A Liability Investors’ Guide to Reassessing Hedge Funds

In the years following the Global Financial Crisis (GFC), the appeal of hedge funds among institutional investors has diminished. This shift has been driven by legitimate concerns about high fees, a lack of transparency, and illiquidity. Yet, against this backdrop, hedge funds today offer a strategic opportunity for investors willing to navigate their complexities, with significant diversification and growth prospects that stand out from traditional asset classes. For investors with liability-oriented portfolios, revisiting the potential of hedge funds could prove an especially prudent strategy in navigating the current financial landscape.

This paper looks at the asset class in the context of current market conditions, specifically higher interest rates and the potential for increased volatility, combined with improved access to hedge fund strategies more generally. These factors could create a prime opportunity for liability investors—such as pensions, nuclear decommissioning trusts, and insurance companies—to explore their use. It also discusses the primary risks associated with hedge funds and presents four actionable guidelines for investors aiming to effectively incorporate these strategies into their portfolios. These include defining a clear role for hedge funds, ensuring thorough due diligence, maintaining diversification, and adopting a strategic approach.

Why Consider Hedge Funds Today?

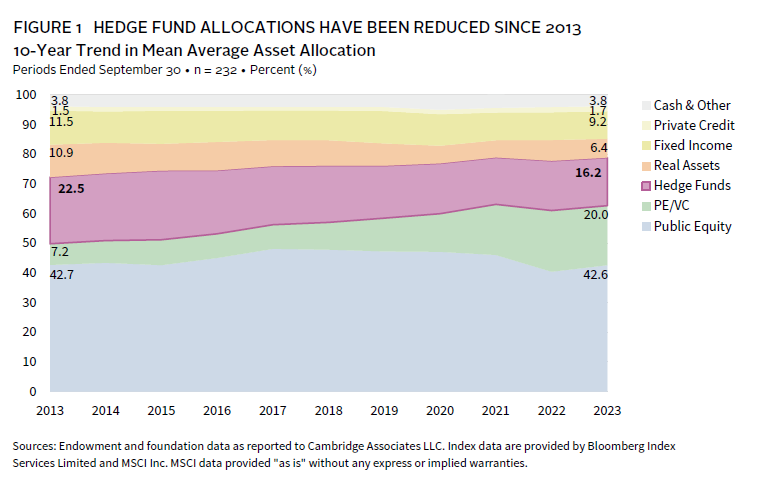

While institutional hedge fund allocations have been reduced in recent years (Figure 1), current market conditions may help to bolster the asset class moving forward.

Higher Interest Rates

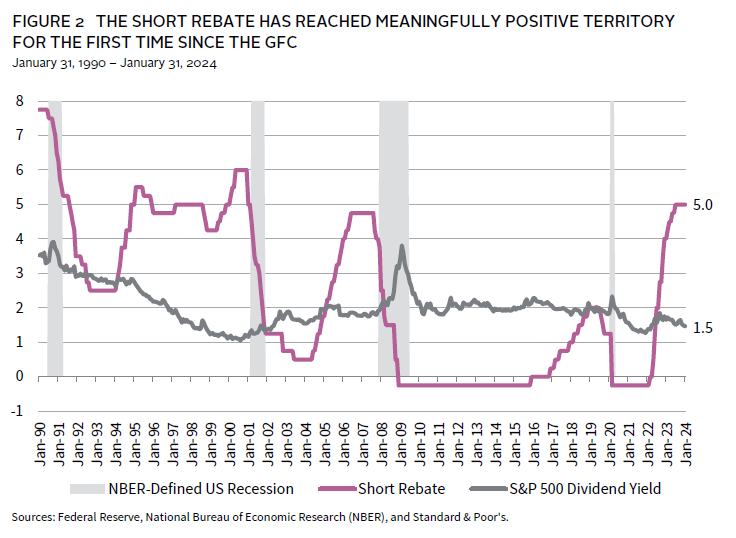

Although a “higher-for-longer” interest rate environment can have both positive and negative implications for investors, it tends to be a tailwind for hedge funds. Heightened interest rates and persistent inflation have pushed the short rebate 1 into meaningfully positive territory for the first time since the GFC (Figure 2), a dynamic that directly benefits hedge fund managers that undertake short selling. While alpha generation remains paramount, the short rebate can function as a stabilizer against volatility for managers with high short exposure, such as long/short equity managers. Higher interest rates also mean increased returns on cash. This is an advantage for managers that have significant amounts of free capital, whether they are operating global macro strategies, relative value strategies, or other approaches involving derivatives.

Increased Volatility Potential

Although volatility has remained relatively low through the first half of 2024, the rapid emergence of generative artificial intelligence is likely to continue to impact volatility in various market sectors over the near term. Moreover, geopolitical uncertainty—including the war between Russia and Ukraine, ongoing conflicts in the Middle East, and US-China tensions—also has the potential to create elevated market turbulence.

What’s notable here is that hedge funds have traditionally thrived amid heightened volatility. This is because greater volatility results in greater dispersion of returns among individual securities and asset classes more broadly, often with projected highs soaring higher than expected and projected lows drawing lower.

As the market identifies winners and losers and companies compete for capital, more alpha opportunities become available to diligent hedge fund managers. Nimble asset managers can also look to capitalize as disparities between a company’s business fundamentals and security price become more defined, creating additional trading opportunities. It is also important to note that hedge fund allocations have the potential to offer portfolios protection from unexpected market headwinds, particularly those designed to be less correlated to traditional sources of return.

Improved Access

Investors allocating to hedge funds today have access to opportunities that they could only dream of a decade ago, partly due to increased openness and innovation within the industry. What’s more, regulatory changes have helped to improve hedge fund transparency. Lastly, technological advancements have helped make it easier to retrieve and analyze information about hedge funds in the pursuit of strategies that are best suited to specific portfolio needs.

Implementation: Four Actionable Guidelines

Even amid more favorable market conditions for hedge funds, investing success depends on effective portfolio implementation. Four important action steps will help institutional investors determine which strategies can complement their broader investment goals.

1. Clearly Define the Role of Hedge Funds in the Portfolio—and Adapt as Needed

Given the wide array of hedge fund strategies available, it is critical to first set clear goals and expectations around the role they will play in a portfolio and seek out managers that match this profile (see Case Study: Enhancing Pension Health with Hedge Funds). Traditionally, hedge funds have been positioned to generate returns between those of bonds and equities, with the expectation of sub-equity volatility.

Case Study: Enhancing Pension Health with Hedge Funds

Background: A corporate pension plan with $3 billion in assets and 90% funded status faces growing liabilities from an increasing number of participants. The administrators seek to boost returns and improve the plan’s funded status without compromising liquidity or elevating risk.

Strategy Implementation: Given the higher interest rates and greater potential market volatility, the plan allocates part of its portfolio to select hedge funds. A detailed due diligence process identifies managers experienced in overcoming market challenges and generating alpha. The focus is on hedge funds with strategies like long/short equity, which present active management opportunities, and global macro strategies that capitalize on geopolitical and inflationary trends.

Outcome: This strategic move diversifies the portfolio, reduces volatility, and targets higher returns, aligning with the goal of enhancing the plan’s funded status. It provides a sophisticated approach to risk management and return enhancement, ensuring the plan can meet its obligations to beneficiaries.

However, allocations should be carefully customized to an investor’s specific needs and risk tolerance (Figure 3). Where some investors may be willing to take on more risk for more return potential, others many want a highly diversifying hedge fund portfolio that seeks to generate returns with low-to-no equity beta. By setting clear goals, investors can access managers that better align with their risk and return objectives. Regularly reviewing and adjusting hedge fund allocations can help ensure they continue to meet these goals.

2. Rigorously Evaluate Managers to Uncover Top-tier Partners

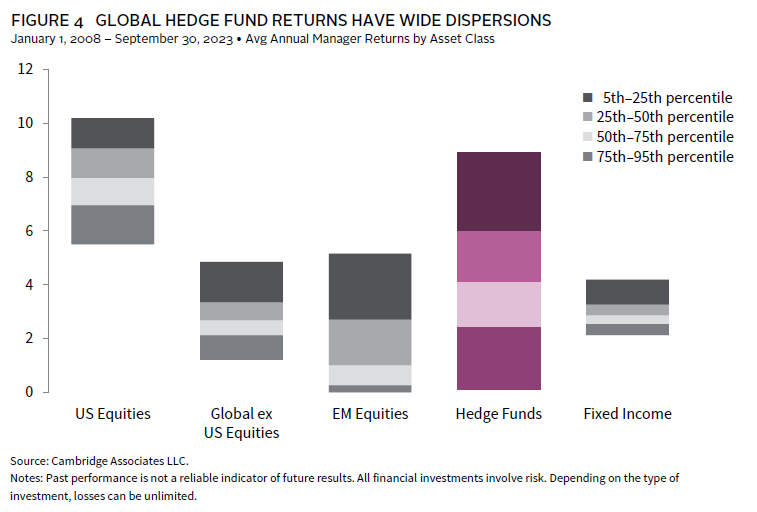

The hedge fund landscape presents substantial divergence in performance outcomes across managers. Working with top-tier managers is essential, as seemingly negligible differences among managers’ expertise and investment approaches can lead to materially different returns (Figure 4).

Historically, the hedge fund industry has been categorized by notable manager turnover due to the risks associated with the use of intricate financial products and balance sheet leverage. Navigating this universe and underwriting new funds demands a due diligence process that requires considerable time and resources. However, this effort is vital and will help investors uncover managers with high-quality investment processes, fund administration, and risk management.

To ensure thorough due diligence, investors should establish clear criteria for manager selection, including track record, investment strategy, risk management practices, and alignment of interests. A comprehensive quantitative analysis of historical performance, including metrics such as Sharpe ratio, alpha generation, and drawdown analysis, is crucial. Tools such as Monte Carlo simulations can be invaluable for stress-testing performance under various market conditions. Additionally, in-depth qualitative assessments through interviews and on-site visits can provide insights into the manager’s investment philosophy, team structure, and operational infrastructure. Engaging third-party service providers for background checks, legal reviews, and operational due diligence helps uncover hidden risks. Comparing potential managers against a peer group using industry benchmarks and databases offers a well-rounded view of their relative strengths and weaknesses.

Many leading hedge funds today are large and complex organizations whose proper evaluation requires significant industry experience. Investors must undertake comprehensive risk assessment to avoid blowups. With the rise of new trading platforms and the increasing commoditization of fundamental research, it becomes even more valuable for allocators to possess deep expertise and substantial global resources. This is necessary not only to proficiently underwrite funds, but to discern the sustainability of a manager’s competitive edge and identify top emerging talent. Understanding the nuances of the manager’s strategy, including their edge in the market, sources of alpha, and competitive advantages, is crucial. Assessing the robustness of the manager’s operational infrastructure, including compliance, reporting, and fund administration, is also essential. Collaborating with industry experts can provide valuable insights and validate findings.

Among the more than 8,000 hedge funds operating worldwide, Cambridge Associates believes that fewer than 2% merit investment consideration. Accessing these “high conviction” funds can be challenging but can improve as investors build relationships with fund managers. Most managers value their client relationships and are often willing to negotiate capacity. This underscores the importance of a proactive, informed approach that emphasizes strategic partnerships. We believe by actively networking within the industry, investors can build relationships with top managers and unlock exclusive opportunities. Being well prepared when negotiating terms and capacity can secure more favorable investment conditions. Additionally, demonstrating a long-term commitment fosters collaboration that can lead to superior investment prospects.

3. Use Hedge Funds to Optimize Diversification

In today’s investment environment, a thoughtfully diversified portfolio requires iterating beyond the traditional 60/40 split between equities and bonds. Investors should consider increasing allocations to alternative investments to provide valuable and differentiated sources of return, downside protection, and liquidity during times of market stress (see Case Study: Navigating Yield Uncertainty, Insurance Firm Turns to Hedge Funds).

Case Study: Navigating Yield Uncertainty, Insurance Firm Turns to Hedge Funds

Background: An insurance firm with a $5 billion asset base confronts the challenge of securing higher returns in a landscape marked by interest rate uncertainty, while ensuring sufficient liquidity for potential claims. Operating within a tightly regulated environment, the firm is on the lookout for an investment strategy that can provide stability without sacrificing returns.

Strategy Implementation: To address yield uncertainty and generate returns away from equities, the firm diversifies its investment approach by incorporating hedge funds. It selects a portfolio of managers with complementary strategies: global macro strategies that excel at capitalizing on broad economic trends and market shifts, other market neutral strategies that find under-trafficked and idiosyncratic opportunities, and long/short specialists whose sector expertise can drive persistent and repeatable uncorrelated alpha generation. These investments combine for a near-zero beta positioning, with little relation to the firm’s equity or fixed income holdings. This helps to reduce drawdown risks from equity sell-offs, rate movements, or credit spread changes. This custom, lower-beta approach to hedge funds is found to be best suited to the insurer’s needs, resulting in a tailored solution that addresses its specific investment objectives and risk tolerances.

Outcome: By integrating uncorrelated hedge fund investments that use both global macro and directional strategies into its portfolio, the insurer enhances its portfolio diversification. This approach boosts its resilience against market volatility and may help mitigate the impact of capital charges. Its portfolio of hedge fund managers is capable of delivering returns similar to public equities with significantly lower realized risk. The firm is in a stronger position to increase its investment income, bolster its ability to cover claims, and solidify its financial stability.

While private equity and venture capital deserve consideration, they are highly illiquid, and cannot be used for regular rebalancing or ongoing cash needs. Hedge funds, however, offer a middle ground. They provide more liquidity than private asset classes and, given the wide array of available strategies, can offer the potential for robust returns in various market environments.

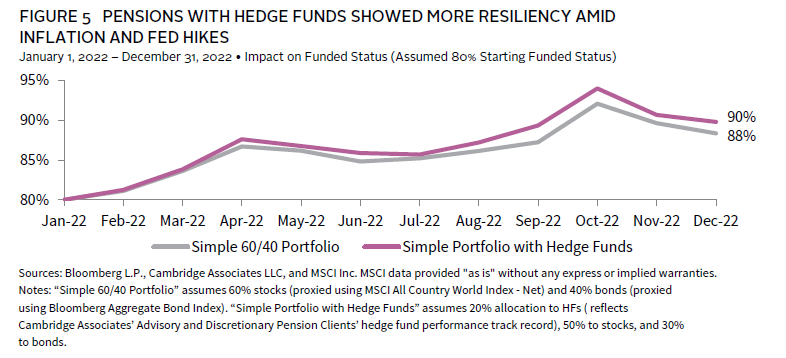

Executed effectively, hedge funds have the ability to play an all-weather role in a portfolio. For instance, in 2022, as equities and bonds suffered material losses, many hedge fund managers generated positive returns for the calendar year. Pensions with hedge fund allocations have tended to show more resiliency amid such market drawdowns (Figure 5).

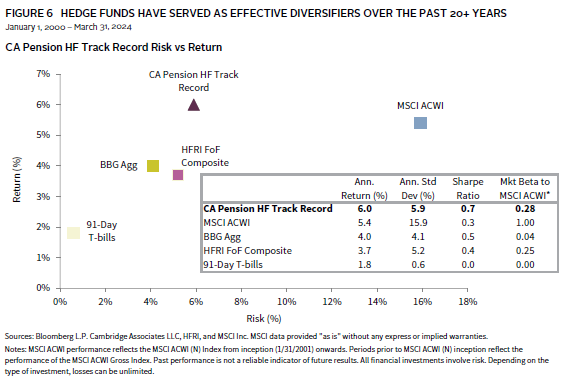

Investors looking for greater consistency in down markets can consider absolute return-oriented funds, which aim to provide positive absolute returns regardless of backdrop. Those expecting inflated default rates following higher-for-longer interest rate conditions can consider credit-oriented funds that excel in identifying and profiting on struggling businesses and/or dislocated securities. Over the past 20-year period, hedge funds have provided moderate returns with lower volatility than equities, helping to balance risk and deliver diversification benefits in an ever-changing investment landscape (Figure 6).

4. Use a Strategic Mindset to Overcome Valid—But Not Insurmountable—Hedge Fund Challenges

Investors are right to be concerned about hedge fund fees, transparency, and liquidity, but a well-informed, strategic approach can help unlock their potential.

While the hedge fund industry is known for its “2 and 20” fees—2% management fee and 20% performance fee—investor costs and terms are often negotiable, particularly with scale. It is critical to ensure fees are reasonable relative to expected alpha and to only invest with managers offering compelling return potential net of all fees.

Similarly, investors should only invest with hedge funds that offer appropriate transparency. Transparency is central to assessing the strategies employed by the fund. Investors should demand clear, comprehensive reporting on holdings, risk metrics, and performance attribution so that they can make informed allocation decisions. Greater transparency not only aids in understanding a fund’s approach and alignment but fosters trust between investors and fund managers.

In terms of illiquidity, adopting strategies that reduce an investor’s readily available capital may be justified in some cases, as long as the overall portfolio maintains adequate liquidity levels. Investors should complement less-liquid strategies with those that provide quarterly, monthly, or more frequent liquidity options to ensure a capital reserve during stressful periods. For those with greater liquidity needs, building well-diversified hedge fund allocations offering full quarterly liquidity is advisable.

Conclusion

Economic conditions and financial markets are unpredictable. Despite 2023’s equity bull run and its continuation in early 2024, investor circumstances can always change. For pensions, insurance firms, and other liability-focused investors, being positioned to withstand volatility is a critical component of successful portfolio management. Despite the skeptics, hedge funds can offer an attractive option for enhancing portfolio diversification and returns, especially in an environment of interest rate uncertainty and elevated volatility.

However, understanding risk is the essence of informed decision making. Action items for investors include: clearly defining the role of hedge funds within the portfolio; seeking out the highest quality managers; maintaining diversification; and adopting a strategic mindset to navigate inherent challenges. By carefully pursuing these actions, liability investors can successfully leverage hedge funds to help achieve their investment objectives, ensuring a balanced approach to risk and return in an ever-changing investment landscape.

Melanie Mandonas, Managing Director, Pension Practice

Index Disclosures

Bloomberg Aggregate Bond Index

The Bloomberg Aggregate Bond Index is a broad-based fixed income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

HFRI Fund of Funds Composite Index

Fund of Funds invest with multiple managers through funds or managed accounts. The strategy designs a diversified portfolio of managers with the objective of significantly lowering the risk (volatility) of investing with an individual manager. The Fund of Funds manager has discretion in choosing which strategies to invest in for the portfolio. A manager may allocate funds to numerous managers within a single strategy, or with numerous managers in multiple strategies. The minimum investment in a Fund of Funds may be lower than an investment in an individual hedge fund or managed account. The investor has the advantage of diversification among managers and styles with significantly less capital than investing with separate managers. PLEASE NOTE: The HFRI Fund of Funds Index is not included in the HFRI Fund Weighted Composite Index.

MSCI All Country World Index

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets and 24 emerging markets countries. With 2,760 constituents, the index covers approximately 85% of the global investable equity opportunity set.

S&P 500 Index

The S&P 500 is a market capitalization–weighted stock market index that tracks the stock performance of about 500 of some of the largest US public companies.

Footnotes

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.