Specialty Finance Investing: A Versatile Tool for Private Credit Investors

Specialty finance is an important subsector of the private credit asset class and is an area that investors should consider as they develop their allocations to private credit. It is an umbrella term that incorporates several niche strategies, with a common thread being lending to non-bank financial businesses backed by a pool of collateral. Because of this, specialty finance has often been called asset-backed finance or private asset-backed securities (ABS). Private ABS differs from its public counterparts as it can be backed by smaller loans or esoteric assets that would likely have trouble securitizing in the public securitization markets.

Specialty finance investments can be additive to a private credit portfolio. This asset class helps to diversify away from corporate lending to individual businesses and is broadly uncorrelated with equity markets. As a world within a world, specialty finance offers a wide range of underlying asset types and potential return targets. It allows investors to tailor the potential liquidity and duration when selecting a fund.

The Growth of Specialty Finance and Role of Alternative Credit Investors

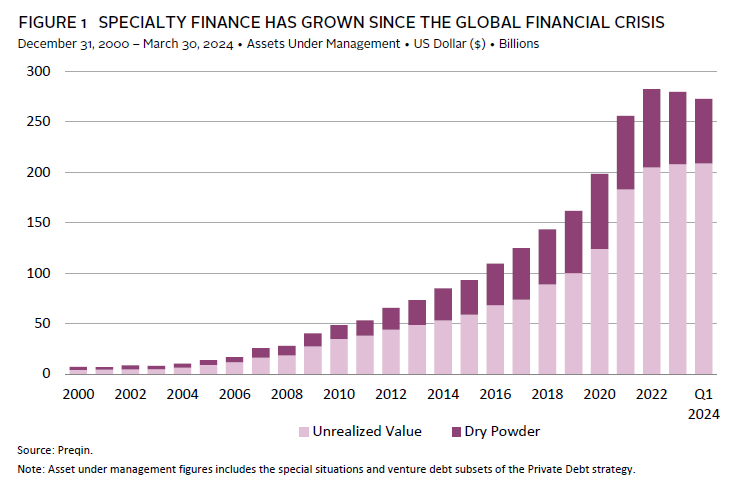

As the amount of assets committed to private credit has grown, renewed attention is being paid to specialty finance. Prior to the 2007–09 Global Financial Crisis (GFC), the specialty finance market was a smaller, less prominent segment of the financial market. Traditional banks dominated lending activities, and non-bank financial institutions (NBFIs) played a relatively minor role. Specialty finance funds, meanwhile, have stepped in to address the financing needs of these NBFIs, resulting in nearly 10x growth in assets of these types of funds since the throws of the GFC (Figure 1) from $28.0 billion in 2008 to $275.8 billion in 2023.

Various factors have contributed to specialty finance’s growth, including tighter bank regulations and stricter capital requirements following the GFC. These rules in part came out of the Dodd-Frank legislation in the United States and the Basel III frameworks established as part of the Basel Accords in Europe. Banks incur risk-based capital charges against the specialty finance lending they do, which has direct impacts on the profitability of certain business lines. The onerous nature of this capital treatment has curtailed lending by banks, and in the cases where banks do engage in these activities, it has typically been with the most pristine businesses with proven track records, leaving newer or more complex borrowers with limited options to obtain financing.

This gap in the demand for borrowing and the supply of financing from banks has been addressed by the specialty finance market, which itself seeks non-traditional sources of financing. Private credit firms focused on the specialty finance space have demonstrated a willingness and ability to work with complex or underbanked segments of the market. These underbanked parts of the market are expected to grow as banks face further strain, including regulatory capital needs. In the United States especially—depending on regulatory approval—the application of the Basel III “endgame” would drive growth in this area. To get in front of this potential supply, specialty finance investors have in many cases been expanding their direct relationships with borrowers, including regional and community banks in the United States.

For US taxable investors in general, we expect that the returns from specialty finance funds to be characterized as ordinary income, and many have commensurate (and sometimes onerous) tax implications. For that reason, these investments might be more suited to non-taxable entities in the United States and non-US entities with friendly tax treatments.

Opportunities, Risks, and Advice for Investors in Specialty Finance

Specialty finance investing offers the potential for compelling risk-adjusted returns. Attractive characteristics of these investments are 1) the cash flowing nature of the underlying assets and 2) the downside protection often created through structuring. There is potential in the current market for higher investment returns from both higher base rates and wider spreads to compensate for the complexity of the assets or their structures.

Non-bank lenders, shadow banks, and financial technology (fintech) businesses have developed in recent years to address a varied set of opportunities.

Consumer and Small Business Lending

One area targeting finance companies in particular is lending against a pool of financial assets. The underlying loans can be made to consumers or small businesses, and this business of lending to lenders is sometimes called re-discount lending. This area has seen growth with the rise of fintech businesses, which help to streamline application, credit selection, and funding processes for consumer and small business financing.

A hallmark of this type of investing is the ring fencing of risk—to protect the collateral from the risk of bankruptcy at the loan originator, the specialty finance manager will lend against a pool of assets that is kept in a separate, bankruptcy-remote special purpose vehicle (SPV). In the event that there were problems with the borrower, the lending specialty finance fund can simply stop funding new loans or other financial assets, thereby stopping the creation of new risks while servicing and running down the book of business in the SPV. It is possible for the loan originator to file for bankruptcy and the specialty finance fund manager to take no losses as 1) the manager, not the loan originator, is exposed to the pool of assets, thereby allowing the pool to be transferred and serviced elsewhere; 2) the existing pool of loans might have been amortizing and reducing the fund’s cost basis; and 3) the existing pool of credits might still have the ability to repay their principal and possibly interest.

Expected returns can vary depending on the credit quality of the underlying investments as well as the seniority of the tranche retained by the fund. Benefits of such funds include diversification away from individual credit risks, as the portfolios tend to include pools of loans or other financial assets. Potential investors should be sure to understand the nature of the underlying assets and beware a concentration of risk in any single risk factor.

Asset and Equipment Leasing

Asset and equipment leasing involves the ownership of a pool of assets, such as transportation assets (e.g., railcars, aircraft engines, shipping containers), yellow metal equipment (i.e., construction and agricultural equipment), or restaurant equipment. As in a fixed income investment, the investor collects cash flows, but they are often in the form of lease payments tied to contracts on the assets and equipment. There is also opportunity to provide financing to companies looking to purchase such equipment.

Expected returns can vary based on the structure and duration of the leases offered as well as the growth stage of the lessee. Investors should take note of the expertise of the specialty finance manager as it pertains to 1) the assets being leased or financed and 2) the ability to structure customized leases that take into account the needs of the lessee.

Litigation Finance

Litigation finance is where investors fund plaintiffs or law firms to cover legal costs, receiving a portion of any monetary settlement if the case is successful. Expected returns are attractive, with internal rates of return (IRRs) for some strategies exceeding 20% and 1.5x multiples on invested capital at the portfolio level. However, individual cases have binary outcomes, with either full recovery or total loss of capital.

Aside from the potential for attractive returns, given the uncorrelated nature of case outcomes to traditional capital markets, investors can achieve diversification benefits for their portfolio. Additionally, there is a positive social aspect to consider, as litigation finance often enables access to justice for those who might not afford it otherwise. However, investors should be aware of potential regulatory changes, adverse selection by law firms, and duration risk. Targeting experienced, institutional-quality managers is recommended.

For those preferring a less binary risk-return profile, managers providing loans to law firms or investing in specialized opportunities may offer more downside protection, while still providing attractive risk-adjusted and uncorrelated returns.

Insurance-Linked Securities

Insurance-linked securities (ILS) are financial instruments where investors take on risk from insured natural catastrophes (e.g., hurricanes and earthquakes) and man-made events (i.e., marine, energy, and cyber incidents). They provide interest income from insurance premiums and principal repayment if no material financial loss occurs. Common types include catastrophe bonds, industry loss warranties, collateralized reinsurance, and collateralized retrocession.

Most ILS are exposed to a narrow definition of natural catastrophe risk: loss due to residential property damage caused by natural disasters. Therefore, diversification is the main attraction of investing in ILS, as the returns of the asset class are uncorrelated to traditional capital markets. Additional highlights of ILS include access to specialized insurance markets, capital efficiency, the potential for attractive risk-adjusted returns, and inflation protection due to their floating-rate nature.

However, portfolio implementation and benchmarking can be challenging. Careful manager selection is crucial, considering factors such as capital reserving techniques and climate change approaches. Investors should be mindful of market cycles and potential headline risks, and a long-term commitment is recommended.

Royalties (Life Sciences and Music)

Royalties in life sciences and music offer exposure to revenue streams from intellectual property. In life sciences, royalties come from pharmaceutical products, medical devices, and biotechnology innovations, paid to original developers or patent holders based on sales or usage. In music, royalties are earned from musical compositions, recordings, and performances, paid to songwriters, artists, and producers whenever their work is played, streamed, or sold.

Benefits of investing in royalty strategies include diversification (returns are uncorrelated to traditional financial assets), steady income streams (royalties provide a consistent and often predictable income stream, as they are tied to the ongoing sales or usage of the underlying intellectual property), and the asset class is often viewed as an inflation hedge, as payments typically increase with the rising cost of goods and services.

Considerations of the asset class include potential regulatory changes (particularly in life sciences) that could impact returns, market demand as the value of royalties is highly dependent on the continued demand for the underlying product or work, intellectual property disputes, and the illiquid nature of royalties.

In some cases, there is a need to assess both loan originators and underlying customers. An investment manager pursuing such investments must underwrite the underwriter and analyze the credit box/profile to which they lend. This analysis on occasion requires expertise in some narrow areas in the market whether that is understanding the mechanics of mass tort lawsuits or having the relationships with lessors of transportation assets and structuring appropriate leasing deals. Look for specialty finance managers with platforms that offer advantages in sourcing investments. While each case is unique, these advantages might be conferred through the breadth of the origination team, the quality of borrower relationships and repeat nature of business, as well as exclusivity or flow arrangements with fintech companies.

Concluding Thoughts

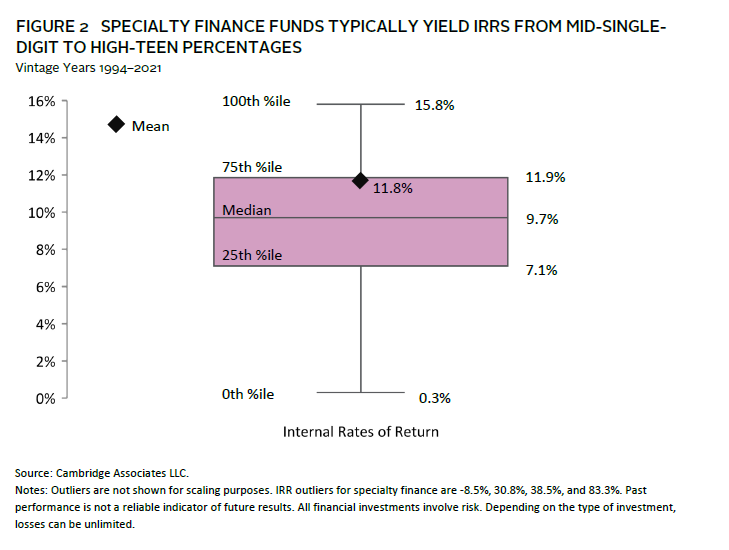

With specialty finance funds, we can generally expect IRRs in a range of mid-single-digit percentages to high-teen percentages, with the difference in returns being a function of use of leverage, age of the borrower, and tenor of the deals. In addition, there is an unknowable element at play in cases, such as litigation finance that might rely on juries’ decisions (Figure 2). A review of specialty finance funds across vintages in the Cambridge Associates database revealed a mean IRR of 11.8%. 1

Specialty finance investing has added layers of complexity relative to other forms of private credit investing. As such, these investments are typically not a core investment in a private credit allocation but rather a satellite or complement to core direct lending exposure. The funds tend to be in typical private equity fund structures in which capital is committed and drawn down across various vintages. In those cases, the funds have investment periods ranging from two years to four years and fund lives of six years to ten years, although the full term of many funds tends to reside in the six- to eight-year zone. Even within these fund lives, many of the transactions are shorter duration in nature relative to private equity deals, for example. As such there is room for recycling of capital during the investment period, which can help drive the fund’s multiple on invested capital. However, the evergreen fund structure has become more popular in recent years, offering limited partners (LPs) flexibility with respect to continuing to invest as well as timing of monetizations and exits.

While the return streams of specialty finance investments often maintain low correlation to general credit and equity indexes, there is the potential for market volatility to impact these investments. Interest rate changes, for example, can have impacts on the cost of financing for the borrowers but also for specialty finance lenders. In some cases, market volatility can impact the value of the underlying pools of assets in these transactions, which has ripple effects on the loan-to-value (LTV) metrics monitored and provide guardrails around risk taking for some specialty finance investors.

Investing in specialty finance funds with their varied sources of returns can help to diversify your portfolio while preserving capital and should help create more stability of cash flows. In this way, specialty finance investing can provide an effective complement to a broad private credit allocation.

Adam Perez, Managing Director, Credit Investments

Joseph Tolen, Senior Investment Director, Credit Investments

Footnotes

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.