Investors Should Direct Their Attention to Private Lending

We believe now is an opportune time to allocate to direct lending. Dislocation in the public leveraged finance markets has allowed direct lenders to increase credit spreads and tighten terms. This, coupled with higher interest rates, means that first-lien senior-secured debt is now yielding low double digits. Recent turmoil in the banking sector may only serve to further accelerate the move of middle-market lending from banks to the private credit market. Managers are structuring deals with strong lender protections, including covenants and lower leverage. While a recession will lead to elevated defaults, we believe that direct lenders with experienced teams will deliver attractive returns.

Looking Back

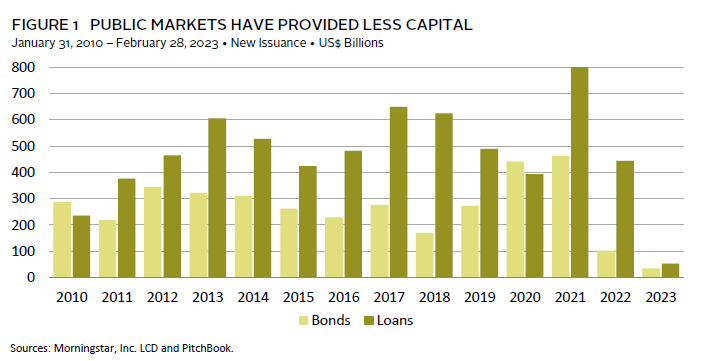

During 2022, soaring inflation and fears of an economic slowdown hammered many asset classes, including the public leveraged finance markets. Even with the modest year-to-date recovery, trailing one-year returns for US high-yield bonds were down 5.5% and broadly syndicated loans (BSLs) up 2.3%, as of February 28. Rising interest rates drove the bulk of the losses in high yield, but credit spreads have widened over the last 12 months for most assets. Investors broadly left the markets, driving new issuance down and leaving deals hung on bank balance sheets. Borrowers instead have turned to the private markets for fresh capital (Figure 1).

The public market retrenchment means that the opportunity set is widening for direct lenders—managers that make loans to companies without the involvement of bond markets or intermediaries such as banks. Historically, direct lenders targeted smaller deals than the $500 million or larger deals seen in the BSL market. However, volatility in the BSL market and the desire of borrowers to obtain more certain execution is causing some larger borrowers to migrate to private markets. Meanwhile, at the other end of the size spectrum, banks—which historically have been direct competition for small loans—have also been pulling back under pressure from regulators to boost capital levels and tighten lending standards. Recent market developments, including the US government takeover of two large banks, will likely only further hasten their retreat.

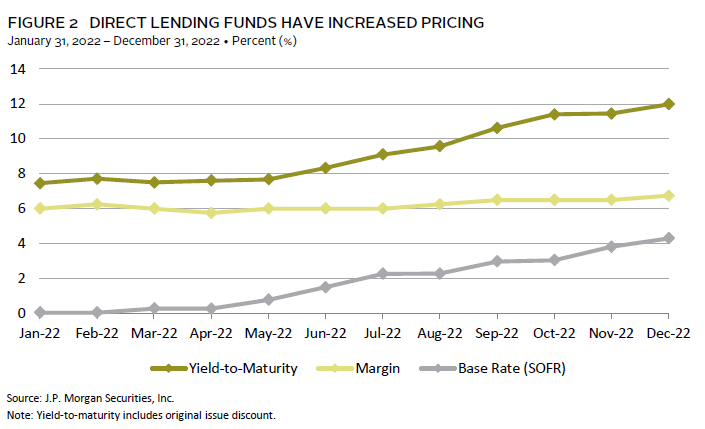

Public market volatility and the resulting rise in credit spreads have in turn allowed private credit funds to increase pricing and lender protections. Using J.P. Morgan data, and echoing discussions with individual managers, typical private loan credit spreads increased 80 basis points (bps) to 680 bps in 2022 (Figure 2). In an effort to combat inflation, the Federal Reserve aggressively raised interest rates, leading to a sharp increase in base rates. This rate increase drove yields on private loans to low double digits by the end of 2022.

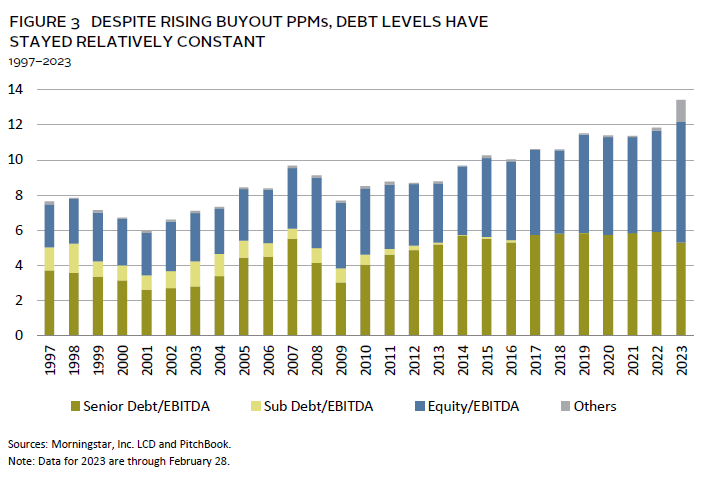

As a result, DL firms now have more deals to choose from and can charge higher spreads and obtain more protections. For example, DL firms can now obtain more covenants—including those requiring certain financial ratios to be maintained and also those restricting collateral movement—as well as push for less leverage in transactions. Recent elevated buyout valuations have been a concern in the market. However, Figure 3 suggests that while purchase price multiples in buyouts have risen in recent years, debt levels have stayed relatively constant, as higher equity contributions from sponsors have bridged the gap. In the current market, managers are reporting that leverage in newly structured loans is 0.5x to 1.0x lower than at the end of 2021.

Comparing Direct Lending and Broadly Syndicated Loans

We believe that an allocation to direct lending is more attractive than the BSL market due to better terms, better pricing, and less mark-to-market volatility. Putting aside the size of the underlying borrowers (which, in direct lending, has historically been $100 million or less in EBITDA, though this is changing), there are several key differences between direct lending and BSLs. One is the documentation referred to earlier. Private loans tend to include more protections for investors, while BSLs will typically have no financial maintenance covenants (cov-lite) and often lack important structural protections, such as allowing the movement of collateral to unrestricted subsidiaries.

Another important difference is liquidity. Private loans are mainly accessible via private closed-end structures that oblige investors to tie up capital for years. Meanwhile, exposure to BSLs can be obtained via exchange-traded funds, mutual funds, and separately managed accounts. To compensate for this illiquidity risk, private loans historically have offered spreads that are 125 bps to 200 bps higher than BSLs.

Implementation

DL strategies vary, with key areas of differentiation among managers including transaction size and whether they focus on sponsored or non-sponsored borrowers. We believe that there is a place in portfolios for different strategies, but universally we favor experienced teams that have sufficient scale to manage a well-diversified portfolio and have resources to work out problem loans. If an investor plans to commit to just one DL manager, we favor one with a differentiated strategy and would try to avoid more commoditized areas of the market, such as sponsor-backed middle market lending. More compelling alternatives include those managers that focus on non-sponsored, lower-middle market, or borrowers that are outside of the plain vanilla leveraged buyout that is the most competitive part of the market.

Generally, managers focused on the upper middle market are competing against the BSL market and may be most likely to sacrifice lender protections. At the moment, the limited number of managers in that space is helping maintain some discipline, but more entrants may force some to succumb to borrower demands for flexibility. Managers that focus on the less-trafficked lower-middle market are working with borrowers that have fewer sources of capital, even where sponsors are involved. Thus, they are more likely to agree to lender-friendly terms and pricing. Direct lenders that focus on non-sponsored borrowers will typically need a strong origination network to find opportunities with companies that do not have the assistance of the capital markets teams employed by large private equity sponsors, which typically can extract the best terms.

Direct lending should be considered one element of a well-diversified private credit portfolio that may also include strategies like credit opportunities and specialty finance. Direct lending will provide stability and a ballast to the portfolio. In comparison, credit opportunities strategies typically should provide a higher return, though with more potential volatility. We favor credit opportunities strategies with the ability to pivot to distressed if the opportunity should develop. Specialty finance strategies should provide some diversification from corporate risk and ballast, given their focus on lending to or owning pools of assets. Specialty finance strategies can range from lending against a pool of consumer or small and medium enterprise loans, to more complex strategies such as litigation finance or insurance.

For investors that do not already have private credit buckets, an allocation to direct lending could occupy a number of places in a portfolio. Some investors include direct lending and other private credit strategies in illiquid or private equity buckets for purposes such as income and J-curve mitigation. However, the current market environment means some investors are overweight privates and thus unable to allocate to new strategies. Instead, investors have turned to diversifier buckets to make private credit allocations.

Conclusion

The current market turmoil has created an attractive environment for direct lenders. The dislocation in the public markets has driven borrowers to private lenders that can demand better pricing and lender-friendly terms. As a floating-rate asset, lenders are benefiting from the sharp increase in rates and all-in yields are in the low double digits. We believe it is a good time to allocate to direct lending.

Frank Fama, Global Head of Credit Investment Group

Wade O’Brien, Managing Director, Capital Markets Research

Brittney McManus and Ilona Vdovina also contributed to this publication.

Index Disclosures

Bloomberg US High-Yield Corporate Index

The Bloomberg Barclays US Corporate High Yield Index measures the US corporate market of non-investment-grade, fixed-rate corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Credit Suisse Leveraged Loan Index

The Credit Suisse Leveraged Loan Index tracks the investable market of the USD–denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries.