Credit Score: Why Bank Retrenchment Spells Opportunity for Pensions

A down year in public markets led to a severe slowdown in new debt issuance in 2022, resulting in increased pressure in the banking sector. During the first half of 2023, the collapse of three US regional banks—in addition to the collapse of Credit Suisse in Europe—led to a further slowdown in bank lending. In light of this, private lenders have begun serving as a main source of capital for both mid-market and larger companies. Properly implemented, a range of strategies in the private credit universe can help pension plan sponsors achieve their investment goals. This paper discusses the potential benefits and challenges of private credit and looks specifically at how direct lending, credit opportunity funds, capital solutions, distressed debt, and specialty financing strategies may help address specific pension portfolio needs.

Potential Benefits and Challenges

Private credit providers are able to charge a yield premium to businesses that need capital and have become increasingly important as market conditions have grown more volatile, uncertain, and perhaps recessionary. In many cases, strong relationships between firms, sponsors, and lenders can result in a quicker investment decision-making process that is less dependent on the vagaries of bank credit cycles.

Stronger relationships can also result from private credit transactions using fewer parties, which can help enhance stability and longer term planning for borrowers. While private credit strategies vary in their approach, they usually attempt to control capital structures, which enable them to manage restructurings and achieve good recoveries. As a result, private credit also has the potential to provide diversification benefits to pension plan portfolios in times of market volatility, in addition to steady income and less-correlated returns.

There are also some challenges associated with private credit investments. The risk premium associated with private credit can make it an expensive source of capital for the borrower, placing additional stress on the company’s cash flows—especially in a higher interest rate environment. Another major risk is lack of liquidity. Private credit investments are not publicly traded and, with a nascent secondaries market, they can be difficult and expensive to sell on short notice.

Private Credit Investment Strategies

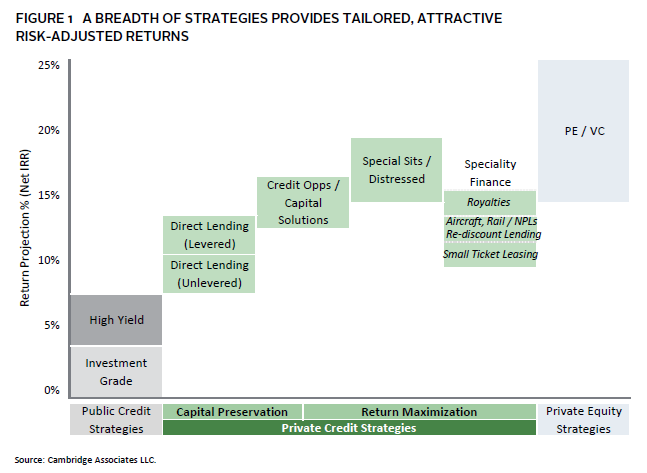

Private credit strategies can generally be bucketed into direct lending, credit opportunities, capital solutions, special situations, distressed debt, and specialty finance (Figure 1). Risk and return vary across this universe. Strategies such as direct lending focus on lower, more predictable returns with minimal expected capital loss, while more complex strategies—such as special situations and distressed—focus on higher returns through capital appreciation. Strategies that don’t solely focus on capital preservation or return maximization include specialty finance strategies like healthcare royalties or re-discount lending.

Private credit funds lend capital to corporations against physical assets and/or cash flows within a private “lock-up” fund partnership structure. The yields tend to be higher than for public credit, as pricing also includes a premium for its smaller size and illiquidity. In difficult financing environments, private capital providers that have accumulated significant dry powder can become important liquidity providers. Consequently, the demand for both their capital and expertise has the potential to generate strong performance.

Direct Lending

Direct lenders, or senior debt funds, typically lend to corporations to finance their buyouts and organic or inorganic acquisition activity. These companies are most often owned by financial sponsors (usually private equity [PE] managers) but can also be held by individual owners. Direct lenders generate yield from current cash-pay coupons composed of a fixed credit spread and a floating reference rate such as the Euro Interbank Offer Rate (Euribor) and Secured Overnight Financing Rate (SOFR), 1 and up-front fees or other fees such as repayment penalties. As “senior debt” implies, these funds invest in the first lien, at the top of the capital structure, and are secured by the borrower’s assets.

In the event of default, these lenders typically have first claim over the shares of a company or its assets to recover the principal. While direct lending offers lower relative returns within private credit, it can provide a consistent income stream and strong downside protection through high recovery values. Senior debt funds can be levered or unlevered at the fund level, and investors should focus on the overall amount of leverage, as well as the risks associated with using leverage lines to boost returns. Based on the current pricing environment, expected unlevered net returns is around 8%–10%, which is higher than the historical 6%–8% net return, while levered net returns may reach 13%–15%, higher than the 10%–12% achieved previously. The typical fund life is six to eight years.

Credit Opportunities

Credit opportunity strategies seek to deploy capital opportunistically, wherever the manager sees attractive relative value in the public or private credit universe. Credit opportunity managers adopt a flexible mandate. These strategies can be considered “all weather,” as they include financing bolt-on acquisitions, additional capex, and providing rescue financings, which help performing borrowers stave off liquidity crises and particularly thrive in times of market dislocation. Credit opportunity funds typically deal with performing companies and are able to deliver a consistent income stream, although a portion of the returns are often back ended with an equity component. Target gross internal rates of return are typically in the mid-teens, and vehicles tend to be locked up for six or more years.

Capital Solutions

Capital solution strategies target companies facing complex financial situations and provide them structured solutions to meet their capital needs. They invest across the capital structure and look for returns in the mid-to-high teens range. Most companies seeking capital solutions face a medium-term cash flow crunch and returns tend to be more back ended and upside linked.

Special Situations/Distressed Debt

Special situation strategies target companies that are under financial stress, while distressed debt managers typically target companies that are restructuring. Both of these strategies invest in debt of companies at deeply discounted valuations. The use of these debt positions varies across managers, but they have the same objective of generating outsized returns from debt and equity-linked structures. Return targets are north of 15% and can be PE-like, mostly back ended, and generated by combining a contractual yield component with equity-like upside. Liquidity can vary, as some managers pursue very similar distressed strategies through liquid hedge funds as well as lock-up vehicles.

Specialty Finance

Specialty finance is a catch-all category for a wide range of private credit managers pursuing niche strategies outside of the aforementioned types. Traditionally, this category mostly contained non-performing loans managers, but has expanded to include healthcare and music royalties, re-discount lenders, 2 litigation finance, and funds specializing in life settlements. It can also include trade finance or other receivables- based lending strategies. The highly specialized nature of these strategies makes it more difficult for limited partners to analyze them, as a deeper level of expertise is required to differentiate between managers. The way in which the risk is determined via underwriting collateral, yield, and enterprise value is unique across each strategy.

Target gross returns for this fund type tend to begin in the mid-single digits and can range into the mid-teens, where returns are typically contractual, but with some niches offering upside potential such as a music royalties fund selling a catalogue at a premium.

Portfolio Implementation: Things to Consider

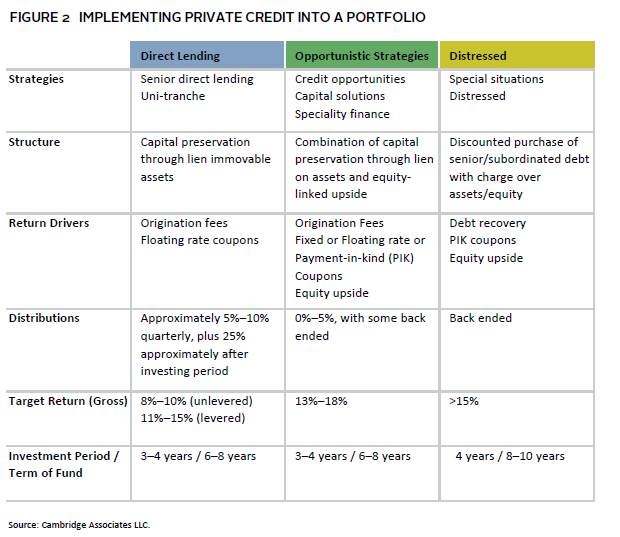

For pensions, a strategic allocation to private credit can broaden the portfolio’s diversifying strategies and provide for attractive yields (Figure 2). Historically, many pensions have used hedge funds and PE strategies as their main sources of diversification and premium returns, respectively. Direct lending and credit opportunity strategies in particular may provide a good fit for pensions looking to generate income and improve their risk-adjusted return profile. Realizations are less dependent on equity market conditions and distributions are somewhat more predictable as they are linked to loan maturity dates. Direct lending strategies may deliver higher returns than historical average in the near term due to increases in base rates and spreads. While very few direct lenders have officially increased their net target returns as of May 2023, most expect at least a 2% increase from the usual 6%–8% net target return.

Opportunistic strategies may also be attractive to plan sponsors as they provide a chance to source and invest in attractive financing deals arising from the weakness in public markets and the banking sector. Because credit markets are constantly evolving, the best approach to private credit strategies is one that aligns with funded status and investment goals.

Well-Funded Plans

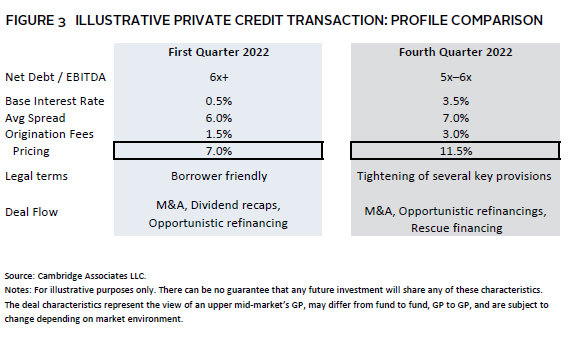

Reasonably well-funded pensions can consider senior direct lending strategies, which offer risk-controlled return enhancement with a high degree of predictability and strong cash flow characteristics. These conservative, capital preservation–oriented strategies are almost always floating rate and provide a natural hedge against interest rates, as opposed to liquid fixed income, which is typically fixed rate and can result in volatile mark to market. Senior direct lending coupons are structured with a floating base rate plus a spread. In challenging macro environments, as traditional capital becomes scarce, private credit capital can charge higher fees and spreads, thus making private credit pricing very attractive (Figure 3). With respect to existing investments, a well-constructed and diversified portfolio of direct lending investments provides more protection from deterioration in corporate profitability during such periods than equity or subordinated debt–oriented strategies due to their seniority in the capital structure. One trade-off is relative illiquidity versus liquid fixed income. However, senior direct lending strategies typically distribute cash flow on a regular basis quickly and have a shorter fund life (6 to 8 years) relative to other private credit strategies. Well-funded pensions that are not looking to substantially insure their liabilities in the near term can take advantage of their long time horizon for investments through direct lending without exposing themselves and their sponsors’ balance sheets to volatility.

Underfunded Plans

For underfunded pensions that need to generate high returns, return-maximizing strategies—especially credit opportunities—offer a complement to PE strategies. In particular, these credit opportunities offer a way to reduce volatility in plan funding ratios (which can be detrimental for sponsor balance sheets) without sacrificing long-term returns. In uncertain markets, they can offer similar returns to PE with more downside protection, given seniority in the capital structure over equity. Credit opportunity strategies provide capital to performing companies, which can translate to lower default risks. The returns are derived from a combination of contractual coupons and equity-linked upside, which can provide some cash flow distribution. The “all weather” nature of the strategy allows it to remain a consistent part of a pension portfolio across all market environments.

Portfolio Construction and Active Management of the Allocation Is Key

The implementation of private credit strategies in pension portfolios, especially in the context of an uncertain and inflationary environment and bank sector retrenchment, is not a one-size-fits-all model. While private credit strategies can deliver growth and diversification, portfolio construction needs to be thoughtful. Robust private credit portfolios require diversification across several dimensions, including vintages, types of credit strategies, geographies, and sectors. The rich range of private credit strategies available allows for portfolio customization to particular return, risk, and liquidity objectives. While the faster rate of distributions through coupons and loan maturities is an attractive feature of private credit, it also requires an active approach to reinvestment of the cash flow received to maintain exposure, akin to other fixed income asset classes. This reinvestment process also provides a lever with which to tweak portfolio structure over time to accommodate changes in plan member profiles, or to take advantage of dislocations in the market.

Vijay Padmanabhan, Managing Director, Pension Practice

Melanie Mandonas, Managing Director, Pension Practice

Footnotes

- Euribor, published by the European Money Markets Institute, represents the price at which European banks lend each other money. SOFR is a benchmark interest rate for dollar-denominated derivatives and loans that have been established as an alternative to the London Interbank Offered Rate (LIBOR). SOFR is based on observable transactions in the Treasury repurchase market.

- Re-discount lenders refer to funds that finance non-bank lending entities.