2023 Outlook: Hedge Funds

We expect macro hedge funds to perform well, given our expectations that market volatilities will remain elevated and our view that inflation risks are skewed to exceeding expectations. We expect long/short managers will benefit from positive short rebates.

Continued Inflation Uncertainties Underpin Our Optimism in Macro Hedge Funds in 2023

Meisan Lim, Managing Director, Hedge Fund Research

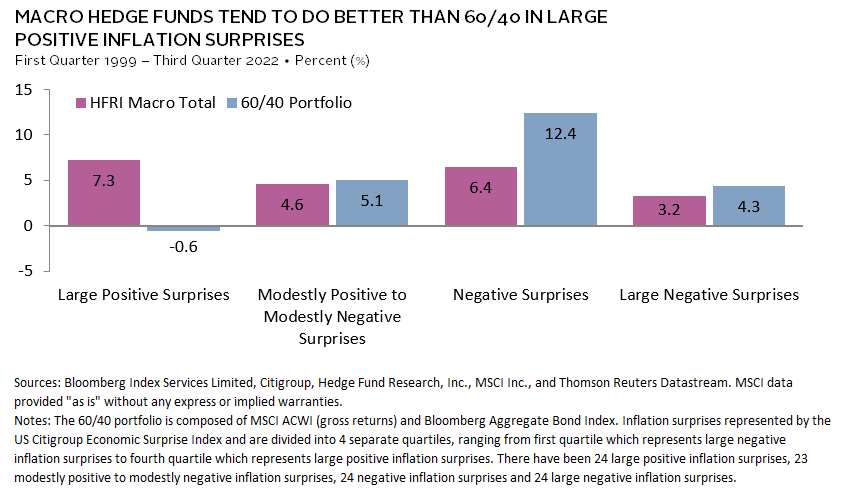

More than at any time in recent history, both equities and bonds have been very sensitive to macro events, particularly to inflation prints. During periods of large positive US inflation surprises, macro hedge funds have tended to do better than a typical 60/40 portfolio. Conversely, when inflation has surprised materially to the downside, these managers have underperformed 60/40, though still managed to generate positive returns.

After the high inflation experienced in 2022, is the case for macro hedge funds still intact? We believe so. First, we suspect risks are skewed to either matching or exceeding current inflation expectations in 2023, which for the United States and euro area are 4% and 6%, respectively, according to Bloomberg. As a group, macro funds have a wide range of resources to identify mispricing and can choose from a variety of instruments to maximize their payout.

Other tailwinds support our thesis that macro strategy will do well in an environment susceptible to inflation surprises. Rather than focusing on promoting maximum employment as it did in the low-inflation era, the Federal Reserve is now forced to favor combating inflation by raising the Fed funds rate. The market is pricing in that the Fed will stop tightening in May 2023 with a terminal rate of 4.9%, and, as written elsewhere, we believe a pause in tightening after May is more likely than a pivot to easing policy rates. This will impact discount rates, making stocks and bonds vulnerable, and provide good short-selling opportunities for macro managers.

Furthermore, when quantitative easing flushed the markets with liquidity and drove investors to reach for yields higher up the risk curve, concentrated beta-driven portfolios were more attractive than a diversified portfolio with many alpha sources. Now that monetary tightening is in effect and interest rates have risen, macro managers are in an opportune position to benefit from greater alpha opportunities and diversification of assets and geographies.

With loose monetary conditions and unusually low inflation in the rear-view mirror, macro funds that are uncorrelated to traditional portfolios of stocks and bonds will prove useful diversifiers.

Positive Short Rebates Will Help Long/Short Equity Performance Improve in 2023

Eric Costa, Global Head of Hedge Funds, and Stephen Mancini, Senior Investment Director, Hedge Fund Research

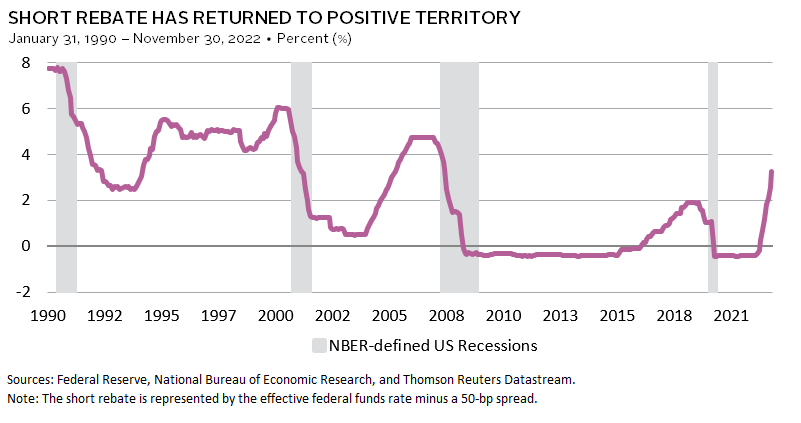

We expect the short rebate available to long/short managers will remain positive next year, given our view that the Federal Reserve will not pivot to cutting interest rates. This rebate, which short sellers receive when they borrow stock, has ranged between -50 basis points (bps) and 0 bps for much of the last 15 years. The recent shift of the short rebate into positive territory removes a clear hurdle for long/short equity funds, and we expect it will help performances in this space improve next year.

In addition to the short rebate, the return components of long/short equity strategies include the long alpha, short alpha, beta, and fees. Skilled long/short equity managers typically generate long alpha on a consistent basis over time. Generating short alpha is challenging and often lumpy, while creating absolute dollar profits from the short portfolio is even more difficult. In fact, absolute short profits have been essentially non-existent since the Global Financial Crisis.

A large, short rebate acts as a return floor, reduces performance volatility, and helps to cover management fees. Simply put, the short rebate is the current Fed funds rate minus a spread (typically 25 bps to 50 bps) multiplied by the total gross short exposure of the manager. Long/short equity managers with robust short portfolios of individual equities will benefit more than managers with small, short portfolios. This being said, the short rebate should not drive investment decisions. The ability to generate long and short alpha remains most critical.

While directional, growth-oriented long/short equity managers benefited the most from the zero interest rate policy and quantitative easing regimes, the current economic environment should result in more obvious winners and losers as companies must now compete for capital. High-quality businesses should trade at a premium, while low-quality, cash-burning businesses should trade at a discount. Dispersion within equity markets is increasing as is volatility. This is an excellent backdrop for alpha creation on longs and shorts as long/short strategies tend to do well relative to equities during periods of heightened volatility.