Better Alternative(s): Private Investments May Improve Outcomes for Defined Contribution Plan Participants

For decades, many institutional investors with private investment (PI) exposure have generated strong long-term returns. However, defined contribution (DC) plan participants have not been able to benefit in the same way, as employers have historically been limited to investment line-ups featuring predominantly public market asset classes. Although greater flexibility is emerging, the question remains how to best offer the advantages of PI, while managing the complexities of these strategies.

This paper addresses this challenge. It explains the historic role that PI allocations have had in generating strong returns for large investors with longer time horizons. Next, it lays out how target date funds (TDFs), which are professionally managed pools with long time horizons, can serve as the vehicle to provide exposure to PI, while simplifying the plan participant experience. Additionally, this paper explores how to incorporate a range of PI in a TDF glide path, optimize the ability of these funds to take on illiquidity, and maximize the probability of success. Lastly, it touches on keys to successful implementation of a value-generating PI program within a TDF structure. Expanding the asset class opportunity set to include PI can provide DC plan participants with exposure to the same higher return potential seen in the broader institutional investment world, and, if implemented effectively, can result in improved retirement outcomes.

Status Report: Where Are Institutions Allocating?

The investment behavior of institutional investors over the last several decades has been meaningfully different from that of DC plan participants, where diversification away from traditional stocks and bonds has been minimal. By contrast, institutions have steadily increased allocations to alternative assets—including PI, hedge funds, infrastructure, and real assets—which now represent more than 25% of total portfolio allocations on average.

The Use of Alternatives in Institutional Portfolios: First Movers

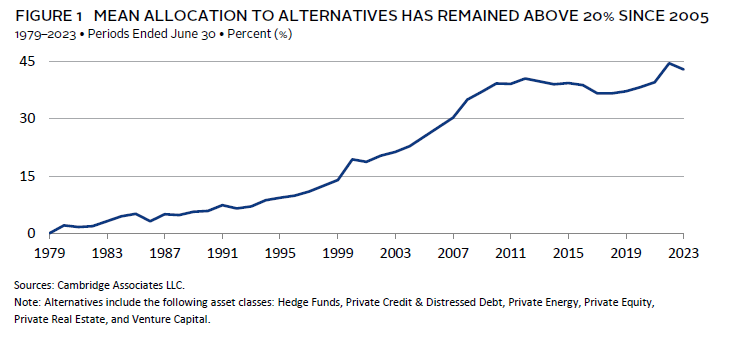

The first movers in building more diversified portfolios were endowments and foundations, which have been significant investors in the space since the 1990s. Many endowments, as reflected in Cambridge Associates’ own client experience, have had allocations to alternatives above 20% for more than two decades and today allocate well over one-third of their assets to these investments (Figure 1).

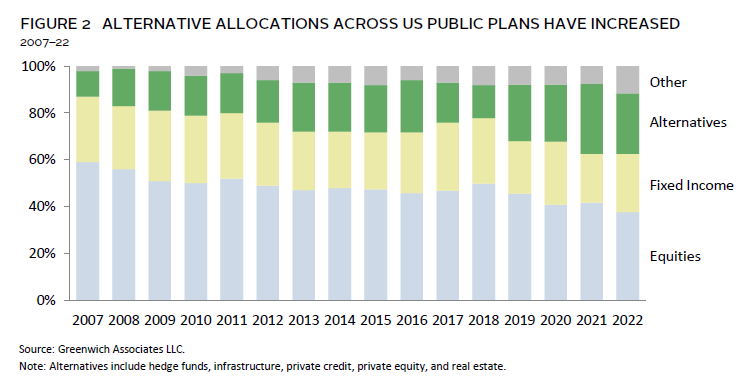

Many defined benefit plan sponsors have taken note of strong returns among endowments and foundations and followed suit with increased exposures to alternatives. Public plans have seen the largest increase, especially over the last 15 years (Figure 2).

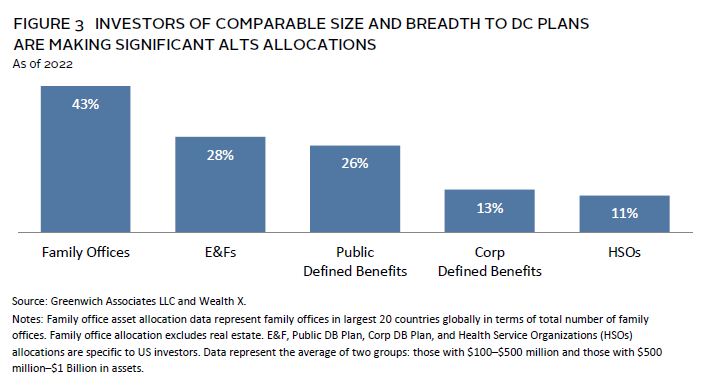

Corporate plans, particularly underfunded plans that are seeking growth rather than de-risking into liability-driven investment strategies, have also raised their allocations. Family offices have made significant allocations as well, currently investing an average of 43% of their total investable assets in these strategies (Figure 3).

What do these investors all have in common? The longer time horizons and institutional scale needed to reap the rewards of alternatives. While DC plans (particularly TDFs) share these characteristics, they have remained a notable outlier in their allocation decisions thus far.

Better Returns Through PI

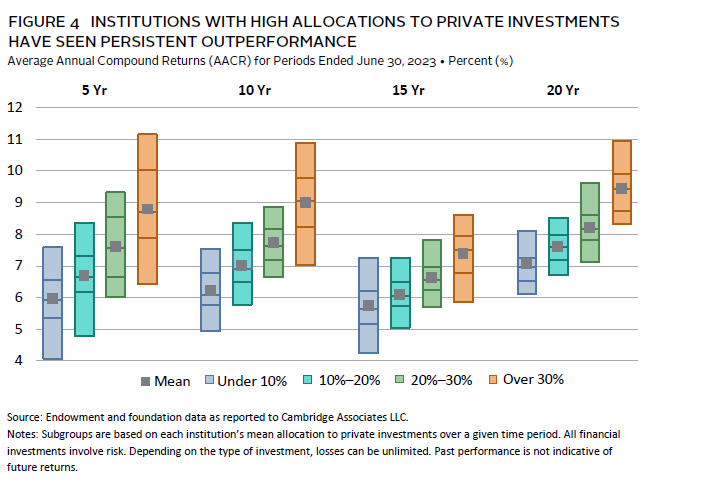

Institutional investors have increasingly incorporated PI—along with other alternatives—in search of higher returns, and the data show that they have been successful in that endeavor. This can be seen by looking at the performance of endowed institutions with similar investment objectives. Those with high allocations to PI have outperformed those with more liquid, traditional portfolios (Figure 4).

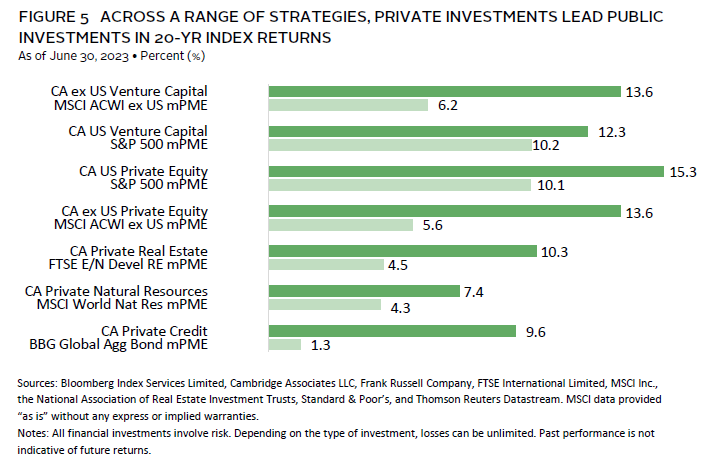

This is especially true for those who have invested in less liquid assets, such as private equity (PE), which has generally outperformed its public counterpart over the last several decades (Figure 5).

It is also worth noting that PI offers an expanded opportunity set for investors, given that the overall number of investable opportunities in the private and public spheres are moving in different directions. Between 1996 and 2019, for instance, the total number of publicly listed US companies decreased by 47%, while the number of private equity and venture capital (PE/VC) investment opportunities grew by 85%. 1

Private Investing: Why?

Participant Benefits

• Higher return potential relative to public markets

• Exposure to innovative, early stage, high-potential growth companies

• Access to larger opportunity set relative to contracting public company universe

• Greater diversification

Forward-looking modeling shows the potential benefits of including alternatives in a target date glide path. An allocation of 10% to PI—divided between PE and private credit—can result in approximately 3% of additional income replacement in retirement, which is comparable to increasing a savings rate by 1%. 2

As noted earlier, the institutions that have been most able to benefit from investing in PI are professionally managed pools with a longer time horizon. The question is—how can that approach be adapted for the benefit of DC plan participants? TDFs can help bridge this gap.

The Place for PI

We believe the best place to include PI in a DC plan is through a multi–asset class portfolio, such as a TDF, which can provide the necessary professional oversight. This supervision is key, as the complexity and range of outcomes from PI make them extremely challenging for participants to manage themselves. TDFs can provide plan participants access to more sophisticated investment strategies through an easy-to-use vehicle with professional oversight. In most TDFs composed of traditional assets, a manager oversees underlying asset class exposures, asset allocation changes, and rebalancing. Enabling a professional fiduciary to oversee the inclusion of private assets in a TDF is simply a logical extension of this framework.

Incorporating PI through a multi–asset class pool also means that a participant does not need to focus on liquidity management or overall risk. Plan sponsors can take comfort that they have selected a professional portfolio management team to oversee these investment options without burdening participants with the task of conducting complex due diligence and decision making.

Range of PI Categories

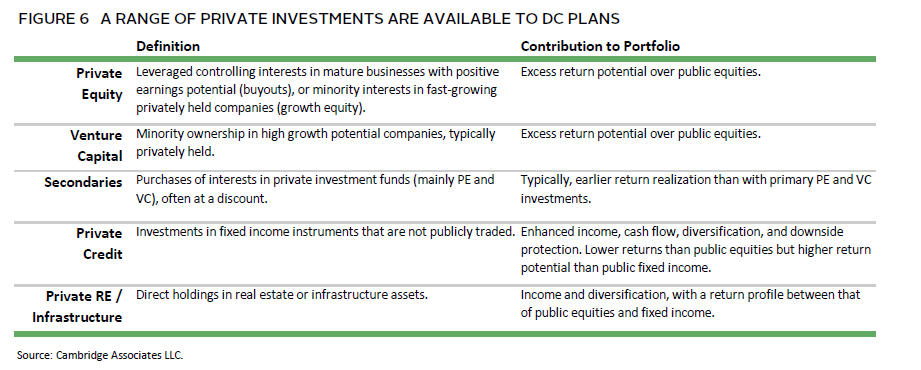

Private investments are often lumped together as a single group of strategies, but their effective use in portfolios requires a more nuanced understanding. The most successful implementation approaches are those that fully recognize how different PI types can serve DC plan portfolios in different ways. Most often, certain allocations are appropriate at distinct parts of the glide path, helping to address participant needs at the appropriate time(s). Figure 6 reviews some of the major PI categories available to DC plans.

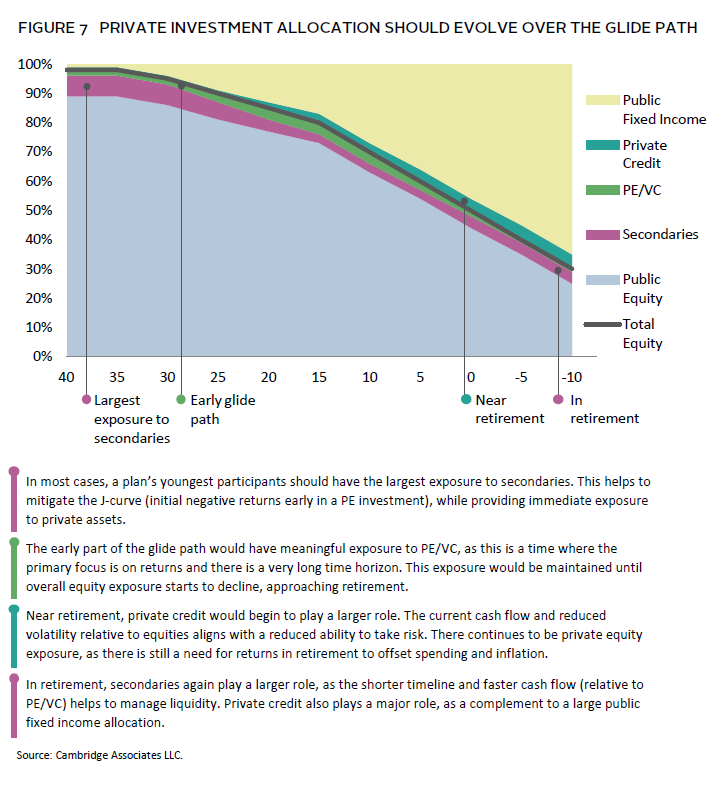

Close consideration of the roles that each of these investment categories can play in a portfolio helps to inform how to include them in the TDF glide path. Plan sponsors may be able to make the largest impact on overall performance by replacing a portion of the portfolio’s public equities with PE/VC and secondaries, and by replacing a portion of the public fixed income portfolio with private credit. While real estate and infrastructure provide some diversification, investors generally will achieve more bang for their illiquidity buck through PE and private credit. Making these changes will allow plan sponsors to better optimize the performance impact of taking on illiquidity relative to available traditional assets. The breakdown of these strategies can change across the glide path to reflect the needs of participants at each point in their lives (Figure 7).

Answering the Liquidity Question

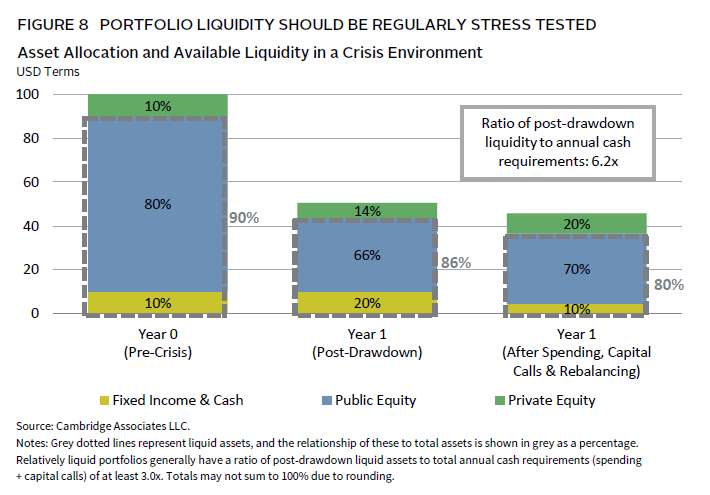

Today, the DC system operates in a daily valued—and mostly daily traded—context, which translates into a need for robust liquidity. Assets with less than daily pricing and liquidity are already included within DC plans (for example, private companies as part of a public equity portfolio, or lower quality parts of the fixed income market). However, including a meaningful allocation to significantly less liquid assets requires careful thought and oversight to ensure that the plan is able to meet participant needs. Overall, an allocation of roughly 10% to illiquid investments balances the need to maintain plan liquidity, while still providing sufficient exposure to PI to move the needle and help accomplish participant investment goals. When thinking about liquidity, it is important to remember that the remaining 90% of the portfolio is liquid and available for cash needs.

Combined with available liquidity from the remainder of the portfolio, there is often more liquidity available from PI than is generally assumed. A mature PI portfolio is typically cash-flow positive—distributions are higher than contributions, particularly for a portfolio that includes private credit. These distributions can be used to meet participant liquidity needs or may be reinvested in the portfolio, all while maintaining sufficient total liquidity.

In addition to ensuring sufficient day-to-day liquidity, it is also important to stress test a portfolio to confirm that liquidity will remain sufficient even during down markets. The hypothetical example illustrated in Figure 8 incorporates both capital market and cash-flow stresses and provides some context for a perfect storm, adverse liquidity event.

The Name of the Game Is Implementation

Ultimately, taking advantage of the growth opportunities and diversification benefits of PI in DC plans requires negotiating two challenges: (1) building a well-designed PI portfolio and (2) situating this portfolio effectively within a TDF structure.

Manager Selection Matters

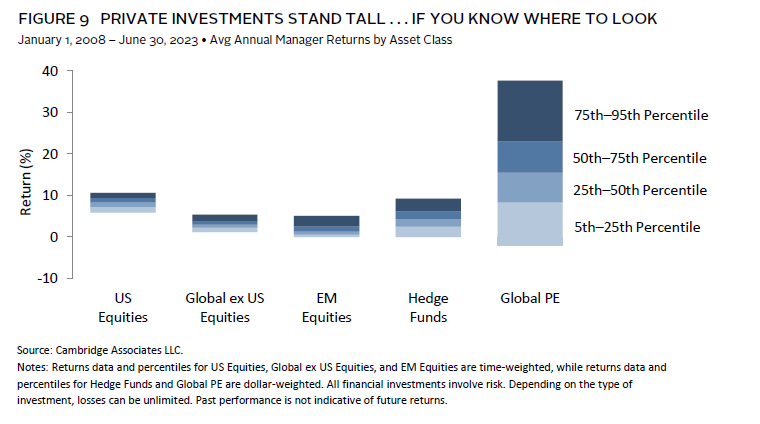

Even more so than with traditional asset classes, how private investments are implemented can spell the difference between success and mediocrity. For example, private markets can provide outsized returns, but the dispersion between the best- and worst-performing managers in PI is much larger than it is for public assets (Figure 9). In other words, while the benefits of getting private market allocations right can be far greater than with traditional asset classes, the consequences of getting them wrong can be markedly detrimental. Thus, working with an expert that has proven capabilities to conduct thorough due diligence on fund managers should be a top priority.

Performance dispersion across managers is just one of many reasons why building a properly diversified portfolio requires significant expertise. Other variables, including time (vintage year), sub-strategy (such as growth, buyouts, and venture capital), and knowledge of underlying general partners (GPs) must also be closely considered. As mentioned, secondaries can also be used to help kick-start a program. This requires proficiency in modeling private exposure(s) over time—how much capital to commit and to which managers—to properly build toward future portfolio success. As liquidity and portfolio size change, this modeling needs to be revisited—and the commitment plan adjusted—to match the evolving portfolio dynamics.

A Pooled Approach

When incorporating PI in a TDF, getting the structure right is essential, as this allows returns generated by the allocation to meaningfully benefit participants. This can be achieved most effectively by creating several pooled funds—or sleeves—for each of the major asset types: PE/VC, secondaries, and private credit. Each sleeve can include a minimal amount of liquidity for purposes of capital calls and distributions, but the primary source of liquidity is derived at the TDF level, as opposed to seeking meaningful liquidity within the private sleeves. These can invest in individual private investments, allowing for appropriate management of each underlying strategy. This structure also allows for a daily valuation process at the private sleeve level, based on the aggregate exposure to underlying managers. Each vintage of the TDF series can invest in these underlying funds, like the structure used by most TDF funds to invest in traditional asset classes. The pooling of PI into sleeves, and the accompanying pooling of cash flows, allows each TDF vintage to individually manage its exposure to each PI asset class.

Private Investing: How?

Keys to Success

• Simplified participant experience through inclusion in TDFs

• Experienced professional investment management

• Diversification across asset categories, adjusted for participant life stages

• Expert manager and fund selection

• Asset class–specific pools, with liquidity management occurring at the total TDF level

It is important to remember that private investments are less liquid than traditional stocks and bonds—each TDF vintage will not be able to precisely rebalance to a specific target the way a portfolio of more traditional assets can. The portfolio management team can accommodate by adjusting the allocations to corresponding pools of public asset classes to maintain the portfolio’s desired risk exposures. To this end, ranges around allocation targets should be designed to provide sufficient flexibility to account for the nature of PI.

Right Mix, Bright Future

A growing number of organizations are considering the use of PI in their DC plans as they strive to offer an optimized line-up of investment strategies to their employees and work to ensure a secure financial future for their plan participants. For those who opt to include them, the most successful approach will be one that is informed by both the growth opportunities and risks associated with more illiquid asset classes. DC plan sponsors should consider building out their plan’s PI allocation options via a TDF structure, using a methodology that matches the efficiency and choice available to participants in the form of more traditional assets. While this approach can result in increased investment management complexity, working with an experienced partner can help. Moreover, PI returns have historically compensated plan sponsors for the additional complications and cost. Regardless of preferred vehicle, having a clear understanding of investment strategy options and how they relate to existing traditional assets is fundamental to success. Proper portfolio implementation, including identifying and investing with top GPs, is also necessary.

Today’s DC plan participants desire—and deserve—institutional-quality investment management, including the diverse selection, robust due diligence, and potential returns that this classification implies.

Hayden Gallary, Managing Director, Pension Practice

Footnotes

- This compares the decrease in publicly listed companies from 1996 to 2019 against the increase in unrealized and partially realized institutional private investments from 1996 to 2020.

- This is based upon Cambridge Associates’ Capital Market Assumptions projected over 60 years using a Latin Hypercube model with 5,000 iterations. We modeled the same participant profile, isolating the change in investment design using 10% of total assets in PE and credit compared to public equities and bonds. For purposes of this analysis, we used a sample 35-year-old participant contributing 11% to 19% to their retirement account, 1.3% to 4.3% real salary increases, and withdrawing 70% of their pre-retirement income at age 65, while offsetting for social security. This analysis compares the assets at retirement and how long those assets last in retirement under the two investment designs.

Hayden Gallary, CFA - Hayden Gallary is a Managing Director for the Pension Practice at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.