Multiemployer Plans Receiving SFA Program Assets Face Critical Allocation Choices

Regulations are often controversial, but few in recent history have had so many different interpretations and large revisions as the Special Financial Assistance (SFA) program for underfunded multiemployer pension plans (MEPP). Now that the dust has settled, one of the biggest risks for plan sponsors is not taking full advantage of the opportunities that are available. Being conservative is an understandable instinct, given current market uncertainty, but this may be detrimental to long-term solvency of the plan—the very thing that the SFA program was designed to protect.

As an investment manager, Cambridge Associates has the privilege of regularly discussing asset allocation strategies with plan sponsors and fixed income managers in the multiemployer space. These interactions have illuminated the need for a wide dispersion of approaches to allocating the SFA program assets. While many options exist, a plan-specific, holistic approach that combines multiple investment strategies is most likely to generate optimal outcomes. This paper provides a guide to plan sponsors as they seek to make the most effective use of their SFA program capital.

About the SFA Program

The American Rescue Plan Act of 2021 included substantial relief funds for the most troubled US multiemployer pension plans through its SFA program. The SFA program was created to help seriously underfunded multiemployer pension plans maintain solvency through 2051.

For more information on this program, and its implications for all MEPP assets, see our companion paper, Solvency Beyond Relief: Unlocking the Full Potential of SFA Program Assets.

Funding Allocation Options

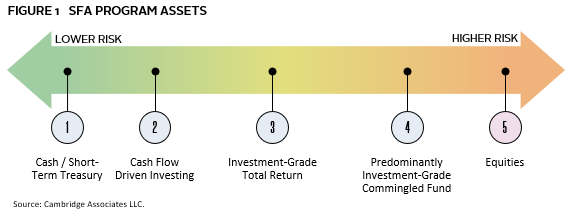

SFA regulations specify which asset classes can be used by program funds, stipulating a 67% allocation to investment-grade bonds with the remainder eligible for allocation to equities and other return-seeking assets. The various allocation options available to plan sponsors are captured below. Approaches 1 through 4 in Figure 1 represent available investment-grade allocations, while equities represent the return-seeking portion.

MEPP sponsors should ensure that the potential benefits and risks of each of these approaches are carefully considered to most effectively allocate their SFA program funds. Some observations on each are provided here:

- Cash / Short-Term Treasury: This is the easiest approach and, based on the current yield curve, provides a decent yield. These assets are also the easiest to use to meet benefit payment requirements. It is the safest option, but also the most likely to underperform other strategy options over the long term.

- Cash Flow Driven Investing: Under the CDI approach, high-quality bonds are purchased in a manner so that the coupon and principal proceeds match the expected benefit payments from the plan. As credit bonds have a higher yield than Treasuries, the portfolio can achieve a higher yield at the expense of the very minor risk of some bonds defaulting.

- Investment-Grade Total Return: This is an unrestricted approach that uses the entire universe of investment-grade bonds and does not rely on the buy-and-hold strategy that CDI employs. The larger opportunity set can, in theory, enable higher return generation. However, this carries additional risk—not only from non-performing bonds but also from a potential duration mismatch to near-term benefit payments. The value of the portfolio will change as interest rates change, causing performance impact, as well as the risk of having to sell assets at a loss to pay for benefits.

- Predominantly Investment-Grade Commingled Funds: This is one of the more interesting approaches, which relies on an interpretation of the ARPA legislation that allows for the use of commingled funds that are predominantly investment grade. The key term here is “predominantly,” which means that the fund may hold higher-yielding fixed income that may not be investment grade, as long as these investments do not represent the majority of assets in the fund. This approach is expected to maximize the return generation for the 67% of SFA assets denoted as “investment grade,” but may also hold the most risk out of all the previous options.

- Equities: This is the allocation of choice for the return-seeking portion of the SFA assets. While the limit is an allocation of 33% of total SFA assets, some plan sponsors are pursuing a slightly lower allocation (25% to 30% is common), while others are foregoing this allocation entirely.

While no single allocation is right for all plan sponsors, we believe the following considerations will prove useful as MEPPs contemplate how to invest their SFA program assets.

- Based on current yield levels, setting up a CDI approach makes sense for a few years, but loses appeal if done excessively.

- Using a total return approach, while staying within the bounds of the legislation, should enable plan sponsors to maximize the return generation of the investment- grade portfolio.

- Don’t shy away from equities. There is little risk of breaching the 33% allocation limit and this asset class is expected to outperform fixed income over time. Allocating to equities should maximize the return generation for the entire SFA asset pool.

Choose Wisely

Plan sponsors receiving SFA assets certainly have a wide range of available options at their disposal. The appropriate allocation, however, can best be arrived at through a holistic assessment that considers multiple factors. These include the amount of SFA assets received, the Trustee’s risk tolerance, the current composition of the legacy (non-SFA assets) portfolio, as well as the ability to allocate to new and alternative asset classes within that legacy portfolio, among others. While the options are wide and the best path forward will be unique to each situation, plan sponsors should keep in mind that their biggest risk in the long run is to be overly conservative. Avoiding this through careful evaluation and action now will be many MEPPs’ key to securing long-term plan solvency.