Many Real Estate Assets Will Be Boosted by Secular Tailwinds

We believe a healthy macro backdrop and strong demand for inflation-sensitive assets will support most real estate assets in 2022. However, given stretched valuations for many core assets and COVID-19–related uncertainty around some sectors, we think return prospects are highest for assets that benefit from secular trends, such as the growing demand for healthcare and broadband.

Real estate funds posted strong returns in 2021, pushing cap rates to historical lows. Many sectors that were last year’s laggards turned into this year’s winners and vice versa. COVID-19–impacted sectors like retail and residential outperformed the broad REIT index, while previous darlings like data centers underperformed. The office sector was an exception to the rule, underperforming again given the Delta outbreak and uncertainty over what “hybrid” work schedules will mean for long-term demand.

A broadening economic recovery should support fundamentals and thus asset prices in 2022. Return to office and reduced supply will mean vacancy rates eventually decline for office properties, and a rebound in business travel should boost still subdued hotel sector revenues. Industrial properties, which saw positive NOI growth in 2021, may continue to see strong tenant demand given exploding ecommerce volumes.

Rising inflationary pressures and thus interest rates are often cited as a headwind, but inflationary pressures are likely to ease during second half 2022. Even if they do not, inflation has not historically been a headwind for REITs. Over the last 30 years, REITs on average have returned over 16% when inflation was greater than 2%, more than double the performance below this level. Operators are able to pass on rising costs to tenants via rent increases, and assets like housing with short leases may have strong inflation-hedging potential.

Sectors that benefit from secular tailwinds include medical properties, where rising drug research spending is generating more demand for lab space and senior housing, which should benefit from an aging society. Demand for data centers also continues to soar as mobile app usage explodes and working from home boosts broadband usage. Both medical and data centers benefit from higher barriers to entry given demand for customized space. Finally, notwithstanding high valuations, industrial assets should remain in demand if ecommerce volumes continue to rise.

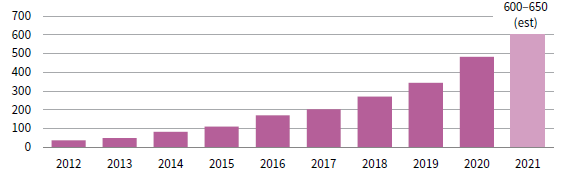

DATA CENTERS MAY BENEFIT FROM BROADBAND GROWTH

Avg Broadband Consumption per Household • Gigabytes (GB)

Sources: Axios and OpenVault.

Notes: Data shown as gigabytes consumed, downstream and upstream. Data for 2021 are forecasted.

Wade O’Brien, Managing Director, Capital Markets Research