Last year, investors watched as the prices of various cryptoassets collapsed. The industry’s most famous digital asset, Bitcoin, lost roughly three quarters of its value, as it slid from more than $16,000 a coin to less than $4,000. The dramatic declines that swept across the crypto space raised questions about the future of these assets and the blockchain technology that underpins them.

Yet, in looking across the investment landscape, we see an industry that is developing, not faltering. Blockchain technology introduces scarcity to the digital world, which can help innovators better monetize their work and foster innovation. It offers the potential to streamline processes across any number of businesses, such as inter-bank settlement. It also holds the hope for a new, more decentralized version of the internet, where users can better manage their privacy.

Although the crypto industry remains in its infancy, we think institutional investors should begin exploring it. A host of different investment options exist, ranging from an illiquid venture capital–like approach to a liquid hedge fund trading–like approach. In this paper, we review recent developments in the industry, highlight our views of the various investment strategies, and discuss a few considerations for investors exploring the space. Though these investments entail a high degree of risk, some may very well upend the digital world.

Industry Developments

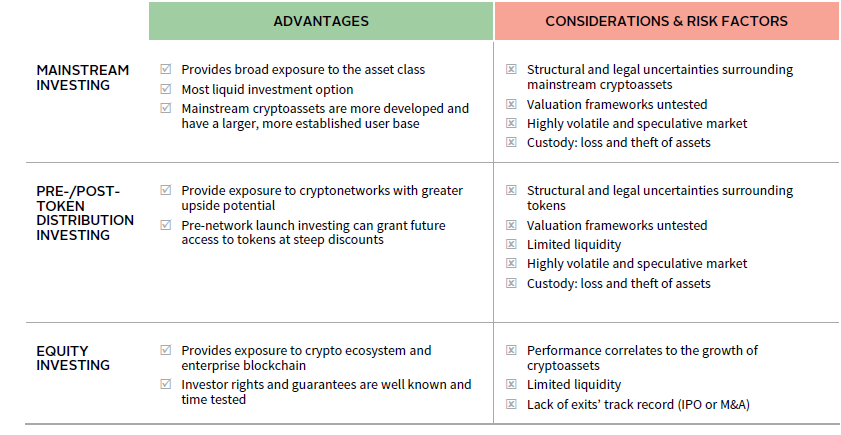

Crypto activity was frenetic in 2018. The industry witnessed large cryptoasset price swings, a surge in fundraising, and important structural developments (Figure 1). While a high-profile change included the recent start of crypto futures trading, notable developments occurred in custody, scalability, and other key infrastructure-related projects. Despite the flurry of activity, the regulatory environment has been slow to develop.

FIGURE 1 CUMULATIVE WEALTH OF PROMINENT CRYPTOASSETS

January 1, 2018 – December 31, 2018 • December 31, 2017 = 100

Sources: BitStamp, Bitwise, and Thomson Reuters Datastream.

Notes: Data are daily. The Bitwise 10 Large-Cap Crypto Index (BITX) tracks the total return of the ten largest cryptoassets, as measured and weighted by free float– and five-year inflation–adjusted market capitalization.

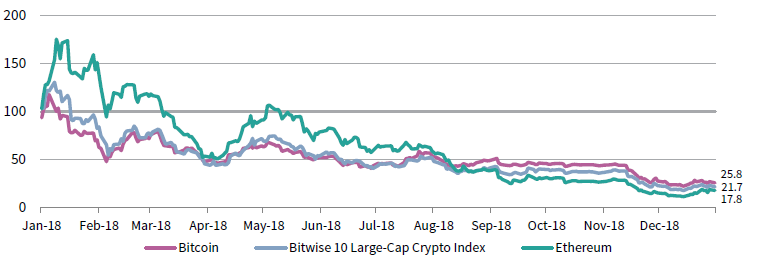

Investment activity has picked up strongly (Figure 2). According to New York Digital Investment Group LLC, the number of blockchain-related software projects on Github—a popular online developer community—has risen by a factor of ten in just the last three years. Similarly, data gathered by the internet news site CoinDesk suggest venture capital funding for blockchain start ups totaled $3.1B between January and October 2018, as compared to $1.2B in 2017 and just $0.5B in 2016.

FIGURE 2 MONTHLY VENTURE CAPITAL FUNDING FOR BLOCKCHAIN START UPS

May 2014 – October 2018

Source: CoinDesk.

A notable example of the pickup in investment activity is Coinbase’s recent capital raise. It raised $300 million in a Series E round at an $8 billion valuation after having raised its Series D round at a $1.6 billion valuation a little over a year ago. In its capital raise announcement, Coinbase noted that the firm sees “tremendous promise in crypto to build the next great phase of the internet (often referred to as Web 3.0).”

Traditional venture capital firms are increasingly moving into the space. In the last six months, Andreessen Horowitz launched a dedicated crypto fund and Sequoia backed a new firm called Paradigm. According to the independent research provider Autonomous Next, crypto fund assets have climbed to between $10 billion and $15 billion.

Beyond investment activity, the Intercontinental Exchange (ICE) formed a subsidiary called Bakkt to start trading physically settled bitcoin futures in early 2019. This follows the December 2017 launch of Bitcoin futures on the Chicago Mercantile Exchange. Fidelity announced plans to launch Fidelity Assets Services, LLC, which will be providing custody and trading solutions for enterprise clients. Furthermore, a number of projects have launched aimed at addressing key problems in the space, such as scalability, privacy, custody, cryptoasset volatility, interoperability, and governance. 1

These developments were, unfortunately, not accompanied by regulatory clarity. Despite active engagement between managers, service providers, and regulators, uncertainty in the regulatory environment continues to hamper institutional capital flows. Still, the SEC has prosecuted industry fraud and sought to protect investors considering an investment in an initial coin offering (ICO). It has also sought to clarify what constitutes a security offering. The Commodity Futures Trading Commission and SEC have suggested that Bitcoin (ticker: BTC) and Ether (ticker: ETH) are not securities because the networks are decentralized, but that many ICOs will fall under securities laws.

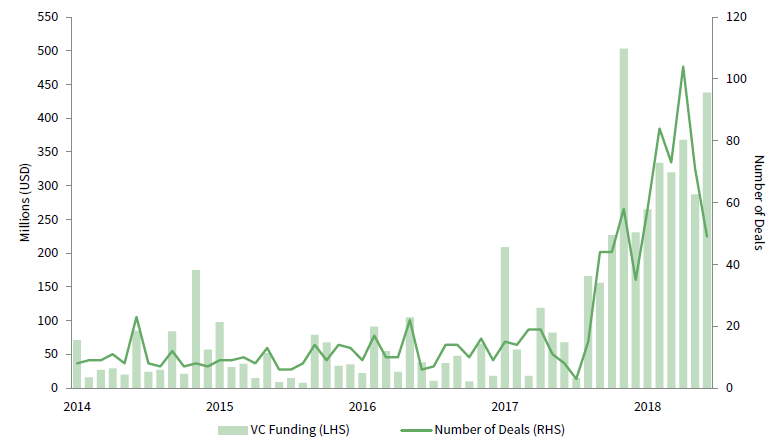

Cryptoasset Investments

There are numerous ways for investment managers to gain cryptoasset exposure. Currently, the available investment options can be grouped into three broad categories: mainstream cryptoasset investing, pre- and post-token distribution investing, and equity investing (Figure 3). While all investment options may not fit neatly into one specific grouping—for instance, mainstream cryptoassets could also be considered post-token distribution investing—we find these broad groupings helpful in thinking about the broader crypto universe.

Source: Cambridge Associates LLC.

Mainstream Cryptoassets. Investors can purchase highly liquid cryptoassets, such as Bitcoin. These assets provide access, in different ways, to blockchain platforms. They are traded all day every day, which means liquidity will be better than other cryptoasset investment options. Still, these markets are inefficient and the assets may be volatile, as we saw last year. Investors can both purchase and have custody of the tokens directly or through centralized exchanges; otherwise, investors can outsource this to a passive or actively managed fund that will do it for them.

Pre- and Post-Token Distribution Investing. This grouping includes ICO tokens and what are known as simple agreements for future tokens (SAFTs). SAFTs grant investors future access to a project’s cryptoassets, usually at a discounted price, prior to their public launch. ICO projects can have various liquidity profiles, as some projects distribute cryptoassets immediately, or, for example, after a 24-month period. Despite the shorter time to liquidity, investing in SAFTs and ICOs is inherently no different than investing in early-stage technology ventures. It should be noted here that the ICO mechanism for fundraising has been abused by bad actors and the majority of such projects have been of questionable quality or outright frauds. That said, there have been numerous reputable projects involving ICOs.

Equity Investing. Equity investing is a third way for investors to gain exposure to crypto and blockchain technology. Investors can make investments in companies whose returns are connected to the growth of the asset class and maintain traditional capital structures. One example is Coinbase, a company that operates a digital currency exchange. Although these companies are impacted by broader cryptoasset price fluctuations, they should be more stable than any one individual investment. They are long-term, illiquid investments held at cost and marked up or down depending on funding rounds. The liquidity of these investments is similar to traditional venture capital investments.

Token investing can also take the form of equity investing in operating companies of token projects, where the main business model is that the company owns rights to the tokens a team is developing, which will be distributed or sold at a later date. In addition, the operating company holding the tokens could also launch other businesses, such as offering services to the network in which an investor would have an ownership stake. Investors are increasingly looking to access tokens via equity ownership, particularly given the regulatory uncertainty with regards to ICOs and the restriction on fundraising options for entrepreneurs, as well as the added investor privileges and protections that equity offers versus tokens. It should also be noted that the SEC is currently reviewing proposals for the launch of a Bitcoin exchange-traded fund (ETF), such as the Van Eck SolidX ETF, but approvals are not expected anytime soon.

Fund Strategies

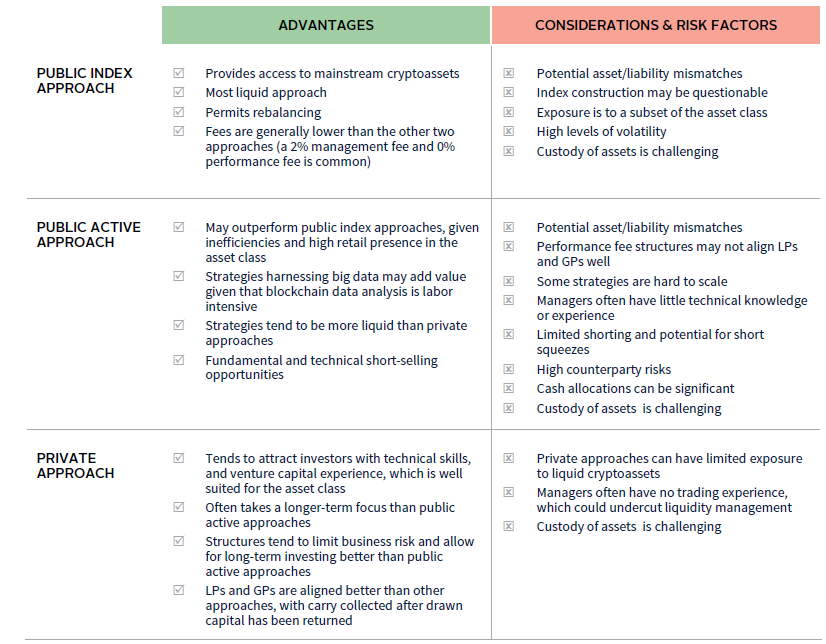

Investment managers engage in a variety of strategies to gain cryptoasset exposure. The vast majority of strategies currently in the market can be thought of as either a public index approach, a public active approach (via mostly liquid hedge fund structures with an initial lock up), or a private approach (via mostly illiquid private structures) (Figure 4). Regardless of the approach investors should understand that any investment would be rooted in very early-stage technologies, so any investment should be thought of as early-stage venture investing, although early liquidity has opened up some hedge fund–style trading opportunities, such as arbitrage.

FIGURE 4 FUND INVESTMENT STRATEGIES

Source: Cambridge Associates LLC.

The early-stage nature of these investments means that many, if not most, of them will fail. There could also be some big winners. In addition, it means that venture-style due diligence and technical expertise may provide a better understanding of these investments and their long-term return potential. For these reasons, we think investors should consider crypto investing as another form of venture capital. It may be riskier, considering technology and adoption risks.

Though investors should generally not exclude high-quality liquid assets from consideration, we generally see a dichotomy between what investors can currently access via a private approach and a public active approach. The former typically makes longer-term investments in pre-token distribution assets and company equity, and the latter tends to make shorter-term investments in post-token distribution assets and mainstream cryptoassets. However, there are long term–oriented public active funds with a venture-like approach that invest in more liquid cryptoassets. We tend to prefer private approaches, as their patient long-term focuses better align with the opportunity set.

Private approaches may overlook short-term opportunities that public active approaches could capitalize on, but they typically don’t suffer from the same structural challenges. For instance, the underlying liquidity of assets and liabilities of a public active approach are often mismatched, which could be a considerable hurdle in a crisis, such as the one experienced in 2018, and after lock ups expire. Furthermore, incentive fees that are annually crystallized do not align incentives well between the general partners (GPs) and limited partners (LPs) and may materially erode investor returns. The limited ability to short, the potential for short squeezes, and the high level of counterparty risk may also hinder public active approaches.

Institutional Investors

The vast majority of institutional investors have little to no cryptoasset exposure. Of those that do have exposure, we estimate that it tends to be around 20–30 basis points on a look-through basis. Investors with exposure tend to have large allocations to venture capital, with certain fund investments being common among them, and/or an allocation to a dedicated crypto fund. We expect traditional venture capital funds to increase their investments in cryptoassets going forward, meaning institutional investor exposure is also likely to rise.

Traditional venture capital funds are subject to the SEC’s Investment Advisers Act of 1940, which mandates a 20% cap to non-qualifying investments (i.e., investments in digital assets) unless they register with the SEC and change their partnership agreements. For this reason, some generalist venture capital funds interested in cryptoassets have invested in both the general partnership and as an LP of dedicated crypto funds in order to increase diversification within the cryptoasset exposure.

The Rise of Generalized Mining

An interesting recent development in the space is the active involvement of investment managers in cryptonetworks. With the proliferation of proof of stake protocols and inflationary rewards for active network participation, buy-and-hold investment managers have an opportunity (a) to use their investments to earn extra yield in the form of cryptoassets to their existing investment and (b) to affect governance by voting on-chain where that is available. For example, a number of managers have been actively participating in the Livepeer (LPT) network. LPT is an open protocol that facilitates permissionless decentralized video transcoding. Any LPT holder can stake their tokens, run a LPT transcoding node, and earn an LPT-denominated yield (currently 24% annualized) for their transcoding services to the network. This implies that investors not participating in this network will be diluted. The proliferation of these types of networks is leading some investment managers to rethink their investment models to include active network participation.

Although investors could rely on venture capital funds in their portfolio to determine their allocations to cryptoassets, there are strong reasons to consider a dedicated crypto fund investment. First, the SEC cap on non-qualifying investment could restrict their desired exposure. Second, the space is highly technical, meaning late entrants and non-specialists will be operating at a disadvantage to investors immersed in the space. Lastly, we expect partners specializing in crypto at traditional venture firms to spin out and launch their own dedicated crypto funds, as has already been the case. Taken together, these reasons mean investors could miss out on investments with the most knowledgeable managers in an industry with large potential payoffs.

Still, the industry is nascent and an allocation of more than 1% of a portfolio on a look-through basis does not appear prudent, even for those comfortable assuming the very high risks involved. Like other asset classes, investors should seek to diversify across managers and assets to mitigate some of the risk involved. Diversification will also help investors capture the industry’s upside, as returns are likely to be generated by a small subset of companies and projects. For smaller portfolios that cannot diversify across managers as easily, investors should consider allocating to a fund-of-funds or an index fund to gain exposure.

Conclusion

The crypto space has taken the investment world by surprise. Though liquid crypto prices have fallen sharply of late, investment activity in the space is booming. Investors interested in the industry need to spend a considerable amount of time learning about the space, getting comfortable with its very high risks, performing manager due diligence, and carefully implementing allocations. Despite the challenges, we believe that it is worthwhile for investors to begin exploring this area today with an eye toward the long term.

Appendix: Types of Infrastructure Projects

A large portion of the current investment activity is aimed at overcoming key challenges confronting the space. These challenges range from scalability limitations and difficulties with custody to poor interoperability between blockchains. While we discuss several issues in the industry below, others exist. What all of these challenges have in common is that there are multiple quality teams seeking to tackle them.

Scalability

Scalability poses one of the biggest challenges for the widespread adoption of blockchain technology. In brief, public decentralized blockchains require all nodes on the network to process every transaction and maintain an up-to-date copy of the entire database. This implies slow transaction times. For instance, transactions per second for many blockchains, such as Bitcoin, are roughly 10 to 20 versus around 2,000 for Visa or MasterCard. The scalability issue is currently being tackled by multiple high-quality teams.

Privacy

Another important issue with public blockchain adoption is privacy. Individuals and/or companies tend to not want to publish all of their information on a public blockchain. Blockchains, such as Bitcoin, are currently pseudonymous, not anonymous, as it is possible to link a public address to a specific individual or entity. Numerous projects are currently in progress, such as privacy coins and smart contract privacy, which aim to better protect user data. How regulators react to new privacy functionalities remains to be seen.

Custody

Cryptoassets are bearer assets, meaning that if a private key is lost, the assets are lost. In that sense, custody of cryptoassets is very different from, for example, the custody of shares. Although a number of custody solutions are being offered, investors tend to self-custody many cryptoassets, as custodians continue to refine their product offerings. The most prominent cryoptoasset custodians are still looking to regulators for expected requirements for approval as a qualified custodian.

Stablecoins

Stablecoins attempt to create internet native digital assets that are pegged to the value of fiat currencies. The reason for their creation is to help solve the issue of volatility of cryptoassets, which make them difficult to use as a means of exchange. There are different approaches to stablecoins each with its unique trade-offs, which are beyond the scope of this paper.

Governance

Given that cryptonetworks are controlled by a community of stakeholders, effective governance will be key to their success. Some protocols, such as Tezos, Dfinity, and Decred, have incorporated on-chain mechanisms for governance where stakeholders can vote for protocol changes and other governance issues. Others still rely on off-chain informal governance (e.g., Bitcoin, Ethereum).

Interoperability

Interoperability is the ability to share information freely across blockchain systems. Interoperability is an important issue as blockchain protocols today are contained, running in a closed system, and competing with one another rather than interacting. In turn, this hinders the growth of the entire space, given scalability issues of individual blockchains. If blockchains could interact, data could be distributed across them, easing the load on any single blockchain and allowing for the system to scale.

Marcos Veremis, Managing Director

Alex Devnew, Director

Michael Armstrong, Investment Associate

Dan Day, Senior Investment Associate