Unlocking New Opportunities for Family Investors Through Private Funds

Direct investments are often the first point of entry into private investments (PI) for wealthy families. In building out their direct portfolios, many families invest exclusively in a particular region, industry, or business sector. Similarly, entrepreneurial families with highly cash-generative operating businesses—or those who have recently sold a business—may have portfolios that are narrower in scope. But for investors whose goal is to maximize long-term returns, direct investments should always be considered relative to other growth opportunities available in the market. Enterprising families seeking more comprehensive private allocations can consider building a PI fund program to serve as a pathway to a multitude of new opportunities. Understanding the potential advantages and challenges of PI fund programs can help family investors consider whether an expansion of their private allocations is right for them.

The Advantages of Private Fund Investments

Benchmarked Return Potential

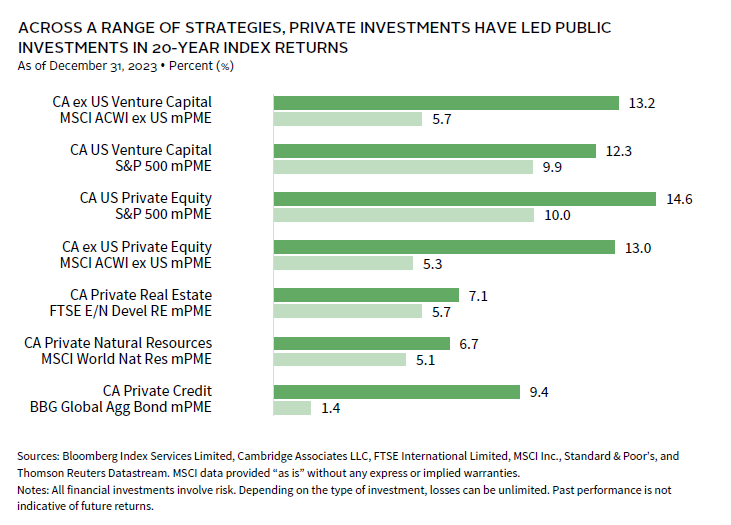

Private markets can add considerable value to family portfolios. Yet, when it comes to evaluating the performance potential of direct versus fund investments, the landscape differs significantly. The figure shows how private investment funds—as measured by Cambridge Associates (CA) benchmarks—have outperformed their public market equivalents over the past 20 years. It is worth noting that these benchmark returns are net of all fees, demonstrating the strong return potential of PI funds despite higher associated costs.

Although CA uses proprietary asset class benchmarks for private investments, standardized public benchmarks for direct investments do not exist. The bespoke nature and complexity of directs often requires investors and their investment managers to instead rely more heavily on their own qualitative assessments and judgments related to the intrinsic value of the asset.

Greater Geographic Reach

Families who focus only on a local market or region may miss a large part of the investment universe. Investors relying solely on a domestic portfolio risk becoming too concentrated while also forgoing opportunities to invest in leading companies domiciled in foreign markets. The broader the investment options, the higher the bar is raised. What’s more, investment talent is everywhere. We believe PI fund managers that specialize in specific markets, rather than having a global focus, are often better positioned to outperform. For example, a family with an operating business in Europe may seek to further globalize their investment exposure by seeking US-focused fund opportunities. Often, a fund-specific strategy is designed to complement a direct portfolio, augmenting the “in-house” resources of the family office.

Expanded Sector Allocations

Similarly, it can be difficult to source direct investment opportunities outside of the specific sector where a family has built their wealth and networks. And if deals are sourced, it can be challenging to develop the know-how required to be an effective investment partner. Expertise in one sector may not translate to expertise in another. For example, it would be difficult for a family with a background in software to leverage their knowledge and capabilities in an industrial strategy requiring large capital investment and manufacturing knowledge—or vice versa. Yet, both sectors should be considered as part of a family’s diverse investment opportunity set. PI fund investments can serve as a conduit to expand a family’s investable universe beyond sectors familiar to them. Relationships with general partners (GPs) can also provide access to professionals and CEOs outside of the family’s typical investment network, which can have a strategic benefit to other businesses in the portfolio.

Opportunities Across Various Stages

Unlike directs, PI funds offer families the opportunity to balance allocations across the PI spectrum to help manage asset class–specific risk. For example, the risks and returns of an early-stage venture opportunity are different from those in a mega-cap buyout strategy. While it is possible to invest across different asset classes and life cycle stages with direct investments, it typically requires managing a larger number of individual investments compared to fund investing. PI funds invest in companies at various stages of their life cycle, frequently specializing within a certain range of business development. Fund investing is also more capital efficient for diversification, especially for families with a smaller PI budget. Having multiple fund investments that target different deal stages can help reduce the impact of any one investment performing poorly. It also has the potential to provide differentiated sources of return and cash flow profiles.

Opportunities Across Different Deal Sizes and Co-investments

Often, large- or mega-cap direct deals—which can range from $10 billion to more than $200 billion—can be challenging for families to secure with participation dependent on the size and scale of the investors involved. Most direct deals tend to be focused on small- and mid-market segments. Through PI funds, families who may otherwise be left out can allocate to a diverse range of market caps, including small-, mid-, and large-cap investments. This can help improve the stability of portfolio returns and enhance their protection against downside risk. Additionally, PI funds offer professional management, diversification, and access to exclusive investment opportunities that might not be available through direct deals alone.

Co-investments provided by a GP to its limited partners (LPs) offer another pathway for families to engage with investment opportunities that might otherwise be inaccessible. They allow families to invest alongside a fund in specific deals, often with no or substantially reduced management fees or carried interest compared to what would typically apply to fund investments. This may enhance the potential returns on those investments. For families of wealth, co-investments represent a compelling way to gain more direct exposure to high-quality opportunities, while leveraging the expertise and due diligence capabilities of the fund managers. This approach can not only broaden the investment horizon but further align the interests of the investor and the fund manager, helping foster partnerships that could lead to other strategic investment opportunities. Investors should keep in mind that the most attractive co-investment opportunities offered by PI fund managers often parallel a manager’s specific experience and expertise, providing direct exposure in areas outside a family’s traditional skill set and business networks.

Different Generational Factors

Many direct investors got their start as entrepreneurs and grew into experienced business owners. They often leverage the skills honed from growing and running their personal businesses into being active, effective direct investors. However, this can make business and wealth succession planning challenging if the inheriting generation of family members does not share the same interest or abilities as the controlling generation. By contrast, fund investments are more institutional and transactional by nature, and do not require family members to preside over them in the same way. They can be easier to leave to beneficiaries and are suited to long-term investors focused on building a family legacy. PI fund opportunities can also provide a means for working with innovative investment ideas—from artificial intelligence to life sciences and music royalties. This can be a way of further engaging families with members across multiple generations and areas of interest.

Key Operational Differences

Direct investing and private fund investing can both be complex—but in different ways. It can be easy for families to underestimate the work involved with holding a directs portfolio. Direct investments sometimes require investors to sit on a board, provide operating advice, or may require extensive “in-house” capabilities to be dedicated to making an operation successful. Generally speaking, the more challenging the market environment and/or business conditions, the greater the time commitment. While fund investments require investment operational support, such as negotiating and executing LP agreements and managing capital calls and distributions, the operational burden they put on investors tends to be more consistent and—more often than not—significantly lighter.

Potential Challenges of Private Fund Investments

Skill Set Requirements

Whereas direct investments are typically more “hands-on,” a different kind of expertise is usually required to be successful in PI funds. The development and execution of fund strategies demands strategic insight, comprehensive due diligence on fund managers and underlying assets, careful risk management through diversification and hedging, and a deep understanding of fund structures and performance metrics. In many cases, industry knowledge and negotiation experience can give families an edge. To remain aligned with their broader investment goals, families should look for experienced investment managers in building a private fund portfolio.

Important Risk Variables

Blind pool risk is a principal factor pertaining to private funds. Families considering fund investments should remember that they do not have control over how the fund allocates capital. As a result, it is important to recognize that fund investments also often come with a high degree of illiquidity risk.

Fee Considerations

Private fund investors pay higher fees relative to other strategies. Historical returns should be considered when determining how they fit into a family’s broader portfolio, keeping in mind that top-tier PI fund performance may result in additional fees over the long term.

The Family Advantage

In our experience, families of wealth are often viewed as preferred strategic LPs by fund managers. While many PI fund managers can be hard to access, families have certain competitive advantages such as bringing a variety of operating backgrounds that are viewed favorably by fund managers. In addition, some managers appreciate that families can have less complex or formalized governance structures relative to institutional investors, helping with faster decision making through more immediate access to the decision maker(s). Many GPs also appreciate and identify with families who have an entrepreneurial background, allowing them to speak the same language of business ownership and development.

New Horizons

Incorporating a private fund portfolio alongside direct investments presents family investors with a strategic opportunity to augment their private market allocations, enhancing the potential for higher returns and greater diversification. However, skilled implementation is key, given the significant variance in returns within the private funds industry, coupled with its inherent illiquidity and other associated risks. To navigate these complexities, families should align their PI funds approach with their long-term financial objectives and desired level of risk tolerance. This alignment, combined with rigorous due diligence in manager selection, can greatly influence the outcome of their investments. Furthermore, disciplined management of the PI fund program—emphasizing vintage year diversification, maintaining adequate liquidity, and robust risk management—is crucial. By adhering to these principles, families can help create a resilient and high-performing PI fund portfolio that complements their direct holdings and successfully broadens their investment horizons.

Elisabeth Lind, Managing Director, Private Client Practice

The Bloomberg Aggregate Bond Index is a broad-based fixed income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

FTSE EPRA Nareit Global Real Estate Index

The FTSE EPRA Nareit Global Real Estate Index Series is designed to represent general trends in listed real estate equities worldwide. Relevant activities are defined as the ownership, trading and development of income-producing real estate. The index series covers Global, Developed, and Emerging markets.

MSCI All Country World ex US Index

The MSCI ACWI ex US Index captures large- and mid-cap representation across 22 of 23 developed markets countries (excluding the United States) and 24 emerging markets countries. With 2,159 constituents, the index covers approximately 85% of the global equity opportunity set outside the United States.

MSCI World Select Natural Resources Index

The MSCI World Select Natural Resources Index is based on its parent index, the MSCI World IMI Index, which captures large-, mid-, and small-cap securities across 23 developed markets countries. The Index is designed to represent the performance of listed companies within the developed markets that own, process, or develop natural resources.

S&P 500 Index

The S&P 500 is a market capitalization–weighted stock market index that tracks the stock performance of about 500 of some of the largest US public companies.

About Cambridge Associates

Cambridge Associates is a global investment firm with 50+ years of institutional investing experience. The firm aims to help pension plans, endowments & foundations, healthcare systems, and private clients implement and manage custom investment portfolios that generate outperformance and maximize their impact on the world. Cambridge Associates delivers a range of services, including outsourced CIO, non-discretionary portfolio management, staff extension and alternative asset class mandates. Contact us today.