2025 Outlook: Diverse Manager & Impact Investing

We expect California Carbon Allowances (CCAs) to recover from 2024 losses as clarity on supply reductions emerges. Meanwhile, impact private investment flows will favor strategies with faster distributions and commercial validation. Additionally, headwinds for private diverse manager allocations should ease, but the overhang of emerging funds may lead to consolidation or shutdowns, challenging managers.

California Carbon Allowances (CCAs) Should Retrace 2024 Losses in 2025

Celia Dallas, Chief Investment Strategist

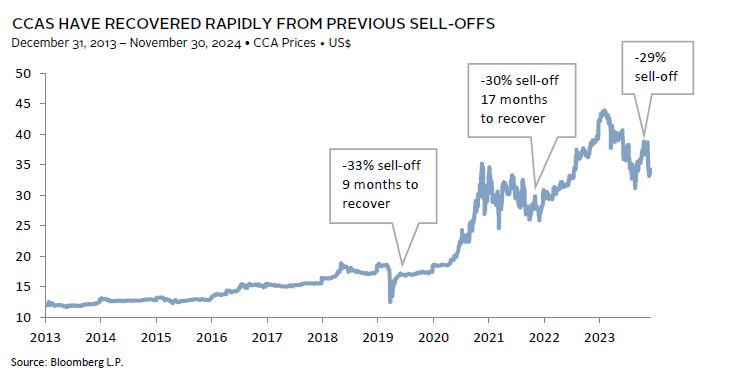

CCAs fell from their $44 high at the start of 2024 to bottom out at $31 in August after news of program changes being delayed to 2026. Once the California Air Resources Board (CARB) finalizes the timing and path of CCA supply reductions, prices should retrace losses. Investors and covered entities are likely to purchase CCAs before program tightening pushes up prices more meaningfully.

Companies covered under California’s cap and trade program must purchase CCAs. Each allowance permits emission of one metric ton of carbon dioxide equivalent. Such programs initially provide excess allowance supply to give covered entities time to reduce emissions. Consequently, carbon prices were relatively flat in the program’s early years. CCA prices began rising as supply/demand balance improved. Following recovery from the COVID-related demand shock, CCA prices have been trending upward, especially as expectations grew that CARB would tighten supply to meet environmental targets. Prices fell in 2022 amid concerns that CCA demand would fall after California extended the Diablo Canyon nuclear plant’s life. However, these concerns faded as expectations for program tightening emerged in 2023.

We anticipate that final clarity on the program’s tightening path and timing of supply reductions will enable the market to recover lost ground in 2025. CARB proposed two potential supply reductions paths, resulting in a 10% to 14% annual decline in allowances, up from the current 4% annual decline, from 2026 to 2030. Even the slower decline path would see a 180 million reduction in CCAs between 2026 and 2030, equivalent to more than 50% of the current inventory surplus. Such a cut would push the program into a cumulative deficit as early as 2030, requiring covered entities to purchase CCAs held in reserve at prices indexed to increase at 5% plus inflation annually. The first tier of reserved allowances is expected to price at $86 in 2030 based on current inflation expectations. As details are finalized, CCA prices should recover in 2025, with significant upside potential into 2030 as the program moves into deficit.

Impact Flows Should Favor Strategies With Faster Distributions and Commercial Validation in 2025

Liqian Ma, Head of Sustainable and Impact Investing Research

Investors will enter 2025 marked by slower exits and distributions. While “patience is a virtue” still applies, private market investors focused on sustainability and impact also need to balance interim liquidity considerations and demonstrate validating proof points to achieve long-term success. Therefore, flows in 2025 should favor strategies that orient toward faster distributions. Managers that have both the intention and the skill to urgently drive commercial progress and liquidity for investors should benefit. Fortunately, an emerging set of tools should help investors achieve these goals even in a muted exit environment.

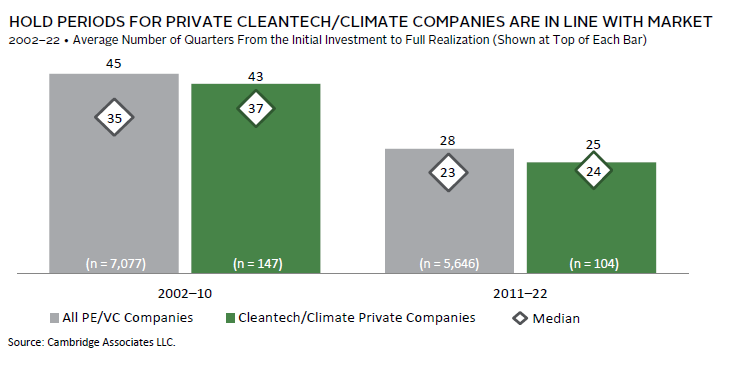

Impact strategies in areas such as climate tech and sustainable real assets can take years to prove out and generate liquidity. While climate-oriented strategies have seen hold periods comparable to those of the broader PE/VC market, the current environment is particularly challenging: follow-on capital is scarce and exit conditions remain subdued. As a result, allocators will likely prioritize new commitments to growth-stage, buyout, credit, and real assets strategies with inherently quicker-to-validate-and-exit models. Allocators will also increasingly hold all managers accountable for distributions in a more reasonable timeframe.

How can this be achieved? First, in the manager diligence and selection process, allocators will increasingly focus on managers’ competence in positioning companies for early validation and eventual exit. Some managers develop a differentiated understanding of what makes companies attractive to both strategic and financial acquirers, then position their portfolios accordingly. Others might sell shares as part of a follow-on or pre-IPO round or monetize parts of businesses, while developing others for upside optionality and impact. Finally, more impact managers are prudently using non-dilutive sources of financing and blended finance 1 to reduce both the cost basis and risk of an investment. With the right strategies, managers, and toolkits, sustainable investors can effectively shorten distribution cycles in 2025 to navigate a challenging liquidity environment.

Headwinds for Private Diverse Manager Allocations Moderate in 2025

Jasmine Richards, Head of Diverse Manager Investing, and Carolina Gómez, Investment Director, Diverse Manager Investing

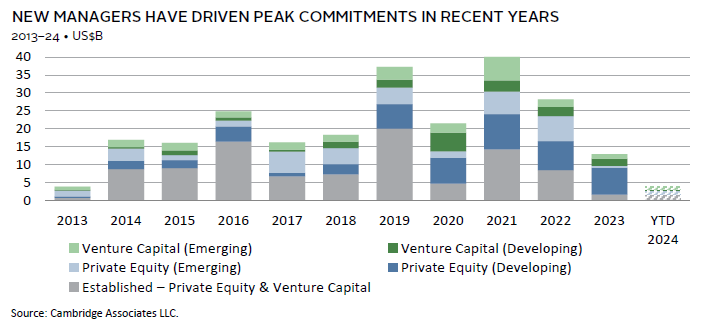

Until 2022, PE/VC firms experienced significant growth in fundraising due to low interest rates and increased risk appetite. Underrepresented fund managers also benefited, with diverse fund managers raising a decade high amount in 2021. However, fundraising declined sharply in 2023 and continued to decline in 2024. In 2025, ebullient markets may offer some relief, but the sizeable overhang of emerging funds could lead to consolidation or shutdowns.

Investments with diverse managers require both willingness and ability. Recent years have seen a decline in commitments, often attributed to decreased willingness. However, in a recent survey, more than half of LP respondents expressed that, despite recent US legislative resistance to DEI programs, these initiatives remain essential and will continue to be implemented and supported across their organizational portfolios. The pullback is more attributable to reduced ability. As US capital markets open, asset owners’ ability to commit to new funds should improve.

While investments in diverse funds are expected to increase, we do not anticipate the record levels seen in 2019–22. From 2019–22, diverse managers raised $127 billion across 198 PE and VC funds, with growth accelerating in 2020 after George Floyd’s murder, according to our data. Initiatives focused on increasing representation of women and people of color often favored new firms. Emerging managers (Funds I or II) accounted for 27% of capital, 51% of funds. Developing managers (Funds III and IV) represented 36% of capital, 31% of funds. By September 2024, these funds were about 75% called and may need to return to market in 2025, posing fundraising challenges. Established managers might withstand slower fundraising, but emerging and developing firms may face financial instability, leading to more consolidations or closures.

With $28 billion across 45 emerging and developing diverse-owned funds potentially returning to market, manager selection will be challenging for LPs with limited budgets. Fundraising momentum will become a key evaluation factor. Early commitments will be crucial in a slow fundraising market. LPs can use creative commitment structuring to support emerging diverse fund managers while mitigating risks from fundraising challenges.

Figure Notes

CCAs Have Recovered Rapidly From Previous Sell-Offs

Data are daily.

Hold Periods for Private Cleantech/Climate Companies Are in Line With Market

Number of companies from the initial investment to complete realization are indicated in parentheses.

New Managers Have Driven Peak Commitments in Recent Years

Private equity includes buyout and growth private equity. An emerging fund is defined as the first or second fund, a developing fund is the third or fourth fund, and an established fund is the fifth fund and beyond. Manager data include US and non-US managers. Data for 2024 are through September 30. Historical data are subject to revisions.

Footnotes

- Blended finance is the use of concessional or catalytic capital to “crowd-in” private capital investment, while optimizing returns and impact. By leveraging concessional funding from philanthropic, governmental, and other sources, blended finance structures are able to “readjust” the risk/return profile of an investment strategy, making terms favorable for institutional investors.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.