Navigating Healthcare System Investments Through the Coronavirus Crisis

The novel coronavirus (COVID-19) pandemic has inflicted significant duress upon the operational and financial situations of nonprofit healthcare systems. An immediate response was necessary to escalate staffing, spending, and resources to provide emergency treatment to those affected by this highly contagious outbreak. Concurrently, healthcare systems must manage through dramatic declines in volumes and margin due to cancellation and postponement of routine and elective patient treatment and procedures.

Providers must take steps to respond to market uncertainty regarding their liquidity and capital in this environment. We provide a simple and easily customizable model to help you understand your healthcare system’s threshold as the financial position shifts from a manageable cash flow situation to a worsening one. Critical support for an investment pool during this extreme environment requires preparation, anticipation and intervention.

Systemic Stress

In parallel with the operational disruption, healthcare system investment assets have been hit hard by what has become the most rapid equity bear market in history. The plunge in equity prices has hammered long-term investment pools (LTIP) with high equity orientations. Compounding this pressure, healthcare systems have seen adverse investment returns in their short- and intermediate-term pools, as even high-quality fixed income markets have not escaped liquidity squeezes and price declines.

The most pressing issue is maintaining sufficient liquidity to sustain the healthcare system when the sector is under systemic financial and medical stress. This double whammy results from the healthcare system doing the right thing—focusing solely on providing the best care possible to those affected by COVID-19. Even with aid to come from the recent $2 trillion economic stimulus package, the cash outlays by healthcare systems in recent weeks are truly a black swan event: a low probability, unforeseen situation come true. Congress is expected to provide additional support to healthcare systems in the coming weeks, but as with any cash flow crises, timing is everything. The cash burn hurts.

Providing Critical Support

In this trying time, we offer the following enterprise and investment guidance as healthcare systems navigate the weeks and months ahead. Inevitably, these ongoing enterprise dynamics necessitate day-to-day check-ins with healthcare system leadership and require the finance office to provide daily cash on-hand information. Providing critical support requires an order of operations, starting with the most urgent actions to a stage where a health system can contemplate and plan for its future state:

- Revisit cash flow needs. Utilizing the run rate of lessened (if not negative) operating cash flow in response to the pandemic, healthcare systems need to employ a conservative approach and extrapolate these operational losses into multi-month scenarios. Healthcare systems should stress test assumptions to the downside on lessened inflows from traditional sources (e.g., receivables collection extends, debt-issuance flexibility decreases, philanthropic gifts dry up in a recession). Some systems operating in geographies with more severe outbreaks may need to layer into these assumptions higher capex due to ramping up equipment and beds to handle surging COVID-19 cases.

- Revisit cash flow sources. Healthcare systems should then map out the size and composition of all short and intermediate pools; focus on how much is immediately sellable and liquid (Treasury bills and short-duration Treasuries), and obtain pricing on short duration bonds and lines of credit, which will need longer lead time for sale (due to atypical liquidity markets and wide bid-asked spreads on many bonds). We recognize bond issuances may be more challenging in the months ahead as investors price in risks associated with COVID-19 and the healthcare sector.

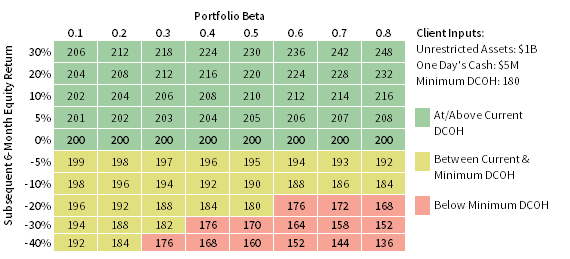

Compare needs and sources, and develop a plan to raise liquidity for the near term. Healthcare systems should determine the order by which cash will be raised, and understand what impact, if any, net cash needs will have on longer term pools. A sensitivity analysis using a model as shown below can inform the enterprise’s ability to withstand further market drawdowns. By entering three inputs (unrestricted assets, one day’s cash needs, and minimum days cash on hand), the model suggests return scenarios in which the healthcare system violates days cash—a proxy we use to understand how much more risk a system can take, or if there is a need to de-risk. With the sensitivity analysis done, using conservative assumptions, institutions should work to determine how much liquidity may be required to carve out of the LTIP.

ONE DAY’S CASH ON HAND SCENARIOS

- Be willing to tap LTIPs now, and replenish later. Healthcare system leaders should remember that the LTIP, and a long-term, customized investment framework, were designed for today’s situation. As we mentioned in Mission Critical, these investment pools are constructed with the understanding that they are a two-way street. Healthcare systems have benefited for many years from healthy margins, philanthropy, proceeds from debt issuance, and other infusions. They are understandably are loathe to tap LTIPs, but these pools are designed to be tapped in times of stress precisely like the situation we face today. The enterprise should embrace using the pools to forestall future financial pressures, but such withdrawals from the pool should be carefully sized and implemented.

- Once liquidity is addressed, develop a rebalancing plan. It is paramount to ensure all liquidity needs are addressed for the next number of months in the event more draconian cash flow scenarios materialize, given the high uncertainty of coronavirus. What remains in LTIPs should be rebalanced to maintain beta targets with equities, which are now more attractively valued than they have been in years. This will likely require selling bonds and hedge funds to purchase equities. The LTIP should have a very long time horizon, and rebalancing requires discipline in order to achieve long term gains.

Like the COVID-19 virus, much is uncertain about the near-term and longer-term impact of the virus on healthcare systems. While the medical staff tends to the sick, an action plan for reviving the enterprise is required: clear foresight around cash needs, cash sources, and other liquidity requirements; an understanding of the threshold at which a healthcare system puts itself in financial risk; and a willingness to be bold and tap the Long-Term Investment Pool to save a healthcare system from permanent financial impairment. These are the essential elements of an investment-oriented life support system for the enterprise.

Jeff Blazek, Head of Healthcare Practice

Hamilton Lee, Managing Director

Bridget Sproles, Managing Director