reveals that most colleges and universities have been prudently managing their balance sheets. The median remained at a healthy 4.4x ratio, but the bottom quartile’s ratio (1.5x) indicates less balance sheet flexibility for future challenges. Average endowment growth (6.5%) outpaced growth in outstanding debt (4.2%). But for some, debt growth far exceeded the average (Figure 6). This may indicate strategic use of borrowing but could also be a sign of distress. Balance sheet health will be important as institutions weather the tumultuous 2025 operating environment.

Net Flow Rate Indicates Future Role of the Endowment

In addition to long-term performance, net flow—the ratio that calculates the net rate of endowment spending and inflows—is an indicator of whether the endowment will keep pace with the enterprise, lose purchasing power, or take on a greater role in the future. Most colleges and universities have negative net flow rates, but the degree that inflows offset spending from the endowment determine the liquidity profile and purchasing power of the portfolio.

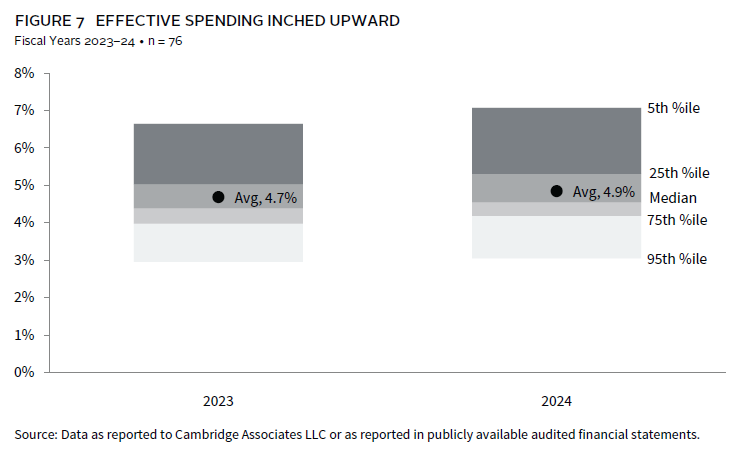

This year, the median net flow rate was -3.0%, which is similar to prior years. In 2024, a higher range of endowment spending is notable, but not alarming. Average spending inched closer to 5% and at the highest quartile, spending ranged from 5.3% to 7.1% (Figure 7). This trend will be something to watch in 2025 for colleges and universities contending with new costs and impaired revenues imposed by an adverse political environment.

Conclusion

Why do endowments keep growing? While it may seem counterintuitive, endowments grow in size because they support institutions that are managing the higher costs of delivering their missions, like wages, physical plant and expanded programming. In 2024, college and university endowments had capacity to fund growing costs and commitments to financial aid. So far, the increase in endowment distributions has been sustainable as endowment growth has outpaced debt growth and new gifts and disciplined endowment spending have helped maintain endowment purchasing power.

In 2025, this sustainable business model faces intense headwinds that threaten to destabilize the financial equation. Revenue challenges include declining demographics for college students and new policies that could reduce government funding for financial aid and research. Potential taxation could increase costs to endowments and reduce endowment funding available for the mission. It will be challenging to maintain the vital role of the endowment in the near term. But endowment funds will be even more essential to delivering education, innovation, and research that benefit the greater good.

Tracy Abedon Filosa, Head of CA Institute

Cameryn Dera also contributed to this publication.

Footnotes

- Endowment Radar is a methodology that Cambridge Associates developed to visually evaluate the endowment’s role in the college and university enterprise. Data as reported to Cambridge Associates LLC, or as reported in publicly available audited financial statements for 90 private colleges and universities.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.