A More Appealing Environment for Equity Long/Short Strategies

Equity long/short (ELS) is a prominent strategy within the diverse hedge fund landscape, accounting for a significant portion—approximately $1.3 trillion, or 29%—of total hedge fund assets as of fourth quarter 2024, according to Hedge Fund Research, Inc. (HFRI). Put simply, ELS managers take long positions in securities they perceive as undervalued, and short positions in those they consider overvalued. Their aim is to deliver equity-like returns with lower volatility, while also being nimble enough to provide ample downside protection during periods of market turmoil. However, since the 2008 Global Financial Crisis (GFC), ELS strategies have faced headwinds. Managers have struggled to consistently generate value in the post-crisis environment characterized primarily by low interest rates and other structural challenges.

We believe the future looks brighter for ELS strategies due to several factors that should enhance returns. First, cash yields are near their highest levels in nearly two decades, creating a more favorable environment for short sellers. While most key central banks have cut their policy rates in recent quarters, we—and the market—expect rates will remain well above the zero-interest rate policy (ZIRP) levels of the 2010s. Second, increased equity dispersion presents opportunities for managers to distinguish themselves. Lastly, ELS strategies have complemented traditional stock/bond portfolios, indicating that hedge funds continue to provide diversification benefits to broader portfolios, even in recent times. With diligent manager selection, we believe investors can see even more meaningful benefits from these allocations.

Institutional Hedge Fund Trends: A Decade of Change

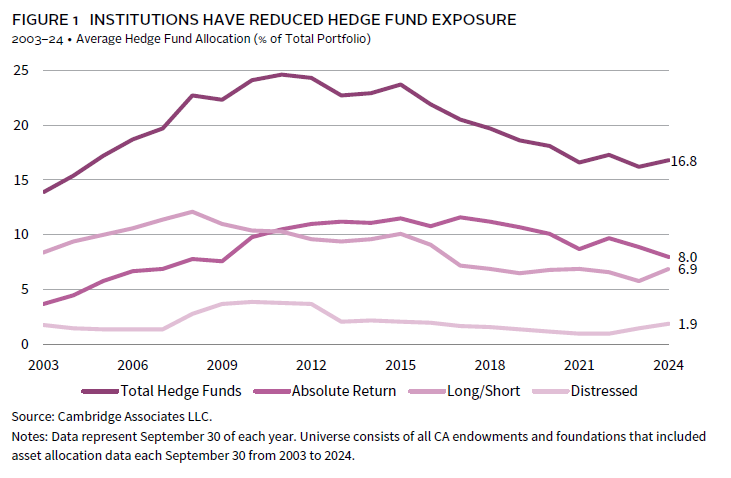

A little over a decade ago, endowments & foundations (E&F) allocated one-quarter of their total portfolios to hedge funds. Since then, these allocations have decreased, with the average hedge fund allocation dropping to approximately 17% by 2024 (Figure 1). This decline was mainly due to the reduction in ELS manager allocations, which have been nearly halved since 2008, alongside the rise of private investment allocations. In contrast, allocations to absolute return strategies—which we define, for simplicity, as a broad category that includes any hedge fund strategy that is not ELS or distressed—have held more stable.

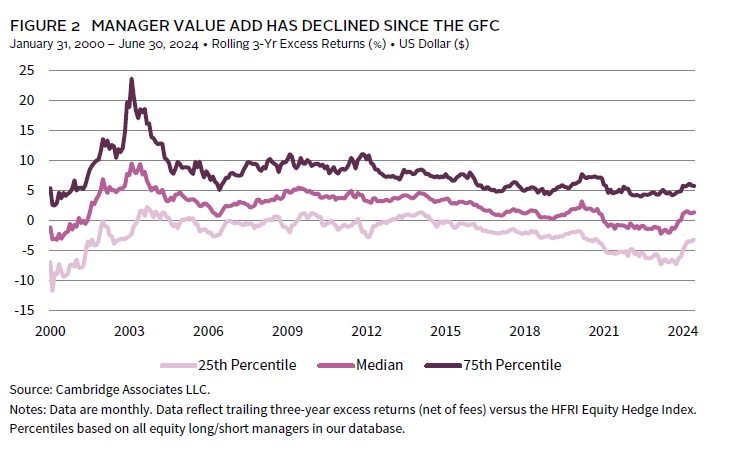

There are several reasons for this reduction. The first involves performance, which has been inconsistent for many managers. The ZIRP environment reduced carry trade opportunities and returns on cash holdings, while muted equity market volatility meant fewer market dislocations for ELS managers to capitalize on. Additionally, exceptional public equity returns increased benchmark pressure and investor expectations, all of which have challenged ELS managers. However, during periods of market turmoil, managers have tended to capitalize on market dislocations, highlighting the role of market conditions in a manager’s ability to add value (Figure 2).

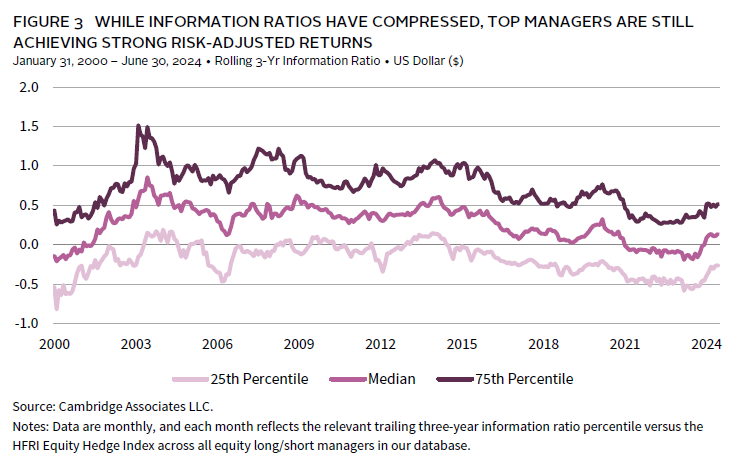

As the level of value add decreased, information ratios (IRs) also declined, indicating less efficiency in generating excess returns relative to their benchmarks. Despite the drop in IRs since 2009, it’s important to remember that many managers have still added significant value. In the past three years to December 31, one-third of managers achieved IRs of 0.30 or higher versus the HFRI Equity Hedge Index, a level targeted by many investors based on industry standards and performance benchmarks (Figure 3).

The second key reason for the decline in institutional hedge fund allocations is the maturation of the private investment landscape. Over the past decade, private equity and venture capital have experienced significant growth and delivered strong returns. This has led many investors to allocate more to the space, which in turn has meant smaller allocations to other asset classes, including hedge funds. Indeed, the mean E&F allocation to private equity and venture capital strategies has exceeded that of hedge funds in each of the last four years.

A More Appealing Interest Rate Environment

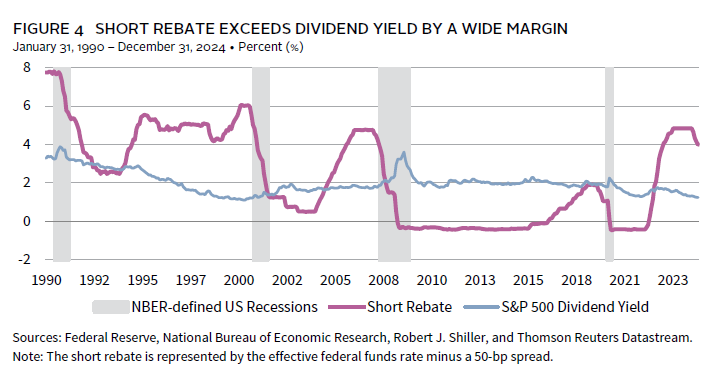

Low interest rates were a headwind for long/short hedge funds for many years. This was because funds earned paltry interest on the collateral held for short sales, i.e., the “short rebate.” In fact, during the ZIRP years, even the interest charged by brokers for lending securities was higher than the minimal short-term interest rates that stock borrowers earned on their collateral. Hedge funds are also obligated to pay securities lenders dividends received on borrowed stock. Taken together, hedge funds were starting at a disadvantage, given the cost of carrying positions in the short book.

Recent market developments have removed this hurdle. The short rebate now looks much more attractive to ELS managers, particularly those that run low net or market neutral portfolios (Figure 4). Increased cash yields from short sales provide additional income, which can enhance the overall returns of these portfolios. Low net portfolios—which typically have a balanced mix of long and short positions—can particularly benefit from the higher short rebate, as it offsets some of the costs associated with short selling. Cash yields have increased substantially in the past few years and are likely to remain relatively sticky, even as the Federal Reserve has embarked on a cautious path of policy rate reductions. In late 2024, the short rebate exceeded dividend yields by nearly the widest margin since 2001.

Historically, environments where the short rebate has exceeded the dividend yield have been beneficial for ELS funds. Since 1990, the median monthly ELS return has been nearly 50 basis points higher when the short rebate exceeded the dividend yield compared to periods when it did not. Indeed, higher cash yields mean the starting point for hedge fund managers is better, given that they achieve a positive return simply by opening short positions due to the short rebate. But a rising tide lifts all boats, and higher cash yields suggest that other asset classes could also perform better. As has historically been the case, long/short funds must differentiate themselves primarily through manager skill.

The shift to an environment with higher borrowing costs could lead to greater equity market dispersion and lower equity market correlations, offering more opportunities for ELS managers to achieve differentiated returns. S&P 500 equity dispersion is elevated compared to the dispersion observed in the post-GFC ZIRP period. In fact, a key measure indicates that recent dispersion levels were in the top quintile of observations since 2010. On the flipside, correlations among S&P 500 stocks rank in the bottom quintile of observations during the same time horizon. The combination of higher dispersion and lower correlation can create a more fertile ground for top long/short managers. However, equity dispersion is still well below the peaks seen during recessionary periods in February 2000, April 2009, and March 2020, when it reached up to twice the current levels. These three periods proved to be attractive starting points for ELS fund managers. Manager dispersion—which tends to follow equity dispersion—has also risen during volatile market periods, so the need for adept manager selection is even more pronounced in these environments.

The Strategic Appeal of ELS

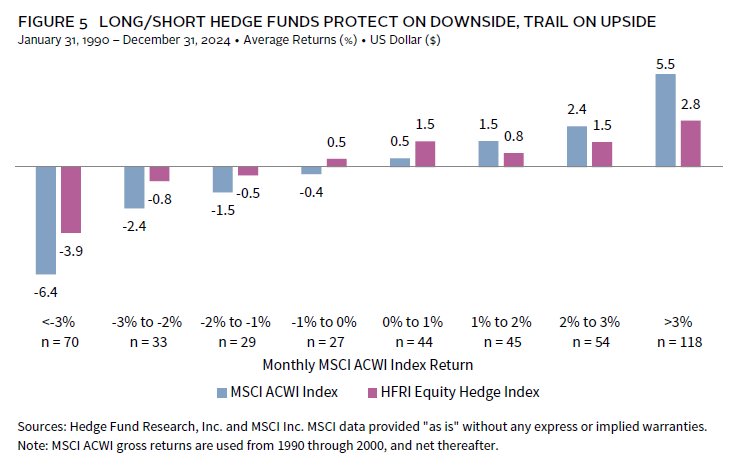

ELS funds are not designed to match the performance of equity markets, and their returns may not always be positive. Historically, these funds capture a smaller portion of market downside and lag on the upside (Figure 5). This lag can be difficult for some investors, particularly when public equities enjoy such strong bull market returns as have been observed recently. Indeed, global equities have climbed 64% since reaching lows in late 2022. But after such a rapid ascent, it remains crucial for investors to ensure that their asset allocation can withstand the ups and downs of market cycles. Equity valuations are elevated today, suggesting that higher expectations are priced in, which could limit equity returns going forward. For instance, developed markets equities’ normalized price-to-earnings ratios are currently trading higher than 99% of the historical observations dating back to 1979.

Historical data underscore the resilience and potential of ELS strategies during market downturns. For instance, during the GFC, the MSCI All Country World Index (ACWI) declined by 55% from its peak in late 2007 to its trough in early 2009. In contrast, the HFRI Equity Hedge Index fell by 31%, representing an outperformance of 24 percentage points. The shallower downturn in ELS allowed investors to recoup their losses within two years of reaching the nadir, whereas the broader MSCI ACWI took nearly five years to recover. ELS strategies also held up better than broader equities during the bear market drawdowns of 2020, and in 2022. These observations highlight the ability of ELS strategies to provide downside protection and mitigate losses during periods of market stress. Conversely, they offer the potential for capital appreciation and active management benefits that safe-haven assets, such as cash or treasury bonds, may not provide. ELS managers can actively exploit market inefficiencies and position for recovery, potentially enhancing long-term returns beyond mere capital preservation.

It is crucial to consider how a specific manager may perform in different environments by reviewing their performance during times of stress. This includes assessing how their equity or credit beta moves in such environments if their track record allows such a review. Understanding a manager’s tendencies during market drawdowns can provide valuable insights into their ability to protect capital and deliver consistent returns.

Positioning for Success

Despite challenges faced by ELS managers, hedge funds have enhanced the performance of simple stock/bond portfolios in both the short and long term. For example, since 2000, a portfolio consisting of 70% stocks and 30% bonds has underperformed compared to a similar portfolio adjusted to include a 20% allocation to ELS. Additionally, the portfolio with ELS exhibited lower volatility compared to the one without it. 1 This trend has persisted over the past three years, particularly as bonds faltered and hedge funds demonstrated resilience during the equity market downturn in 2022. While these results are encouraging, selecting top-tier managers could further improve outcomes. The heterogeneity among ELS managers offers investors opportunities to benefit from careful manager selection, as the performance dispersion among hedge fund managers tends to be broader than that among public equity managers, who typically follow more standardized investment strategies.

A successful hedge fund allocation will depend on good manager selection and thoughtful risk management. ELS managers tend to have higher tracking error relative to other asset classes. For instance, the median ELS manager in our database had a tracking error of 11% in the three years ended December 31, 2024—double that of global equity managers in the same period. This means investors may need to size ELS positions more modestly relative to other managers in the broader portfolio. Investors should also assess the stability of a manager’s tracking error over time, as this can provide valuable insights for managing risk through position sizing.

Investors should also consider fee structure alignment. A higher risk-free rate environment should boost the expected absolute returns of long/short hedge funds, but managers should not be rewarded simply for collecting that cash yield. If funds are charging performance fees on total returns, which include the impact of the higher short rebate, then the structure of those fees could create a drag that offsets any supposed benefit from yields on the short book. Fee alignment will vary and will be driven by numerous factors, but investors should be attuned to the benefit of more investor-friendly fee structures, such as those that incorporate a cash-based hurdle.

Conclusion

Fundamental ELS strategies have faced challenges since the GFC, but the tide may be turning. The recent increase in cash yields and higher equity dispersion create a more favorable environment for the short book and will offer opportunities for managers to distinguish themselves. Moreover, with equity markets having experienced a massive rally over the last decade and trading at elevated valuations, it is prudent for investors to consider adding more defensive strategies like ELS to their portfolios. Success in hedge fund portfolios will depend largely on manager selection, sizing, and strategy mix. Thoughtful implementation of these portfolios will enable investors to capitalize on the new attractive dynamics emerging in the ELS landscape.

Sean Duffin, Senior Investment Director, Capital Markets Research

Ilona Vdovina also contributed to this publication.

Footnotes

- In this example, we assume the ELS allocation has a 0.3 equity beta for the entire period. Given that assumption, we fund the 20% ELS allocation from 30% equities and 70% bonds. This results in a portfolio with an allocation of 64% equities, 16% bonds, and 20% hedge funds, which we compare to a 70% equities and 30% bond portfolio. We use the following indexes as proxies: MSCI World, Bloomberg Global Aggregate, and HFRI Equity Hedge, and calculate based on monthly rebalancing.

Sean Duffin - Sean Duffin is a Senior Investment Director for the Capital Markets Research team at Cambridge Associates.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.