2024 Outlook: Hedge Funds

We expect equity long/short strategies will outperform their long-term average, due partly to the considerable rise in short rebates. This expectation is also linked to our view that global equity volatility will increase due to our economic expectation and ongoing geopolitical crises.

Equity Long/Short Performance Should Be Above Average in 2024

Joe Marenda, Head of Hedge Fund Research and Digital Assets Investing

We expect equity long/short (ELS) hedge funds should perform above the industry’s long-term average in 2024, due to the considerable rise in short rebates and economic conditions within major geographic regions. We believe this will support US ELS generalist strategies and sector specialists, as well as regionally focused ELS funds in Europe and Asia.

Higher short-term interest rates have increased the short rebate to levels unseen since the GFC. In fact, a fund’s short book now generates yields greater than benchmark equity dividend yields for the first time since 2008. A higher short rebate improves potential future performance, as it lowers the cost of carrying short positions and increases the opportunity set for single-name shorts.

The weak economic backdrop we expect in 2024 should lead to a greater focus among investors on earnings and free cash flow. This positions ELS funds well, as companies that have been cheap on a fundamental basis may perform better and companies that are expensive may be strong candidates for shorting.

In Europe, dispersion is above median among listed companies, which suggests that active stock pickers have an above-average field of candidates for longs and shorts. Economically transformative dynamics—reshoring of supply chains and a wall of low interest rate loan maturities, the latter of which will peak in Europe in 2026—will lead to clear winners and losers among European companies.

In Asia, where long-biased strategies did particularly well over the last decade, we expect less directionally biased ELS funds should outperform in 2024. Market leadership and underperformance are likely to shift more rapidly among companies and countries in Asia in 2024 than over the past decade, which will give more nimble portfolios greater alpha opportunities.

In the United States, the same dynamics facing Asian managers and the broader European economy will set up US ELS and sector specialist funds for a wide dispersion of outcomes. Historically popular long-biased sector strategies are likely to face pressure from peers with lower net exposures and greater skill at selecting alpha generating shorts. In 2024, long out-of-favor US value ELS funds should perform particularly well.

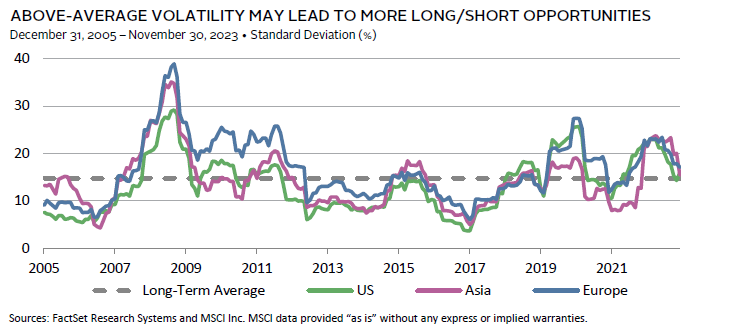

Above-Average Volatility May Lead to More Long/Short Opportunities

The standard deviation is based on rolling 12-month index returns. US, Asia, and Europe are represented by the MSCI US, MSCI All Country Asia, and MSCI Europe indexes, respectively. Long-term average represents historical average of all three regions.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50 years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.