Asian markets have had a difficult year so far due to headwinds from slowing global growth and higher inflation.

Asia Insights: Playing Defense

Introduction

Aaron Costello, Regional Head for Asia, and Vivian Gan, Senior Investment Associate, Capital Markets Research

Asian markets have had a difficult year so far due to headwinds from slowing global growth and higher inflation. Asian equities and yield-sensitive assets have sold off alongside their global counterparts amid heightened volatility and rising interest rates. Ongoing lockdowns in China arising from the country’s dynamic zero-COVID policy have also weighed on the Chinese economy, dampening investor sentiments in both public and private markets alike. While the current environment has been challenging for most investments, it has also created an opportunity for more defensive and diversifying strategies to add value. In this edition of Asia Insights, we focus on these asset class themes and opportunities:

- For Public Equities, we make the case that Asia quality strategies focusing on companies with stronger financial health and pricing power will remain more resilient against further inflationary and/or recessionary shocks.

- Within Private Investments, amid the recent cooldown in the China venture capital market, we are seeing increased interest in India and Southeast Asia as alternative avenues for growth as investors await a rebound in China.

- Across Real Assets, we view private infrastructure investments and private credit as more defensive in a rising rate environment and believe they can provide added inflation protection, while also offering a yield premium over other private strategies such as core real estate.

- For Hedge Funds, macro strategies may have more room to run, given the shifting macro regime in Asia, but we continue to find value in Asia equity long/short given their ability to add diversification and higher expected returns to portfolios.

Public Equities: Asia Quality to Offer Resilience Against Further Volatility

Wilson Chen, Managing Director, Public Equities

Asian equities have been buffeted in 2022 amid ongoing global market volatility. Elevated inflation in the United States and Europe, coupled with aggressive monetary policy tightening by the Federal Reserve, have dampened economic growth prospects and weighed on Asian equities. Markets such as Taiwan and South Korea, which are more sensitive to global growth and export demand, are down more than 20% in USD terms as of the end of August. At the same time, Chinese equities are also facing idiosyncratic risks arising from the country’s zero-COVID policy.

With the global macroeconomic picture remaining uncertain, we expect market volatility to persist in the near term. In such an environment, we believe that quality strategies that focus on the stability of corporate earnings and financial health can provide a level of downside protection against current headwinds. These strategies identify companies with stronger pricing power, steady earnings, and higher profitability that can cushion against pressures on profit margins caused by higher inflation, as well as healthier balance sheets and cash flows to withstand recessionary shocks. Quality strategies also tend to have a bias toward companies with stronger corporate governance. These characteristics are what made quality companies more resilient in past down-market cycles.

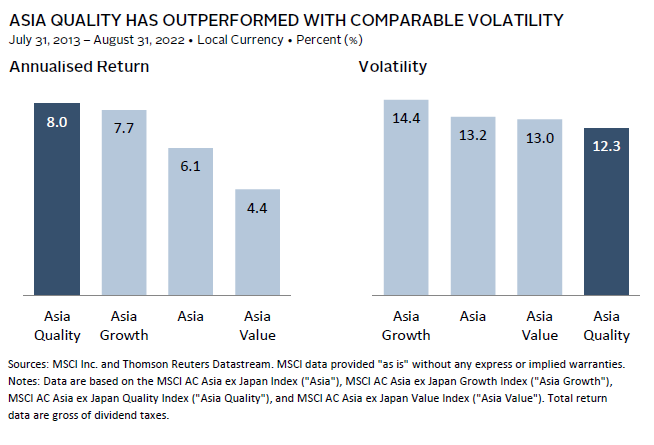

Historically, Asia quality has outperformed the broad market with comparable volatility. However, these companies generally tend to command a valuation premium, and the sharp rise in global interest rates has led to a repricing of quality stocks, causing performance to trail that of broader Asia and global equities year-to-date. As a result, valuations have declined from previously stretched levels and are now low in both absolute and relative terms. Thus, we believe client portfolios should benefit from the addition of quality characteristics, given reasonable valuations and the defensive profile of underlying names.

Venture Capital: Interest Builds in India and Southeast Asia as Investors Await China’s Rebound

Vish Ramaswami, Managing Director, Private Equity

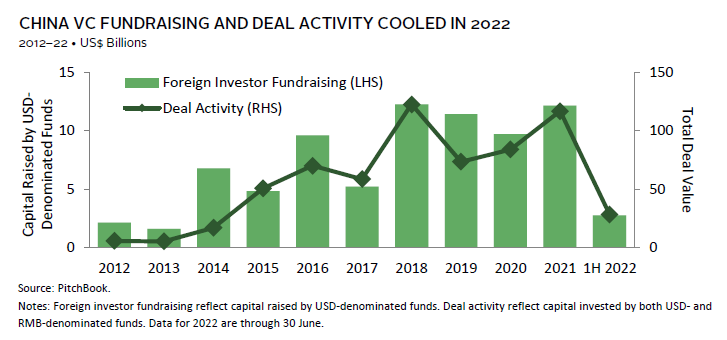

Geopolitical dynamics and the uncertainty over the lifting of China’s zero-COVID policy have dampened investor sentiments and activity in the China venture capital (VC) space. The strong momentum in China VC deal activity leading up to 2021 has cooled in 2022, while fundraising activities have also declined.

Concurrently, interest has increased in India and Southeast Asia as potential alternative growth and venture markets. In India, the entrepreneur ecosystem is maturing and there has been a buildup of strong domestic and foreign VC presence. Government and private-sector initiatives introduced over the past decade have facilitated the development of financial and digital infrastructure, creating a fertile opportunity set for start-ups operating in the domestic consumer and enterprise space. Consumer technology, fintech, and software-as-a-service (SaaS) deals have dominated investment activity, leading to a rise in the number of India unicorns in recent years. While the India VC market is looking more proven and attractive vis-à-vis a decade ago, investors should be mindful that the market depth and track record of managers will continue to take time to build.

The same investment themes apply in Southeast Asia, given the rise of internet penetration in markets such as Indonesia and Vietnam. The region likely boasts the second-largest slate of VC managers in Asia, after China. However, the market is fragmented across many countries with varied levels of infrastructure development and talent pools, posing a unique challenge to scaling and growing businesses. As a result, Southeast Asia VC still lags China or India VC and requires more validation in terms of unicorns created, returns, and exits.

Overall, while near-term sentiments toward China are mixed, the market still holds potential in the longer term. Indeed, consumer technology themes have plateaued, given market developments and regulatory headwinds. But China’s increased emphasis on self-sufficiency and innovation in the clean energy and “deep technology” sectors (e.g., semiconductors, automation), supported by the already well-developed supply chain and advanced manufacturing capabilities, presents a secular growth opportunity for companies in these areas. Meanwhile, investors are also focused on the potential lifting of China’s zero-COVID policy. Any clarity on the lifting of zero-COVID could trigger a rebound in China’s growth prospects and financial markets and lead to a renewed surge in China VC deal activity and fundraising.

Real Assets: Seek Yield Premium in Private Infrastructure and Private Credit

Johnny Adji, Senior Investment Director, Real Assets and Private Credit

Real assets have returned to the spotlight in portfolios due to decades-high inflation in major economies. Yet, a simultaneous rise in global interest rates implies that not all real assets have provided the same level of protection against inflation. Year-to-date through August, commodity futures (23.6% in USD terms) have starkly outperformed other asset classes, driven by energy. On the other hand, both gold and inflation-linked securities have posted negative returns, while REITs were among the worst-performing asset classes. Asia private core real estate strategies have also been under pressure due to rising borrowing costs, with certain sectors and regions still recovering from the aftermaths of COVID-19.

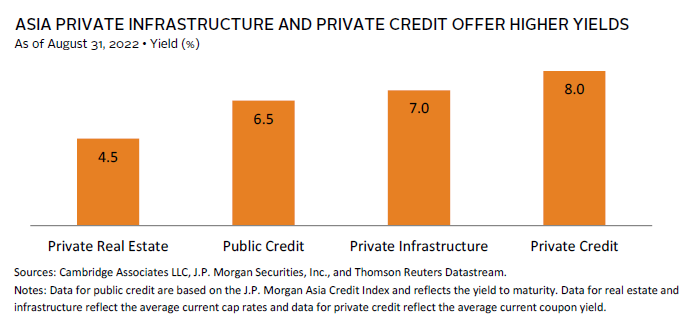

Against this macro backdrop, we view that certain private infrastructure investments can serve as both a defensive and high-yield play, offering a premium over traditional core real estate. Private infrastructure investments in the areas of transportation and social infrastructure (e.g., schools, hospitals) are commonly public-private partnerships, with credible counterparties and minimal downside risk. The current income from these assets is uncorrelated to GDP, as revenue models are structured based on availability rather than the volume of demand. Furthermore, many of these contracts embed inflation-linked clauses in the revenue contract, allowing for the pass-through of higher prices. Within Asia, for example, investments in shipping and education can offer an expected yield of 7% or higher, a more than 250 bp premium over private core real estate strategies.

For investors with a higher risk tolerance, there are also opportunities in Asia private credit where recent market volatility has led to increased credit market dislocations. As liquidity tightens from traditional lenders, private credit funds have an opportunity to fill in the gap. Such strategies often use bespoke and more complex capital solutions, allowing for funds to target a yield of 8% or higher, and are often focused on small and medium enterprises that in aggregate provide a diversified pool of underlying asset collateral in multiple sectors and creditor-friendly jurisdictions. The nature of the target borrowers implies that such strategies tend to be biased toward developed Asia (e.g., South Korea, Hong Kong, and Australia), offering a differentiated exposure to emerging growth-oriented Asia private investments.

Hedge Funds: Macro Funds Shine in 2022, but Case for Asia Equity Long/Short Stands

Benjamin Low, Senior Investment Director, Hedge Funds

Global macro has outpaced other hedge fund strategies so far in 2022. Heightened market volatility, driven by elevated inflation figures and central bank tightening, provided ample ground for discretionary macro managers to act across various asset classes including government bonds, currencies, and commodities. Global macro hedge funds returned 9.3% year-to-date through August, while global broad strategies, as proxied by the Hedge Fund Research Fund Weighted Composite Index, were down 4.1%.

Within Asia, macro hedge funds played out successfully as well. The market continues to offer multiple investment themes given the varying pace of policy cycles within Asian economies themselves and relative to the United States. This has opened up attractive opportunities on the rates front, while also allowing for idiosyncratic regional trades to be made. Although Asia macro may not have generated the same eye-catching returns as some of their global peers, this boils down to their mandates that are often structured to be of lower volatility.

In stark contrast, Asia equity long/short funds found difficulty in gaining ground this year amid the broad equity market decline, particularly for long-biased funds. Hedge Fund Research data show Asia ex Japan equity hedge funds down 16.3% year-to-date, trailing their global peers (-10.0%) but holding up relative to the broader Asian equity market (-17.1%). Underperformance relative to global equity long/short was driven by a combination of exposure to China as well as the net-long bias that most Asia long/short managers tend to hold.

Despite recent underperformance, we remain confident that Asia equity long/short can add value to investor portfolios. Historically, Asia equity long/short has had higher volatility than global equity hedge funds but also higher expected returns. The alpha potential in Asia is arguably higher because of market inefficiencies arising from the large investable universe, low institutional presence, and limited analyst coverage. As always, manager selection is critical, but thoughtful implementation of Asia equity long/short can provide investors with increased diversification and a differentiated return profile to existing hedge fund portfolios.

Index Disclosures

HFR Macro (Total) Index

The HFR Macro (Total) Index includes macro investment managers that trade a broad range of strategies in which the investment process is predicated on movements in underlying economic variables and the impact these have on equity, fixed income, hard currency, and commodity markets.

HFR Fund Weighted Composite Index

The HFRI Fund Weighted Composite Index is a global, equal-weighted index of single-manager funds that report to HFR Database. Constituent funds report monthly net of all fees performance in US dollar and have a minimum of $50 million under management or $10 million under management and a 12-month track record of active performance. The HFRI Fund Weighted Composite Index does not include Funds of Hedge Funds.

HFR Equity Hedge (Total) Index

The HFR Equity Hedge (Total) Index includes equity hedge investment managers that maintain positions both long and short in primarily equity and equity derivative securities. Managers would typically maintain at least 50% exposure to, and may in some cases be entirely invested in, equities, both long and short.

HFR Emerging Markets: Asia ex-Japan Index

HFR Emerging Markets: Asia ex-Japan funds focus greater than 50% of their investments in the Asia ex-Japan region, which includes China, Korea, Australia, India, Hong Kong, and Singapore.

J.P. Morgan Asia Credit Index

The J.P. Morgan Asia Credit Index provides investors with a benchmark that tracks USD-denominated debt instruments in the Asia ex Japan region.

MSCI AC Asia ex Japan Index

The MSCI AC Asia ex Japan Index captures large- and mid-cap representation across two of three developed markets countries (excluding Japan) and eight emerging markets countries in Asia. With 1,201 constituents, the index covers approximately 85% of the free float–adjusted market capitalisation in each country.

MSCI AC Asia ex Japan Growth Index

The MSCI AC Asia ex Japan Growth Index captures large- and mid-cap securities exhibiting overall growth style characteristics across two of three developed markets countries (excluding Japan) and eight emerging markets countries in Asia.

MSCI AC Asia ex Japan Quality Index

The MSCI AC Asia ex Japan Quality Index is based on MSCI AC Asia ex Japan, its parent index, which includes large- and mid-cap stocks across two of three developed markets countries (excluding Japan) and eight emerging markets countries in Asia.

MSCI AC Asia ex Japan Value Index

The MSCI AC Asia ex Japan Value Index captures large- and mid-cap securities exhibiting overall value style characteristics across two of three developed markets countries (excluding Japan) and eight emerging markets countries in Asia.

MCSI All Country World

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets and 24 emerging markets countries. With 2,898 constituents, the index covers approximately 85% of the global investable equity opportunity set.