2025 Outlook: Credit Markets

We expect liquid credit returns to decline due to low credit spreads and anticipated Fed easing. Direct lending returns should moderate but continue to outperform their liquid counterparts. Meanwhile, insurance-linked securities will continue to benefit from strong demand, and increased transaction volumes should support both specialty finance and credit opportunities managers. In emerging markets, currencies should become a tailwind for local bonds.

Liquid Credit Returns Should Be Lower in 2025

Wade O’Brien, Managing Director, Capital Markets Research

Following solid gains in 2024, US liquid credit returns will be lower in 2025, given lower credit spreads and expected Fed easing. The flipside is that credit fundamentals remain sound and there are pockets where investors can find attractive risk-adjusted returns.

US high-yield bonds returned roughly 9% year-to-date through November 30 and US investment-grade credit bonds generated around 4%. Returns were boosted by falling credit spreads; through November 30 US high-yield and investment-grade index spreads had fallen by 58 bps and 21 bps, respectively. The decline in Treasury yields further benefited returns, with respective yields at 7.14% and 5.05%.

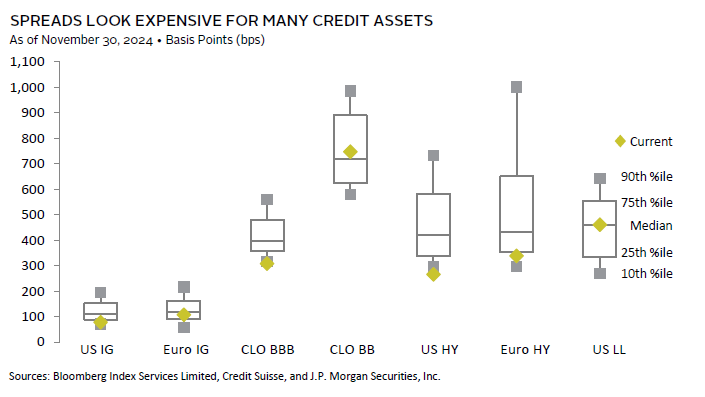

Even if investors in 2025 receive coupon-like returns, this would still be higher than recent averages, given the low interest rate environment that prevailed prior to the pandemic. For example, the ten-year AACR on US high-yield bonds was just 5.1% as of November 30. Returns next year could receive a lift if spreads compress further or if the Fed cuts rates faster than expected, though we would note spreads look expensive on a historical basis and in recent weeks the amount of expected Fed easing in 2025 has been pared back.

Either way, returns should be supported by improving fundamentals. Earnings growth was inflecting upward for both high-yield and investment-grade borrowers as 2024 drew to a close, and borrowers with floating rate debt should continue to see interest coverage ratios improve given falling short-term rates.

Looking across liquid credit markets, we are neutral between fixed and floating rate. Additional rate cuts could boost values for the former, but the latter will serve as a hedge against inflationary pressures. Across all types of liquid credit, we do not think it is an opportune time to stretch for yields, as spreads for most assets are in the bottom quartile, or even decile, of historical readings. While being mindful of duration, collateralized loan obligation debt offers a spread pickup with little give up in terms of credit quality or liquidity.

Insurance-Linked Securities Should Deliver Attractive Returns in 2025

Joseph Tolen, Senior Investment Director, Credit Investments

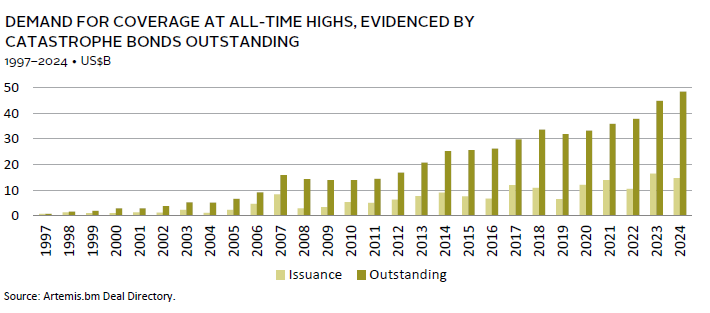

The insurance-linked securities (ILS) market continues to be attractive and should deliver strong returns in 2025. The demand for additional catastrophe coverage from insurance companies has kept the market firm, providing sufficient cushion for reinsurers and ILS managers to absorb risk. This is evidenced by managers achieving impressive returns in both 2023 and 2024 despite a notable rise in severe storms in the US Midwest, multiple significant hurricanes making landfall, and flooding in Europe. The sustained hard insurance market, combined with the uncorrelated nature and diversification benefits of investing in ILS, make 2025 an attractive opportunity for investors.

Several factors have supported the insurance market, which has improved ILS pricing and resulted in more favorable terms and conditions for investors. Premium increases following Hurricane Ian and balance sheet losses on the back of a particularly challenging year for traditional assets in 2022 created a capital shortage for reinsurers, limiting their ability to provide coverage for insurance companies. Conversely, demand for protection from insurance companies has sharply increased due to high rates of inflation in recent years and the need for broader coverage, largely related to climate change.

The supply/demand imbalance is set to continue into 2025. Additional supply will be available from reinsurers and ILS managers following two strong years of performance, but this is expected to be offset by continued demand for coverage from insurance companies, particularly on the back of hurricanes Helene and Milton. These factors will keep the insurance market firm, leading to more attractive pricing for investors and giving them additional cushion to absorb losses, even if 2025 sees higher-than-average catastrophe events.

When considering opportunities, terms and conditions will be crucial to performance success. We favor managers that are meticulous in portfolio construction and appropriately invest in line with their stated risk/return profiles regarding attachment points and where they sit in the capital stack, perils, trigger mechanisms, geographies, and so on. Doing so will help mitigate exposure to risks associated with climate change, put investors in the best position to absorb losses from events, and help maximize returns.

Currencies Should Become a Tailwind for Emerging Markets Local Bonds in 2025

Thomas O’Mahony, Senior Investment Director, Capital Markets Research

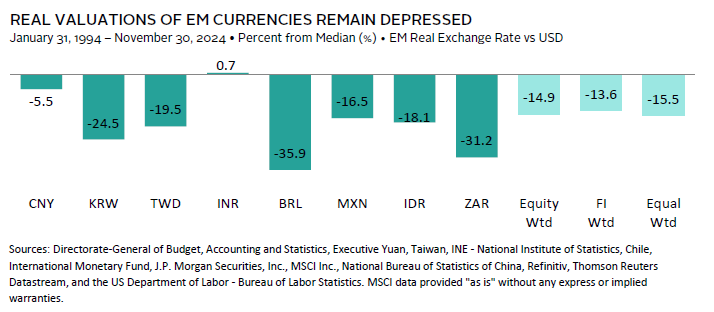

The currency component of EM local currency bond performance has frequently been the dominant driver of the asset class. This is perhaps unsurprising when one considers it has exhibited nearly twice the volatility of the local currency performance. In four out of the past five calendar years, including 2024, the currency return has been a detractor from the total return for a USD-based investor, which is of course explained to a large extent by the strong performance of the dollar over this time period. While the currency return may not exceed the fixed income return in 2025, we think it is likely to cease being a headwind and ultimately become a tailwind.

The J.P. Morgan GBI-EM Global Diversified Index currently yields 6.30%. This is at the 34th percentile of its history, so in terms of return drivers, it looks as though the carry of the index will be somewhat below average in 2025. Despite this more moderate yield, there is still scope for the index to deliver some price appreciation next year. Inflation in emerging markets has remained contained after the post-COVID spike. Therefore, with real yields still somewhat elevated, there is scope for EM central banks to ease rates should growth conditions necessitate. Further, if DM bonds yields decline, EM bonds yields, which typically trade with a beta to those of developed markets, should also move somewhat lower.

Our EMD-weighted currency index has declined in recent months, now sitting 14% below its median real valuation versus the dollar. We anticipate this valuation gap will narrow somewhat next year. First, from the USD perspective, the currency remains richly valued against substantially all peers. Though we remain sensitive to the risk of further dollar appreciation given, in particular, the spectre of tariffs being placed on trade with the US, we expect the dollar to eventually weaken as the Fed continues to ease policy, narrowing interest rate differentials. Furthermore, the growth differential between emerging and developed markets looks set to widen as we move into 2025, which may support the risk appetite for EM assets. Any additional policy easing from China would reinforce such a dynamic. Naturally, there are risks to this view, such as a material slowdown in global growth or a pickup in global inflation. However, our expectations are for a more favorable environment for EM currencies in 2025.

Direct Lending Returns Should Decline in 2025

Wade O’Brien, Managing Director, Capital Markets Research

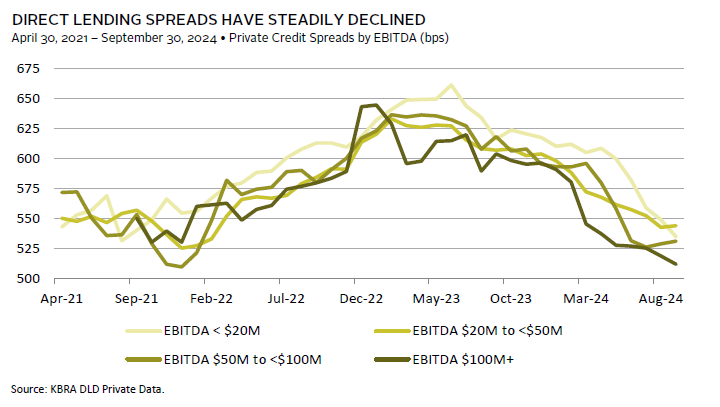

Direct lending funds are on track to generate strong returns in 2024, returning 9% year-to-date through September 30. Returns should decline in 2025 as central banks continue cutting benchmark rates and competition among lenders lowers credit spreads. Still, spreads will remain above those available in public credit, and rising deal volumes will create more opportunity for investors to put capital to work.

Benchmark yields have moved lower after the Fed’s recent rate cuts and are expected to continue declining over the course of 2025. Direct lending spreads are also falling and are now around SOFR+ 525 compared to around 370 bps for broadly syndicated loans (BSLs). Spreads should continue to decline in 2025, given competition from the BSL market for larger deals and as direct lending funds are eager to deploy more than $250 billion in dry powder.

There is some good news for investors. Credit fundamentals, which have been under pressure for some borrowers, should improve in 2025 as rates decline. This will be especially helpful for smaller firms, which have seen slower revenue growth than larger peers. Default rates on private loans should start to recede as debt servicing ability improves.

Deal volumes have picked up in recent quarters and this trend should continue in 2025. Low interest rates are improving deal economics for PE sponsors, which in some cases are under pressure from investors to deploy capital. Greater supply could serve to offset some of the downward pressure on spreads from growing competition among lenders.

Weighing these dynamics, investors in private lending funds should continue to earn higher returns in 2025 than available from public equivalents and should see more capital put to work. Lower middle-market funds may suffer from less spread compression than large peers, which tend to face competition from BSLs, though investors should carefully screen managers as not all small companies will see fundamentals improve.

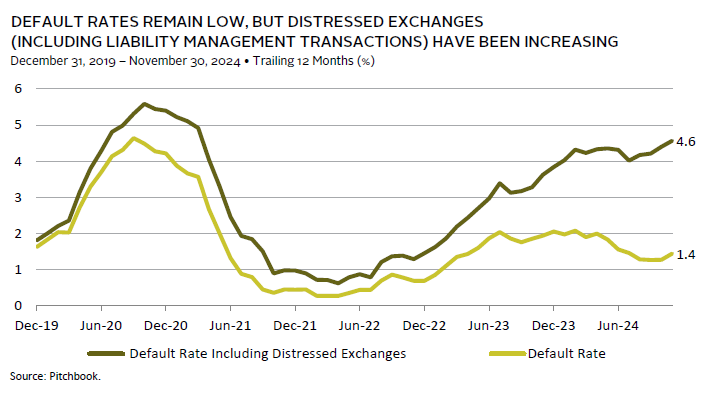

Liability Management Transactions Should Accelerate in 2025

Frank Fama, Head of Global Credit Investment Group

With the Fed transitioning to a rate-cutting cycle and inflation trending to target, recession fears have largely abated. However, with the dearth of M&A activity and weak IPO market, PE sponsors are finding it difficult to exit investments. Sponsors are faced with an aging portfolio and a number of problems. Many of these leveraged buyouts (LBOs) were financed in the broadly syndicated loan market in 2021 before the rate increase cycle and after the disruption of COVID-19. Lenders agreed to provide high leverage due to elevated valuations and low interest rates, and credit protection provisions were extremely weak. Now PE sponsors have overleveraged companies with maturing debt in need of a recapitalization solution and companies in need of growth capital to take advantage of attractive opportunities.

Credit opportunities managers will work with sponsors to take advantage of the excesses of the BSL market to structure investments that may prime existing lenders and lend new money at mid-teens rates. Known as liability management, the transactions can take different forms, but they all take advantage of provisions in the credit agreement that allow for the creation of new debt, to the detriment of existing lenders. Skilled managers are able to accumulate a position at a discount and structure and lead a transaction that results in at par or near par recovery for their debt and create a new debt security that is senior and secured by the most valuable collateral. Executing the strategy well requires active management and strong industry relationships. At first, sponsors viewed the transactions as excessively aggressive, but they are coming to view the solution as effective in managing their stressed LBOs and activity is expected to accelerate in 2025.

PE managers are holding investments longer, which is creating pressure to continue supporting companies, either because the company has too much debt or the company needs growth capital. Credit opportunities managers will partner with PE managers to take advantage of weak creditor protections in loan documents to provide capital that is senior and at higher yields relative to the existing BSL lenders.

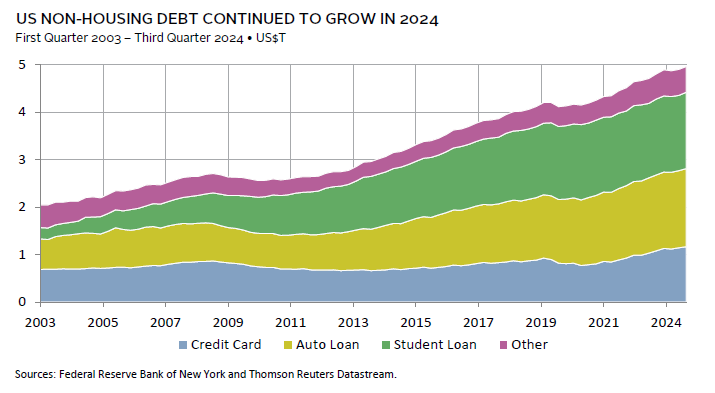

US Specialty Finance Transaction Volumes Should Increase in 2025

Adam Perez, Managing Director, Credit Investments

With US consumer non-housing debt at nearly $5 trillion and growing, the opportunity set for specialty finance managers to fund non-bank lenders is expanding. In addition, specialty finance funds are poised to engage in larger significant risk transfer (SRT) transactions with banks, driven by the need for banks to align their balance sheets with the Basel III Endgame requirements. These factors will increase US specialty finance deal volumes in 2025.

Declining policy rates and avoiding a global recession in 2025 should entice US consumer borrowing further next year. As traditional banks face regulatory constraints and capital requirements, non-bank lenders are stepping in to fill the gap. This shift is creating a robust pipeline of investment opportunities for specialty finance funds, which can provide the necessary capital to these non-bank entities and benefit from a sustained demand for alternative lending transactions.

Moreover, the Basel III Endgame, the latest set of rules from the Basel Committee on Banking Supervision, which aims to fortify the management of risk within the banking sector, is pushing banks to offload riskier assets from their balance sheets. Like specialty finance lending, SRT is another element in the trend of reduction in bank balance sheet risk. This regulatory environment is conducive to the growth of SRT transactions, a mechanism whereby a third party agrees to assume certain credit risks from a bank, deleveraging the bank’s balance sheet and thus providing the bank with regulatory relief. US bank regulator proposals for alignment with the Basel III Endgame portend higher capital charges and are an important factor contributing to the growth of these deals in the United States. In addition, our expectation that policy rates will fall will likely reduce net interest margins, putting further pressure on banks as they seek profitability to right size balance sheets through SRTs. As banks strive to align with these rules, SRT deal volume will increase in 2025.

Figure Notes

Spreads Look Expensive for Many Credit Assets

Asset classes represented by: Bloomberg US Corporate Investment Grade Bond Index (US IG), Bloomberg Pan-European Aggregate Corporate Bond Index (Euro IG), J.P. Morgan CLOIE BBB Index (CLO BBB), J.P. Morgan CLOIE BB Index (CLO BB), Bloomberg US Corporate High Yield Bond Index (US HY), Bloomberg Pan-European High Yield Index (Euro HY), and Credit Suisse Leveraged Loan Index (US LL). Observation periods begin June 30, 1989, for US IG, January 31, 1992, for US LL, January 31, 1994, for US HY, August 31, 2000, for Euro HY & Euro IG, and December 31, 2011, for CLO BBB & CLO BB.

Demand for Coverage at All-Time Highs, Evidenced by Catastrophe Bonds Outstanding

Data for 2024 are through November 30.

Direct Lending Spreads Have Steadily Declined

Three-month rolling averages for first lien term loans. Spreads are to the Secured Overnight Financing Rate (SOFR). EBITDA $100M+ data begin September 30, 2021.

Default Rates Remain Low, But Distressed Exchanges (Including Liability Management Transactions) Have Been Increasing

The Default Rate is calculated by dividing the number of issuers that defaulted in the last 12 months by the total number of issuers.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.